A thaw in US–Russia relations is changing how foreign investors view the country. At the same time, Russia’s gold and foreign currency reserves are helping drive the USD/RUB down. Let’s discuss it and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Foreign investors are showing interest in Russian assets.

- Debt restructuring is supporting the ruble.

- Gold is boosting the Russian currency.

- Selling USD/RUB with a target of 75 remains a relevant strategy.

Weekly Fundamental Forecast for Ruble

With gold hitting record highs, you might think nothing can outperform it in 2025. But that’s not entirely true. The Russian ruble is actually the best-performing global currency on Forex this year. Since January, the USD/RUB rate has dropped by almost 28%. Interestingly, this downward trend would not have been so rapid if not for gold.

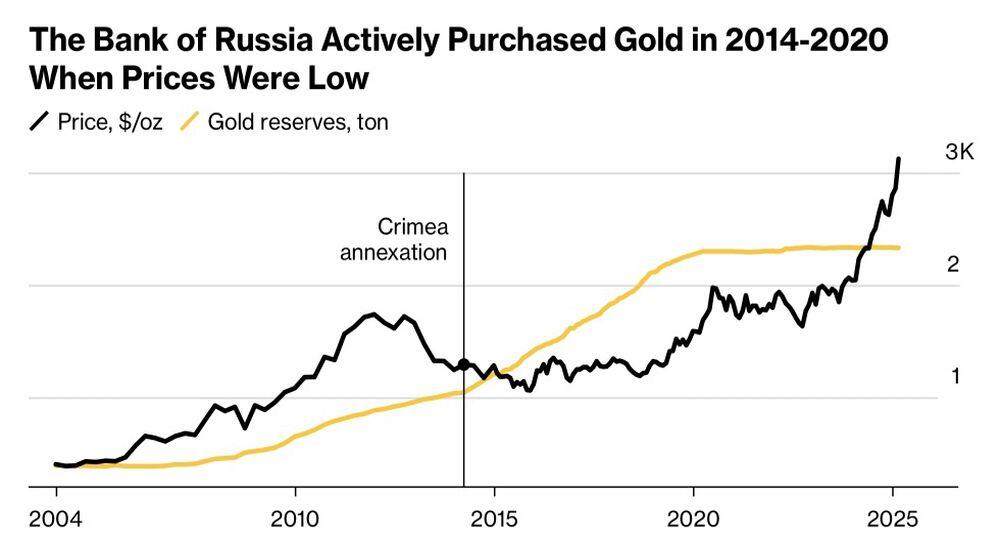

According to the Bank of Russia, the value of gold in Russia’s reserves has grown by 72% (or $96 billion) since 2022. That accounts for approximately one-third of the $300 billion Russia has lost due to Western sanctions. If the improving relations between Washington and Moscow help unfreeze those funds, the Kremlin will gain a financial cushion it has never had before.

Gold Prices and Russia’s Gold Reserves over Time

Source: Bloomberg.

The higher XAU/USD climbs, the richer gold-holding countries become. With the world’s fifth-largest gold reserves, Russia is benefiting from this trend in the commodity market.

The political thaw is also changing investor sentiment. Many are now willing to take the risk and invest in high-yield Russian assets, despite heavy Western sanctions. To circumvent these restrictions, they are working through so-called “friendly” countries. Even the Bank of Russia acknowledges this, saying the ruble’s consolidation is partly due to renewed interest from foreign investors as geopolitical tensions ease.

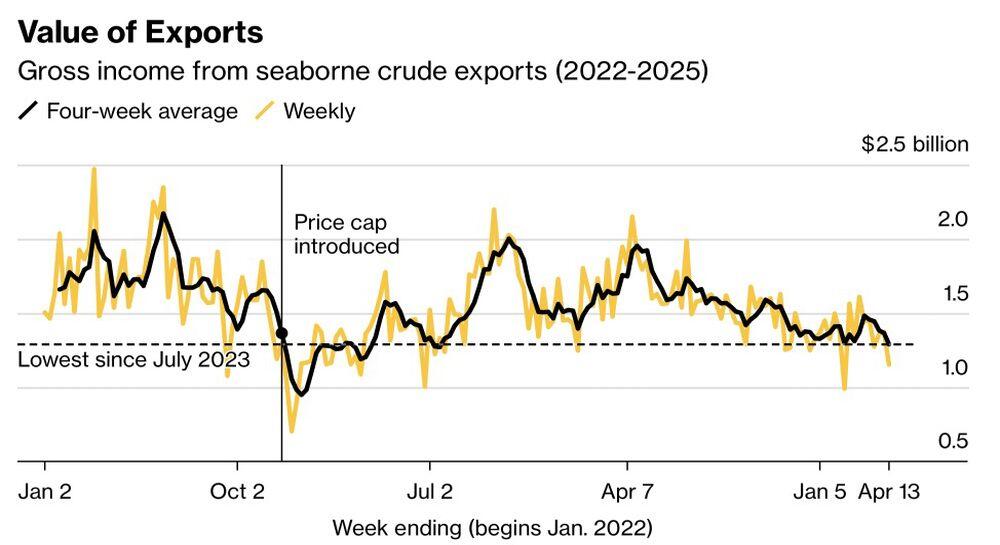

Another factor driving the USD/RUB down is a kind of carry trade by Russian companies. They’re taking out low-interest loans in Chinese yuan to restructure debt, which increases demand for rubles when converting currencies. This unexpected surge in the ruble is confusing analysts and government officials alike. In March, experts surveyed by the Bank of Russia predicted the USD/RUB would reach 98.5 by year-end. The national budget assumed a rate of 96.5%, which is 19% above current levels. Coupled with falling oil prices, this is reducing export revenues and the state’s tax income.

Russia’s Oil Export Revenue Trend

Source: Bloomberg.

Still, the ruble’s rise is good news for the Kremlin. It boosts confidence in government policies. Additionally, a stronger ruble helps slow inflation, which could enable the central bank to lower rates and support economic growth. It is unlikely that the government will try to stop the ruble from strengthening.

Weekly Trading Plan for USDRUB

The only thing that might reverse the downtrend in USD/RUB will be a complete breakdown in US–Russia relations. But that seems unlikely, especially for Donald Trump, who sees improved relations with Russia as a golden opportunity. The decline to the previously stated target of 75 — first mentioned in February — continues. The recommendation is to hold your short positions and use any pullbacks to add more.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDRUB in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.