Even Donald Trump’s imminent return to the White House does not frighten XAUUSD bulls. Gold may get preferential treatment as a safe-haven asset and as a beneficiary of a renewed US-China trade war. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Gold managed to rise against a strong US dollar.

- A renewed trade war will help the XAUUSD.

- The precious metal can soar to $2525 per ounce.

Monthly fundamental forecast for gold

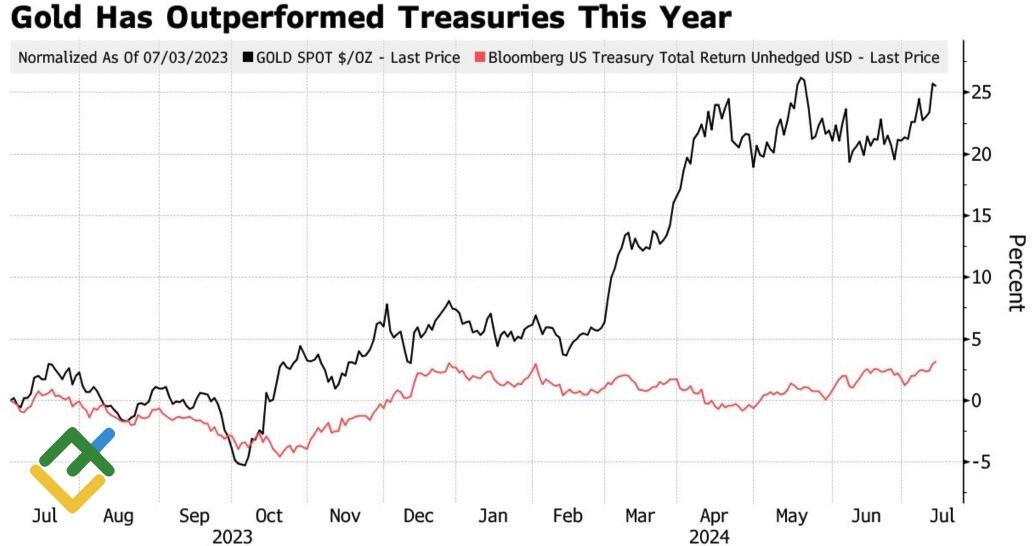

If gold has surged against a strong headwind, how will it perform when the tailwind turns? Over the past 12 months, the XAUUSD has added 25%, a real feat against the Fed tightening and higher-for-longer interest rates, the dominance of the US dollar in the Forex market, and surging Treasury yields. When good times come, it is an excellent time to think about new all-time highs.

A series of disappointing reports on the US economy has forced FOMC officials to switch to dovish rhetoric, and the futures market has increased the odds of a September easing to 100% from 73%. Derivatives are now 60% confident of a third act of monetary expansion before the end of the year, pushing Treasury yields lower and creating a favorable backdrop for the precious metal.

Gold price and US Treasury yield

Source: Bloomberg.

It goes without saying that gold is outperforming US Treasuries, which are under pressure from the risks of a Donald Trump victory in November. The Republican’s policies have a pro-inflationary bias, increasing the likelihood of a repeat of 2016 history. At the time of the vote, the yield on 10-year bonds was 1.85%, rising to 2.6% by the end of the year.

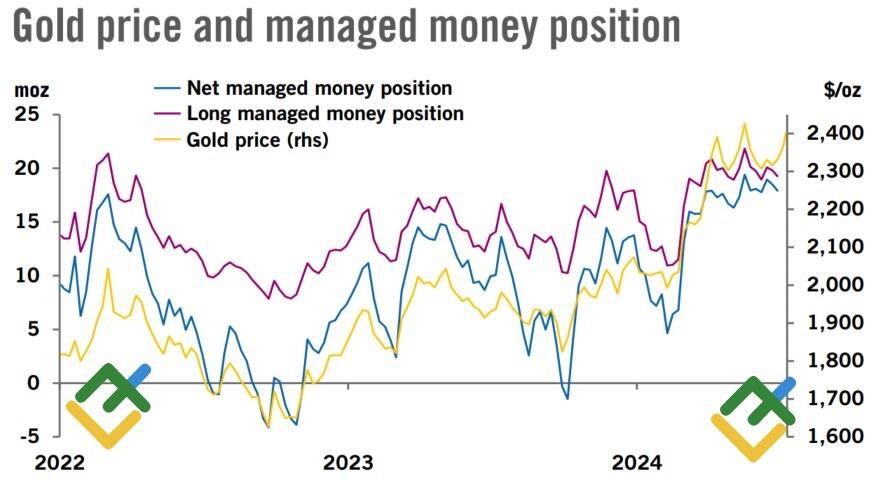

The multidirectional factors exclude Treasuries from the list of gold’s competitors. Moreover, the precious metal’s reaction to the assassination attempt on Donald Trump shows that it benefits from its safe-haven status. Speculators are not tired of building up longs, pushing the XAUUSD closer to a new all-time high. In addition, the dovish rhetoric of FOMC members and the growing likelihood that the Fed will soon begin to taper are driving capital into gold-linked ETFs.

Gold speculative net positions

Source: Kitco.

Despite the fact that the Trump trade implies a stronger US dollar, higher Treasury yields, and higher equity indices, the precious metal is poised to benefit from these factors as a safe-haven asset and as a major beneficiary of a renewed US-China trade war.

Notably, the main drivers of the XAUUSD rally in the face of headwinds have been strong Asian demand, active central bank buying, and the de-dollarization of the conventional Eastern economies. The deterioration in relations between Washington and Beijing will accelerate these processes. Indeed, the People’s Bank of China has not officially bought gold for two months, but what will happen when it does?

Monthly trading plan for gold

The XAUUSD is poised to maintain a bullish trend amid the cooling US economy and financial stability problems due to excessive fiscal stimulus. The first two targets for the previously established long trades on gold at $2400 and $2425 per ounce have been hit. The third target implies a move from $2480 to $2525. Against this backdrop, it is better to keep your long trades open or initiate them if you have not done it yet.

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.