The gold price may retreat should the Fed implement a 25-basis-point reduction in rates in September. Nevertheless, gold bulls will likely maintain the upward trajectory of XAUUSD due to the inflow of capital into ETFs and other advantages. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Two gold all-time highs were linked to assassination attempts on Trump.

- The precious metals market is awaiting the Fed’s decision.

- An influx of capital into ETFs will reinforce the XAUUSD’s uptrend.

- Consider buying gold with the target of $2,800 per ounce.

Quarterly fundamental forecast for gold

Gold has set another record. On multiple occasions in 2024, the price of gold has reached historical highs, with two instances coinciding with assassination attempts on Donald Trump. However, the Republican candidate has pledged to challenge countries that are de-dollarizing, refusing to use the US dollar and preferring to buy the precious metal. It would appear that the removal of this obstacle should have freed up the capacity of central banks to increase demand for gold. Regardless of who wins the election, the XAUUSD is likely to continue its upward trajectory.

Neither Kamala Harris nor Donald Trump is expected to pursue a policy of fiscal consolidation. They will implement fiscal incentives, which is a pro-inflationary policy. Notably, the Republican’s protectionist policies are also a factor. Precious metals are traditionally viewed as a hedge against inflation, so the intention of both candidates to accelerate economic growth will create a tailwind for the XAUUSD rate.

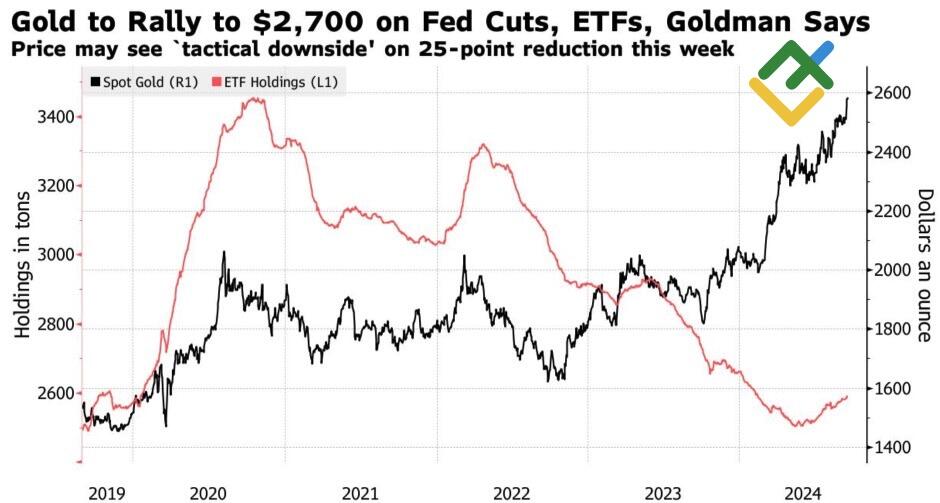

Gold will continue to attract capital from the West, as evidenced by the ETF market. The stock of specialized exchange-traded funds reached its lowest point since 2019 in May but has since demonstrated consistent growth. It is currently standing at approximately a quarter below the record peak reached during the 2020 pandemic, with significant potential for growth. Goldman Sachs anticipates a rally in the precious metal to $2,700 by the end of 2024, noting that the 25 bp cut in the federal funds rate in September may result in a short-lived pullback, but gold’s uptrend will eventually resume.

Spot gold and ETF holdings

Source: Bloomberg.

The initial cut size does matter. This will assist investors in gaining insight into how the Fed evaluates the current state of the economy. Additionally, fundamental indicators, according to Societe Generale, are identified as one of five drivers influencing XAUUSD quotes. The other key drivers are geopolitics, the US dollar and interest rates, central bank purchases, and investment flows. The company anticipates that the average gold price in 2025 will be $2,800 per ounce.

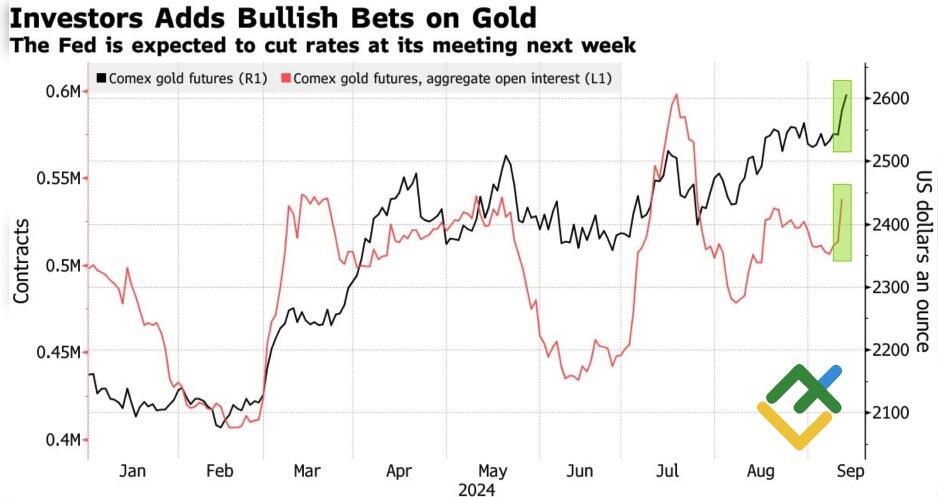

The growing interest in purchasing the precious metal is evidenced not only by capital flows into ETFs but also by the growth of open interest in the futures market against the backdrop of an upward trend in the XAUUSD. This is a typical indicator of bulls entering the market.

Gold price performance and open interest change

Source: Bloomberg.

TD Securities predicts that gold prices will reach new all-time highs if the Fed reduces the federal funds rate by 50 basis points. The futures market gives a 67% probability of this outcome at the September FOMC meeting, though the release of US retail sales data may cancel this scenario.

Quarterly trading plan for gold

According to Goldman Sachs, the gradual start of the Fed’s monetary expansion may trigger a pullback in the precious metal’s price. During this short-lived decline, one can open more long trades on the XAUUSD with the previous target of $2,800 per ounce.

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.