Before the Reserve Bank’s July meeting, the outlook for the New Zealand dollar looked bullish, but the RBNZ’s dovish rhetoric has caused a huge shock in the market. Let’s discuss this topic and make a trading plan for the NZDUSD pair.

The article covers the following subjects:

Highlights and key points

- The RBNZ did not rule out a rate hike at the previous meeting.

- The central bank started talking about a rate cut in July.

- A dovish reversal will cause the NZDUSD to collapse.

- The pair may fail to stay in the 0.605-0.615 range if US inflation accelerates.

Weekly New Zealand dollar fundamental forecast

The Reserve Bank of New Zealand’s abrupt policy shift has put the kiwi over the edge. Back in May, the RBNZ claimed that monetary policy would remain tight for a long time, and a rate hike was possible if inflation got out of control. At that time, the cash rate was not expected to fall before the third quarter of 2025. In July, everything turned upside down, and the NZDUSD pair tumbled.

All 20 Bloomberg experts predicted that the RBNZ would leave the cost of borrowing at 5.5% for the eighth time in a row, but no one expected the dovish rhetoric from the regulator. Prior to the meeting, ATFX called Asia-Pacific a new haven trade as Australia and New Zealand did not rule out a rate hike and forecast the NZDUSD to rise to 0.62. Commonwealth Bank of Australia argued that the aussie and kiwi could look even better were it not for political uncertainty in Europe and the US, while Westpac called their short-term outlook bullish.

The Reserve Bank’s statement came as a big surprise. The central bank admitted that monetary policy should remain tight for some period but would be eased over time in line with the expected reduction in inflationary pressures.

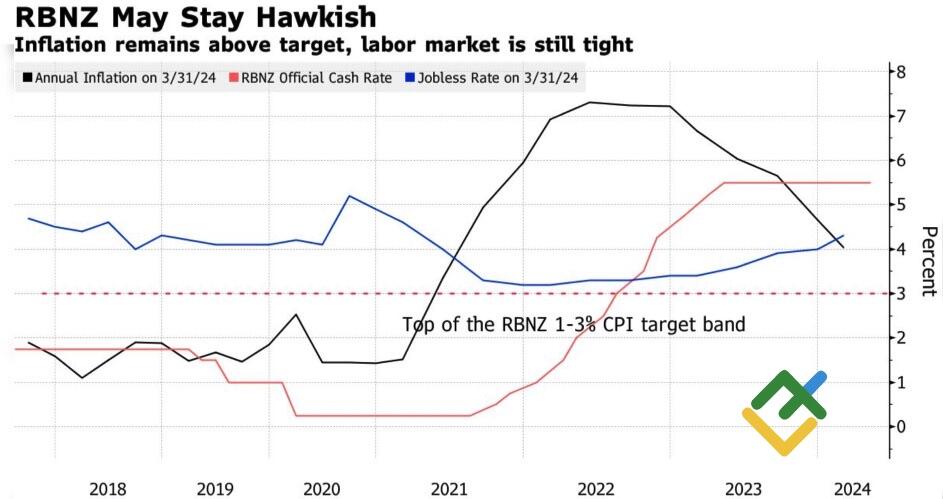

New Zealand’s cash rate, inflation, and unemployment

Source: Bloomberg.

In late 2023, such Fed rhetoric was called a dovish reversal. The New Zealand dollar followed its American counterpart’s footsteps and collapsed.

While the Reserve Bank’s mandate is to fight inflation, it cannot turn a blind eye to what is happening in the economy. The latest statistics signal that GDP is at risk of contracting in April-June. This would mean sagging gross domestic product for five of the last seven quarters. Clearly, monetary policy is too tight, and the economy cannot withstand a key rate of 5.5%.

Thus, there is a high probability that the RBNZ will follow central banks that aim for monetary expansion. This move will deprive the kiwi of its main growth driver, and the weakness of the economy, political risks in the US, as well as problems with China’s GDP recovery make bulls’ position on NZDUSD vulnerable.

The pair’s collapse could have been even more precipitous had it not been for Jerome Powell’s signals of monetary policy easing. Like the Reserve Bank of New Zealand, the Fed is starting to focus on the economy and the labor market, increasing the chances of lowering the federal funds rate in September.

Weekly NZDUSD trading plan

The assumption that the disappointing US employment report for June would force the NZDUSD to consolidate in the 0.605-0.615 range proved correct. Short trades opened at the upper boundary generated profits. In the meantime, short positions can be kept open and increased if US inflation data appears to be strong.

Price chart of NZDUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.