While most countries have come to terms with US tariffs, Canada continues to push back firmly. Still, USDCAD bears remain hopeful that the downtrend will resume. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- US tariffs against Canada will rise to 35%.

- 85% of Canadian exports are exempt from duties.

- The Bank of Canada’s cautious approach is bolstering the loonie.

- If the USDCAD pair falls below 1.376, consider short trades.

Weekly Fundamental Forecast for Canadian Dollar

Canada had hoped other nations would stand with it against US protectionism, but those hopes quickly faded. Aside from China, no country was willing to confront Washington directly. Even Mexico and the EU, which had initially threatened retaliation, ended up backing down.

As a result, Mexico secured a 90-day reprieve, while Canada now faces the threat of 35% tariffs. Nevertheless, USDCAD bears seem to believe that the situation could improve.

The situation may not be as bleak as it seems. The US and Canada share a massive bilateral trade relationship valued at around $900 billion. In 2024 alone, Canada exported $477 billion worth of goods to the US and imported $441 billion in return. However, tensions remain. Canadian steel and aluminium are currently subject to 50% tariffs, while cars and other goods face 25% duties. The latter category is expected to see a sharp increase with tariffs jumping to 35% soon.

Roughly 85% of Canadian exports remain exempt from duties under the North American Free Trade Agreement. This gives Prime Minister Mark Carney some flexibility to apply a carrot-and-stick strategy. The Canadian government is offering support to industries affected by US tariffs while also responding with targeted retaliatory measures. However, according to US Commerce Secretary Howard Lutnick, Canada may face serious consequences if it does not remove these measures.

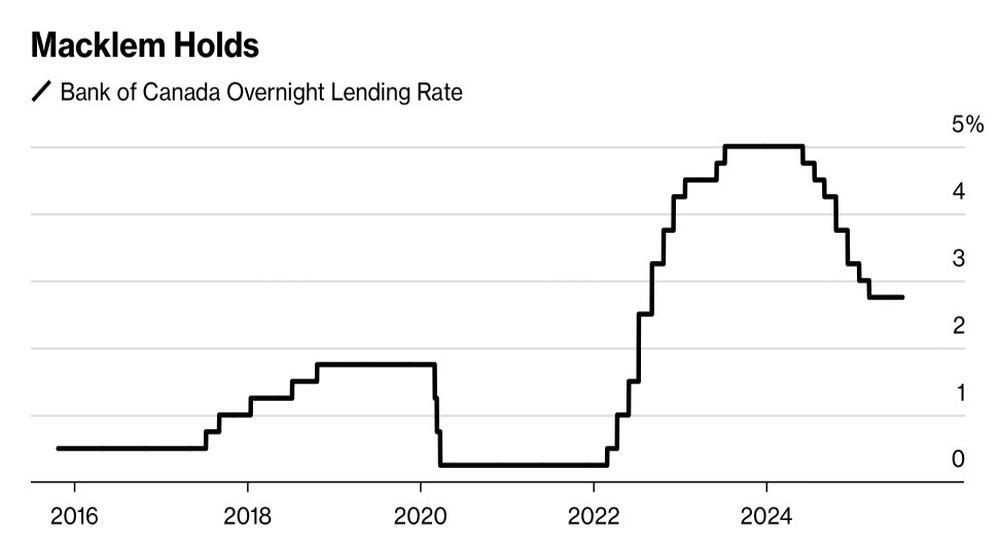

Bank of Canada’s Overnight Rate

Source: Bloomberg.

At its last meeting, the Bank of Canada left its overnight rate unchanged at 2.75% and predicted a 1.5% decline in GDP in Q2 after 2.2% growth in Q1. The central bank also warned that the economy risks contracting if trade tensions escalate.

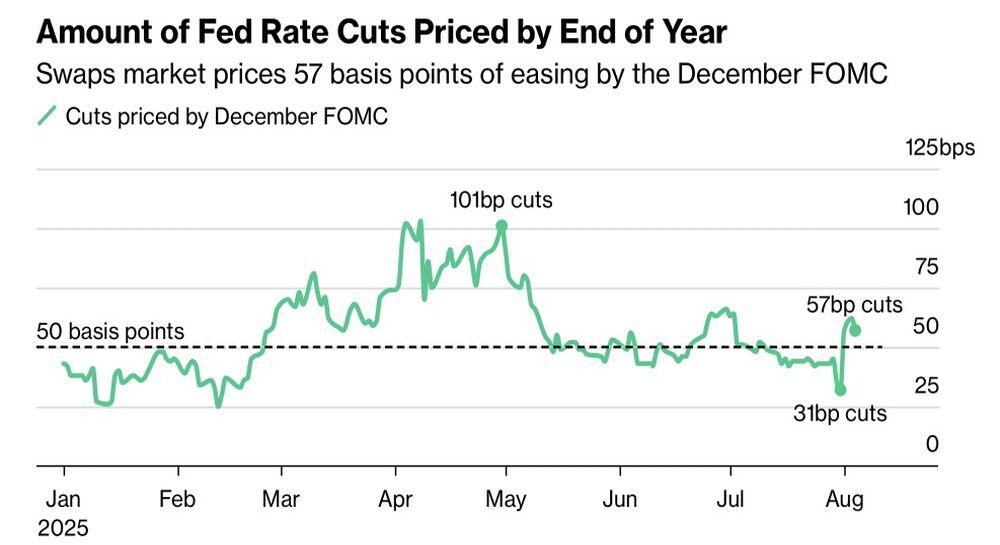

According to Tiff Macklem, there are signs that inflation may decelerate, as the strengthening of the Canadian dollar is curbing import prices. If economic weakness and supply chain disruptions continue to weigh on the CPI, the BoC will resume its monetary expansion cycle. Bloomberg experts anticipate at least one overnight rate cut by the end of 2025. Given the Fed’s expected monetary policy easing by 57 basis points, the USDCAD pair may plummet.

US Fed’s Monetary Expansion Expectations

Source: Bloomberg.

Desjardins Securities expects the Bank of Canada to cut its overnight rate three times in 2025. However, that will unlikely prevent the USDCAD pair from sliding to 1.35. Selling pressure may be reinforced by currency hedging flows from international investors holding US assets. Had the BoC not mirrored the Fed’s aggressive monetary expansion policy, the loonie might have strengthened even further.

Weekly USDCAD Trading Plan

The USDCAD pair reached the first bullish target of 1.3815 but failed to hit the second target of 1.39. As a result, the downtrend resumed. If the asset tumbles below the support of 1.376, consider short trades.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDCAD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.