Today, I will deal with the most popular Forex trading asset – the EURUSD pair. We shall dive into the history of EURUSD, explore modern trends, and have a look at euro-dollar trading strategies. This overview will be of interest to both beginners and professionals!

The article covers the following subjects:

The EURUSD Pair Overview

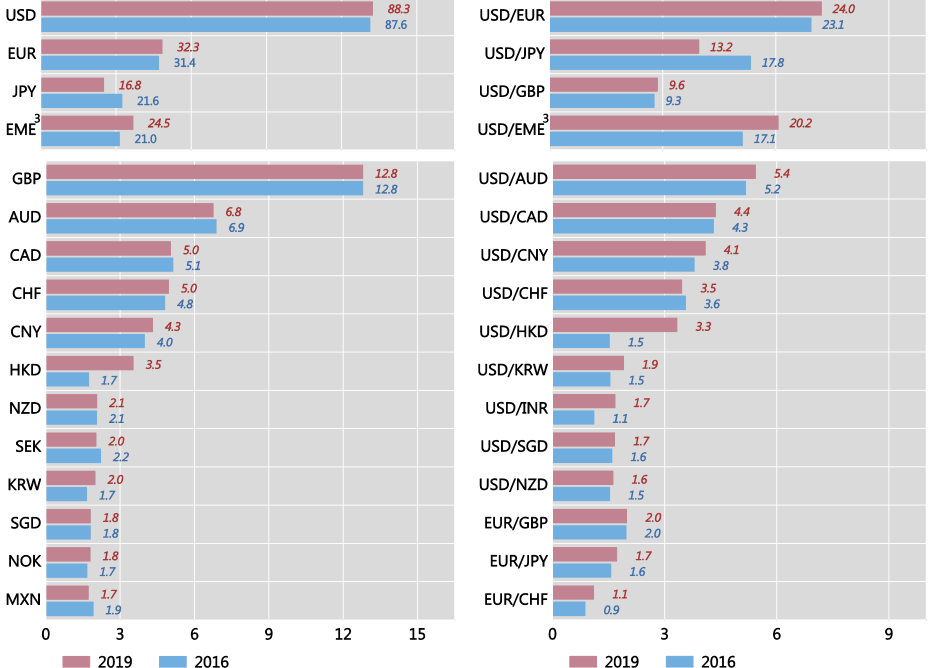

The EURUSD pair (EUR – base currency, USD – quote currency) is the most popular Forex trading asset, also known as the major currency pair, which is justified. Trading the EURUSD foreign exchange pair accounted for almost a quarter of all FX trades, according to the BIS survey. Its main competitors, USDJPY (US Dollar/Japanese yen) and GBPUSD, account for about 13% and 9%. Therefore, the EURUSD is the most liquid currency pair traded.

Structure of Forex trading operations

Source: BIS.

The popularity of the EURUSD currency pair is fueled by high media attention and investors’ demand. From 2016 to 2019, the Forex currency pairs daily trading volume increased from $5.1 trillion to $6.6 trillion, while the share of EURUSD increased by almost 1%. It’s about $600 billion!

The USD history began after the proclamation of the United States’ independence in 1776 when the dollar became the local currency. The influence of the greenback, as the dollar is called because of its color, increased significantly after World War II. The British pound could not compete with the dollar due to the weakness of the UK economy. For a long time, Europe had been hatching a design to create a common currency that would outperform the US dollar. As a result, in 1999, the euro emerged – a single currency for 19 member countries of the Eurozone.

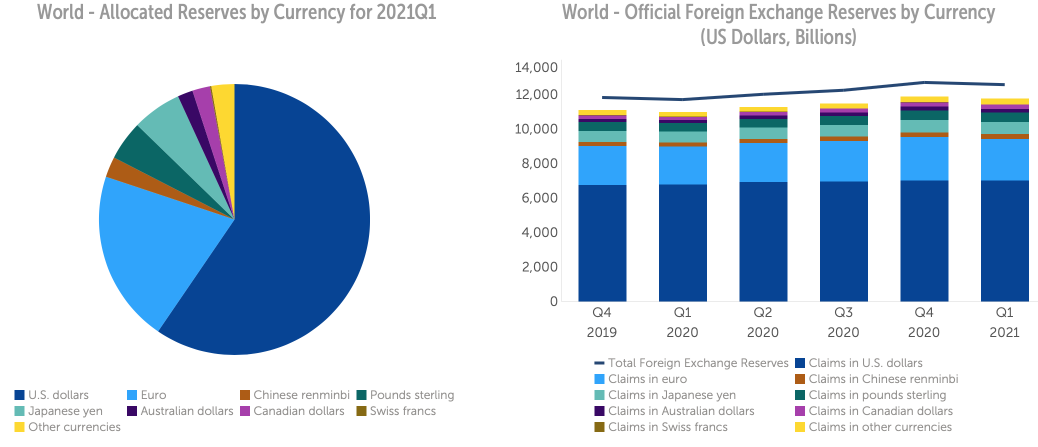

A lot of time has passed since then. Trading the US dollar is dominant in the Forex (Foreign Exchange) global market. According to the IMF data, the greenback’s share in the FX reserves of the world’s central banks as of December 2020 is 59.5%, the share of the euro is 20.6%. However, we cannot say that the single European union currency is not a competitor to the US dollar. Before the euro introduction, the share of the US dollar exceeded 71%.

Structure of central bank’s foreign exchange reserves

Source: IMF.

EURUSD trend in 1999-2021

The EURUSD features quite high volatility on hourly volatility chart and daily volatility chart. In the beginning, the EURUSD currency pair was trading below parity. However, starting from 2002, one euro has never been below $1. The euro-dollar all-time low is 0.82; the record high is close to 1.604.

EURUSD Lately Trends

In recent years, the EUR/USD currency pair has exhibited significant volatility, influenced by divergent monetary policies of the Federal Reserve (Fed) and the European Central Bank (ECB), as well as geopolitical events. The Fed’s interest rate hikes to combat inflation have strengthened the U.S. dollar, while the ECB’s more accommodative stance has weakened the euro. Additionally, Europe’s energy crisis and global economic uncertainties have exerted downward pressure on the euro, contributing to its depreciation against the dollar.

EUR/USD Dynamics in Recent Years

In 2021, the EUR/USD pair fluctuated between 1.17 and 1.22, reflecting the global economic recovery post-COVID-19. However, in 2022, the euro significantly declined, reaching parity with the dollar in July for the first time in two decades. This drop was driven by the Fed’s aggressive interest rate hikes aimed at curbing rising U.S. inflation, which bolstered the dollar. Concurrently, the ECB’s delayed tightening of monetary policy further weakened the euro.

In 2023, the ECB commenced rate hikes to address inflation within the Eurozone, leading to a partial recovery of the euro. The EUR/USD pair traded between 1.05 and 1.10 during this period. Nonetheless, ongoing geopolitical risks, including Europe’s energy crisis, limited the euro’s growth potential.

By the end of 2024, the EUR/USD pair remained under pressure. The Fed maintained a hawkish monetary policy with elevated interest rates, strengthening the dollar. Meanwhile, the ECB faced slowing economic growth in the Eurozone, constraining further rate hikes. Consequently, the EUR/USD exchange rate hovered around 1.07, reflecting the balance between divergent monetary policies and the economic outlooks of the U.S. and the Eurozone.

Factors Moving the Euro / US Dollar Currency Pair

The EURUSD trend with considerable momentum depends on what stage of the cycle the global economy is. During a recession, the demand for safe-haven assets, including the US dollar, increases. As a result, the euro dollar goes down.

During a recovery from recession, investors are not that focused on preserving the money. Retail investors search for ways to multiply the deposit. At this stage, the fundamentals driving the EURUSD currency pair are the GDP growth rates and the monetary policy of European central banks and the Federal reserve.

A strong economy is a strong currency. The rapid rebound of GDP after the recession is a reason to buy securities of the country. In particular, the belief that the US economy will fully recover from the 2020 recession in the second quarter of 2021 and exceed its potential level in 2022 contributed to the S&P 500 rally by 18% from January to early August. As a result of the capital inflow into the US stock market, the US dollar was strengthening.

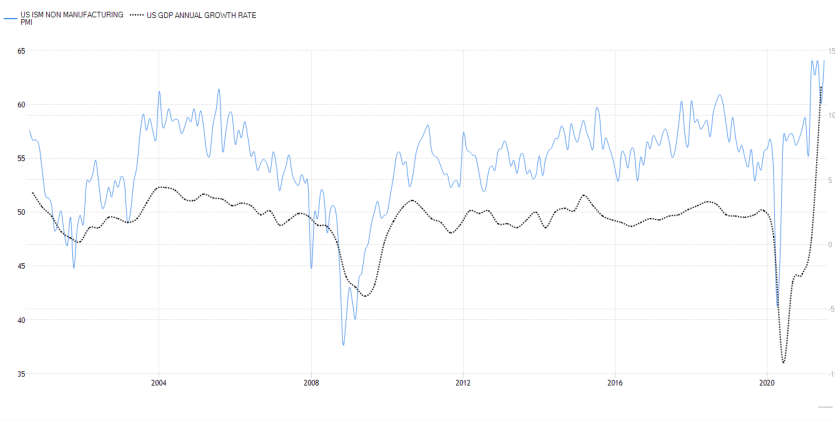

The GDP rate is a reliable indicator but, unfortunately, lagging. The GDP report is published a month or month and a half after the end of the quarter. Therefore, it is very difficult to determine whose economy is growing faster at a particular time, which doesn’t provide a clear picture of the current economic situation to investors. That is why currency pairs traders have to monitor some leading technical indicators, such as the US and Eurozone PMIs.

Dynamics of US PMI and GDP

The more the economy heats, the more likely the European central bank or other central authority to phase out the quantitative easing program and hike the interest rates. As a result, the assets denominated in the local currency grow more attractively. That is why the US dollar is currently strengthening against a basket of major currencies.

To understand the Fed’s intentions, one should track such indicators as inflation and unemployment rate. When these indicators reach the thresholds set by the Fed, the central bank starts scaling back monetary stimulus. In this case, the greenback will grow in value.

Speeches of banks representatives are important in forecasting the EURUSD exchange rate. The officials’ comments give a clue on how the European central bank or US federal reserve’s policies could change, and investors could develop trading plans based on this.

Every trading day, I carry out the fundamental analysis of the euro-dollar pair and study all the factors influencing the pair’s quotes (economic data, market sentiment, political news, interest rate, regulations introduced by the Security exchange commission, etc.). Follow my daily forecasts in the LiteFinance trader blog and learn about potential changes in the Euro Dollar exchange rate.

Best Time to Day Trade EURUSD

You can day trade Forex currency pairs round the clock, at any time when it is convenient for you. It’s important to note that your own risk increases in the most volatile hours. The Forex currency markets operate 24 hours a day from Monday till Friday.

0:00-9:00 UTC – Asian trading session;

07:00-16:00 UTC – European trading session;

13:30-22:30 UTC – American trading session.

The volume of transactions usually increases during the crossover of several trading sessions: from 7:00 UTC to 9:00 UTC and from 12:30 UTC to 16:00 UTC, when Asians close day trading positions, and Europeans, on the contrary, enter the market. The same is true for the crossover of European late afternoon and New York morning trading hours is normally the most active.

According to BIS research, London is the major trading centre. In 2019, it accounted for 43% of all Foreign Exchange trader activity. The capital of the UK is the center of the European session where EURUSD, GBPUSD, USDCHF, EURGBP, EURCHF, and other currency pairs’ exchange rates are mostly traded.

The second largest trading centre is New York, the share of which in the total volume of Forex transactions is 17%. Other trading centres are Singapore (7.3%), Hong Kong (6.7%), and Tokyo (6.1%). Americans prefer to trade the Euro Dollar exchange rate, USDCAD (US Dollar/ Canadian Dollar), and other currencies with US Dollar in pairs. The Asian trading session has its favorites – the USDJPY one currency pair, as well as AUDUSD (Australian dollar/ US dollar), AUDJPY, NZDUSD, NZDJPY, and others.

What is the best time to trade? If you are not going to invest a billion dollars in one trade, liquidity is not a problem. Increased volatility is observed during the crossovers of trading sessions. At that time, the news is actively published. In general, it all depends on the EURUSD investing strategy that you apply.

EURUSD Technical Analysis

Freedom of creation – what could be better? EURUSD is one of the most liquid Forex pairs, so you can use absolutely any technical analysis method to predict the future price of this liquid Forex pair EURUSD. Are you a chartered market technician and a fan of Price Action? No problem! Do what you like – discover the repeating chart patterns and use them to determine entry points. Are you fond of indicators? You can apply any reliable indicator, MACD, RSI, Stochastic, pivot points, support and resistance levels, or ADX. Everything will work in trading EURUSD.

Do you prefer the market profile, VSA, Elliott wave technical analysis, Keltner channels, support and resistance levels, or margin zones? Any ideas within these areas can be implemented on the euro dollar technical analysis chart in MetaTrader. The trading approach should satisfy the trader and yield a positive result. Remember, every pip contributes to your deposit.

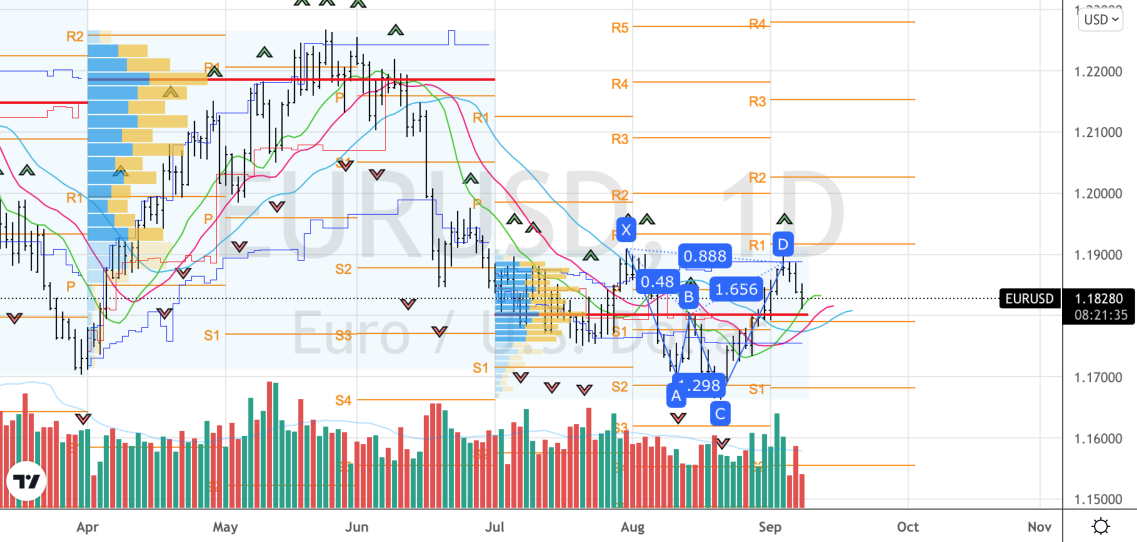

Technical analysis in trading the EURUSD on the chart

My colleague writes daily technical analysis and shares the EURUSD trading signals based on margin zones in the trader blog.

EURUSD Forex Trading Strategies

In Forex trading, only strict adherence to the trading system rules allows one to save the deposit and increase the capital. Below, I will analyse several strategies that have proved to be profitable among foreign exchange traders. Examples here refer to day trading, but the strategies will work in intraday trading as well.

Moving Average Crossovers

Moving Averages are a simple and efficient tool for trading Forex. When the MAs frequently cross the EURUSD chart, it means consolidation. Otherwise, if the MAs rarely meet with the price chart, it signals that prices generate considerable momentum. During such a period, there is an opportunity to trade liquid Forex pair EURUSD on the continuation of the initial trend direction.

Rules to buy the EURUSD:

-

The trend is up.

-

The price chart crosses the 14 trading day moving average downside.

-

The breakout bar or candlestick closes above the EMA-14.

-

Set a buy order at the high of the breakout bar.

Rules to sell one of the most liquid Forex pairs — EURUSD:

-

The trend is down.

-

The price chart crosses the 14 trading day moving average upside.

-

The breakout bar closes below the EMA-14.

-

The sell price is at the low of the breakout bar.

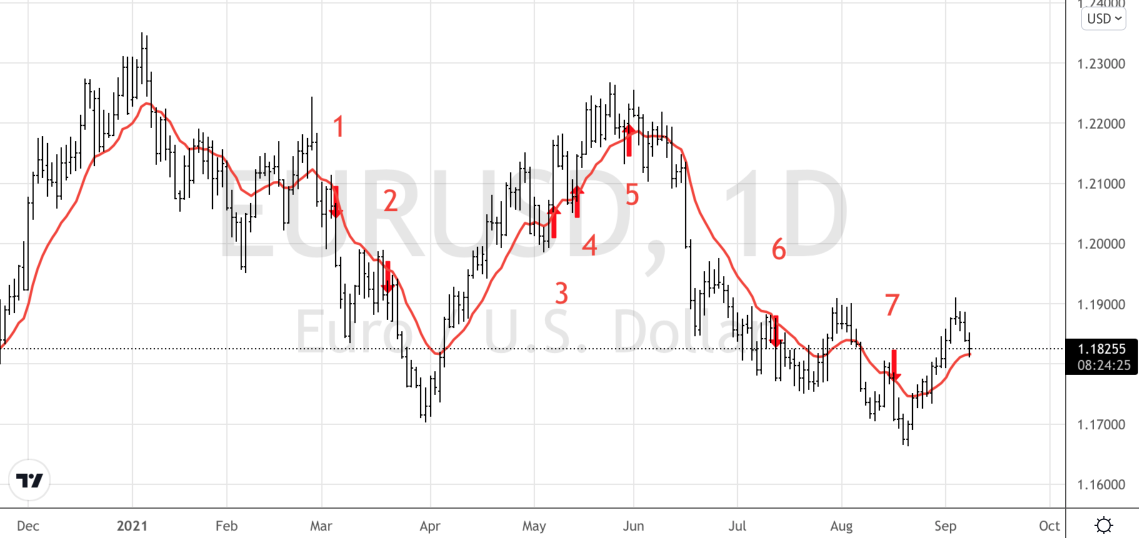

EURUSD daily chart:

As you see from the USD price chart, the strategy is successful amid a clear trend. If the trend is broken, a trader will face a loss. There should be a stop loss to ensure negative balance protection.

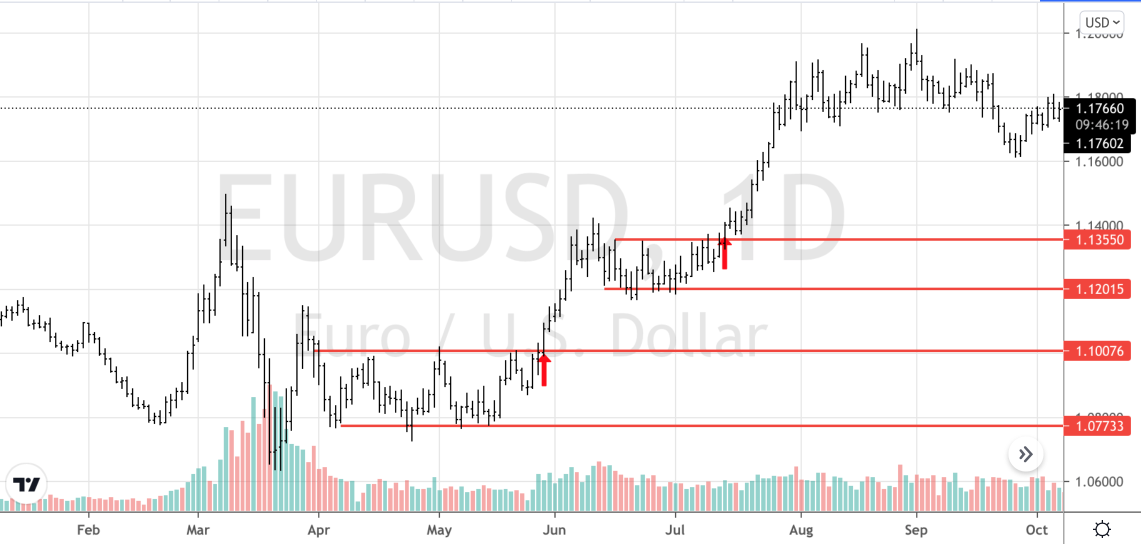

Pullback and Breakout

Retail traders often say that the market is boring when it is trading flat (consolidation). In fact, one should pay much attention to the Forex market when there is a narrow range pattern of price fluctuations. Experienced traders know that big traders (funds, institutional investors) get in the game when the market seems to be trading flat and there is little market activity. As a result, there emerges a general trend.

Conditions to buy the EURUSD:

-

Consolidation (sideways trend).

-

Price tests the channel’s upper border and rolls back.

-

Price retests the upper level after 2-5 bars and closes above the upper border of the consolidation range.

-

Enter a long at the breakout level or at the level of the breakout bar’s close.

Conditions to sell the EURUSD:

-

Consolidation.

-

Price tests the lower border of the channel and rolls back.

-

Price retests the lower level after 2-5 bars and closes below the lower border of the consolidation range.

-

Enter a short at the breakout level or at the level of the breakout bar’s close.

EURUSD daily chart:

After the price goes beyond the consolidation range, it often retests it, goes back to the border of the range. In this case, there appears another entry point. In our example, this happens in the second case.

Follow planned events

Large traders always plan their actions. Interbank markets and hedge funds understand that they are not the only participants in the market. A strong opponent can appear at any moment. Therefore, all trading decisions must be justified. Investment ideas are often based on the fundamental analysis of the market (political and economic data, future policy direction of the SEC). In this context, news trading takes on a special character.

Important events planned in the economic calendar include reports on inflation, employment, GDP, PMI, meetings of the ECB and the Fed, as well as the presidential elections in the USA or parliamentary elections in the EU countries. All these planned events could result in radical EURUSD price moves.

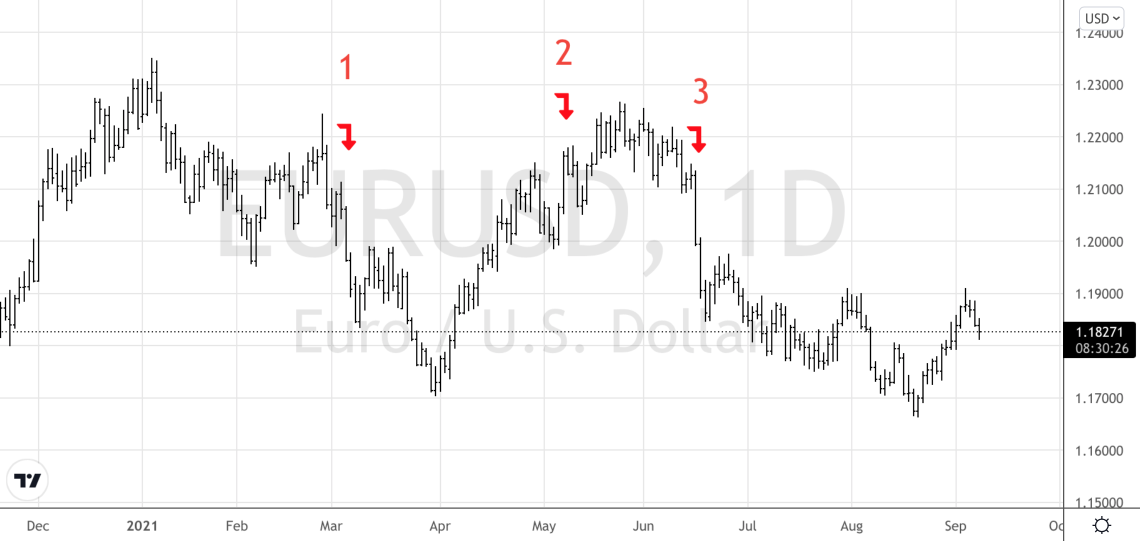

Daily EURUSD chart:

-

In early March, the Fed Chair didn’t express any concern about the S&P 500 drop. Investors were puzzled, as they believed that the central bank should spare no effort to support the US equity market. Therefore, the demand for safe havens surged, and the EURUSD crashed.

-

In early May, a weak reading of the employment data encouraged the EURUSD bulls to go ahead. The indicator was almost four times less than Bloomberg experts expected.

-

In mid-June, the Fed signaled a possible funds rate hike in 2022, and the euro uptrend was broken.

If trade on the news, you should observe the following rules:

-

If the EURUSD starts consolidation ahead of an important event, you should put a buy order above the upper border of the consolidation range, a sell order – below the lower border.

-

If the Forex pair is rising or falling a few trading days before an important report publication or a central bank’s meeting, one could follow the ‘buy the news, sell the facts’ principle.

-

A stop-loss will limit the potential loss. A stop loss is necessary for balance protection because the volatility increases when the important news releases.

Start trading with a trustworthy broker

EURUSD CFD Trading

The international foreign exchange market has been rapidly evolving since the abolition of the Gold Standard 50 years ago. Nonetheless, a retail investor couldn’t enter Forex for a long time. The reason is the high minimum lot price of $100,000, which only banks and investment could afford. The advent of CFDs or Contracts for Difference in the 1990s allowed individual investors to enter Forex currency markets.

If a trader is interested in the differences in the exchange rate of EURUSD rather than in the currency itself, why enter a trade for $100,000? Suppose you have a couple of US dollars, preferably $1000, on your retail investor accounts. Any ECN or another Forex broker company registered provides 1:100 leverage, and you can buy EURUSD at the rate of 1.17. The growth of the eur usd Forex pair quotes to 1.18 will allow you to double your capital while trading CFDs. If the euro is down to $1.16, you will lose your money. Individual retail traders usually apply a Meta Trader platform, MT4 or MT5, or another trading platform.

Trading CFDs means quite a high risk, it’s one of the most complex instruments, especially due to the leverage, but the potential profit is worth it!

EURUSD Trading Tips

-

A necessary condition to buy EUR vs USD in the long term is the sync trends in the global economy. If the US GDP features a robust growth, but China and the euro area face problems, sell the pair.

-

Monitor the commodity and stock markets. If the S&P 500 and oil are rallying up simultaneously, it is a reason to buy the Euro versus US Dollar. If the stock index is growing and the black gold is falling in value, or both financial assets are depreciating, it is relevant to sell the EURUSD.

-

Study the history of the financial asset’s quotes. An example that took place in the past performance may emerge in the future as a potential EURUSD price action.

-

Use moving averages in trading the EURUSD to determine the current market state. If the MAs often cross the EURUSD chart, the market is trading flat. If the price action chart is above the EMA, the trend is bullish; if the price is below the indicator, the underlying trend is bearish.

-

Do not try to use all popular strategies to mitigate high risks; you’d better find the one that suits you best.

-

Always observe the rules of your trading system.

Best EURUSD Forex robot

The advanced and intuitive software applications help many traders place trades and implement market strategies. Currency trading involves a lot of minute actions. These small activities vary from something as simple as choosing a currency pair to complicated trend analysis and fundamental analysis calculations.

A good Expert Advisor, which utilizes MetaTrader platform, can provide you with significant support in executing all these decisions. And you can apply tested techniques like Bollinger band strategy, through these bots.

What is Bollinger band technique?

Originally designed by John Bollinger in 1980s, this technique employs standard deviation along with moving average. In fact, you usually plot the bands two standard deviations away from a simple moving average.

If your currency pair’s price touches upper band, then you can say that market is overbought. Similarly, if that price hovers near lower band, you will say that its oversold market. Users can design their currency bots in a way that they can implement Bollinger’s rules and regulations.

How to use robot Forex eur usd with Bollinger bands?

The EURUSD currency pair is a highly sought after pair in Forex. It relates two major economies. On the one hand, there is the European Union’s euro and on the other hand U.S dollar. Both these currencies influence international economic conditions. So, analyzing this currency pair is vital.

Example:

Joey trades in EURUSD currency pair. He wants to use Bollinger bands as a way of monitoring prevailing trends. Here, he should use his investing EA and establish a simple moving average; which bases itself on market data. From here, that app will help Joey gauge upper and lower bands through standard deviation.

So, as you can see, implementing Bollinger bands is not rocket science. But as an investor everybody must learn some core Bollinger band philosophies to grasp the intricacies of eurusd Forex robot.

What are some important core concepts of Bollinger bands?

Following are some important philosophies of this investment technique;

Squeeze:

It is a fundamental concept in Bollinger band technique. When both upper and lower bands come close to each other, they restrict moving average. This is the squeeze phenomenon. Usually, seasoned investors believe a squeeze can mean lower volatility. But in future, the situation will flip.

Breakouts:

If you use an EA program, it will show that majority of price actions occur within upper and lower bands. But sometimes users find a few outlier situations. Experts call these anomalies breakouts.

Now a breakout is a major event, but it does not signify buy or sell option. As an investor, you should program your application accordingly.

In the end, it seems that Forex applications are highly versatile equipment. You can use EURUSD Forex robot or any other application while applying different techniques like Bollinger bands, Stochastic models, support and resistance levels, etc.

Conclusions

Therefore, you can make quite a profit from trading the EURUSD. Choose the most suitable trading system for you, monitor central banks’ statements and the economic calendar. And most importantly, always learn! You will become a successful trader if you understand the market processes.

Take into account Asian, European and American trading sessions. Remember factors driving the currency rates, technical analysis, and trading strategies. Distinguish between trading flat and a trending market. Bear in mind that general trends of EURUSD could change at any time. Study the fundamentals to increase your knowledge base and limit high risks in Forex trading. I wish you success on your way to professional Forex trading!

EURUSD trading FAQ

If you want to trade the EUR USD pair, it’s important to know that Forex trading hours are round the clock, from Monday morning till Friday evening.

The answer to this question depends on how quickly humanity defeats the coronavirus. The current situation of uncertainty suggests entering EURUSD sell trades. The return to the pre-pandemic economic situation will lure investors back to invest in EURUSD. Remember that Forex trading is highly volatile and comes with high risk, and thus requires a robust strategy and risk management plan. Moreover, if you are a beginner trader, you can start your trading experience with a demo account to avoid potential losses.

Everything you need to start Euro/Dollar trading is to open a Forex trading account with LiteFinance.

It is very easy! You should follow these five steps:

- Sign up with LiteFinance and open retail investor accounts.

- Make a deposit in a currency convenient for you and in any convenient way.

- Click on the Trade tab.

- In the list of trading complex instruments, select the desired asset from the sections Currencies, Cryptocurrencies, Metals, Oil, Shares NYSE, Shares NASDAQ, Stock Indexes. In this example, you select the EURUSD instrument.

- Specify transaction volume and click on the Buy or Sell buttons. Be careful when entering a trade. First, study the relevant price analysis or consider built-in indicators. This will help you to mitigate the high risks and avoid losing money from your retail investor accounts.

Yes. In EURUSD investing, several factors are supporting the US dollar’s strength, at least in the long run. They include the US exclusivity, the Fed’s monetary policy, and the appeal of the US assets. However, before starting to trade the EUR USD pair, it’s crucial to understand its high risk. Therefore it’s crucial to have a robust risk management plan when trading complex instruments like Forex.

It means clicking on the Sell button in the trading terminal.

Can you sell something that you don’t actually possess? Yes, if you are trading the EURUSD with such a broker as LiteFinance, which will lend you any asset. If the asset depreciates, you will pay back the borrowed money. The difference between a higher selling price and a lower buying price will be your profit. You can safely press the Sell button in the trading terminal if you are sure that the EURUSD will fall. LiteFinance will take care of everything else.

The best trading indicator to trade the EURUSD pair is the one whose work principle you clearly understand.

If you prefer trading EURUSD on the trend continuation, I would recommend using the ADX, Average True Range, and MACD to trade the Euro Dollar. The ADX will indicate the trend strength. The MACD will signal a potential major reversal of the trend by divergence with the price chart. When the market is trading flat, RSI and Stochastic will be efficient. These tools indicate the market overbought and oversold states allowing you to make profits.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.