The XAUUSD pair is again focused on the monetary policy of central banks and the risks of recession in the U.S. economy, which allowed bulls to push quotes to record peaks. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Gold will benefit regardless of the US election results.

- The XAUUSD pair returns its focus to monetary policy.

- Aggressive rate cuts by the Fed will boost the growth of the precious metal.

- Gold may soar above $2500 an ounce soon.

Daily fundamental forecast for gold

Is it possible for gold to fail? Donald Trump’s ascension to the presidency will initially bolster the US dollar and elevate US Treasury yields due to the Republican’s pro-inflationary and anti-globalization policies. However, as currency intervention and pressure on the Fed come into play, the precious metal will thrive as a safe-haven asset. Conversely, the victory of Kamala Harris, who has gained a lot in ratings, will allow the central bank to confidently pursue monetary expansion, which is already beneficial for the XAUUSD.

US presidential election ratings

Source: Bloomberg.

As soon as the majority of votes switched from Republican to Democrat, investors’ focus returned to monetary policy. The Federal Reserve suggested the start of monetary expansion in September. Canada and Britain cut interest rates, while Australia abandoned the idea of raising rates. Additionally, the decline in European inflation expectations prompts the ECB to take active measures.

According to JP Morgan, the current monetary easing cycle will be the most synchronized ever outside of recessions. If so, it could undermine confidence in all fiat currencies, leading to a surge in the value of gold.

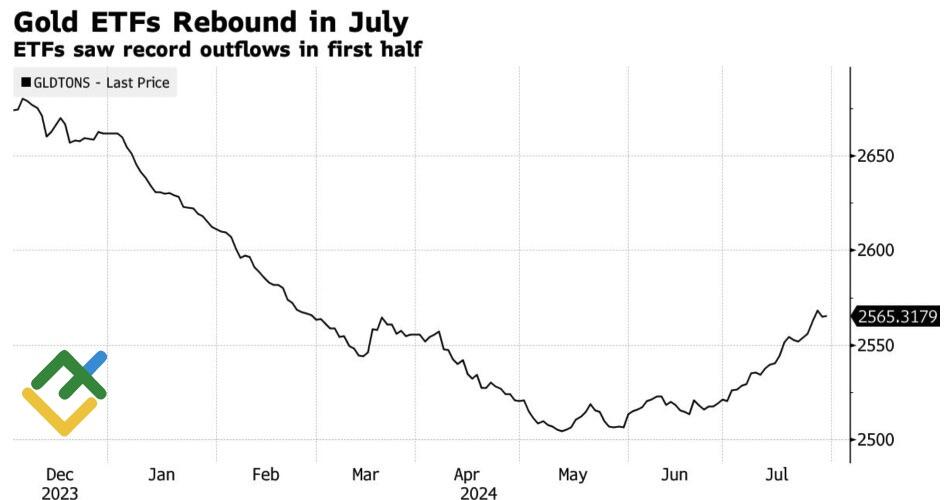

Both investors and central banks are fully aware of this. In July, investors put money in gold ETFs at the fastest pace since March 2022. Central banks purchased a record 483 tons of gold during the first half of the year. Continued dedollarization will likely result in a figure above 1,000 tons for the third consecutive year.

ETF capital flows

Source: Bloomberg.

It is evident that historically high prices are placing limitations on demand. In the jewelry sector, there was a 19% decline in the second quarter, with 390 tons traded. Shanghai premiums have once again shifted to a discount compared to London, and the People’s Bank of China has officially abandoned gold purchases for the second consecutive month. Nevertheless, the shift in focus from the eastern to the western market was sufficient to allow the XAUUSD bulls to maintain their upward trajectory.

The decline in 2-year US Treasury yields to their lowest levels in 14 months and 10-year yields to their lowest point since February results in an upward shift in the long-inverted yield curve. Historically, the US economy has consistently experienced a recession when this has occurred. The latest weak statistics on manufacturing activity and the rise in jobless claims to near-yearly highs confirm this assessment.

Daily trading plan for gold

The futures market raised the odds of a 50 bp cut in the federal funds rate in September to 25%, which was positive for gold. If July US non-farm payrolls fall short of expectations, the precious metal will likely exceed $2,500/oz for the first time in history, and traders will have the opportunity to open long trades from the $2,410 level.

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.