Hantec Markets Limited, the UK subsidiary of the global

forex and CFD broker, has returned to profitability for the financial year

ended 31 December 2024. The company disclosed the figures in its recently filed

financial statements.

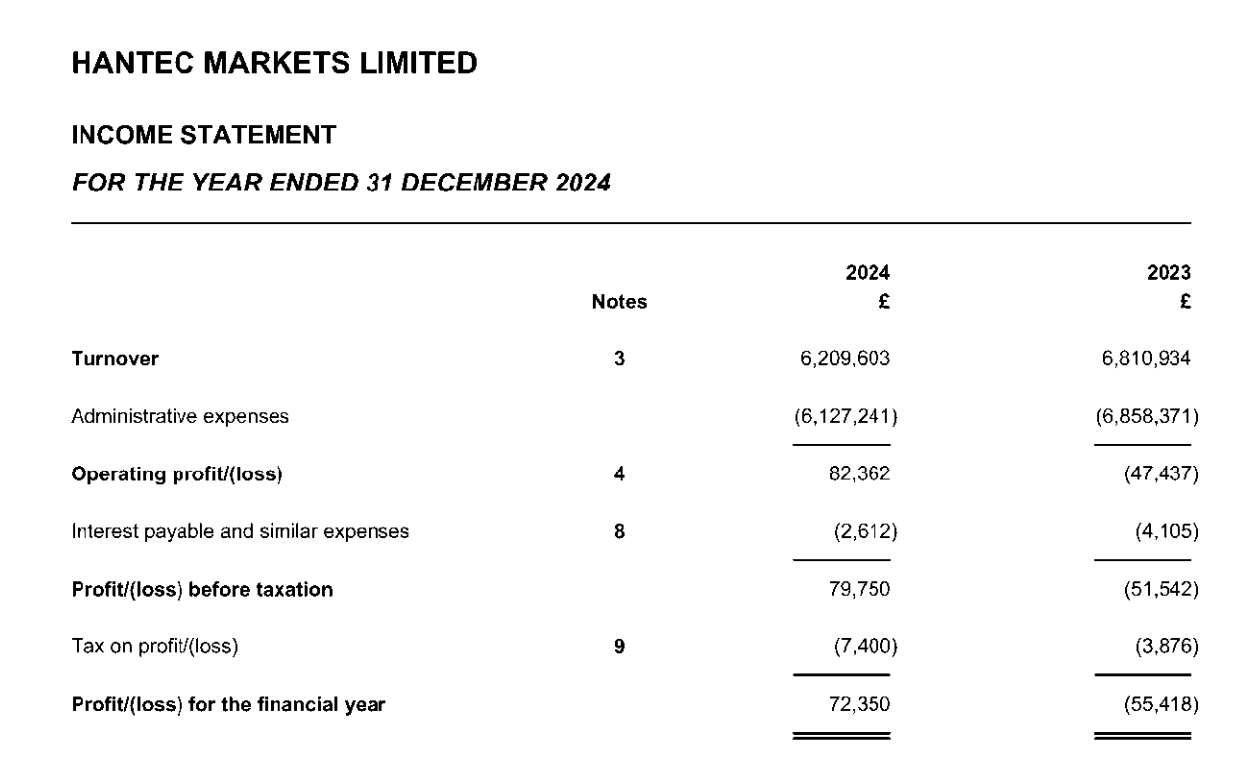

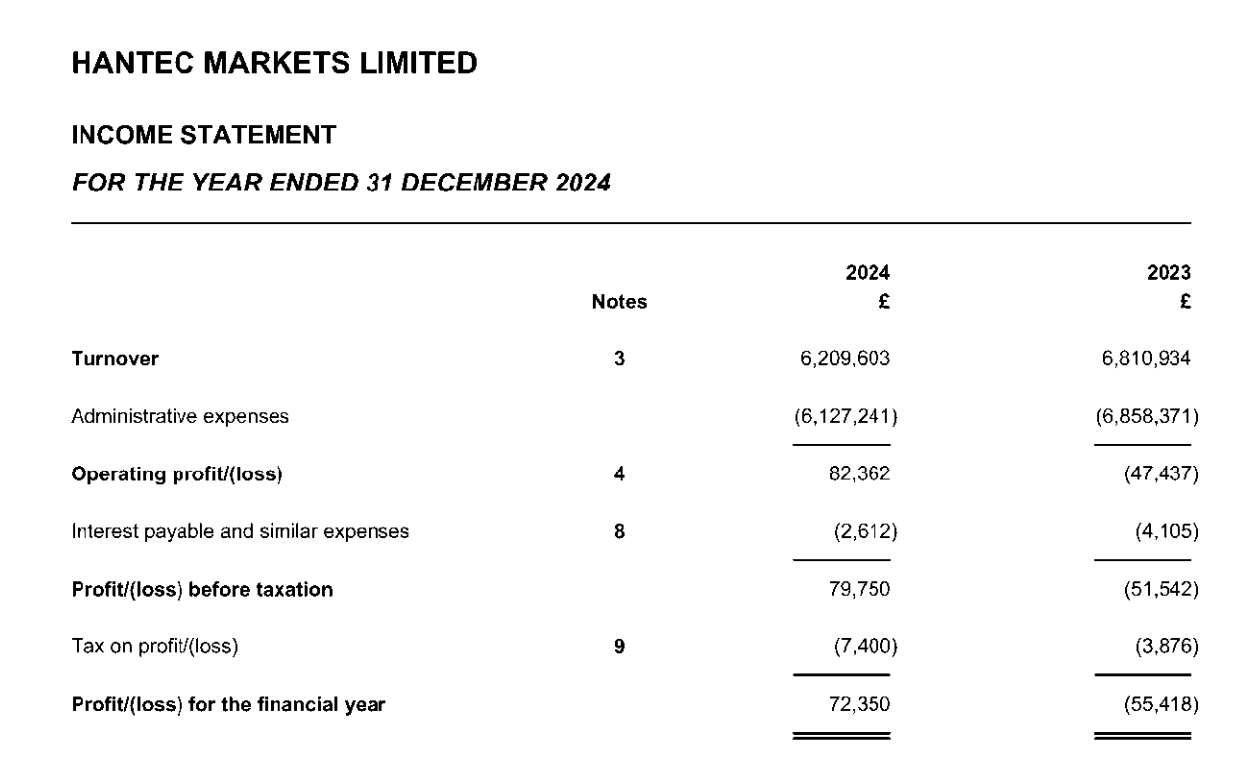

UK Unit Reports £72K Profit, Lower Turnover

The company posted a profit of £72K for the year, compared

to a loss of £55K in 2023. This improvement came despite a decline in turnover,

which fell to £6.21 million from £6.81 million in the previous year.

Operating profit reached £82K, reversing an operating loss

of £47K in 2023. Administrative expenses were slightly lower, amounting to

£6.13 million compared to £6.86 million the year before.

Reports Stability, No Material Uncertainties Identified

Interest payable and similar charges declined to £2K, while

tax for the year totalled £7K. There was no other comprehensive income in

either year, making the net profit equal to total comprehensive income.

Total equity increased modestly, rising to £5.46 million

from £5.39 million in 2023. All business activities during the reporting period

were continuing in nature.

The audited statements also addressed the company’s

financial outlook for the near term.

“Based on the work we have performed, we have not identified

any material uncertainties relating to events or conditions that, individually

or collectively, may cast significant doubt on the company’s ability to

continue as a going concern for a period of at least twelve months from when

the financial statements are authorised for issue,” the company stated.

Hantec Markets Limited, the UK subsidiary of the global

forex and CFD broker, has returned to profitability for the financial year

ended 31 December 2024. The company disclosed the figures in its recently filed

financial statements.

UK Unit Reports £72K Profit, Lower Turnover

The company posted a profit of £72K for the year, compared

to a loss of £55K in 2023. This improvement came despite a decline in turnover,

which fell to £6.21 million from £6.81 million in the previous year.

Operating profit reached £82K, reversing an operating loss

of £47K in 2023. Administrative expenses were slightly lower, amounting to

£6.13 million compared to £6.86 million the year before.

Reports Stability, No Material Uncertainties Identified

Interest payable and similar charges declined to £2K, while

tax for the year totalled £7K. There was no other comprehensive income in

either year, making the net profit equal to total comprehensive income.

Total equity increased modestly, rising to £5.46 million

from £5.39 million in 2023. All business activities during the reporting period

were continuing in nature.

The audited statements also addressed the company’s

financial outlook for the near term.

“Based on the work we have performed, we have not identified

any material uncertainties relating to events or conditions that, individually

or collectively, may cast significant doubt on the company’s ability to

continue as a going concern for a period of at least twelve months from when

the financial statements are authorised for issue,” the company stated.

This post is originally published on FINANCEMAGNATES.