iFOREX, a forex and contracts for differences (CFDs) broker, is boosting its brand visibility ahead of its planned initial public offering (IPO) by sponsoring Polish football club Lech Poznań for the upcoming season. The firm also recently renewed its partnership with Dutch club PSV Eindhoven for another year.

Putting the Brand on the Sleeves

According to an official announcement today (Wednesday), iFOREX has become the Official Online Trading Partner and non-exclusive Official Sleeve Partner of Lech Poznań.

A recent report by Sportquake highlights the growing use of “Online Trading Partner” deals, which cover various marketing areas and are typically cheaper than more prominent placements on team jerseys.

“This partnership is an exciting chapter for iFOREX as we continue to expand our global reach and connect with European communities in engaging and meaningful ways,” said Itai Sadeh, CEO of iFOREX.

iFOREX’s tie-up with Lech Poznań comes shortly after the club won the domestic league in Poland. The team enjoys strong local support and a notable social media following: 665K followers on Facebook, 266K on Instagram, 208.5K on X (formerly Twitter), and 124K YouTube subscribers.

Although the broker did not detail the marketing channels it would use, its role as Official Sleeve Partner suggests its branding will appear on the club’s jersey sleeves.

Cost of Sports Sponsorships

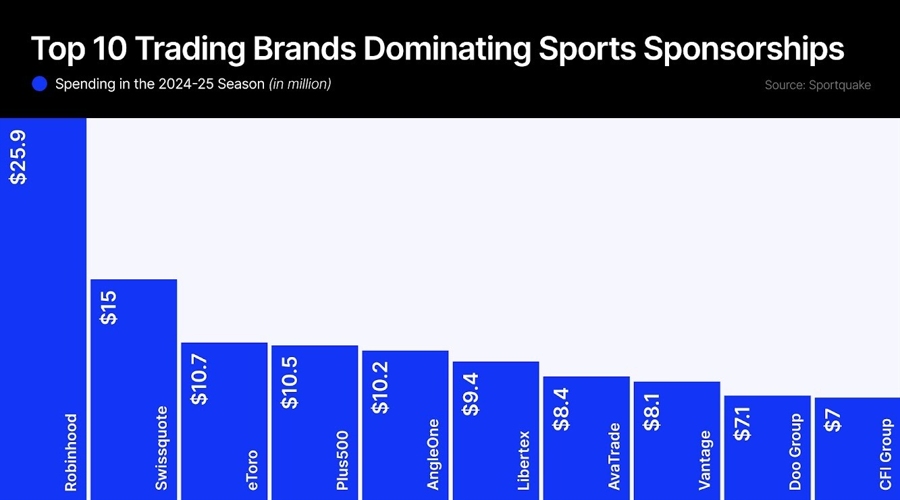

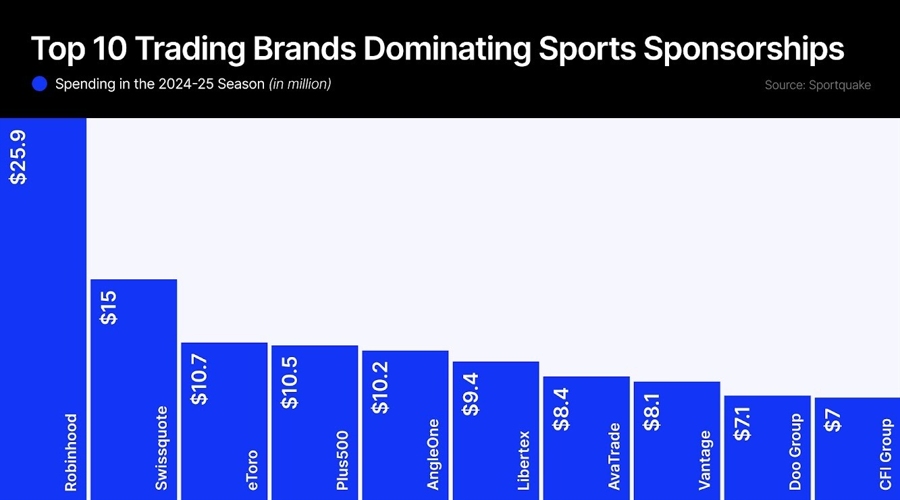

The financial details of the sponsorship were not disclosed. As reported by Finance Magnates, brokers often spend several million dollars to place their logos on football kits.

Read more: Football Sponsorship Shake-Up – CFDs Brokers Could Score as Betting Brands Get Benched

Among brokers offering CFDs, Swissquote was the highest spender on sports sponsorships last season at $15 million, followed by eToro and Plus500 at $10.7 million and $10.5 million respectively. Other significant spenders include Libertex, AvaTrade, Vantage, Doo Group, and CFI Group.

These amounts, however, are still much lower than the levels seen with top cryptocurrency exchanges.

While iFOREX builds its sports marketing profile, its planned IPO in London has been delayed due to a compliance review by regulators in the British Virgin Islands (BVI). The company is licensed in both BVI and Cyprus.

According to its IPO prospectus, 35 per cent of iFOREX’s revenue comes from Japan, 17 per cent from India, and 20 per cent from various countries in the Middle East. However, the broker does not hold licences in any of these markets.

iFOREX, a forex and contracts for differences (CFDs) broker, is boosting its brand visibility ahead of its planned initial public offering (IPO) by sponsoring Polish football club Lech Poznań for the upcoming season. The firm also recently renewed its partnership with Dutch club PSV Eindhoven for another year.

Putting the Brand on the Sleeves

According to an official announcement today (Wednesday), iFOREX has become the Official Online Trading Partner and non-exclusive Official Sleeve Partner of Lech Poznań.

A recent report by Sportquake highlights the growing use of “Online Trading Partner” deals, which cover various marketing areas and are typically cheaper than more prominent placements on team jerseys.

“This partnership is an exciting chapter for iFOREX as we continue to expand our global reach and connect with European communities in engaging and meaningful ways,” said Itai Sadeh, CEO of iFOREX.

iFOREX’s tie-up with Lech Poznań comes shortly after the club won the domestic league in Poland. The team enjoys strong local support and a notable social media following: 665K followers on Facebook, 266K on Instagram, 208.5K on X (formerly Twitter), and 124K YouTube subscribers.

Although the broker did not detail the marketing channels it would use, its role as Official Sleeve Partner suggests its branding will appear on the club’s jersey sleeves.

Cost of Sports Sponsorships

The financial details of the sponsorship were not disclosed. As reported by Finance Magnates, brokers often spend several million dollars to place their logos on football kits.

Read more: Football Sponsorship Shake-Up – CFDs Brokers Could Score as Betting Brands Get Benched

Among brokers offering CFDs, Swissquote was the highest spender on sports sponsorships last season at $15 million, followed by eToro and Plus500 at $10.7 million and $10.5 million respectively. Other significant spenders include Libertex, AvaTrade, Vantage, Doo Group, and CFI Group.

These amounts, however, are still much lower than the levels seen with top cryptocurrency exchanges.

While iFOREX builds its sports marketing profile, its planned IPO in London has been delayed due to a compliance review by regulators in the British Virgin Islands (BVI). The company is licensed in both BVI and Cyprus.

According to its IPO prospectus, 35 per cent of iFOREX’s revenue comes from Japan, 17 per cent from India, and 20 per cent from various countries in the Middle East. However, the broker does not hold licences in any of these markets.

This post is originally published on FINANCEMAGNATES.