Silver has traditionally attracted investors’ attention as one of the most stable precious metals, especially during periods of economic instability and rising inflation. However, many people wonder whether silver is a bad or good investment. This precious metal has a number of features that make it a promising asset, but it is essential to consider the potential risks involved.

This article examines silver investment from multiple angles, covering everything from long-term prospects to price volatility, helping you assess whether silver is worth investing in. Besides, it provides an overview of various investment options, including physical silver, mining stocks, and ETFs, to guide you in choosing the right instrument. This detailed analysis will help you decide whether to consider silver as a good investment in 2024 and beyond.

The article covers the following subjects:

Major key takeaways

- Investing in silver can safeguard your capital amid inflation and economic turbulence. However, it is vital to stay alert to potential price fluctuations.

- When evaluating whether to invest in silver, it is crucial to assess the long-term outlook and be prepared for potential short-term risks.

- Many people consider silver a good investment for diversification of their portfolios, especially when this asset is combined with physical metals, mining stocks, or ETFs.

- Silver is often viewed as a more affordable asset than gold, making it attractive to novice investors.

- Silver is poised for growth driven by industrial demand, particularly in the electronic and renewable energy sectors, making it a promising asset for long-term investors.

Why invest in Silver?

Silver is a physical good with intrinsic value. Therefore, its value cannot fall to zero, unlike numerous securities. Stocks depreciate due to the bankruptcy of companies, and futures contracts can go negative, like oil futures in April 2020.

The silver price is influenced by both investment and industrial demand. This makes it possible to predict future XAG price dynamics based on the analysis of fundamental factors. Investor demand is influenced by the condition of the global economy, while the situation in the mining and manufacturing sectors affects the industrial sector.

It is possible to invest in metal itself (bars, coins), in depersonalized silver (unallocated metal account, purchase on the exchange) or to buy papers of silver mining companies (stocks, ETFs, mutual funds, etc). Investors can choose an investment object according to the desired parameters.

Historically, in the medium term (from three years or more), the growth rate of silver outstrips inflation, so investing in this metal can be used as a low-risk way to preserve and increase capital.

What are the risks of investing in silver?

With short-term investments in silver, investors risk losing some of their money. This is particularly applicable to investments in physical silver, characterized by the largest difference between the purchase and sale (or repurchase) prices. If silver investment coins are not properly stored, their condition may deteriorate, reducing the sale price.

Silver investments in unallocated metal accounts are not insured as standard deposits, so if the bank’s license is revoked or if it goes bankrupt, the investor may lose funds.

Investments in silver UIFs are not insured as well. In addition, there is a possibility that the UIF manager will buy silver at the wrong time, and the investor will lose part of the capital.

A common risk for all silver investing methods is associated with uncertainty about future prices. Even after conducting a competent fundamental and price analysis, the possibility of the opposite situation will remain.

Brief history of Silver investing price

Silver’s all-time low of $0.28 per troy ounce was recorded during the US Great Depression in 1932. However, the stock market crash was not the main cause but the catalyst. The decline in industrial demand for silver began ten years earlier. During this period, the gradual deterioration of the economic situation reduced the demand for finished products, which led to lower prices and made producing silver products unprofitable. The investors’ demand did not have a significant impact at that time.

The subsequent price rise, which lasted approximately 35 years, was due to the low volumes of silver mining during the economic recovery after WWII.

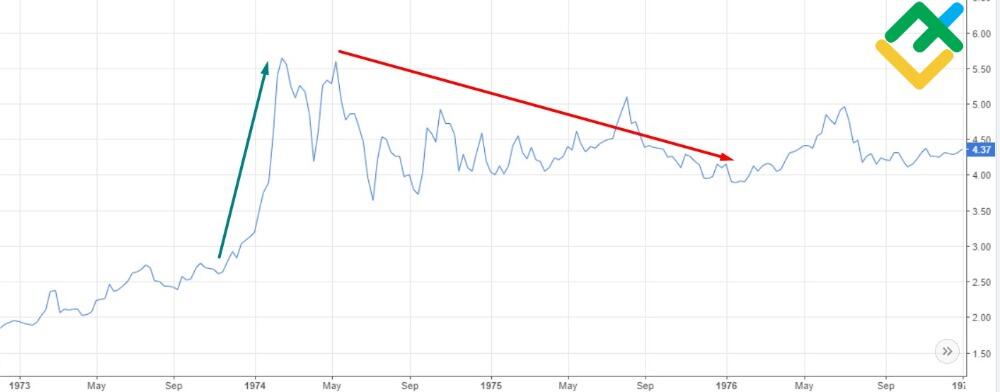

In the 1970s, the Hunt brothers invested millions of their inheritance in silver. In 1973, they began buying metal at $2.9 an ounce. As a result, the XAG price rose to $6.75 after two months of continued purchases.

Between 1974 and 1976, silver prices collapsed from $6.75 to $3.75 per ounce as Mexico saw an opportunity to capitalize on earlier price increases and sharply increased silver sales in the market. This happened at a time of rising unemployment and inflation, so there was no stable support for the silver demand from the industry.

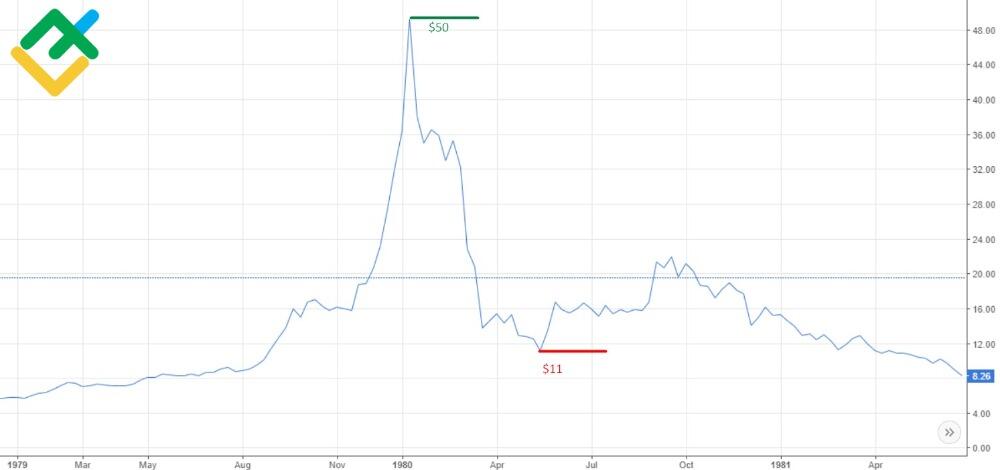

Owing 15% of the world’s reserves, the Hunt brothers bought silver, pushing the price to about $50 per ounce. In 1980, the exchange raised the amount of collateral for silver contracts. The Hunt brothers’ financial resources were insufficient to meet the margin requirements. Brothers had to sell some of the silver they had purchased to contribute the necessary funds. This caused a 500% price drop. As a result, by the spring of 1980, an ounce of silver had dropped to $11.

Before the stock market crash in 1987, silver had surged by 50% to $9. The hike occurred due to increased investment demand for precious metals, which is typical for unstable economic conditions. However, by the end of the year, the rate collapsed almost to the previous level along with the rest of the stock market, as the demand for industrial metal fell sharply.

Over the next few years, the silver decline continued. Significant reserves have been explored in the silver mines, so the supply greatly exceeded demand. In 1993, silver reached a low of $3.67 per ounce.

One of the most significant silver price rises occurred during the global bull market. From 2002 to 2008, XAG soared from $4 to $20 an ounce, increasing by almost 400%.

In the same year, a global banking crisis occurred. As a result, silver declined to almost $9 per ounce by December.

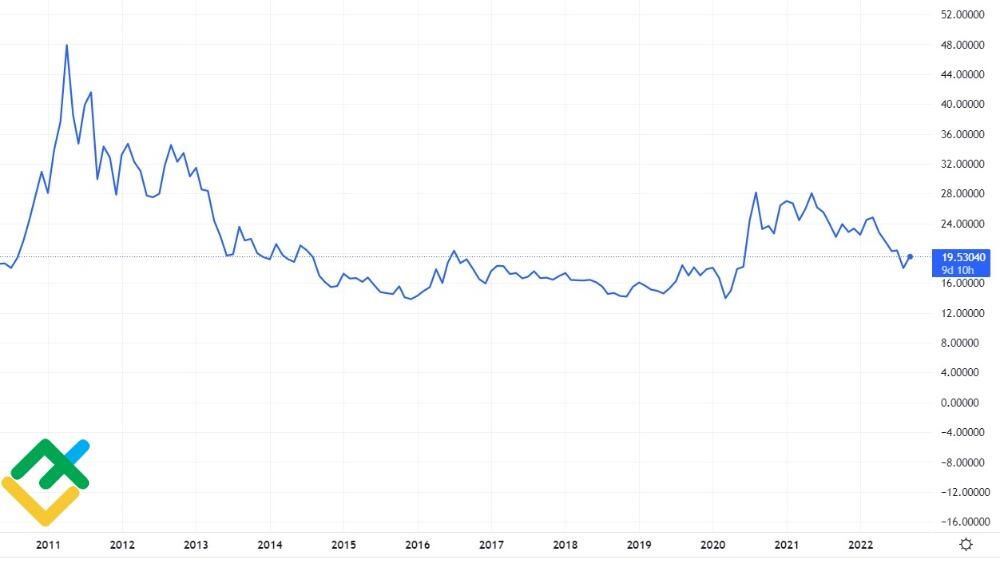

Due to increased investment demand during the crisis, the silver rate reached its previous high of $20 by the end of 2010. After that, XAG price more than doubled, reaching $48 per ounce by April 2011.

Against the background of the strengthening dollar and the outflow of investments from the mining sector into securities with a stable income, silver has decreased by 70% over the next 5 years. It reached $14 an ounce by early 2016.

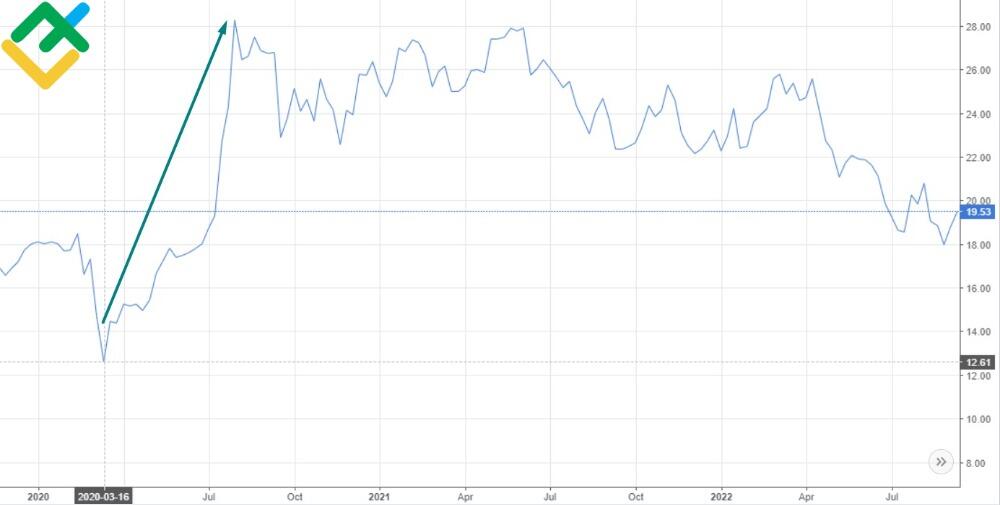

A new silver rally began in 2020 at $12.65 per ounce in February and ended at $28 per ounce in July.

According to analytics, the reason for the rise in prices lies in a decrease in the overall silver supply. It is associated with logistics disruptions due to COVID-19 amid increased investor demand for precious metals during economic turmoil.

Currently, there is a silver downtrend, which has been linked to several record rate hikes by the Fed amid no signs of industrial demand growth.

Silver, stocks and inflation

Let’s assume the investor wants to spend the profit, not leave it as heritage. Therefore, the return on investment for the periods of one, five, and ten years will be analyzed further.

Let’s consider 2021.

Profitability formula:

(P – S) / S х 100%,

where P is the value of the investment at the end of the period, and S is the value of the initial investment.

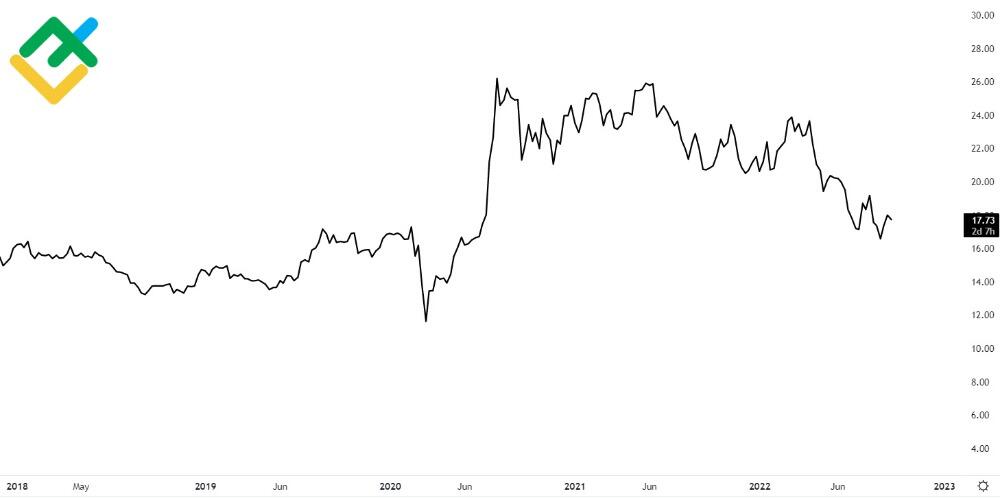

Let’s compare prices for silver, three silver mining stocks, and a silver ETF. The charts for the ten years are below.

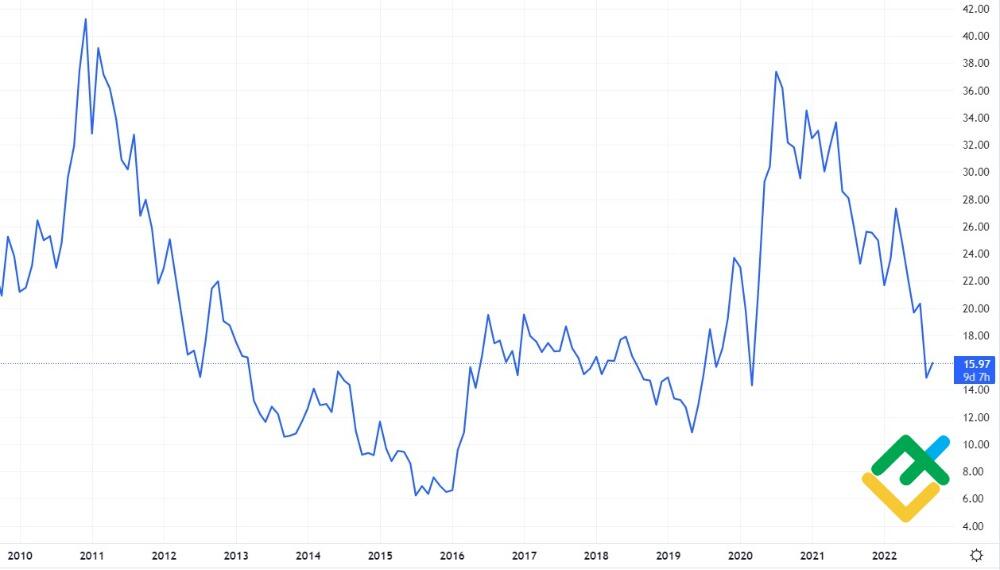

Silver:

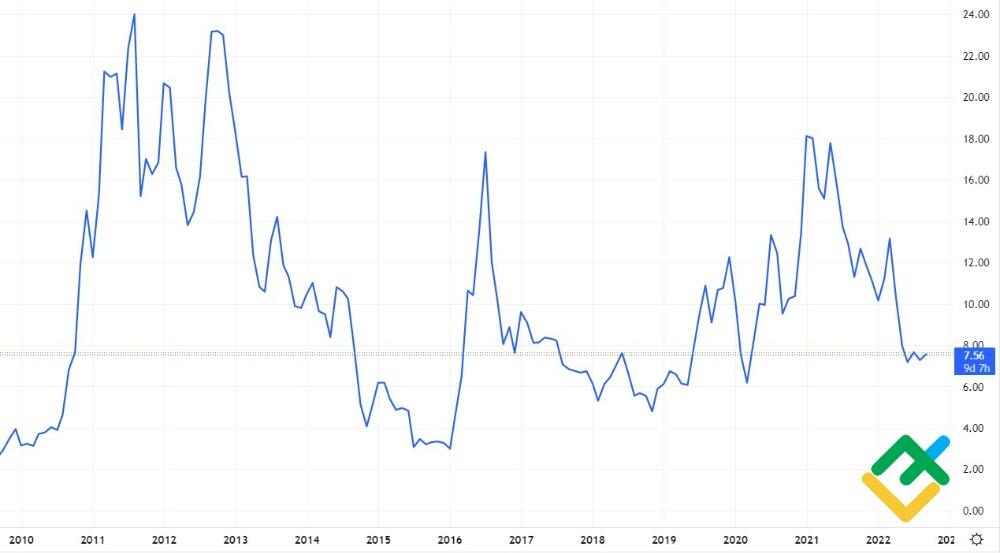

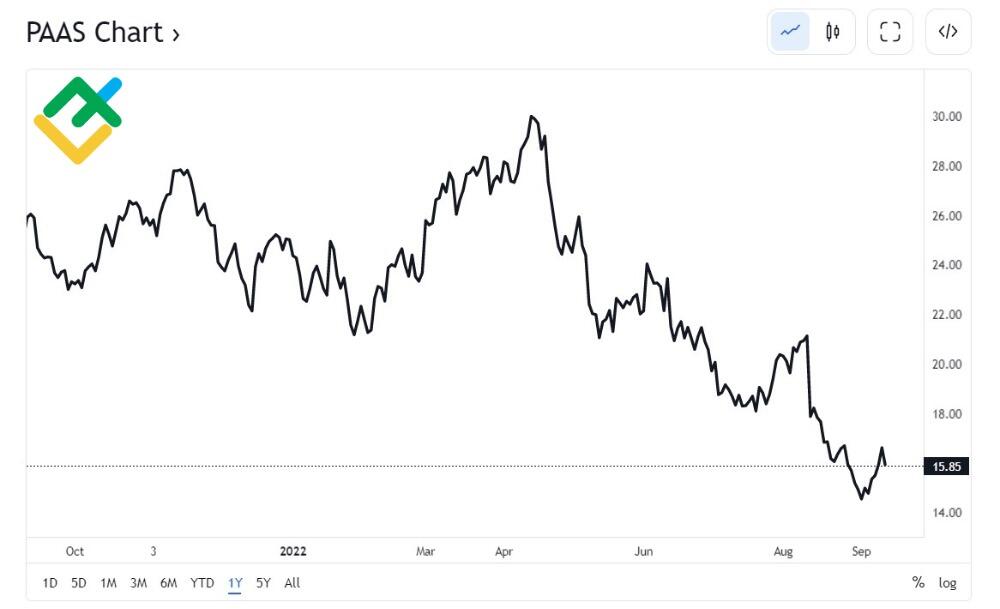

Pan American Silver Corp. stocks:

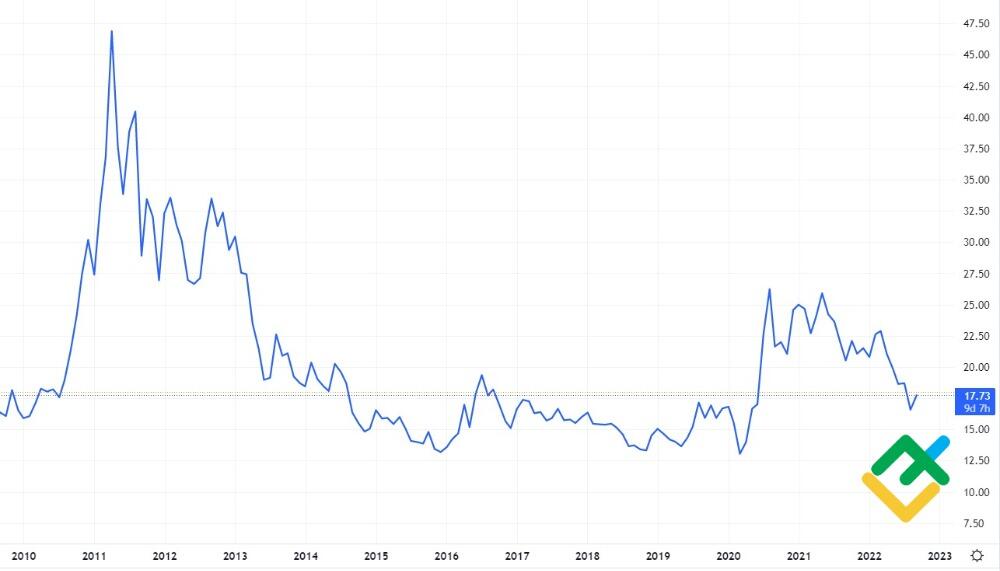

First Majestic Silver Corp. stocks:

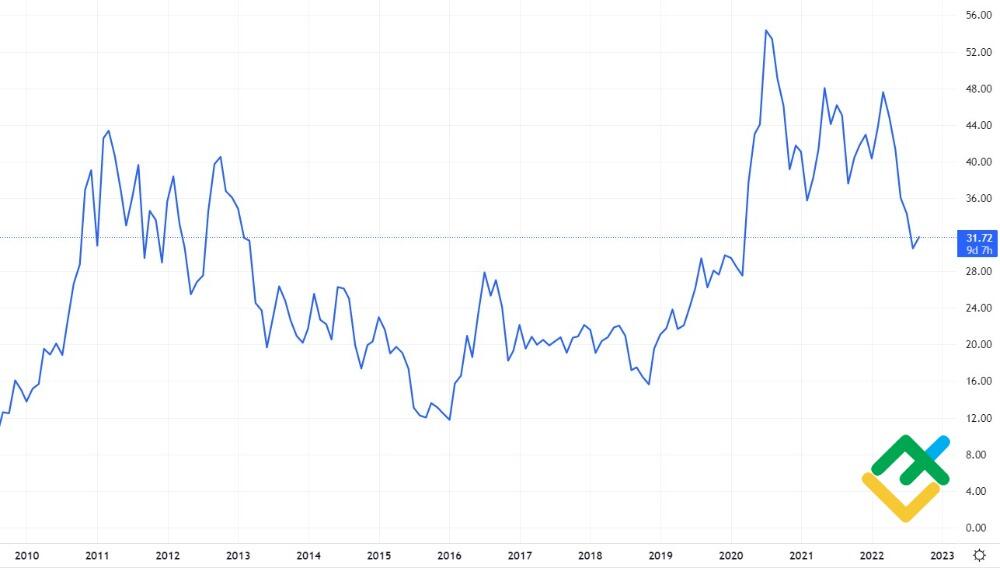

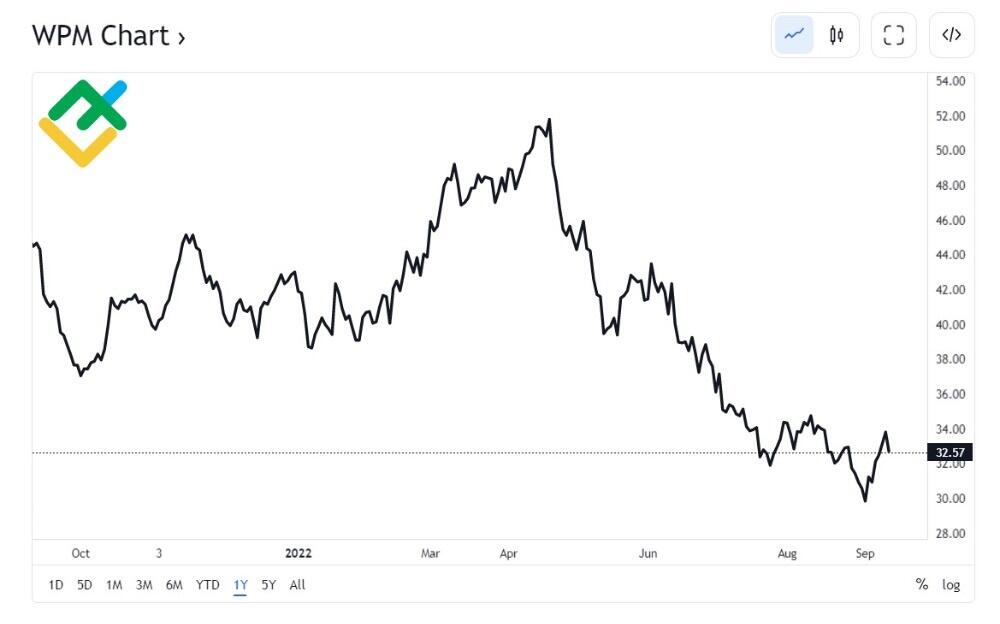

Wheaton Precious Metals Corporation stocks:

iShares silver trust ETF:

Profit for 2021:

-

Silver: (23,24 – 25,46) / 25,46 × 100% = -8,7%;

-

Pan American Silver Corp. stocks: (24,97 – 34,51) / 34,51 × 100% = -27,6%;

-

First Majestic Silver Corp. stocks: (11,11 – 14,14) / 14,14 × 100% = -21,42%;

-

Wheaton Precious Metals Corporation stocks: (42,93 – 43,56) / 43,56 × 100% = -1,4%;

-

iShares silver trust ETF: (21,51 – 25,54) / 25,54 × 100% = -15,8%.

The results are negative for all the above investment instruments. However, a randomly chosen year does not provide a complete view of the future results of short-term investment, as investment and industrial demand may increase. Only Wheaton Precious Metals Corporation stocks outperformed 2021 US inflation (-7%), a record for the last 40 years.

ROI for the five years from 2017 to 2021:

-

Silver: (23,21 – 15,92) / 15,92 × 100% = 45,8%;

-

Pan American Silver Corp. stocks: (24,97 – 15,14) /15,14 × 100% = 65%;

-

First Majestic Silver Corp. stocks: (11,11 – 7,74) / 7,74 × 100% = 43,5%;

-

Wheaton Precious Metals Corporation stocks: (42,93 – 19,36) / 19,36 × 100% = 121,7%;

-

iShares silver trust ETF: (21,51 – 15,25) / 15,25 × 100% = 41%.

Over this period, all instruments showed a profit. The loss for 2021 is proportional to the profit for the five years. Thus, the instruments with the highest profit in five years lost the most in 2021 (except for Wheaton Precious Metals Corp. stocks). Headline inflation in the US was about -14.6% over the same period. As a result, investments in silver outperformed inflation from 65% (investing in a silver ETF) to 159.6% (shares in Wheaton Precious Metals Corporation).

ROI for the 10-year period from 2017 to 2021:

-

Silver: (23,21 – 27,93) / 27,93 × 100% = -16,9%;

-

Pan American Silver Corp. stocks.: (24,97 – 22,45) / 22,45 × 100% = 11,2%;

-

First Majestic Silver Corp. stocks.: (11,11 – 17,47) / 17,47 × 100% = -36,4%;

-

Wheaton Precious Metals Corporation stocks: (42,93 – 29,84) / 29,84 = 43,9%;

-

iShares silver trust ETF: (21,51 – 27,97) / 27,97 × 100% = -23,1%.

Over a period of ten years, stocks of two companies remained leaders in terms of profitability. However, their returns are not as impressive as over the past five years. Other instruments showed negative returns. Again, the losses are proportional to the profits. Thus, the greater the profitability, the greater the amount of loss. Inflation from 2012 to 2021 was approximate -21.47%. As a result, silver and stocks of Pan American Silver Corp. and Wheaton Precious Metals Corporation managed to outperform inflation.

How to invest?

Silver investments are divided into:

-

investments in physical silver (coins and bars);

-

direct investment in depersonalized silver, for example, by opening an unallocated metal account, buying derivatives (ETFs, futures);

- indirect investments, such as purchasing stocks of companies associated with the extraction, processing, or sale of silver.

Silver Coins

Silver coins are cheaper than silver bars because they weigh less. On the other hand, due to their light weight, the coins have the highest markup compared to silver exchange quotes. So for every dollar invested in coins, an investor will receive an average of 20% less silver compared to buying on the exchange.

There is no VAT when buying silver coins. However, if the investor has made a profit, paying personal income tax when selling is necessary.

As a rule, coins are purchased for a long period, from five years or more. Their price depends mainly on two factors, the current silver rate and the duration of storage. Thus, purchases during the period of minimum exchange prices for silver and sales a few years after a prolonged price rise serve as the ideal investment in silver coins. Given the dynamics of the silver price, which increases on average every five years (during annual purchases in the same month), it is possible to save capital or even make money on investments in coins with the right approach.

Investment coins are a means of payment along with standard coins, as they are issued only by central banks. However, if the central bank removes them from circulation, they will become a standard product, so it will be necessary to pay VAT when buying or selling such coins.

When investing in coins, proper storage conditions are important. Since if there are defects, the sale price decreases.

Silver Bars

A bar is a tangible asset. It is possible to buy silver bars through a bank and from individuals. When buying, you do not need to pay VAT. However, personal income tax must be paid when selling if the investment is profitable.

A silver bar has a simpler design than a gold bar, so its value is closer to the metal price. Also, the higher the bar weight, the lower the markup. If the bar weighs more than 1 kg, the overpayment will be about 10% compared to the metal’s price. On the other hand, large bars cannot be divided, which means that it will not be possible to withdraw part of the investment less than the cost of one bar.

When buying bars from hand, check the weight and purity of the metal with a specialist to minimize the risks of buying low-quality bars.

To make profitable deals, compare the price of the bar with the price of silver on the stock exchange. Experts recommend considering purchases in March or June.

Unallocated metal account

An unallocated metal account is an investment method according to which investors do not need to hold silver in physical form, as in the case with bars or coins. The difference with a regular bank deposit is that when opening an unallocated metal account, investments are not stored in currency, but in an equivalent amount of silver.

Some banks allow traders to convert silver assets from one unallocated metal account to another (concerning different metals), as well as transfer metal to bars.

Working conditions with unallocated metal accounts may also vary. For example, in Switzerland, it is necessary to pay VAT when opening an unallocated metal account in any metal other than gold, and an account falls under the insurance program. In Russia, opening and maintaining an unallocated metal account is usually free, but there is no possibility of interbank transfer from one unallocated metal account to another. In the United States, possessing unallocated metal accounts for more than a year falls under the collection category with a corresponding tax of 28%.

In my opinion, the main advantage of unallocated metal accounts over physical metal is the lower or no costs of maintaining a silver account and storing the metal.

Otherwise, unallocated metal accounts are less convenient than CFDs, except for the possibility of converting them into physical metal.

Silver ETFs/Futures

Silver futures and ETFs are instruments that are traded on exchanges.

ETF is a security that allows traders to get a share in an investment portfolio. In the case of silver ETFs, this is the share of the portfolio of silver mining companies. iShares silver trust (#SLV) serves as an example of such an ETF. The chart below shows #SLV returns over the last five years:

When investing via ETF, investors may not form their own securities portfolios. Buying instruments will be more expensive than buying an ETF with the same set. Consequently, the investors get the opportunity to receive the same percentage of income with a smaller amount of money required for the investment.

ETF management fees are lower than those of mutual funds.

Silver futures is a contract to buy silver at a certain price in the future. Therefore, it is a derivative financial instrument whose underlying asset is silver. As an investment object, it allows traders to earn on the rise and fall of the price, since it is possible to enter both long and short futures trades.

The duration of the futures contract is three months. If the trade is not closed or extended, a physical delivery will be made.

The main expenses of investing in futures are:

-

commission for opening and closing a position;

-

fee for carrying over an open position to the next day.

Silver CFDs

Start trading right now

Trading both CFDs and futures, the parties make a profit or loss from the difference in the opening and closing prices of a transaction. The main differences between CFD and futures:

-

the second party to the contract is a broker, not another investor;

-

CFDs do not have expiration dates. Therefore, CFDs are more profitable for long-term investment than futures. Their investment horizon is equal to the duration of the contract (three months).

When trading CFDs, there is no commission for opening and closing a trade, but there is a fee for carrying over a position to the next day.

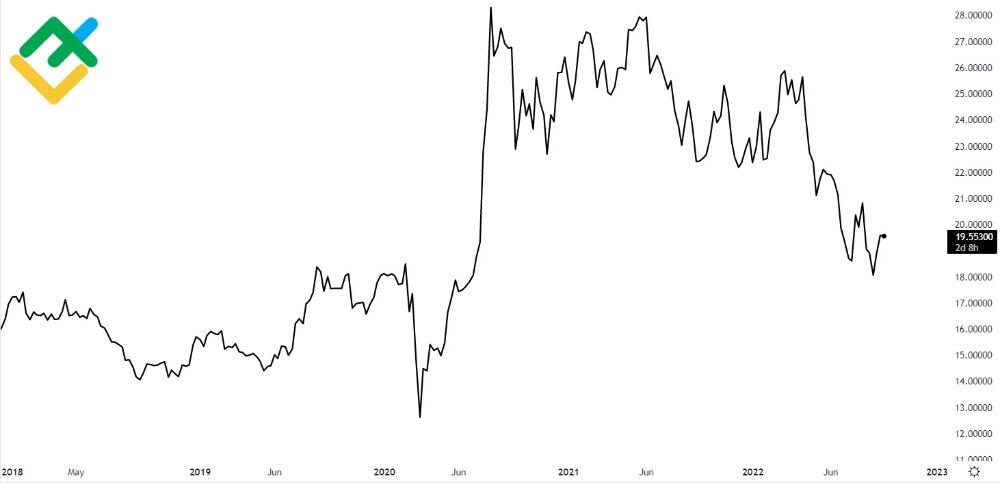

The five-year Silver CFD chart is shown below:

CFDs are very similar to iShares silver trust ETF, aren’t they?

CFDs have lower margin requirements than futures due to the larger leverage. Therefore, silver trading or investment requires less capital than investing in futures. At the same time, this can be a disadvantage for beginners who have difficulty with risk management.

It is possible to trade CFDs through the MetaTrader trading terminal or the online terminal on the broker’s website.

The instrument is suitable for any investment horizon, from scalping on small timeframes to long-term investment over a year.

Silver stocks

Buying shares in silver mining companies is an indirect investment in silver. Shares are not directly related to the metal but are sensitive to fundamental factors that affect the silver rate, such as production volumes and logistics.

Let’s consider some major mining companies that are publicly traded.

Pan American Silver Corp.

This is a Canadian company engaged in silver mining in Latin America. It is one of the largest miners in the world with a market capitalization of more than $8 billion in 2021.

First Majestic Silver Corp.

Another company from Canada. It is also engaged in silver mining as well as gold mining and silver bullion production. Production facilities are located in Mexico and the USA.

Wheaton Precious Metals Corporation

This company (ticker #WPM) is also registered in Canada. It is engaged in wholesale purchases of metal from other mining companies. The company mainly buys silver from mines in Mexico (40%) and Portugal (20%).

7 Reasons to invest in Silver

To achieve positive investment results, it is necessary to have a more objective look at the situation. Silver can be used both to earn and save money, but not at every moment and in every economic situation. Let’s consider the arguments for investing in silver.

Silver Preserves Wealth

In the medium term, investing in silver instruments at least allows to overtake inflation. In addition, during geopolitical uncertainty or global crises, the demand for silver as an investment asset increases, which drives up its price.

Precious metals like silver or gold are used by investors as a safe haven during times of high inflation.

Silver as a Hedge Against the dollar and fiat money

Silver is inversely proportional to the USD, that is, the stronger the US dollar, the greater the possibility of lowering the silver price. Therefore, it is reasonable to enter the USD trade first and then consider opening an opposite silver trade for hedging purposes.

Silver as a Safe Haven

Silver has intrinsic value as it is a material that is used in industries to produce microchips, medical equipment, and jewelry. As long as silver is in demand, its price cannot drop to zero.

Portfolio Diversification

Silver has a strong correlation with the US dollar and with the US Treasuries (federal loan bonds). Therefore, investments in any of the silver instruments can be used to diversify almost any portfolio.

High volatility

Silver, like any metal, is known for its wide price fluctuations. This allows investors to earn the desired profit percentage faster than trading low-volatility instruments like the SP 500 index.

Wide range of instruments

There are four ways to invest in silver. First, directly through bars, coins and other products. Secondly, through unallocated metal accounts, funds and derivative financial instruments. Thirdly, through the stocks of companies associated with silver. Finally, through these stocks’ derivatives.

Price

Silver has the lowest price among the metals available for investment. The price ratio of gold and silver is approximately 1 to 85. Therefore, XAG is used for both small and large investments.

7 Reasons not to invest in Silver

Let’s talk about the disadvantages of investing in silver. Some of them are visible even with a superficial analysis of the price chart. Below you will learn about seven problems that arise when investing in both physical and exchange-traded silver.

Large price drawdowns

Historically, silver has lost more than 50% in value several times in a short period of time. It may take several years to recover from such drawdowns, which is psychologically uncomfortable. For a faster recovery, it may be necessary to buy more silver on the fall, but this will significantly increase the risks.

Compared to inflation-adjusting bonds, also known as floaters, silver has a higher profit potential. But floaters have almost zero risk of drawdowns. At the end of the year, even a small, but almost guaranteed yield on bonds can cover the potentially negative yield of silver investments.

Decline rate

Collapses in silver prices are not only big but fast. This is typical for highly volatile instruments. Investors may not have time to close the trade according to the rules of risk management, and then their losses will be greater than planned.

Market volatility

Unlike indices, silver prices rarely have long-term trends, so a buy-and-hold strategy is not suitable for XAG. Investors need to have sufficient competence to choose the right investment horizon to avoid a long period of opposite price movement.

Low trend frequency

Silver has an impulse dynamics of price movements. In other words, a large and rapid rise or fall is usually followed by a long period of non-directional movement. Silver can be in the sideways trend for years and, therefore, will only be suitable for short-term trades. Thus, there will be no return on funds invested in the medium or long term.

Numerous factors to consider

The silver price is affected by both industrial and investment demand. Thus, in order to make a correct medium- and long-term forecast, it is necessary to monitor and analyze a large number of factors. For example, the state of the US economy, the strength/weakness of the USD, the situation in the mining industry, inflation, gold price dynamics and much more. As a result, based on this data, it is quite difficult to come up with an investment decision to buy or sell silver.

Markup

Physical silver is sold with a markup to the exchange price. It can reach 3% for bars, and 10% for coins. When trading bullion it is necessary to pay for storage. Thus, investing in physical silver is likely to become long-term.

Low liquidity

The silver exchange market is not characterized by large trading volumes. In the case of a large purchase, traders may need to look for sellers at higher price levels, which will worsen the average open price of the trade.

Also, due to low liquidity, a wide spread determines investors’ strategy towards catching trends and refusing counter-trend trades.

Silver Alternatives for Investments

First of all, it’s gold. In terms of pricing structure, it is similar to silver, as it depends on industrial and investment demand. It should be noted that the investment demand for gold prevails over the industrial one. The distribution of investment capital between gold and silver diversifies investments. Thus, silver will be more correlated with the situation in the industry and gold with investor sentiment. Gold can be purchased in the form of bars and coins, which will be more expensive than silver.

Platinum can also be used as an investment. It is a precious metal that is used in industry and jewelry. However, compared to gold and silver, the platinum market is low-liquid due to a narrow market and scarcity. The global economic situation and changes even in one sector of the economy can significantly affect its rate (for example, in the automotive industry, where platinum is actively used). On the other hand, low liquidity leads to high volatility. Thus, platinum can be a good investment in some cases due to the high potential return, but it will be associated with high risks.

Palladium is also considered an alternative to silver. Industrial demand for PA also outstrips investment demand (as in the case of silver). It is even less liquid and even more volatile than platinum. This is because the palladium market is even narrower, and PA reserves in the world are 15 times less than those of platinum. If you consider palladium as an investment, I recommend choosing a short-term investment.

Oil (WTI, Brent) is also a good investment option. It is possible to invest both through derivative instruments and indirectly through shares of oil companies. Oil futures are highly liquid and volatile. It is convenient to analyze oil fundamentally since there is practically no investment demand. The main influence on the oil price is provided by current production volumes and OPEC future plans.

I would not consider stocks and cryptocurrencies investments as alternatives to silver since they do not have intrinsic value, unlike other metals or materials. Both stocks and cryptocurrencies can be used for investment, but they are mostly speculative instruments, which means they are not supported by demand from the real sector of the economy. The prices of stocks and cryptocurrencies will follow the market, in most cases, which means that these instruments cannot be used as a safe haven during economic turmoil.

Which is Better to Invest in Gold or Silver?

Silver and gold were the first metals to be invested not only by producers, but also by investors. Investment demand for palladium and platinum is still far from that of silver and gold. Moreover, historically, silver has been catching up with gold. After waiting a little after the start of gold growth, silver sometimes even surpasses the rise of XAU in percentage terms. Let’s determine which metal is more interesting from an investment point of view.

Required amount of capital

The price of gold is higher than silver. Therefore, all gold objects of direct investment, bullion, coins, derivative financial instruments, will be much more expensive. Similar investments in silver require less money, which means that investors will have more opportunities to diversify.

Liquidity

Gold is more liquid on the exchange, bringing more benefits from large investments. High liquidity also provides both short-term and long-term investment opportunities, while a justified investment horizon for low-liquid silver is medium and long-term.

Volatility

Both instruments are volatile intraday. However, silver’s volatility is higher in the medium and long term, while gold’s volatility over the past 20 years has been slightly above the SP 500 index.

Stability

The maximum historical drawdown for gold was about 45% and 76% for silver. Therefore, gold is more suitable for the buy-and-hold strategy and is a more stable investment.

Portfolio diversification

The price of silver is largely determined by industrial demand and gold price by investment. Thus, the silver price will be more correlated with the stock market, in particular, with the shares of mining and manufacturing companies, than gold. Therefore, investments in gold diversify the portfolio better than silver ones.

A Good or bad time to invest in Silver right now?

Silver downtrend continues from March 2022. Since July 2022, it has begun to slow down. However, fundamental factors do not contribute to price growth. Thus, a strong dollar and a possible further increase in the Fed’s rate to fight inflation suggest an increase in the stability of the US economy, which means that investors will not be interested in entering metal trades yet.

On the other hand, during the year, the silver market is expected to maintain stable demand from clean-tech businesses, as well as companies engaged in electronics, jewelry and silver retail.

In view of those facts, investing in silver or related instruments is now risky but, to some extent, justified. Now is not the right moment for conservative investment, as the current fundamentals and price dynamics suggest a further decline.

It is unprofitable to enter short silver trades now, as silver has been in its lower price range since the start of the decline in March 2022. Therefore, an upward correction is more likely to occur at the moment than a continuation of the downward movement. From a fundamental point of view, short silver trades are reasonable at the moment, as the US is trying hard to curb inflation against the backdrop of a strong dollar, which together puts pressure on the silver rate.

Silver Investment FAQs

The first way is to buy silver in physical form: bars, coins, and jewelry. The second way is to buy securities associated with silver, such as shares of silver mining companies, ETFs, mutual funds, and derivative financial instruments such as CFDs, futures, or options. The third way is to buy virtual silver by opening an unallocated metal account or buying silver on the exchange.

Due to the fact that silver supply exceeds demand at current prices. The rising supply is facilitated by an increase in silver mining, a stable global economy, and poor-established supply chains from mining to processing companies.

Due to the fact that silver demand exceeds supply at current prices. Growth in demand is facilitated by an increase in the production of silver products, economic instability, and a decrease of silver reserves in explored deposits.

Yes, if the investor is aware of the risks, follows the rules of money management, and can wait for the right moment to invest. The chance of profiting from rising silver prices increases during times of economic instability, declining production rates, and rising industrial production. For success in the short and medium term, conducting a technical analysis of price charts is desirable.

Investments are always associated with risks. Unlike the purchase of securities, when buying silver in physical form, investors are insured against the total loss of the asset value. However, there is still a risk of losing part of the savings due to price reduction.

Yes, in the long term, since the growth in their value is noticeable over a period of 5-10 years. The purchase will not be subject to VAT, but the price will be higher than the exchange price, since the average markup is 5%.

It is the most affordable metal that you can invest in. Also, XAG price is highly volatile, which makes it possible to earn both on growth and fall faster than with other instruments. A wide selection of silver-related instruments, bars, coins, stocks of silver mining companies, funds, and metal accounts, allows investors to find suitable assets for investment.

To buy physical silver (bars, coins), contact a bank or a specialized store. To buy virtual silver, you need to open an unallocated metal bank account, or buy silver on the stock exchange through a broker. To buy securities associated with the silver industry, you need to open an account with a stock broker.

On the one hand, the situation in the mining and manufacturing sectors of the economy, for example, the growth rate of production, the volume of production of silver products, and the logistics efficiency. On the other hand, the amount of investment demand, which depends on the current silver/gold ratio and how close the economic crisis is.

First, you need to find out on which exchanges these stocks are traded. After that, choose a broker that provides access to the necessary exchanges and deposit funds into your brokerage account. After that, you can buy shares of silver mining companies using an exchange order with your broker.

Yes, if you are satisfied with the current silver dynamics. These funds are highly liquid, traded around the clock and allow traders to profit from both rising and falling prices. Funds charge a management fee.

As a rule, silver rises in price during periods of economic instability. In addition, silver is a tangible asset, which means that XAG investments cannot be completely depreciated due to the metal’s intrinsic value.

From 2017 to 2021, the average annual return on silver investments was +6%, -9%, +17%, +48%, -14% (purchase at the beginning of January and sale at the end of December). Thus, the average return over five years was +9.6% with a total return of 48% from January 2017 to December 2021.

In the next one or two years, expect stagnation of silver, or a further decline in its price due to problems in the global economy, a strong dollar and a decrease in demand from investors due to positive statements by the Fed about an imminent increase in interest rates. From about 2025, analysts predict the beginning of a bullish trend and a subsequent increase in the price to $50-$60 per ounce in the next five years. This forecast is based on the historical cyclical nature of silver quotes and the gradual removal of disruptions in the supply chain in the mining industry.

Price chart of XAGUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.