This article provides a detailed analysis of Ripple and the XRP token. The Ripple network is one of the oldest in the cryptocurrency market, and the coin of this network is the most unusual in the TOP 10 in terms of capitalization. The Ripple development team is actively improving the blockchain, which supports XRP growth rate.

How is Ripple XRP different from other digital assets? Why is this token popular on crypto exchanges? Is it better to trade XRP or store it in a hardware or digital wallet? How to trade Ripple to get real income? You will find answers to these and many other questions below.

The article covers the following subjects:

What Is Ripple (XRP)?

Ripple is a currency exchange and payment platform based on the XRPL blockchain. Although its tokens are publicly traded, the platform’s main purpose is to provide institutional traders with an alternative to the SWIFT global payment network. Therefore, XRP is under special scrutiny by the Securities and Exchange Commission (SEC), the main regulatory financial institution in the United States.

Ripple has been in litigation with the SEC longer than other projects in the Web3 space. The lawsuit was filed in December 2020, and the case is still ongoing. The SEC is trying to prove that XRP is an unregistered security. The commission imposed multimillion-dollar fines along with a requirement to suspend trading of XRP in the United States.

What is the difference between Ripple and other cryptocurrencies?

Some crypto traders believe that XRP is not a cryptocurrency due to significant differences from Bitcoin and other cryptocurrencies. Here are some examples:

-

XRP is more like a centralized digital asset, while cryptocurrencies are usually classified as decentralized finance. This is due to the small number of validators in the XRPL blockchain (about 150). The greater their number, the more independent control over the sale and purchase of XRP becomes. Ripple’s Unique Node List includes 35 validators. It is known that at least 6 validators belong to Ripple Labs.

-

RPCA (Ripple Protocol Consensus Algorithm) is a type of XRPL consensus that does not involve material incentives (unlike PoW and PoS). Thus, there is no motivation for anyone to develop the network other than the Ripple platform itself, large XRP holders, and those engaged in XRP trading.

-

XRP has a fixed supply with a maximum limit of 100 billion tokens. 20% of them went to the direct disposal of the project founders, and 80% belong to the Ripple Labs foundation. Both sides periodically sell off part of the reserves, contributing to a fall in the asset price. At the same time, about 44 billion XRP coins are Ripple Labs’ own money or funds controlled by a limited number of persons.

What is RippleNet?

RippleNet is another distinctive feature of XRP. It is similar to SWIFT, only in the crypto space. This is an ecosystem that includes tools for fast, large-scale trading using secure private keys. It is based on the XRPL blockchain. Transactions are backed by the XRP token. The processing time for XRP sales and purchases is only 3-5 seconds, and the network bandwidth is 1500 transactions per second.

RippleNet has gained significant traction, connecting over 200 large companies and institutional investors from more than 40 countries. Among them are such giants as Bank of America, Western Union and Revolute.

History of Ripple

In 2004, before the advent of cryptocurrencies, Ryan Fugger came up with the idea to create a payment system where participants could create and exchange their own digital currencies. This is how RipplePay was born. In 2005, the website RipplePay.com was launched.

In 2012, Ripple made the transition from providing financial transactions with fiat currencies and bank accounts to the OpenCoin blockchain. In 2013, the platform bought Ripple Labs with an XRP token. Subsequent events in the development of the crypto platform began to influence the coin’s rate.

September, 2013

Ripple extended its open-source platform to all developers. After some time, this led to an increase in the purchase of Ripple and the XRP’s price by 500%.

October, 2014

The company began to follow Windhover’s secure transaction processing principles. A month later, the number of people wanting to buy XRP increased multiple times, and the coin’s price increased by 450%.

September, 2017

The company began to cooperate with LianLian International and entered the Chinese market. At that time, centralized and decentralized exchanges were actively developing in the country, and the number of people wishing to buy Ripple exceeded several million.

2020: Beginning of the SEC Lawsuit

In December 2020, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs, accusing the company of selling unregistered securities worth over $1.3 billion through XRP tokens. This event caused a significant drop in XRP’s value, with the token’s price falling from approximately $0.60 to $0.20 by the end of December 2020.

2021

In March 2021, Ripple won a lawsuit against Tetragon. This victory gave XRP supporters hope that the ongoing SEC lawsuit would also end in Ripple’s favor.

2022: Ongoing Legal Battles, Business Expansion, and the Crypto Winter

In 2022, the cryptocurrency market experienced a significant downturn, often referred to as the “crypto winter.” This prolonged decline in prices across the market impacted XRP, keeping it mostly within the $0.30–$0.40 range for much of the year, with investor sentiment significantly affected.

Despite challenging market conditions, Ripple continued to expand its business. In March 2022, Ripple announced an expansion into the UAE and launched new partnerships in the MENA region, which temporarily boosted XRP’s price to $0.86.

In December 2022, Ripple released a report highlighting an increase in the volume of international transfers using the RippleNet platform. Despite the ongoing SEC case, XRP’s price remained stable, trading between $0.30 and $0.40, amid a broader market downturn.

2023: Legal Breakthrough

In June 2023, Ripple launched its central bank digital currency (CBDC) platform, which was adopted by the governments of Hong Kong and Taiwan. This led to a 20% increase in XRP’s price within the month, reaching $0.84.

In July 2023, Ripple achieved a landmark legal victory when a judge ruled in its favor, stating that XRP is not a security. This verdict broke the bearish trend, causing XRP’s price to skyrocket, with peaks on several exchanges exceeding a 100% increase.

In August, Ripple was fined $125 million for non-compliance with certain XRP sales regulations. This led to a temporary 10% drop in the token’s price, though it recovered within a month.

In October 2024, the SEC appealed the court’s decision, challenging limitations on its regulatory powers over cryptocurrency markets. This news created uncertainty among investors, and XRP’s price fell from $0.65 to $0.58 within a week.

2024

In November 2024, Ripple partnered with the National Bank of Georgia to pilot a digital lari (GEL) using its CBDC platform. Following this announcement, XRP’s price rose by 12%, reaching $0.92.

What Factors Drive Ripple’s Price?

Five factors that influence the pricing of XRP are listed below:

-

changes in regulatory legislation;

-

XRP supply and demand;

-

actions of large crypto investors;

-

development of the RippleNet ecosystem;

-

news and FUD (Fear, uncertainty, and doubt).

These factors also affect other cryptocurrencies, but XRP has its own distinctive features.

1. Changes in regulatory legislation

Cryptocurrency regulation is a set of rules for buying, selling, using, exchanging and storing Ripple XRP or other digital assets in hot wallets and hardware wallets. For example, Chinese regulatory laws have blocked any private cryptocurrency activity.

2. XRP supply and demand

XRP freely trades on cryptocurrency exchanges. The final coin price is determined by trading activity. The higher the XRP emission and the more centralized the storage of the majority of tokens, the higher the inflation. XRP is referred to as centralized crypto, as 55 billion tokens out of 100 are held in Ripple’s team wallets. For investors who want to buy XRP, this increases the risks.

3. Actions of large crypto investors

It is also important to monitor how the tokens are distributed. According to Coincarp.com, almost 52 billion XRP tokens are in free circulation. According to the same source, the total number of XRP holders is only 4.5 million wallets. 32.58% of all tokens belong to 100 holders. For comparison, there are about 48 million Bitcoin holders and the richest 100 of them own only 13.57%.

4. Development of the RippleNet ecosystem

Digitalization in the financial services industry affects price. In this sense, XRP is the market leader. RippleNet includes more than 200 large institutions. The more major players use Ripple, the stronger the position of those who bought XRP.

5. News and FUD

Important internal corporate events and global news affect the XRP market cap. Due to the rapid spread of information and the large amount of fake news, FUDs have become commonplace.

FUD is fake news created to create panic or demand. Even Elon Musk has used this tactic. Each of his posts about Dogecoin caused a strong reaction from the market.

Other news that can move quotes is related to:

-

listing and delisting;

-

news about hacker attacks;

-

court cases;

-

regulator news.

Why You Should Trade Ripple

XRP trading is the buying and selling of cryptocurrencies on cryptocurrency exchanges. The benefits of trading XRP are listed below.

Fast transactions and low fees

The Ripple network is known for instant transfers through intuitive apps with low fees. Therefore, XRP is used for international payments and as an alternative to bank transfers.

Scalability

The crypto network is capable of processing a large number of transactions per second. This makes it more scalable compared to other blockchains.

Cooperation with banks and financial institutions

Ripple Labs actively cooperates with banks and traditional financial institutions, increasing interest in its technology.

Convenient arbitrage

As a rule, several trading pairs with XRP are available on cryptocurrency exchanges, which makes the crypto asset convenient for use in arbitrage transactions.

High liquidity

Thanks to the worldwide popularity of Ripple, XRP is one of the leaders in trading volumes and has high liquidity. This allows traders to trade large volumes even in scalping mode.

RippleNet and xRapid platform

RippleNet is an international global payments network. The xRapid platform reduces costs and speeds up transfers while maintaining liquidity through the use of XRP as a bridge currency. However, cryptocurrency trading is risky. Before you buy XRP, do your own research.

How to start trading Ripple on a cryptocurrency exchange?

The classic way to get started is to purchase XRP tokens. You can do it easily on most exchanges by exchanging fiat currency or other tokens for Ripple coins. This method of profit generation is considered a long-term investment, since investors need to buy coins and then wait for their value to rise.

Crypto traders often use CFDs or contracts for difference to trade XRP. Market participants can profit from price differences without owning XRP. Contracts can be:

-

long (for betting on a price growth);

-

short (for betting on a price fall).

Depending in which direction traders think the XRP price will go, they select the type of contract and open a trade. There are other options for selling and buying XRP derivatives. For example, traders can make money using options and futures.

How to Trade Ripple

To start trading XRP, register a LiteFinance trading account. But in order to buy XRP without losses, and even with profit, you need to have a relevant trading strategy.

Step 1. Open a Trading Account

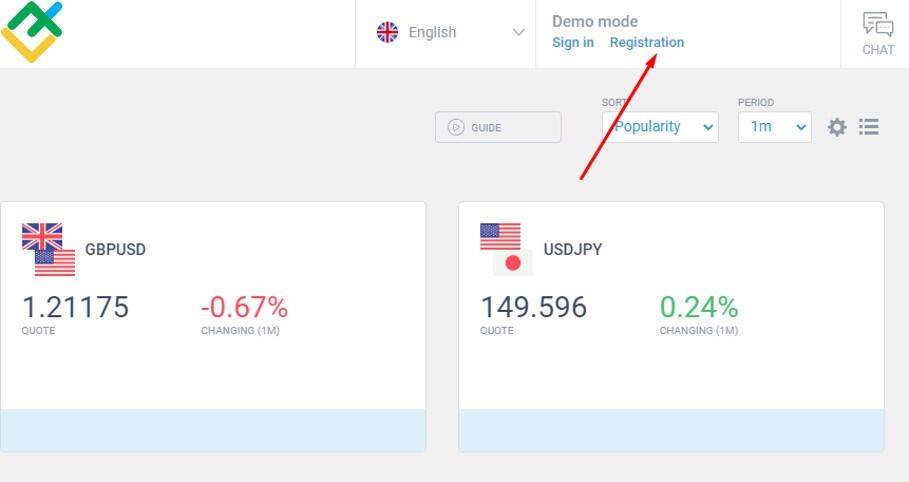

Go to the LiteFinance website and click “Registration” to register a new account.

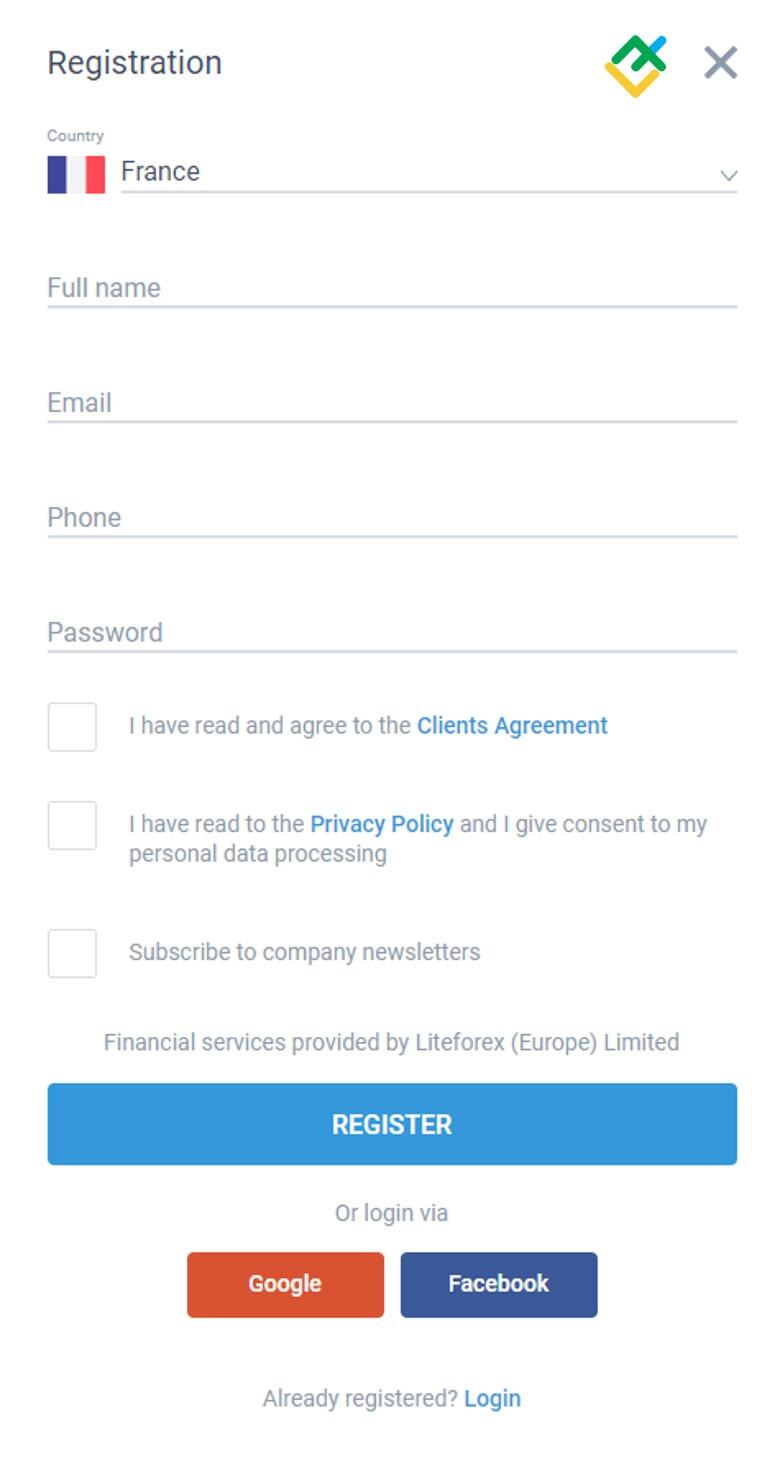

In the form that opens, provide all the requested information about yourself and click “Register”. The broker will open a trading account in your name and you can deposit USD in dollars or any other currency.

Step 2. Develop a Trading Plan

Before you buy Ripple, you need to understand what the market sentiment is now. Study the fundamental factors that affect the XRP rate. Read the news and statements from company representatives to stay informed about events that could change the financial situation. The price of XRP is affected by developments in the field of cryptocurrency regulation.

Explore supply and demand, general investor sentiment towards the crypto market and XRP. Supply and demand are constantly changing, especially in the crypto space where investor sentiment changes very quickly. For example, according to analytics, the collapse over the past two years was caused by a transition from enthusiasm associated with the rapid development of the market in 2020-2021 to “sobering up”, which occurred when large investors came to the conclusion that the market was overheated.

Traders determine the time to enter the market and take profits using technical analysis. Technical factors can be used together with fundamental factors to get confirmation signals and therefore a more accurate forecast.

Step 3. Do Your Market Research

After a competent analysis of the market, you will get an insight into how it will move further, and where the price will develop within the forecast range.

Whether you are trading XRP, CFDs, futures or options, you need a trading plan. To do this, you need to determine the price of XRP at which you will:

-

open a trade;

-

take profit;

-

cut losses.

After analyzing the market, it will be easy for you to determine these parameters. Price levels for opening and closing a transaction can be floating and fixed, for example, to signals from a technical analysis indicator. Therefore, a trading plan for a specific trade becomes part of your trading strategy. You also need to calculate the trade size and timing within which the trading plan will remain valid and when it should be revised.

If you want to buy XRP, but find it difficult to determine the parameters listed above, postpone the purchase and wait until the market situation becomes more predictable and matches your trading strategy.

Step 4. Trade Ripple

The LiteFinance trading platform gives you the opportunity to trade XRP CFDs, making a profit on the rise or fall of quotes. Before opening a trade, I recommend analyzing fundamental factors and market sentiment and choosing a convenient moment to open a trade using technical analysis tools.

Let’s look at the principles of trading on the LiteFinance platform using the example of trading with floating levels using the MACD indicator.

The H4 XRPUSD chart shows a reversal signal. This is the intersection of the lines of the MACD indicator, followed by a sharp price rise. Thus, the XRP value will increase.

Therefore, after the next green candle closes, enter the market with an Ask position (blue line on the chart above). To minimize risks, set a stop loss just below the last local low. In the chart, the stop loss is marked with a red line.

A few days later, a reversal bearish signal appears in the price chart (crossing the signal line down). This is a good time to close a long trade, so immediately after the signal appears, close the position and take profit. This level is marked with a green line in the chart. The same signal makes it possible to enter a short trade. When the confirming red candle closes, enter XRP sales.

Place your stop loss just above the nearest local high.

When the MACD indicator signals an upward price reversal, close the short trade with a profit.

Trading Ripple (XRP): Tips & Advice

To successfully trade XRP, traders need to adhere to the same basic principles as with other cryptocurrencies.

Regularly analyze the state of the market

The XRP price is volatile and depends on news, market events, actions of major players and other factors.

Select trading instruments

For long-term investment, you can buy XRP before prices rise. If you plan to trade intraday or make money on falling prices, then choose CFDs.

Use technical analysis

Even if you monitor all events related to the XRP blockchain and the cryptocurrency world, technical analysis will help you choose the best moment to enter the market.

Develop a trading strategy and stick to it

You can get a stable profit only by trading systematically. Don’t trade on emotions.

Use risk management

Successful trading is a balance of risk and possible profit. Follow the risk management rules to protect your deposit from severe drawdowns.

Should I Invest in Ripple?

The goal of Ripple Labs is to transform classical banking. The rapid adoption of Ripple’s innovative blockchain technology is poised to revolutionize cross-border transactions, challenging traditional systems like Swift. This is a big risk, but if successful, Ripple will receive international recognition and unlimited income.

The potential success of XRP investing is not always associated with a multiple increase in the price of the token. Not everyone knows this, but XRP is not required to run the Ripple network. There are many examples of successful projects that took place despite negative market sentiment due to the emotional reactions of investors, deliberate actions of major players, and marketing mistakes.

Conclusion

Ripple XRP is one of the top 10 largest cryptocurrencies and has long been considered one of the pillars of the market. The project is designed for instant international payments, which are possible due to high scalability with the ability to process up to 1500 transactions per second. This is many times more than other market leaders, Bitcoin and Ethereum, can offer.

It is worth noting that investors are attracted not only by the technical capabilities of the blockchain and the global plans of the developers. Ripple Labs has established partnerships with major banks and financial institutions. However, to ensure the reliability and sustainability of the project, Ripple sacrificed decentralization. This move was criticized by many crypto enthusiasts.

As a result, investing in XRP remains very controversial. On the other hand, this makes the token stand out from other cryptocurrencies and attracts many traders due to the high volatility and liquidity in the market.

Ripple trading FAQs

The price of XRP is highly volatile. Thanks to this, crypto traders can make large profits in a short period. But the risks of significant losses are also high.

It is important to understand that the XRP token has no relation to the company’s capitalization. Well-known banks and financial institutions, including American Express, Standard Chartered, and Santander, cooperate with Ripple Labs. This fact indicates the high sustainability of the project, so a decision to buy XRP shares may be a good idea, which cannot be said about the company’s tokens.

XRP is traded on almost all cryptocurrency exchanges. Therefore, this token belongs to cryptocurrencies with high liquidity. XRP is easy to trade and can always be exchanged for other assets in large quantities without greatly affecting the price.

XRP holders can make money from rising prices. But this is not the only way to make a profit. Various platforms also offer CFD trading, allowing traders to earn both on the rise and fall of the token price.

Cryptocurrency ticker is a symbol representing a specific digital currency on financial platforms. Ripple ticker is XRP. It makes it easy to find the currency pairs of interest and start trading Ripple on the cryptocurrency market.

It all depends on whether Ripple Labs manages to create an alternative to SWIFT and make it popular. Also, the price of the token may be affected by the actions of major players, marketing and other factors.

Beginner traders can register on the LiteFinance platform and start trading CFDs immediately. The main advantage of this method of trading is the ability to make money on price growth and decline.

XRP is highly liquid, so this token is convenient to trade on small timeframes. At the same time, due to high price volatility, intraday Ripple trading can bring good profits.

Both cryptocurrencies are widespread in the markets and are equally convenient for trading. Therefore, the choice between BTC or XRP is usually determined by the market situation and the personal preferences of the trader.

Price chart of XRPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.