One of the first questions beginner traders and investors ask is how much Forex traders can make per month. Everyone would like to know what they will have in exchange for their time and efforts, compared with other earning opportunities. Some expect that Forex will yield 100% per annum and more, and some are skeptical even about 30%. So, how much can a trader make for real? Let’s calculate together.

The article covers the following subjects:

What Is the Average Earnings of Forex Traders per Month?

Many people rely on Forex as their primary source of income. The question is, How much do professional Forex traders make per month? Forex trading income per month can vary considerably and depend on many factors. Traders’ earnings are influenced by their experience, trading strategy, the amount of capital invested, and market conditions. Beginner traders tend to earn less as it takes time and practice to achieve consistent profitability in Forex. More experienced traders who utilize proven strategies and effectively manage risk have a higher likelihood of generating a steady income.

Moreover, how much can you make trading Forex daily? Forex trading profit per day can fluctuate depending on trading strategy. Some traders opt for numerous trades with small profits, while others focus on less frequent but more significant trades with larger yields. Therefore, the potential earnings from Forex trading are highly individual and influenced by a variety of unique factors that affect each trader’s performance.

How much can a beginner trader earn?

The income of novice Forex traders can be limited as they are at the early stages of learning the essential skills and principles of trading. So, how much can a beginner Forex trader make? According to 2024 statistics, an average beginner Forex trader can earn from $100 to $500, provided they trade carefully and start with small investments. However, many novices may struggle to achieve consistent profits in the first few months and, in some cases, may even suffer losses. Ultimately, how much a beginner Forex trader can make depends largely on their level of training and the amount of money invested.

How much do professional traders earn?

Professional Forex traders with considerable experience and effective risk management can earn significantly more. The average monthly income of professional Forex traders can range from $5,000 to $10,000 or more, depending on strategy, capital, and market conditions. According to Glassdoor’s 2024 data, a trader’s salary in the UK can reach £155,634 per year, which is around £12,970 per month. However, many professionals receive performance bonuses, which can significantly increase their monthly income.

Copy successful traders

Make profits from the first day of trading without training. The best traders from the whole world gathered on the same platform to share their money-making strategies.

What is the income of an independent trader?

The monthly income from Forex trading for independent traders largely hinges on their skills and the amount of capital they possess. Those who trade with their own funds can earn from a hundred to a thousand dollars per month. According to 2024 sources, successful independent traders can make from $2,000 to $5,000 per month. Nevertheless, the lack of steady income and stable conditions makes such trading more risky and unstable in terms of profitability.

How and How Much Do Forex Traders Earn?

Imagine a classical market where goods are sold and bought. You can be a seller or a buyer there. For example, you buy something cheap and sell it high, and make money from that. What will your income level depend on?

- Your start capital (the more goods you have, the higher your profit is)

- Bank credit amount (you can take out a loan if you don’t have enough money)

- Asset liquidity and price volatility. The more people want to buy/sell your product, the faster you make trades. The faster the price changes, the more trades you can make in a unit of time.

The same applies to Forex, where traders also sell or buy goods, using leverage and taking volatility and liquidity into account. Here are two practical examples. Let’s suppose the EURUSD is 1 to 2, and the euro is a base currency.

Example 1: With a deposit of $2000 without leverage

You have a deposit of 2,000 USD. One lot is 100,000 units of the base currency (check this article for more details on calculating a lot size). The minimum trade size set out in the account conditions is 0.01 lots or 1,000 base units, which equals 100% of your deposit (2,000 USD or 1,000 EUR). With 0.01 lots, the EUR/USD’s one point cost is 0.1 USD or 10 cents for four-digit quotes (100,000 * 0.01 * 0.0001).

Thus, if your deposit is 2,000 USD and you open a trade worth 2,000 USD, one price variation step will yield you 10 cents if your forecast is correct.

An average currency fluctuation may go up to 80-100 points in a day based on the volatility calculator. So, you can make money from such fluctuations in any direction! According to surveys, beginner traders earn 100 points a day on average, making 10 USD per day.

Conclusion

A trader may earn 10 USD a day with a deposit of 2,000 USD if all goes right. That means monthly profitability will be 10% (10*20 business days = 200 USD).

However, this calculation doesn’t provide for spreads and swaps that swallow a substantial part of profits. Second, there’s a risk management rule that says a risk per trade mustn’t exceed 2% of a deposit, whereas, in my example, the risk totals 100%! Third, a trader doesn’t always make profits. With a deposit of 1,000 USD and without leverage, a trader won’t have enough funds to open a trade because 0.01 standard lots is 2,000 USD when the rate is 1:2. The real rate being 1.1066, the minimum trade amount without leverage will be 1,106 USD.

Here’s an example in the print screen below.

Example 2: With a deposit of $2000 and leverage of 1:1000

Your deposit is 2,000 USD. You observe the “2% risk per trade” rule and therefore can’t do without leverage (a broker’s credit money). Assume the leverage is 1:1,000. Then, you can open a trade worth 40,000 USD ( 2000 * 0.02 * 1,000) USD. You’ll then be able to buy 20,000 EUR, which corresponds to 0.2 lots (20,000/100,000). Let’s calculate one point cost: 100,000 * 0.0001 * 0.2 = 2 USD.

Conclusion

- With a deposit of 2,000 USD and 100 points earned a day, you can earn 200 USD (2 * 100). That makes about 4,000 USD or 200% a month. As you can see in the last screenshot or in the traders’ earning stats, that’s real money.

- You risk only 2% of the deposit, so the risk per trade is 40 USD.

Those are quite optimistic figures, but you need to subtract spreads, swaps, previous losses, and withdrawal fees to calculate net profits. Also, remember that using leverage without observing risk management rules will most probable induce stop-outs.

There isn’t any “easy” money on Forex. Experienced traders who earn a lot in the foreign exchange market approach trading with all responsibility: they optimize their trading strategies and thoroughly study financial instruments and the trading platform’s features. If you want to earn much, use the following algorithm:

- Start simple. Make sure your net monthly profit is at least 3%-5% of your investment in a real account on a stable basis. It doesn’t matter how much it makes as a money equivalent. What matters is your trading system’s stability and risk optimization.

- Gather your trading statistics (link the account to MyFxBook).

- Continue trading as per your trading system, attract beginner traders, and make extra profits from commissions (Social trading).

ADVICE: you can copy experienced traders’ trades onto your account. Choose a trader from the list, top up your account, and start copying!

Let’s sum up

- Your profit amount is subject to the following factors:

- The sum of the deposit that you use in trading. Remember about risk management rules.

- Leverage. You can increase your trade size by 10, 100, or even 200 times. However, don’t forget about stop-outs.

- Trading strategy (how often you open trades, Take-Profit levels, etc.)

- Asset’s average volatility

- Your willingness to learn, your patience, experience, and self-confidence!

How much do Forex traders make in three months? It all depends on you: your willingness to risk and the time you’re ready to spend trading. Sky’s the limit! So, make a table based on the previous calculations and set your goals yourself!

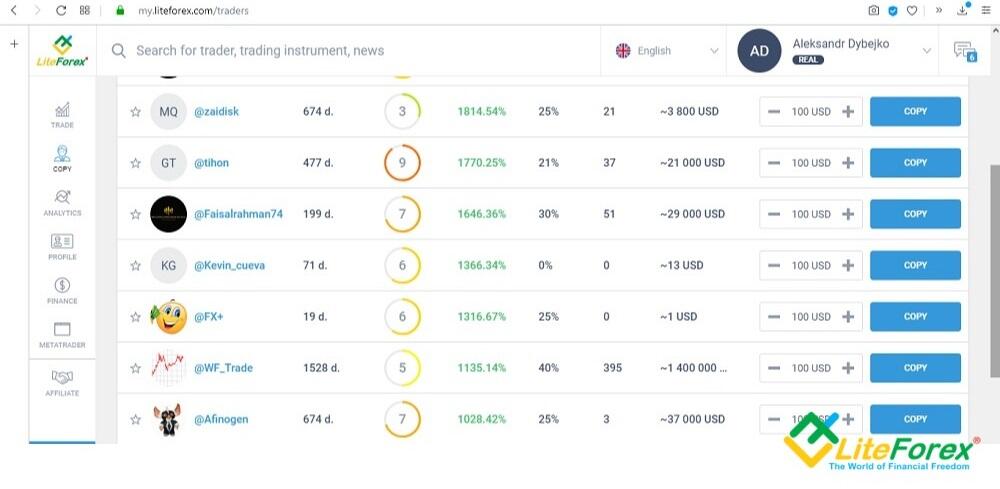

Look how much LiteFinance’s best traders earn (this is profitability reached over the account’s total lifespan. The second column shows lifespans in days. More details are available in Personal Profile at LiteFinance) :

Everyone can earn as much!

P.S. Did you like my article? Share it in social networks: it will be the best “thank you” 🙂

Ask me questions and comment below. I’ll be glad to answer your questions and give necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe.

- Use my promo code BLOG for getting deposit bonus 50% on LiteFinance platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.me/litefinancebrokerchat. We are sharing the signals and trading experience.

- Telegram channel with high-quality analytics, Forex reviews, training articles, and other useful things for traders https://t.me/litefinance

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.