A strong labor market, high inflation and lower rates allowed the RBA to keep the cash rate plateaued while other central banks were easing monetary policy. In autumn, everything changed. Let’s discuss it and make a trading plan for AUDUSD.

The article covers the following subjects:

Highlights and key points

- The Reserve Bank does not exclude a reduction in the cash rate.

- The RBA is fighting inflation, boosted by the government.

- As expectations of monetary expansion grow, the Aussie will fall.

- Sell AUDUSD on a rise to 0.678 and 0.6825 or on a decline to 0.67.

Weekly fundamental forecast for Australian dollar

It was bound to happen sooner or later. RBA’s September minutes showed that the central bank discussed easing monetary policy, although it decided to leave its key rate at 4.35%. The divergence in bank policy from other regulators has supported AUDUSD for a long time. Now that this is no longer the case, the pair has lost ground. Moreover, China has not introduced fiscal stimulus, while the strength of the U.S. labor market highlights the resilience of the U.S. economy.

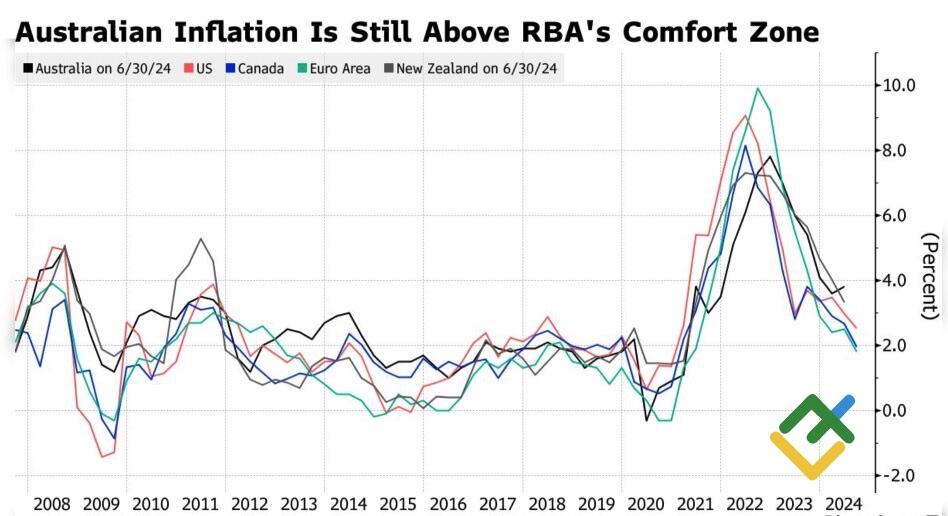

For most of 2024, the Reserve Bank appeared to be the black sheep. While many central banks, led by the Fed, were actively cutting rates, the RBA did not rule out the possibility of raising them because the Australian labor market was said to be strong as a bull, inflation was not declining as quickly as in other countries, and monetary policy remained less restrictive. As a result, the RBA’s key rate reached 4.35%, compared to the Fed’s 5.5% in the U.S.

Inflation trends

Source: Bloomberg.

However, this situation cannot continue indefinitely. Central banks typically act in concert, and massive rate cuts, according to the WTO, would accelerate international trade growth to 2.7% in 2024. If desynchronization occurs, volatility in the Forex market will increase, negatively impacting export-import transactions.

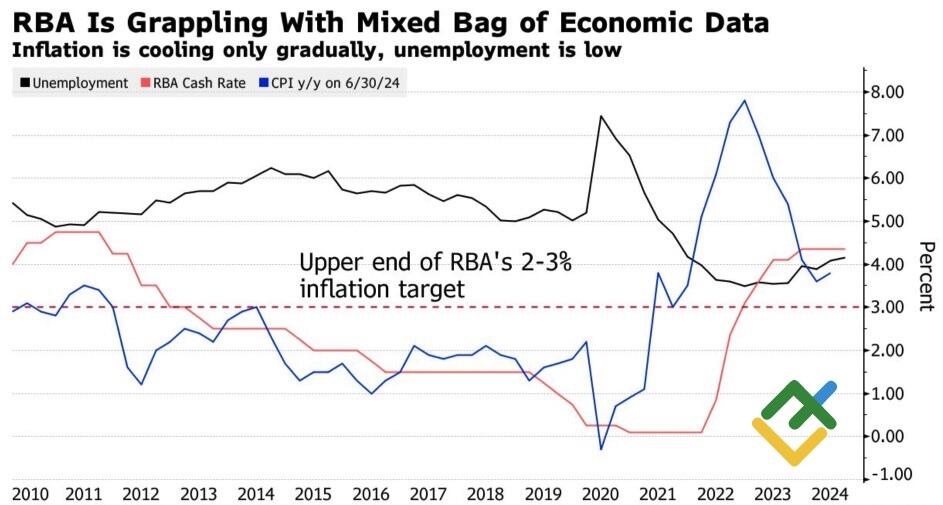

The RBA removed the phrase, “it is unlikely that the cash rate target will be reduced in the short term,” from its September minutes and discussed the global easing agenda. Although the Reserve Bank is not yet prepared to follow other central banks, it will likely need to align as rates become synchronized.

A strong labor market and persistently high inflation are largely due to the government’s generous fiscal policies. The IMF warned Canberra that the previously announced cuts in personal income tax and increased budget spending, including broad support for measures to reduce the cost of living, will result in a deficit.

Unemployment, RBA rate, and inflation trends

Source: Bloomberg.

Thus, the RBA is fighting inflation, boosted by the government. At the same time, Treasurer Jim Chalmers asserts that this helps households resist high prices, allowing the economy to avoid falling into recession.

Australia is a unique country. It does not join the synchronization of monetary policy and uses an unorthodox approach to fiscal stimulus. At the same time, the Reserve Bank’s abandonment of the idea of raising the cash rate, China’s problems, and a sharp change in expectations for a Fed rate cut from 70 basis points to 43 basis points in 2024 allowed the AUDUSD bears to seize the initiative.

Weekly trading plan for AUDUSD

Pressure on the Australian dollar will increase as the US presidential election approaches. The risks of a Donald Trump victory and the associated trade wars have not been eliminated. So, sell AUDUSD on growth to 0.678 and 0.6825, or on a breakout of support at 0.67.

Price chart of AUDUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.