The global economy is expected to face a significant shortage of copper in the coming decades, making it an attractive investment. This metal is used in many industrial sectors, and demand for it continues to grow along with the global economy.

There are several investment options: buying physical copper, shares of mining companies, futures, and ETFs. This variety allows you to diversify your investment portfolio.

The article covers the following subjects:

Major Takeaways

- Over the coming decades, soaring demand may trigger a major copper shortage.

- Global demand for copper is expected to exceed 50 million tonnes by 2050.

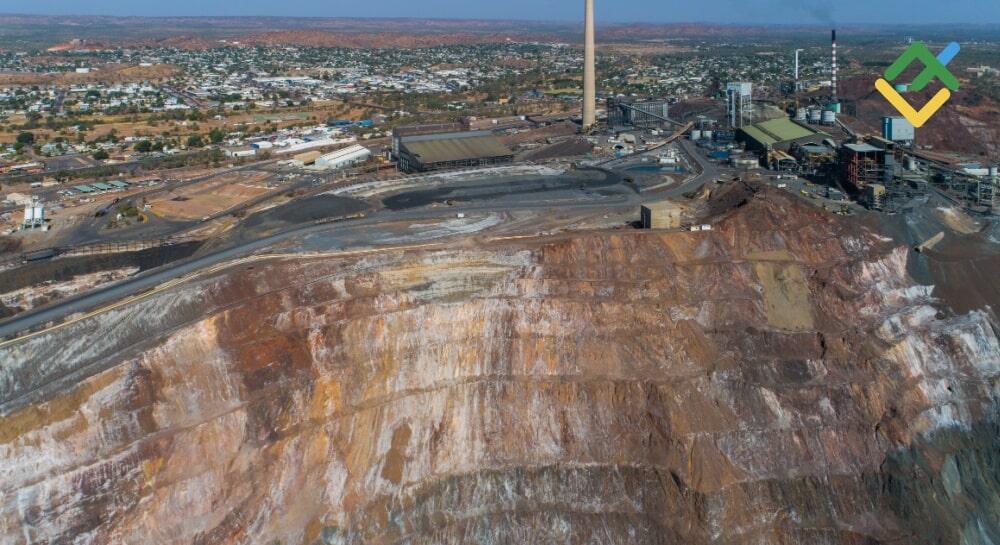

- The exploration, engineering, construction, and development of a copper mine takes around 15 years, making it impossible to quickly ramp up copper supply.

- Copper is sought after in the metals and mining sector, energy, and construction. This industrial metal is widely used in the global economy.

- You can invest in copper by buying physical metal, stocks, ETFs, and futures.

- Copper prices depend on supply and demand dynamics, economic conditions, and supply chain disruptions.

- Copper futures contracts and CFDs offer the opportunity to profit from price fluctuations.

- Copper producer ETFs, copper mining companies’ stocks, and CFDs provide a way to invest in the market without owning the physical metal.

Ways to Invest in Copper

Investors can choose the most suitable option for investing in copper depending on their strategy and risk tolerance. Available investment options include buying physical copper, copper mining companies’ shares, ETFs, copper futures, and CFDs. Each of these instruments has its own features, advantages, and disadvantages.

1. Physical Copper Investment (Copper Bullion)

Buying copper bullion, cathodes, or scrap is one of the most straightforward ways to invest in the metal. Physical copper can be stored in specialized warehouses or secure storage facilities. However, large volumes of copper require additional logistics costs, security, and insurance.

This approach suits investors who want to own physical copper and benefit from demand fluctuations without relying on intermediaries. However, unlike currencies or other financial assets, storing and transporting metal can be expensive. Selling copper may also involve extra fees, taxes, and commissions. In addition, there is a risk that copper could be seized by the government in case of a severe shortage of base metals.

This investment method is unlikely to appeal to a wide range of investors. However, despite its drawbacks, investing in physical copper can be an effective way to diversify risk.

2. Copper Mining Stocks

Copper mining companies’ stocks enable investors to profit from price increases without having to own the physical metal. This method allows investors to trade securities on major stock exchanges, pass assets on through inheritance, and use assets as collateral for loans and other financial transactions.

The largest copper mining companies include Freeport-McMoRan (USA), BHP Group (Australia), Southern Copper Corp, which is a subsidiary of Grupo Mexico (Mexico), and Glencore (Switzerland). These companies hold substantial copper reserves and are actively involved in copper exploration and mining across South America, Australia, and other regions. Their share prices tend to rise steadily as their profits increase.

The price of mining company shares depends on copper production volumes, operating costs, and the state of the global economy. Investing in shares makes it possible to earn profits both from price appreciation and dividend payouts.

However, key risks include global economic slumps, copper price fluctuations, geopolitical instability in producing countries, and possible regulatory changes. For example, the introduction of ESG ratings has significantly affected natural resources companies.

3. Copper Mining ETFs

ETFs contain assets of mining companies involved in the production, extraction, exploration, and operation of copper mines. They offer a way to diversify a portfolio with lower risk compared to investing in individual stocks. By holding shares of several major industry players, these funds help reduce unsystematic risk.

One of the largest ETFs is the Global X Copper Miners ETF (COPX), which includes Freeport-McMoRan, BHP Billiton Group, and Southern Copper Corporation. Another popular fund is the iShares MSCI Global Metals & Mining Producers ETF (PICK), which comprises a number of companies dealing with various base metals, including copper.

Advantages of copper mining ETFs:

- liquidity;

- the possibility of investing with little capital;

- automatic portfolio diversification.

However, the price of an ETF does not just follow copper prices. It also depends on the overall stock market, individual companies’ performance, and global economic trends. Investors should also keep in mind the operating fees, which usually come to about 0.5% of the annual investment amount.

4. Copper Futures

Copper futures are exchange-traded financial instruments that oblige the buyer to purchase or sell a specified quantity of copper at a predetermined price in the future. They allow investors and traders to speculate on changes in copper prices or use them to hedge risks.

Copper futures contracts are traded on major global exchanges such as COMEX (USA), the London Metal Exchange (LME, UK), and the Shanghai Futures Exchange (China). For example, a standard copper futures contract on COMEX typically represents 25,000 pounds of copper or roughly 11.34 tonnes.

An investor can open a long trade in anticipation of rising copper prices or a short trade if they expect prices to fall. However, trading copper futures requires a deep understanding of the commodity market, analysis of supply and demand, and consideration of contango and backwardation, the difference between futures prices across maturities and the spot price.

Futures are suitable for experienced traders and institutional investors, as they require margin collateral and carry high risks due to the volatility of copper prices. An alternative for long-term investors may be copper futures ETFs.

5. Copper Futures ETFs

There are various exchange-traded funds that invest directly in copper futures, including the United States Copper Index Fund (CPER).

This fund tracks the Bloomberg Copper Subindex, which consists of copper futures contracts traded on the Chicago Mercantile Exchange (COMEX). Investing in CPER enables investors to profit from increases in copper prices without having to physically own the metal or buy individual mining stocks.

Another popular fund is the iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC). This fund focuses on investing in futures contracts, but it is an ETN (exchange-traded note) rather than a traditional ETF. This structure entails additional credit risks for the issuer.

The main advantages of such funds include:

- Access to futures contracts without the need to use margin accounts.

- High liquidity, transparent quotes, and simple purchasing via broker trading terminals.

- The opportunity to earn money both from price increases and decreases through short selling.

However, it is essential to consider the risks of volatility, management fees, and the impact of speculative factors.

6. Copper CFDs

Contracts for Difference (CFDs) allow traders to profit from changes in the spot price of copper without having to own the physical metal. This method is convenient for short-term speculation, as it does not require storage, logistics, or insurance costs.

CFDs work as follows: a trader opens a position expecting the copper price to rise or fall. If an increase is anticipated, a long trade is opened, and if a decrease is predicted, a short trade is initiated. When the trade is closed, the profit or loss is calculated as the difference between the opening and closing prices of the trade.

The main benefit of CFDs is the ability to use leverage, enabling traders to significantly expand their trade sizes with borrowed capital. This can lead to higher profits but also increases the risk of losses. Copper CFDs are ideal for active traders prepared to take on high risks, but they are unsuitable for long-term investments.

Market Factors Affecting Copper Investment

The price of copper and the attractiveness of investments in this metal depend on a variety of factors. In recent years, copper has been increasingly in demand, especially in connection with the development of renewable energy technologies and the electric vehicle market.

The copper market is impacted by various economic and political factors:

- Supply and demand. The balance between copper production and consumption determines its price. Copper demand growth in China, the US, and Europe, as well as possible supply disruptions, may significantly affect the market..

- The state of the global economy. During periods of economic growth, copper consumption increases, leading to higher copper prices.

- Infrastructure projects. Large public and private investments in energy and transport networks require large volumes of copper, which bolsters demand.

- Extraction and geopolitical factors. Major copper-producing countries such as Chile, Peru, and China may face extraction challenges due to labor strikes, regulatory changes, or political instability.

- Technological advances. The widespread adoption of electric vehicles and the development of solar and wind energy are boosting copper demand.

- Speculative factors. Hedge funds, banks, and traders using copper futures and CFDs can influence short-term price fluctuations, adding to volatility.

Investment Timing and Strategy

Choosing the optimal time to invest in copper depends on current market conditions and economic factors. One of the key indicators is the balance between supply and demand. For example, if expert forecasts predict that the copper deficit will increase, then its price will edge higher, provided that demand remains stable.

However, during a crisis, the XCUUSD price may plunge. Consequently, one can buy the metal at a lower price.

It is crucial to monitor political and geopolitical risks. Instability in major producing countries may lead to supply chain disruptions and price surges.

For active investors and traders, copper futures or CFD short-term trading can be profitable in highly volatile conditions. Investments in ETFs or shares of mining companies, on the other hand, are better suited for long-term investments.

Benefits of Copper Investment

Investing in copper provides a number of advantages:

- Growing demand. Copper is an essential component in the production of electric vehicles, renewable energy technologies, construction, and industry. Moreover, this metal is an excellent conductor of electricity and is widely utilized in making equipment and electronics. As global production expands and the transition to green technologies continues, copper consumption is projected to advance.

- Inflation hedge. Copper prices rise during periods of high inflation, as base metals tend to retain their value better than currency assets.

- A variety of investment instruments. Investors can select the most suitable investment option: purchasing physical copper, shares of copper mining companies, ETFs, futures, or CFDs.

- Trading. High volatility in the XCUUSD market makes it possible to profit from day trading.

- Limited reserves. Global copper reserves are not infinite, and developing new deposits requires significant investment and, above all, considerable time. This factor contributes to the long-term appreciation of the XCUUSD exchange rate.

All these factors make copper a promising investment asset amid global economic shifts.

Start trading with a trustworthy broker

Risks of Copper Investment

Investing in copper comes with a number of risks that should be taken into account:

- Price volatility. Copper prices may fluctuate significantly due to changes in supply and demand, market sentiment, macroeconomic instability, and geopolitical developments.

- Economic cycles. Copper is widely used in industrial production. Therefore, demand for the metal drops during economic downturns, potentially leading to lower prices.

- Geopolitical and environmental risks. The main copper deposits are located in Chile, Peru, China, etc. Political instability, labor strikes, and stricter environmental regulations in these regions may reduce production, affecting metal prices.

- Storage and transportation costs. Physical copper requires additional expenses for logistics, insurance, and storage.

- Risks associated with financial instruments. Copper futures, ETFs, and CFDs can be difficult to understand and may involve additional commission fees. Furthermore, liquidity may decrease.

- Impact of technological progress. Due to technological advancements, demand for copper may be reduced in some sectors.

While the potential for gains is encouraging, investing in any asset demands thorough market analysis and a careful assessment of possible risks.

Copper vs Other Metals

Investing in copper differs significantly from gold and silver trading. The table below compares the key differences between copper and gold, silver, and platinum. Copper has an advantage in terms of industrial demand but is inferior to precious metals in terms of liquidity and stability during turbulent times. Unlike gold, which is considered a safe-haven asset, copper is more vulnerable to economic cycles, supply, and demand.

|

Metal |

Application |

Volatility |

Liquidity |

Features |

|

Copper |

Industry, energy, construction |

High |

Moderate |

The price depends on industrial demand |

|

Gold |

Investments, jewellery, electronics |

Moderate |

High |

Utilized in industry and investment |

|

Silver |

Jewellery, industry, electronics |

High |

High |

Utilized in industry and investment |

|

Platinum |

Automotive industry, jewellery, manufacturing |

High |

Low |

The price varies depending on the demand for cars |

Conclusion

Copper is a promising asset, suitable for both short-term trading and long-term investments. Growing global demand, especially in the renewable energy, electric transport, and construction sectors, makes this metal a strategically important element of the global economy.

Investors can choose the best investment method based on their own goals and risk tolerance. Buying physical copper provides direct ownership of the asset but involves storage costs. Shares of copper mining companies and ETFs allow you to participate in the development of the industry without owning the metal. Copper futures and CFDs are suitable for active traders who seek to profit from short-term price fluctuations.

Despite its advantages, investing in copper carries risks connected with market volatility and global economic conditions. However, given the projected increase in demand and steady production volumes, this metal has promising prospects. Careful analysis and selection of the optimal strategy will help minimize risks and maximize profits.

Copy successful traders

Make profits from the first day of trading without training. The best traders from the whole world gathered on the same platform to share their money-making strategies.

Investment in Copper FAQs

Chile is the world’s largest copper producer, accounting for about 27% of global output. Peru ranks second with 10% of global production. China and the Democratic Republic of Congo rank third, each accounting for 8%.

Chile holds the largest proven copper reserves, with major deposits at Chuquicamata and Escondida, followed by Peru and Australia. The US and Russia also have significant reserves.

Copper investments can be profitable due to the burgeoning demand for copper and limited supply. Major investment companies anticipate that demand for copper and other industrial metals will grow significantly until 2050.

You cannot buy copper in the stock market, but you can buy shares of copper mining companies, ETFs, or futures. Physical metal is available on special exchanges.

It is best to buy shares of the largest mining companies, such as Freeport-McMoRan, BHP Billiton, and Southern Copper Corporation. Besides, you can also use such ETFs as the United States Copper Index Fund (CPER) and iPath Series B Bloomberg Copper Subindex Total Return ETN.

Copper is sought after in industrial production, while silver is attractive both in terms of investment and manufacturing. The choice depends on your goals. However, liquidity and volatility should be taken into account, as they may also affect the long-term value of copper.

Investing in copper involves risks linked to price volatility, economic crises, and supply issues. However, increasing demand and a predicted shortage mean that this metal remains a promising asset. Choosing the right strategy and taking market factors into account will help reduce risks and enhance returns.

The high volatility and dependence of copper prices on the global economy may not appeal to conservative investors. If you buy metal at an unfavorable price, you may face a prolonged decline in prices, low liquidity, and, as a result, lose your savings.

During an economic slump, demand for copper and other industrial metals declines, potentially driving prices down. However, if you buy metal at an attractive price, you can earn high profits in the long term.

Copper ETFs are funds that invest in shares of copper mining companies or copper futures. When purchasing shares in these funds, investors indirectly invest in a wide range of assets related to copper mining and processing.

You can make money from soaring copper prices and by buying ETFs, futures, and shares of copper mining companies. The investment process is quite straightforward: buy low and wait for prices to go up. Additionally, investing in stocks can yield extra income through dividends.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.