Gold, along with other assets, is an instrument of the Trump trade. The Republican’s ratings growth ahead of the US presidential election pushes the XAUUSD pair higher despite the strength of the US dollar. Let’s discuss this topic and develop a trading plan.

The article covers the following subjects:

Highlights and key points

- The growing popularity of the Trump trade bolsters the XAUUSD pair.

- Central banks continue to actively buy the precious metal.

- Stocks of gold-focused ETFs have been rising for the fifth month in a row.

- Gold may reach $2,800 per ounce before the US elections.

Weekly fundamental forecast for gold

Gold has soared to a new record high of over $2,700 per ounce, marking a 30% increase since the start of the year. The precious metal continues to be one of the top performers in the financial markets in 2024. The asset is driven by market uncertainty, which is likely to intensify as the US presidential election draws near. Is this significant rally in the XAUUSD pair surprising?

Gold, along with Bitcoin, bank stocks, and small-capitalization companies, is a key asset in the Trump trade. The growth of the latter two is fuelled by Donald Trump’s promises of business deregulation, while the former two are supported by uncertainty. The Republican intends to reorganize the entire international trade system through tariffs, frightening investors. Consequently, they hastily purchase gold, diminishing the likelihood of a pullback.

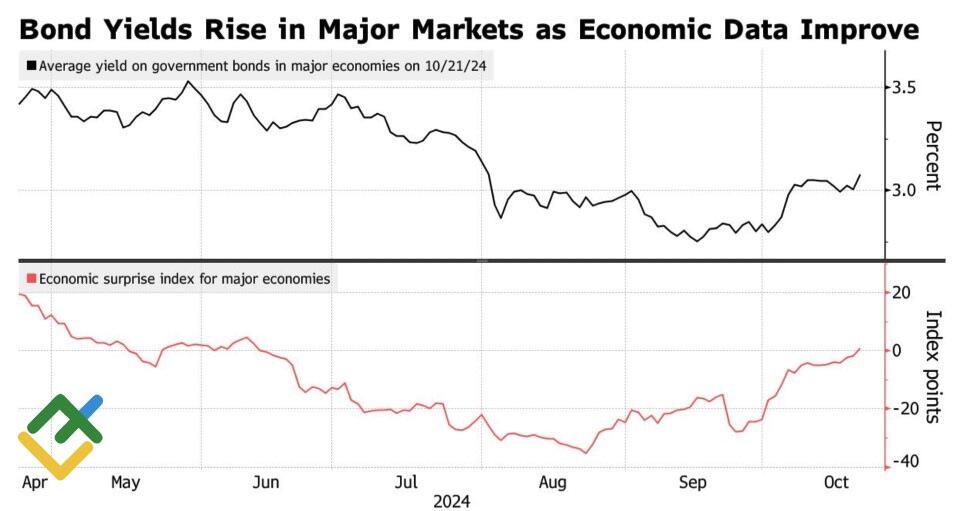

A rising US dollar and increasing US Treasury yields are generally considered unfavorable for the XAUUSD pair. This is exactly what occurred in October. After showing its weakest performance in Q3 since late 2023, the US dollar index appears to have recovered, supported by the Trump trade. Following a series of positive reports on the state of the US economy, investors are reevaluating the Fed’s monetary expansion scale, leading to an increase in bond market rates.

Bond yields and Economic Surprise Index performance

Source: Bloomberg.

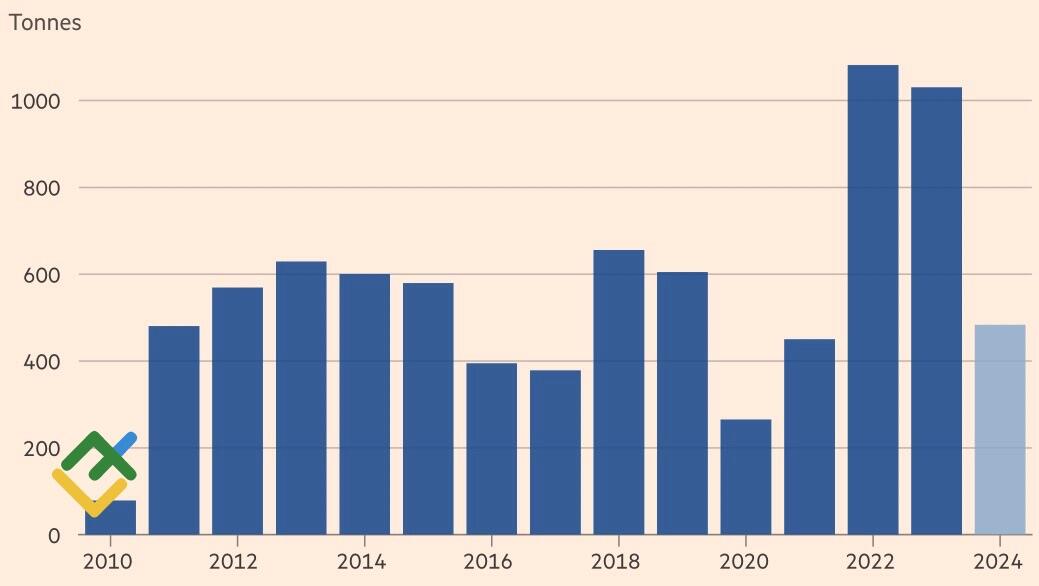

Gold’s historically strong correlation with the US dollar and Treasury yields was relevant in the past. However, the global landscape has shifted significantly in recent years. Central banks in the traditional East are demonstrating a notable lack of response to decades-old correlations, buying more gold. According to the WGC, the amount of gold purchases reached 483 tonnes in the first half of the year.

Central banks’ gold purchases

Source: Financial Times.

The US Fed’s shift from monetary policy tightening to easing has resulted in five months of capital inflows into gold-focused ETFs, marking the longest period of inflows since the pandemic. UBS anticipates that this process will continue, with the precious metal reaching the psychologically significant mark of $3,000 per ounce in 2025. The Commonwealth Bank of Australia also anticipates the same value, assuming it will be achieved in the fourth quarter of next year.

Weekly trading plan for gold

The financial markets have almost completely believed in Donald Trump’s victory in the election on November 5. Gold risks a serious wave of sell-offs if Kamala Harris celebrates the victory. In this case, the strong US dollar and high Treasury bond yields will help XAUUSD bears. However, consider holding the previously formed long trades, targetted at $2,800 per ounce, open.

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.