Amid record-high prices, China has significantly reduced its gold purchases. However, the market tends to seize every opportunity, and investors are eager to buy gold as there is no tomorrow. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Massive rate cuts are more important for gold than a strong US dollar.

- US Treasury yield growth results from concerns about the government debt’s future.

- Waning demand in China does not stop XAUUSD bulls.

- The precious metal can grow to $2,840 and $2,940 per ounce.

Weekly fundamental forecast for gold

As gold prices climb higher, the question of when XAUUSD buyers will cease their purchases. Thus far, the de-escalation of the geopolitical conflict in the Middle East, the strengthening of the US dollar against major world currencies, the rapid rally in US Treasury bond yields, and the sharp decline in demand for precious metals in China have not provided sufficient grounds for a correction. The market demonstrates an immediate and decisive response to any minor pullbacks, reinforcing the dominance of bulls.

Given the XAUUSD rally of over 30% since the start of the year and the series of record highs achieved in 2024, investors are not concerned with the potential for further price increases. What factors could potentially impede this growth? At what point might this occur? HSBC anticipates that the reversal will take place only in the second half of 2025, resulting in a modest gain for the precious metal by the end of next year. The company highlights increased production levels in response to rising prices and reduced consumption. The market’s shift towards a surplus justifies a decline in value.

According to data from Bloomberg based on statistics from the China Gold Council, gold consumption in Asia’s largest economy is already falling sharply. In the third quarter, demand fell by 22% to 218 tonnes, with the investment component down by 9% to 69 tonnes and jewelry demand down by 29% to 130 tonnes. The People’s Bank of China has not purchased the precious metal for five consecutive months. It would appear that China has lost its appetite for gold, so is it time for XAUUSD to reverse the uptrend?

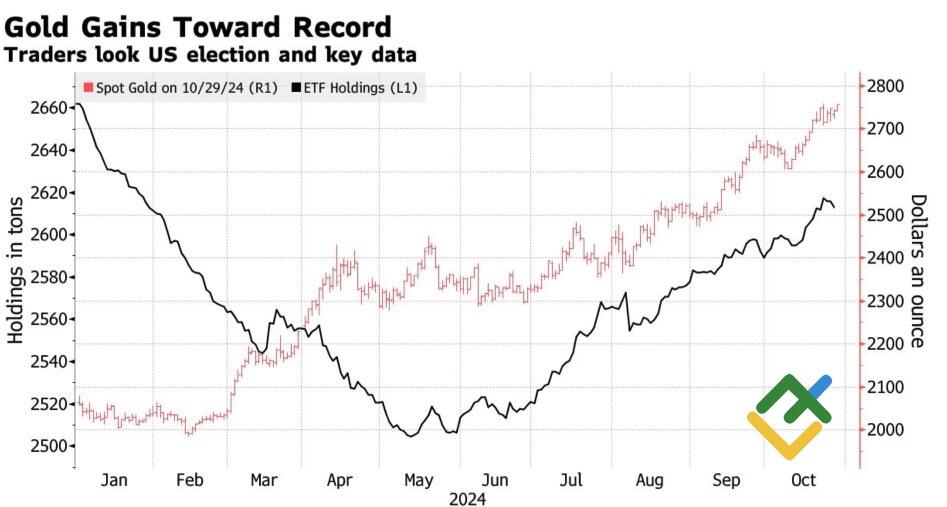

Capital inflows into gold-oriented specialized exchange-traded funds are gaining momentum, their stocks are recovering, and speculators are still increasing net-longs. Notably, this is happening against a strong headwind – the strengthening of the US dollar and the rally in US Treasury bond yields.

Gold price and ETF holdings

Source: Bloomberg.

Significant monetary expansion has boosted the USD index. Furthermore, numerous central banks are adopting a more aggressive approach than the Fed. They have already reduced interest rates several times, and the significant weakening of major global currencies is positive for gold. The increase in Treasury yields is the result of concerns about the negative impact of Donald Trump’s fiscal stimulus on government debt. This is also beneficial for the XAUUSD. Therefore, the precious metal’s growth does not come as a surprise in the context of these headwinds.

Weekly trading plan for gold

The weak US employment statistics for October and the impact of hurricanes and strikes may accelerate monetary easing and spur the gold rally. The asset has almost reached the previous target of $2,800 per ounce. Therefore, it may be appropriate to shift the targets higher to $2,840 and $2,940. The recommendation is to buy gold.

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.