Despite being regarded as the underdog at the start of the year, the Canadian dollar gained traction following Mark Carney’s meeting with Donald Trump. Canada is not for sale, but it has nothing to offer in exchange for the removal of tariffs. Let’s discuss this topic and make a trading plan for the USDCAD pair.

The article covers the following subjects:

Major Takeaways

- Canada does not intend to sell its sovereignty.

- Ottawa plans to shift its trade focus away from the US to other countries.

- The risk of the greenback falling against the loonie is at its highest since 2009.

- Consider selling the USDCAD pair with targets of 1.362 and 1.35.

Weekly Fundamental Forecast for Canadian Dollar

Donald Trump has no intention of annexing Canada without the consent of Canadians themselves. Speaking at the White House, the lion’s den, Mark Carney insists that the country is not for sale. Just as certain real estate is never for sale, as the US President, who made billions on it, knows very well. Thus, never say never. The US President is direct as always, and his meeting with the Canadian Prime Minister has caused the USDCAD exchange rate to fall.

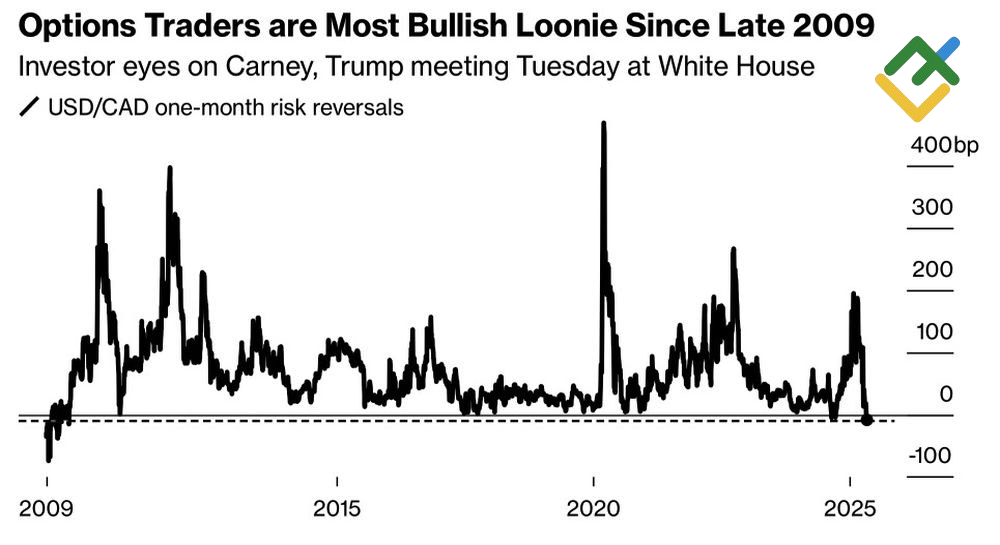

USDCAD bulls were encouraged by Donald Trump’s words that Canadians had made the right choice in favour of Mark Carney, meaning that the North American Free Trade Agreement is a good deal for everyone. However, the conversation concluded without resolution. Following the dialogue, the US president noted that Canada has nothing to offer the US in exchange for the lifting of tariffs. Ottawa has gained no real benefit from this decision. It is encouraging to note that the risks associated with a reversal in the USDCAD have not been as low since 2009.

USDCAD Risk Reversal Trend

Source: Bloomberg.

The shock following April 2 has diminished, and countries are now negotiating with the US regarding tariffs while also engaging in private discussions among themselves. The US is not the only option. If it restricts access to its super luxury store, others will step in. Recent data shows a significant shift in Canadian foreign trade: exports to the US dropped by 6.6% in March, marking the steepest decline since the pandemic, while exports to other countries surged by 24.8%, the second-best performance since records began in 1997.

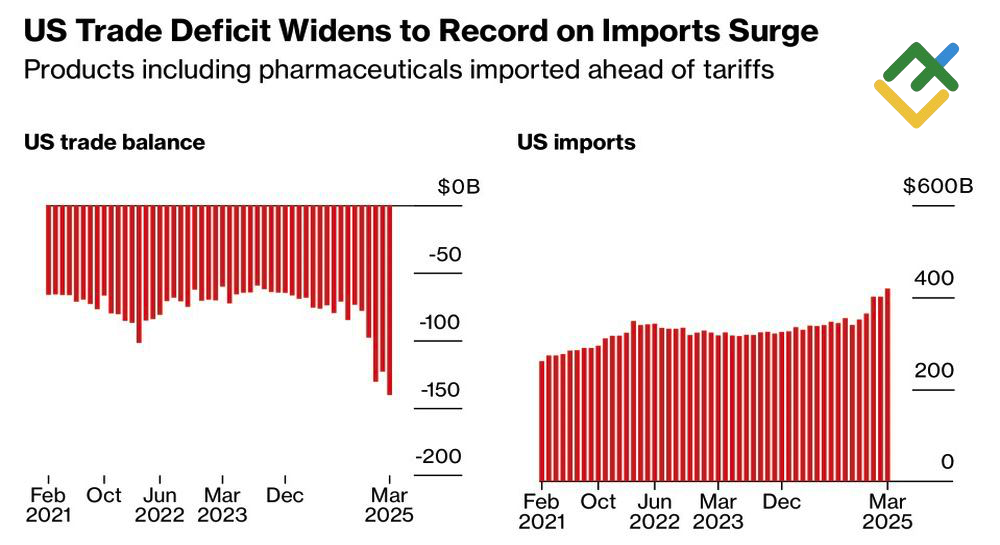

Canada’s GDP expanded by 1.5% in the first quarter, reflecting strong US imports. This is an excellent performance, especially in light of the contraction experienced by the US economy, which is grappling with a record trade deficit. This divergence has fueled a downtrend in the USDCAD pair.

US Trade Deficit and Imports

Source: Bloomberg.

The 90-day tariff reprieve indicates that the trends observed in January-March are likely to continue in April-June, albeit on a smaller scale. Concurrently, Canada has gained time to reorient its exports, allowing it to adopt a positive outlook for the future of the Canadian dollar.

Although the Bank of Canada discussed the possibility of lowering its overnight rate in April, it ultimately left it unchanged at 2.75%, which does not necessarily mean that it will ease monetary policy at its next meeting. Central banks tend to act in a coordinated manner. Therefore, if the US Fed has decided to remain cautious due to the uncertainty surrounding the US policy, the others will follow suit.

Weekly USDCAD Trading Plan

Given these conditions, a downtrend is likely to resume in the USDCAD pair. While the asset is trading below 1.385, consider following the previous strategy, suggesting opening short trades with targets of 1.362 and 1.35.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDCAD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.