The previous trade war spurred XAUUSD quotes. Today, gold has a significant competitive advantage in the form of geopolitical factors. This provides the precious metal with a resilience that allows it to withstand strong headwinds. Let’s discuss these topics and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Another trade war will support gold prices.

- Geopolitics is a safety cushion for XAUUSD quotes.

- The precious metal will enjoy the Fed’s rate cuts.

- Long trades opened at $2,715 should be kept open.

Weekly Fundamental Forecast for Gold

Gold’s reaction to falling Treasury yields and the US dollar’s worst performance since November 2023 was significant, although reports of imminent tariffs against Mexico and Canada did not impact its performance. Investors are assessing the implications of the 47th President’s policies, and the XAUUSD is offering a viable option for those seeking to capitalize on market fluctuations.

Prior to the 2024 presidential election, the Fed dominated financial markets. However, following the victory in the US presidential election, Donald Trump was under the spotlight. In the fourth quarter, stock indices and the US dollar rose, while gold slumped, as investors anticipated Trump to implement policies to stimulate the US economy, reinforce American exceptionalism, and attract capital to North America.

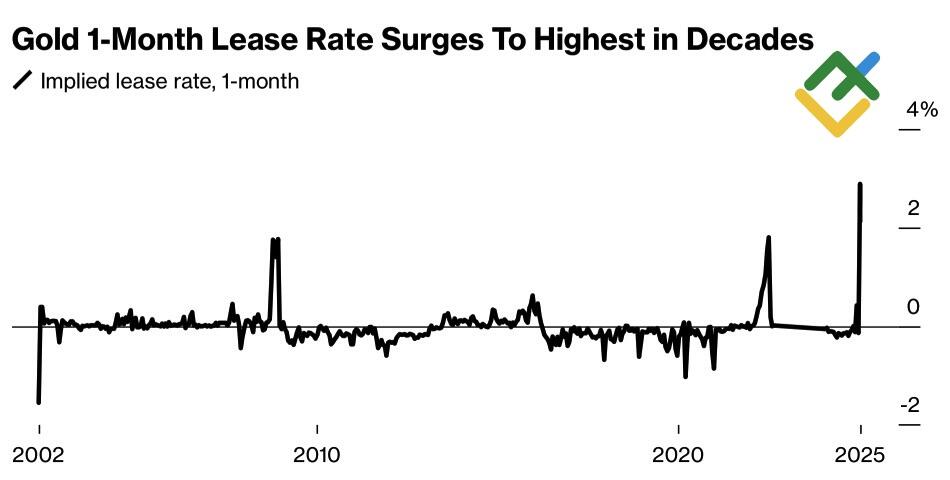

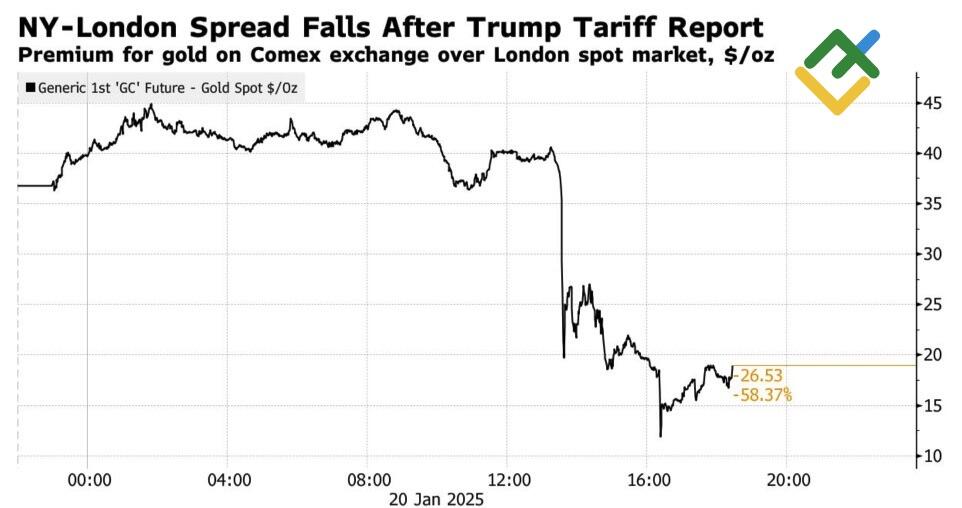

In 2025, investors recalled the trade wars that contributed to the global economic slowdown in 2018–2019 and provided a solid foundation for the XAUUSD rally. Markets fear that import duties will make it unsafe for gold to be stored in other countries, leading to its relocation to the US. As a result, the lease rate in London surged to its highest levels since 2022. This development coincided with Donald Trump’s announcement that Washington is not prepared for universal tariffs, leading to a halving of premiums between the COMEX and LBMA.

Gold Implied Lease Rate in London OTC Market

Source: Bloomberg.

NY-London Premium for Gold Spread

Source: Bloomberg.

Tariffs and related fears of new trade wars and a slowdown in the global economy are not the only factors boosting the XAUUSD rally. This time, gold has another strong driver – geopolitics. It has become a form of risk mitigation for the precious metal, enabling it to withstand fierce headwinds, including soaring US Treasury yields, stronger US dollar, and capital flight from gold ETFs.

The gold market had feared that Donald Trump’s intention to end the war in Eastern Europe would reverse the processes of dedollarization and diversification of reserves by central banks in favor of gold. However, the President only declared his mission as a peacemaker during his inauguration, leaving investors in the dark as to how exactly he intends to put a stop to the military conflict in Ukraine. Concurrently, Trump has prompted countries to accelerate their gold purchases by reiterating his threat to impose 100% tariffs on the BRICS bloc, which is reportedly developing its currency.

Weekly Trading Plan for Gold

Therefore, the precious metal market reacted to the decline in the US dollar and Treasuries and the increase in the probability of two acts of monetary expansion by the Fed in 2025 from 46% to 69%. Gold has maintained its status as a safe-haven asset in the face of geopolitical factors, and experts predict that it will continue to appreciate in value. As a result, one can consider keeping their long positions formed at $2,715 per ounce open.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.