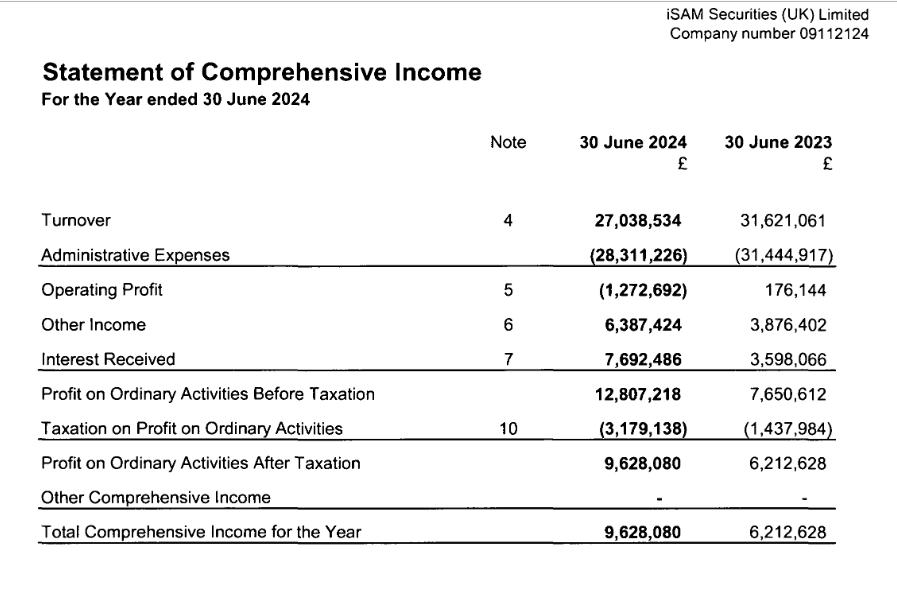

iSAM Securities (UK) Limited reported a total turnover of

£27.04 million for the financial year ending 30 June 2024, reflecting a decline

from £31.62 million in the previous year. Despite lower revenue, administrative

expenses saw a slight reduction, standing at £28.31 million compared to

£31.44 million in 2023.

Operating Loss Offset by Increased Income

“The Board of Directors has conducted a comprehensive

review of the company’s financial position, performance, prospects and current

geopolitical conflicts as part of its assessment of the going concern

assumption for the preparation of the financial statements,” the firm

stated in company filing.

The company reported an operating loss of £1.27 million, a

significant decline from the £176,144 profit in the previous year. However, the

firm benefited from a substantial increase in other income, which rose to £6.39

million from £3.88 million, alongside interest income nearly doubling to £7.69

million from £3.60 million.

Board Confirms Adequate Resources for Operations

These additional income streams led to a pre-tax profit of

£12.81 million, improving from £7.65 million in 2023. However, taxation

expenses nearly doubled to £3.18 million from £1.44 million, resulting in a

post-tax profit of £9.63 million, up from £6.21 million in the prior year.

No other comprehensive income was reported, making the total

comprehensive income for the year £9.63 million, marking a 55% increase from

the previous year.

“Based on the current economic environment, market

conditions and liquidity forecasts, the Board has concluded that the company

has adequate resources to continue its operations for the foreseeable future,

defined as at least 12 months from the date of approval of the financial

statements,” the firm added.

iSAM Securities Promotes New Leaders to Key Roles

Meanwhile, iSAM

Securities has promoted Barry Flanigan to Head of Asia Pacific. He will

manage operations in the region, focusing on growth, client engagement, and

expanding services. Flanigan has been with iSAM for over nine years, most

recently as Head of Electronic Trading, and has held various other positions

since joining in 2009.

iSAM has also promoted

James Wale to Head of Leveraged Sales EMEA. With 15+ years in institutional

sales, Wale has spent over seven years at iSAM, demonstrating strong

leadership. In his new role, he will lead the EMEA Sales team and manage the

sales strategy.

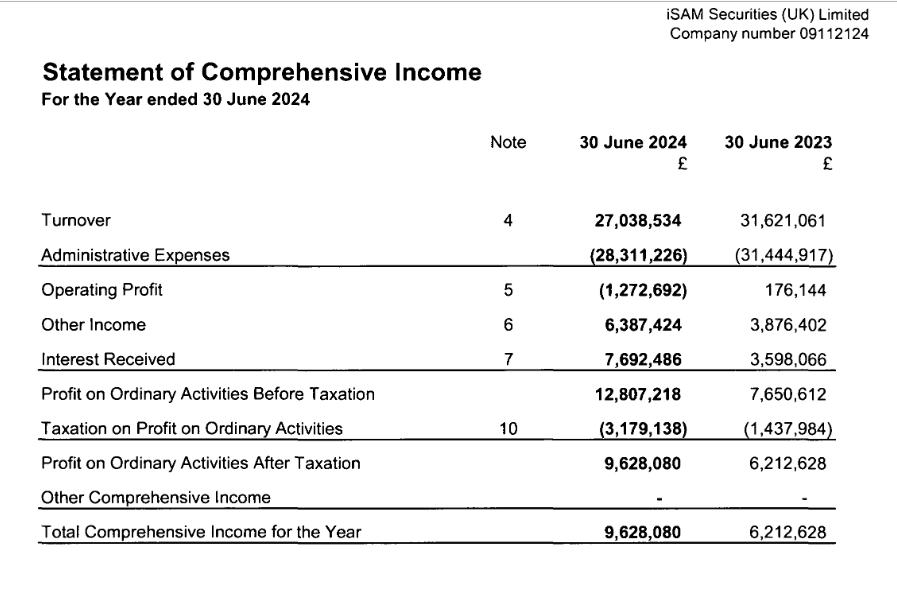

iSAM Securities (UK) Limited reported a total turnover of

£27.04 million for the financial year ending 30 June 2024, reflecting a decline

from £31.62 million in the previous year. Despite lower revenue, administrative

expenses saw a slight reduction, standing at £28.31 million compared to

£31.44 million in 2023.

Operating Loss Offset by Increased Income

“The Board of Directors has conducted a comprehensive

review of the company’s financial position, performance, prospects and current

geopolitical conflicts as part of its assessment of the going concern

assumption for the preparation of the financial statements,” the firm

stated in company filing.

The company reported an operating loss of £1.27 million, a

significant decline from the £176,144 profit in the previous year. However, the

firm benefited from a substantial increase in other income, which rose to £6.39

million from £3.88 million, alongside interest income nearly doubling to £7.69

million from £3.60 million.

Board Confirms Adequate Resources for Operations

These additional income streams led to a pre-tax profit of

£12.81 million, improving from £7.65 million in 2023. However, taxation

expenses nearly doubled to £3.18 million from £1.44 million, resulting in a

post-tax profit of £9.63 million, up from £6.21 million in the prior year.

No other comprehensive income was reported, making the total

comprehensive income for the year £9.63 million, marking a 55% increase from

the previous year.

“Based on the current economic environment, market

conditions and liquidity forecasts, the Board has concluded that the company

has adequate resources to continue its operations for the foreseeable future,

defined as at least 12 months from the date of approval of the financial

statements,” the firm added.

iSAM Securities Promotes New Leaders to Key Roles

Meanwhile, iSAM

Securities has promoted Barry Flanigan to Head of Asia Pacific. He will

manage operations in the region, focusing on growth, client engagement, and

expanding services. Flanigan has been with iSAM for over nine years, most

recently as Head of Electronic Trading, and has held various other positions

since joining in 2009.

iSAM has also promoted

James Wale to Head of Leveraged Sales EMEA. With 15+ years in institutional

sales, Wale has spent over seven years at iSAM, demonstrating strong

leadership. In his new role, he will lead the EMEA Sales team and manage the

sales strategy.

This post is originally published on FINANCEMAGNATES.