If the price of gold has been rising despite headwinds, how high can it potentially soar if the headwinds change to tailwinds? The answer to this question depends on the pace of the Federal Reserve’s monetary policy and the US labor market data. Let’s discuss these topics and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The correlation between gold and the US bond market is recovering.

- The trajectory of XAUUSD quotes will depend on the Fed’s monetary expansion.

- The US labor market will guide the precious metal.

- Gold risks falling below $2,600, but the bullish target of $2,800 remains relevant.

Weekly fundamental forecast for gold

Gold prices retreated in response to comments by Fed Chairman Jerome Powell indicating that the Fed was not inclined to act hastily. Nevertheless, XAUUSD bulls remained undeterred by this development. The precious metal is enjoying a period of considerable gains. From July to September, the asset’s value increased by 13%, representing the strongest performance since the beginning of 2016. The rally has continued for four consecutive quarters, marking the longest winning streak since late 2020. Over that period, the total gain was 42.6%. Such a performance has not been seen since mid-2008.

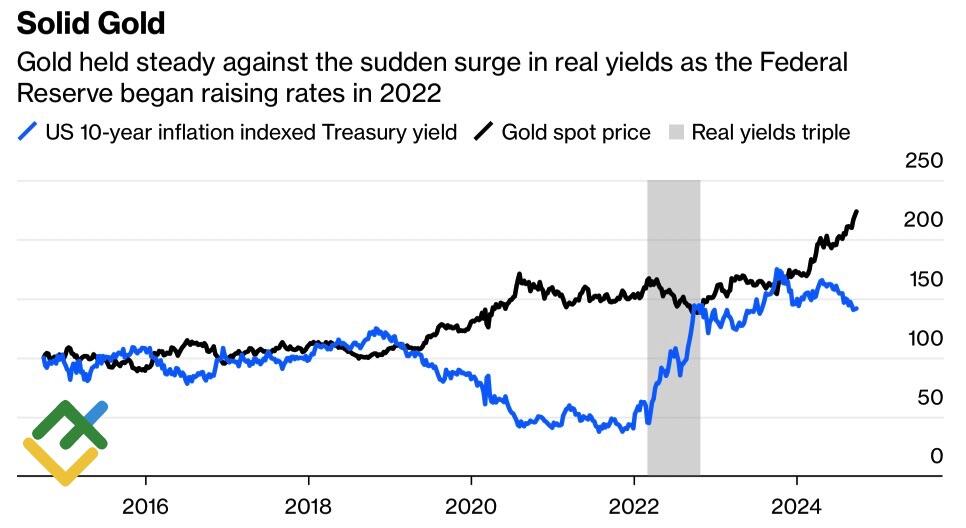

The figures are impressive, but even more noteworthy is gold’s capacity to advance despite significant headwinds. For decades, the XAUUSD reacted to the dynamics of real Treasury yields. However, in 2022-2023, this trend reversed. According to the Longview Economics multi-factor model, which has demonstrated consistent accuracy since 2008, the precious metal should have fallen to $1,000 per ounce in 2022. However, the market price exceeded $2,000.

Gold performance and US Treasury bond real yields

Source: Bloomberg.

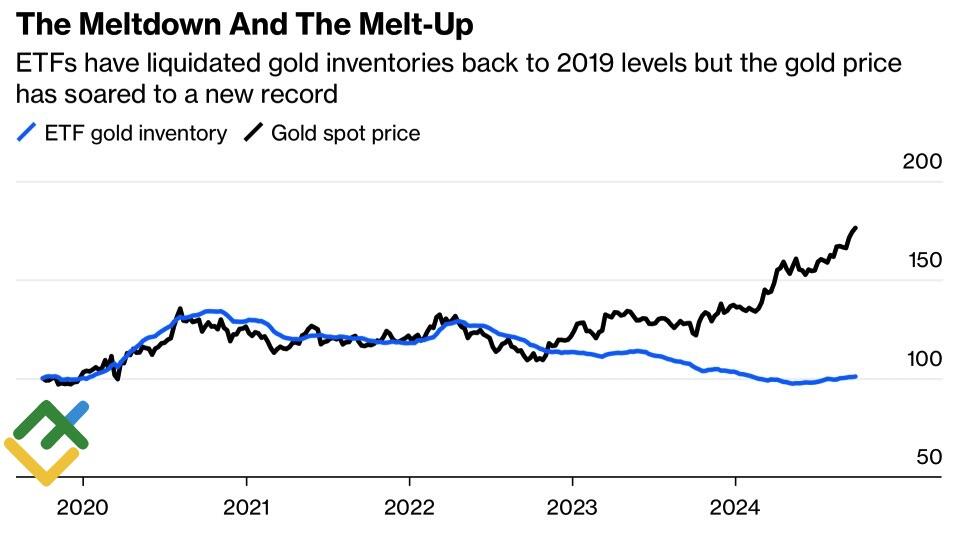

There was a discrepancy between the XAUUSD and capital flows into ETFs. Typically, an increase in gold prices results in greater demand for exchange-traded funds. However, during the previous cycle of the Fed’s monetary restrictions, this was not the case. Despite a rally in precious metal quotes, there was an outflow of capital.

Gold price and capital inflows into ETFs

Source: Bloomberg.

China and central banks’ active gold purchases as part of the dedollarization process have been instrumental in safeguarding the precious metal. China’s insatiable demand for gold has since diminished in the context of record-high prices, and premiums in Shanghai compared to London have been replaced by a discount. However, the headwind from the Fed and the debt market transformed into a tailwind for the XAUUSD. In light of Jerome Powell’s decision to loosen monetary policy, gold will likely rise in value.

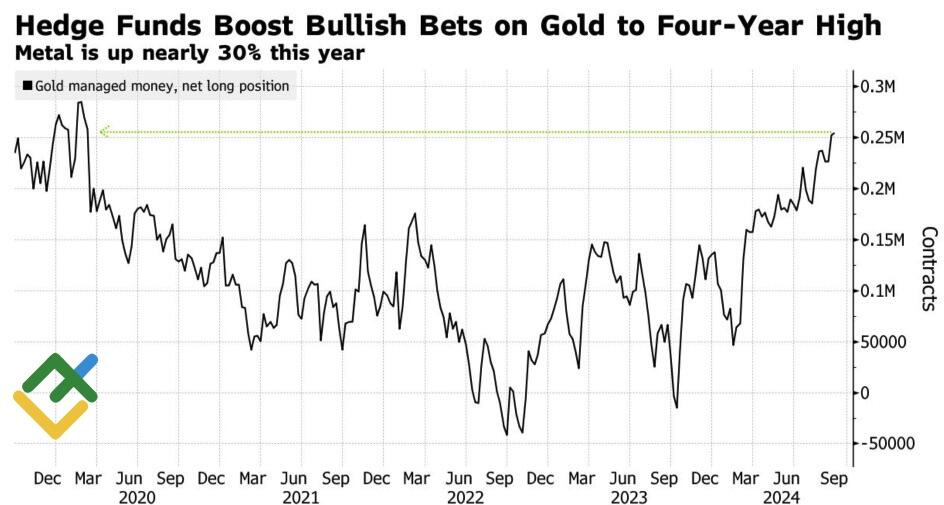

Given the Fed chairman’s remarks about the central bank’s lack of urgency, it is not surprising that the precious metal has been negatively affected. With asset managers holding net long positions at their highest level in four years, a pullback is a distinct possibility.

Speculative positions on gold

Source: Bloomberg.

Against the Fed’s data-dependent monetary policy, the XAUUSD will demonstrate a heightened sensitivity to macroeconomic data. Jerome Powell’s speech has reduced the likelihood of a 50 bp cut in the federal funds rate in November from nearly 50% to 37%.

Weekly trading plan for gold

Should the US labor market display robust performance, the probability of a decline in gold prices will likely plunge to $2,600 and $2,570 per ounce. Against this backdrop, one may open long positions at these levels. Conversely, should the Non-farm payrolls for September prove to be less encouraging, this could provide an opportunity to purchase gold at market prices. The target of $2,800 per ounce remains intact.

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.