The growing prospect of Donald Trump’s victory in the US presidential election has triggered a wave of sell-offs in commodity currencies. Protectionist policies will hurt China. Meanwhile, the Bank of Canada is mulling interest rate cuts. Let’s discuss these issues and make a trading plan for the USDCAD pair.

The article covers the following subjects:

Highlights and key points

- The USDCAD pair has been rising for 9 out of 10 trading sessions.

- The rally is based on the commodity market rout due to the Trump trade.

- The BoC rate cut cycle will highly likely continue.

- The BoC meeting could push the USDCAD pair towards 1.395.

Daily Canadian dollar fundamental forecast

The Canadian dollar has fallen against its US counterpart in 9 out of the last 10 trading sessions due to a double whammy. On the one hand, USDCAD bears are being held back by the Trump trade. On the other hand, markets are awaiting the second easing from the BoC in the last two months. The pair is at risk of breaking out of its medium-term trading range of 1.36-1.38 and starting a new trend. Is it a good time to buy?

If gold and bitcoin are considered the main beneficiaries of Donald Trump’s return to the White House, most commodity market assets and related commodity currencies are among the victims. Oil plunged to a 6-week low on expectations of a slowdown in China, while forex traders are staying away from the Australian, New Zealand, and Canadian dollars. Trump promises to raise tariffs on imports from China to as much as 60%, adding to the woes of the world’s largest commodity consumer.

At the same time, the Bank of Canada decided to continue the cycle of monetary easing. In June, it was the first of the G7 central banks to cut the overnight rate to 4.75%. Three-quarters of Reuters experts and all 14 experts polled by the Wall Street Journal expect the cycle to continue on July 24, with borrowing costs falling by 25 basis points to 4.5%. The futures market is pricing in a 93% probability of such an outcome. Rumors are pushing USDCAD quotes higher.

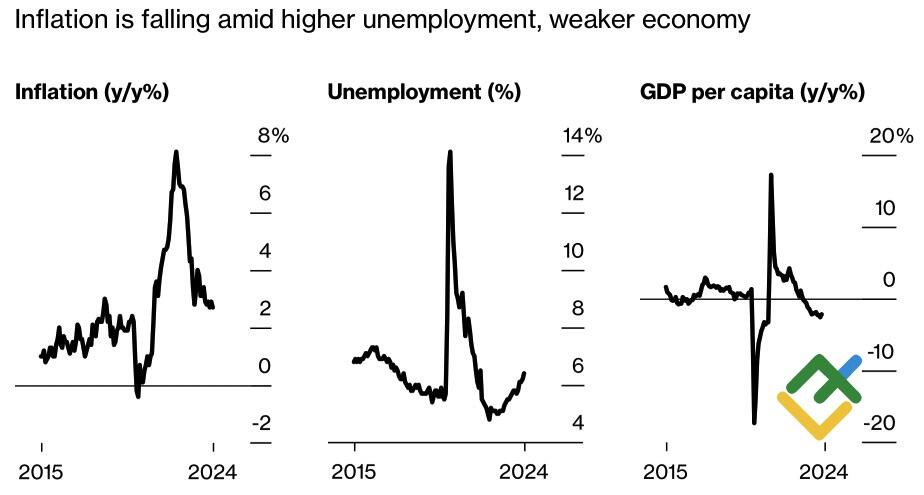

Canada’s economic indicators

Source: Bloomberg.

The weakness of Canada’s economy is to blame. In June, the unemployment rate jumped by 0.2 pp to 6.4%, the highest level since January 2022. Employment unexpectedly fell by 1,400 versus expectations for a gain of 25,000, and core inflation rose by 2% or less for the fourth consecutive month. In addition, the unpleasant surprise of a 0.8% m/m decline in June retail sales was another pinch of salt for the Canadian dollar.

BoC Governor Tiff Macklem expressed confidence in a soft landing for the country’s economy. However, it requires a cut in the overnight rate at almost all of the central bank’s remaining meetings through 2024 in September, October, and December. Yet only 4 of 14 Wall Street Journal experts predict the BoC will take four more steps down the path of monetary expansion before the end of the year, including the meeting in July.

Daily USDCAD trading plan

The future of the USDCAD pair will depend on what signal the Bank of Canada gives on July 24. An overnight rate cut coupled with Tiff Macklem’s neutral rhetoric may lead to a sell-off on facts after buying on rumors. On the contrary, signs of weakness in the economy and the continuation of the cycle have the potential to accelerate the rally towards 1.395, especially as the Trump trade continues. However, the balance of power may change closer to the release of the US labor market report for July.

Price chart of USDCAD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.