Investing $100 in Bitcoin today is a straightforward and affordable way to delve into the realm of cryptocurrencies. As a prominent digital asset, Bitcoin has demonstrated considerable price volatility, capturing the interest of beginners and seasoned traders.

Long-term Bitcoin investments have gained significant traction amid high volatility and increasing interest from institutional investors, particularly following the approval of ETFs. Yet, should you consider BTC as a profitable investment if you only have $100? Can such an investment yield tangible profits?

Is Bitcoin a promising asset or a high-risk investment that fails to meet expectations?

The article covers the following subjects:

Major Takeaways

- Although investing $100 in Bitcoin today is easy, such an amount is unlikely to make you wealthy. Nevertheless, it is a great way to explore the cryptocurrency market and start learning.

- Bitcoin is known for its significant price volatility, with its value capable of soaring or plummeting dramatically. Historically, long-term investments have been the most profitable.

- The minimum investment amount depends on the chosen platform, but you can even start with $10–$20 by purchasing fractions of Bitcoin.

- There are three main ways to invest in Bitcoin: CFDs, ETFs, and direct purchases. CFDs allow you to trade using leverage. ETFs are more suitable for conservative investors. Meanwhile, direct purchase provides full ownership of the asset.

- Back in 2015, the price of Bitcoin was approximately $220, but it surged by an impressive 349% between 2023 and 2025.

- Security is a key factor in investing. Store your Bitcoins in secure wallets and utilize two-factor authentication to safeguard your capital.

- When considering trading Bitcoin, it is crucial to make a well-thought-out decision. Investing calls for a solid strategy and effective risk management. Only invest what you can afford to lose.

Is Bitcoin a Good Investment Today?

The Bitcoin price stands at $84 501.23 and continues to solidify its status as the most sought-after cryptocurrency globally. Investors and traders are drawn to its impressive growth potential despite the inherent volatility associated with it.

Throughout its history, Bitcoin has experienced considerable ups and downs, yet interest continues to thrive, particularly among those ready to embrace risks in pursuit of substantial rewards.

Bitcoin stands out as the premier cryptocurrency, and this title is well-deserved. With a market capitalization of $2.034 trillion, it holds the top spot globally, solidifying its position as the largest digital asset available.

Nevertheless, like any investment, Bitcoin has its own features. One of the key features of the Bitcoin market is high volatility. Price swings can reach several dozen percent in a short period.

For seasoned traders, these market fluctuations can present an excellent opportunity to profit, while for novices, such volatility often leads to anxiety and doubt.

One of the reasons people place their trust and invest in Bitcoin is its potential for long-term growth. Many see BTC as a way to safeguard their funds from inflation or even multiply their capital if its price starts to climb again.

On the other hand, the lack of regulation and high price volatility make such investments quite risky. This fact is particularly crucial for those just starting their journey in the crypto market.

Today, Bitcoin garners the attention not only of private investors, but also of large companies and institutional investors. The approval of ETFs based on BTC was one of the most important events that bolstered its position in the digital asset landscape.

Nonetheless, remember: Bitcoin remains a high-risk asset. Its value can skyrocket in a short period, only to plummet just as fast.

When considering investing $100 in Bitcoin, it is crucial to define your objectives. This investment can serve as an excellent starting point for learning about digital assets. However, your success will heavily rely on your risk tolerance and willingness to closely monitor the ever-changing cryptocurrency landscape.

Is $100 Enough to Invest in Bitcoin?

When considering whether to invest money in cryptocurrencies, especially a modest sum like $100, many beginners wonder if it is a worthwhile venture.

To address that, let’s explore how Bitcoin investing has changed over time. After all, even small investments can yield substantial returns with the right strategy and patience.

If you had invested $100 in Bitcoin a year ago, your investment would have grown to $246.55, or by 146.62% today. Had you invested two years ago, your $100 would now be worth $449.15, marking a staggering rise of 349.15%. This clearly illustrates that even small investments can yield notable returns over the long term.

A $500 investment a year ago would have turned into $1,232.74 and into $2,245.73 over two years. While the percentage gain stays the same, the actual return is much higher.

If you had decided to invest $1,000 two years ago, that amount would have surged to $4,491.46 today. A $5,000 Bitcoin investment would have resulted in $22,000. These figures show how the initial investment amount significantly influences the outcome.

The Bitcoin market shows significant upside potential, and even starting with just $100 can provide you with an excellent opportunity to become familiar with the market and acquire practical experience. However, it is essential to keep in mind that high volatility introduces a substantial level of risk. Always invest the funds you can afford to lose without facing serious financial strain. This is one of the main rules of cryptocurrency trading.

Conclusion: $100 is enough to get started. Nevertheless, if you are aiming for more significant financial results, consider investing a larger sum.

|

Investment Amount |

Value After 1 Year |

Return (%) |

Value After 2 Years |

Return (%) |

|

$100 |

$246.55 |

+146.62% |

$449.15 |

+349.15% |

|

$500 |

$1,232.74 |

+146.62% |

$2,245.73 |

+349.15% |

|

$1,000 |

$2,465.48 |

+146.62% |

$4,491.46 |

+349.15% |

|

$5,000 |

$12,327.39 |

+146.62% |

$22,457.32 |

+349.15% |

What Makes Bitcoin Valuable?

Bitcoin is frequently dubbed “digital gold,” and for good reason. It remains one of the most popular and valuable cryptocurrencies in the world. Its price is determined by a number of factors that make the asset truly unique. Let’s take a look at the key reasons why Bitcoin retains and continues to strengthen its value.

- Limited supply. Unlike fiat currencies that can be issued unlimitedly, the supply of bitcoins is capped at 21 million coins. This limitation positions Bitcoin as a scarce asset, akin to gold, which enhances its investment appeal.

- Decentralization and independence. Bitcoin is not controlled by banks or government entities, making it resistant to political sway. No third party can freeze your wallet or influence the issuance of new coins.

- Security and data protection. Blockchain technology ensures transparency and reliability of all transactions, significantly reducing fraud risks and making Bitcoin a safe tool for storing and transferring capital.

- Recognition from large investors. Institutional investors, investment funds, and companies such as Tesla and MicroStrategy have already invested significant amounts in Bitcoin. Besides, the approval of Bitcoin ETFs has boosted the confidence of traditional financial players.

- Halving cycles and growing demand. The number of new bitcoins decreases with each halving while interest in the cryptocurrency continues to surge. This creates an imbalance between supply and demand, contributing to the price appreciation.

All of these factors make Bitcoin an exceptional digital asset that continues to attract the attention of private and institutional investors around the world.

Understanding Bitcoin’s Price History and Volatility

Since its inception, Bitcoin has traveled an astonishing journey from a few cents to over $100,000. Its history is marked by a series of rapid spikes, corrections, and remarkable recoveries. Below are the key milestones that highlight the evolution of its price:

- 2010 — first transactions. Bitcoin started trading at around $0.8. These were the initial steps into the market that only a few enthusiasts were aware of.

- 2013 — first major surge. The price surpassed the $100 mark for the first time and climbed to $1,000 by the end of the year. This was the turning point when cryptocurrency began to capture widespread attention from investors and the media.

- 2017 — phenomenal jump. By December, Bitcoin hit a high of $20,000, thanks to the excitement among retail investors. This is an important milestone in the development of the crypto market.

- 2020 — institutional adoption. After a period of correction, Bitcoin began a new rally. Large companies such as MicroStrategy and Tesla started investing in BTC. By the end of the year, the price climbed to $29,000.

- 2021 — setting an all-time high. In November 2021, Bitcoin reached an all-time high of around $69,000, fuelled by the growth of institutional investment and the launch of the first Bitcoin ETFs.

- 2022 — sharp fall. This year proved challenging as the collapse of the FTX crypto exchange, coupled with a general decline in financial markets and waning investor confidence, led to the price drop to $15,464.

- 2023–2024 — recovery and growth. In 2023, the market started to rebound, and Bitcoin reached the $31,000 mark. In 2024, another halving took place, triggering a fresh wave of increases. At its peak, the price soared to $108,244.

As history shows, Bitcoin remains a highly volatile asset, yet it has demonstrated a steady upward trend over the long term.

How to Invest $100 in Bitcoin: Investment Methods

Investing $100 in Bitcoin has never been more accessible. You have a variety of options at your fingertips, whether it is purchasing cryptocurrency through an online exchange, utilizing a mobile app, or exploring platforms that offer automated investing.

Starting with even a small amount like this can serve as a crucial first step toward grasping the intricacies of the market and gaining valuable investment experience. The key is to select a trustworthy and convenient method that aligns with your personal goals and level of expertise.

1. Direct Bitcoin Purchase

Direct purchase is one of the simplest and most common ways to invest in Bitcoin. You acquire the digital asset itself and store it in your crypto wallet, with the ability to transfer it freely to other addresses.

However, this approach requires proper security measures: use reliable wallets, enable two-factor authentication, and carefully protect your private keys. These steps will help secure your assets and minimize potential risks.

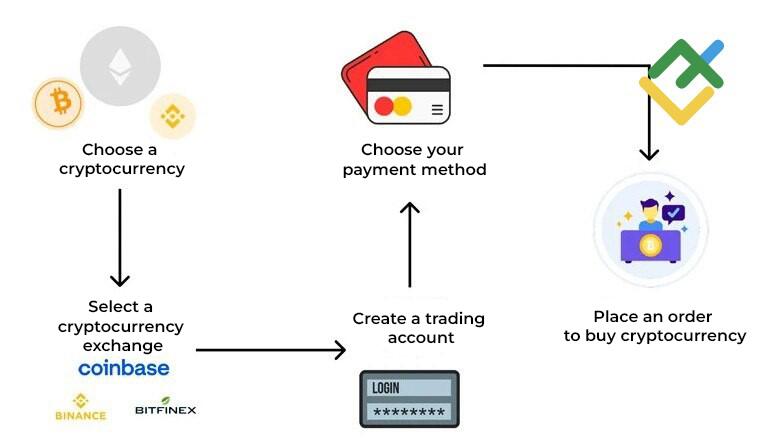

How to buy Bitcoin:

- Choose an exchange. Select a reliable platform to buy BTC. Popular options include Binance, Coinbase, OKX, and others. They offer a user-friendly interface and a wide range of payment options.

- Create an account. Sign up on your chosen exchange, complete the identity verification (KYC), and fund your account using a convenient method, such as a bank card, P2P transfer, or crypto wallet.

- Buy BTC. Open a trading terminal and select BTCUSD or BTCUSDT. Enter the amount, for example, $100, and confirm the transaction. Once completed, the Bitcoin will be credited to your exchange wallet.

Bitcoin wallets:

- Hot wallets are convenient for daily use but are susceptible to hackers’ attacks. Examples include Trust Wallet, MetaMask (with BTC support), and Exodus.

- Cold wallets are offline storage solutions, often in the form of hardware devices like Ledger or Trezor, that offer maximum security. They are ideal for long-term storage.

- Exchange wallets are suitable for active trading but come with security risks. If the platform is hacked, your funds could be lost. They are not recommended for storing large amounts of cryptocurrency.

Additional security:

- Keep your private keys securely (offline, not in the cloud).

- Enable two-factor authentication (2FA) to access your accounts.

- Avoid keeping large sums on the exchange. It is better to transfer them to a cold wallet.

- Stay alert: watch out for phishing websites and emails, and do not click on suspicious links.

- Create a backup copy of your seed phrase and store it offline in a protected place.

2. CFD Trading

A Contract for Difference (CFD) is an alternative method of investing in Bitcoin, allowing you to profit from price fluctuations without the need to own the asset. This approach is well-suited for both short-term and medium-term trading strategies.

Advantages of CFDs:

- Trade in both directions. You can profit from both rising and falling Bitcoin prices by opening long or short trades.

- Leverage. You can trade with more capital than you actually own. This enhances potential profits but also heightens the level of risk.

- No need to store crypto. Since you do not own the underlying asset, there is no need to worry about wallets, private keys, or security.

- Fast trade execution. CFD platforms let you open and close positions instantly, making them ideal for active traders.

Risks:

- High volatility. Bitcoin’s significant price swings can result in substantial losses in a short time.

- Leverage risks. While leverage can amplify profits, it also increases potential losses. You can lose your entire deposit much faster than with a direct Bitcoin purchase.

- Commissions and swaps. Brokers may charge additional fees, such as swaps for holding a position for more than one day or even an hourly fee when using leverage.

It is crucial to choose a reliable broker for profitable trading. As for me, I work with LiteFinance, and here’s why:

- Low spreads and commissions. Lower trading costs mean you preserve more of your profits.

- Access to large trades. To open a position of 1 BTCUSD, you need 50 times less funds thanks to 1:50 leverage.

- Fast order execution. When trading in highly volatile markets, avoiding delays is crucial.

- Copy trading system. Not ready to trade on your own? Use the copy trading platform to automatically follow and replicate the strategies of experienced traders in real-time.

Example: If you had invested $100 with 1:50 leverage and Bitcoin rose from $30,000 to $31,000, your profit would have been $165. In comparison, a regular $100 investment without leverage would have earned just $3.30.

Copy successful traders

Make profits from the first day of trading without training. The best traders from the whole world gathered on the same platform to share their money-making strategies.

3. Bitcoin ETFs and Alternative Investment Methods

A Bitcoin ETF is a regulated exchange-traded instrument that allows you to invest in Bitcoin through traditional stock markets. It is a convenient option for those who do not want to delve into crypto wallets and trading platforms.

Advantages of Bitcoin ETFs:

- Simplicity. Investments are made through a broker, like buying stocks or bonds.

- Reliability. ETFs are regulated by state authorities, reducing the risk of fraud and ensuring transparency.

- No technical complexity. There is no need to keep private keys or fear losing access to your wallet.

Alternative ways to invest in Bitcoin:

- Cryptocurrency funds. These professionally managed funds help reduce the risks associated with independent trading. It is a good option for passive investors.

- Staking and DeFi platforms. These allow you to earn passive income from your crypto investments. They work similarly to bank deposits but within the world of decentralized finance.

- Bitcoin futures. Best suited for experienced traders and investors, Bitcoin futures help hedge risks, use leverage, and profit from both rising and falling prices.

Bitcoin ETFs and other alternative investment options make it easier for a broader audience to invest in this cryptocurrency. This is particularly beneficial for those who would rather avoid the complexities of dealing directly with cryptocurrency exchanges and handling asset storage.

What May Happen if I Invest $100 in Bitcoin?

Remember that any investment involves risk, whether bonds, stocks, or cryptocurrency.

As mentioned earlier, if you had invested $100 in Bitcoin two years ago, your return would have been +349%. However, you should not forget that BTC is a highly volatile asset, and its price can change dramatically, not in your favor.

In 2022, for example, the market experienced a major correction, and the Bitcoin price tumbled by more than 60%. The fall of key crypto platforms and widespread economic instability fueled skepticism within the industry. As a result, only the most committed and patient investors remained in the market.

Nowadays, many analysts make price forecasts for Bitcoin based on historical data and key market factors. Despite the volatility, long-term investors continue to believe in the potential of BTC and often make profits thanks to stamina and a buy-and-hold strategy.

Can Investing $100 in Bitcoin Make Me Wealthy?

Investing $100 in Bitcoin can yield substantial returns, such as 50%, 100%, or even 300%. These figures are indeed impressive when compared to traditional markets. However, such gains are unlikely to turn you into a millionaire.

Yes, getting +300% in a year or two is awesome, but transforming $100 into a substantial fortune requires considerable time, discipline, and a well-defined strategy. The cornerstone of success is patience and a long-term vision.

Those who bought Bitcoin 10 years ago at $220.71 would have more than $46,100 today, 461 times their original investment. However, the market back then was highly volatile and unpredictable. Only a few dared to take the risk and stayed in the game until the end.

A $100 investment is not the path to immediate wealth but a great starting point. The key is to invest regularly, stick to a sensible approach, and be able to hold your position in the long term.

Conclusion

Investing $100 in Bitcoin is a great way to start exploring the cryptocurrency market, learn how to work with exchanges and brokers, and understand the basics of buying and selling digital assets.

However, this is not a quick path to fortune. Bitcoin remains a highly volatile asset, investing in which can bring profit or lead to considerable losses.

Historical data show that Bitcoin tends to grow over the long term. Nevertheless, investing in it requires time, patience, and a calm approach. There are several ways to invest, including direct purchases, ETFs, and CFDs, each with its own advantages and drawbacks.

It is essential to establish a clear strategy and approach your decisions mindfully. Prioritize risk management and ensure that your investment in Bitcoin is weighted and aligns with your overall financial goals.

Bitcoin Investing FAQs

You can invest any amount in Bitcoin — even as little as $1 — since the cryptocurrency can be divided into millions of fractions called satoshis. However, your potential profit depends directly on how much you invest. For example, if you had invested $100 a year ago, your return would have been around $246.55. With a $1,000 investment, you would have received $2,465.48.

Although the exact Bitcoin’s future price is unknown, experts predict a wide range from $180,000 to $700,000. Bitcoin’s price movement will be influenced by the level of demand, the regulation of cryptocurrencies, Bitcoin’s integration into the global economy, central banks’ actions, and the macroeconomic situation.

Yes, even small investments can be profitable. Bitcoin is divided into satoshis (1 BTC = 100,000,000 satoshis), allowing you to invest any amount. Remember: only invest what you are ready to lose and be aware of the market’s volatility.

$100 is a good amount to start with, especially if you want to test the market, learn how to use the exchanges, and form a strategy. Although such an amount will not make you rich, it can bring real profit in the long term and give you valuable experience.

In 2015, Bitcoin was priced at around $220. For just $1, you could have bought approximately 0.0045 BTC. With Bitcoin trading at $102,000, that amount of Bitcoin would now be worth about $459. Thus, your profit would be about $458, equivalent to an increase of more than 45,000%.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.