Germany’s DAX 40 has outperformed other global stock indices, marking the onset of a transformation from the “sick man of Europe” to a locomotive of the European economy. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Germany intends to borrow about €800 billion.

- The ECB continues its monetary expansion cycle.

- The German index is outperforming all of its counterparts.

- The DAX 40 target should be raised to 25,000–26,000.

Monthly Fundamental Forecast for DAX 40

The new German administration’s policies are positively affecting the country’s economy, with the DAX 40 index reaching record highs. The Germans are celebrating substantial fiscal stimulus from the new government of Friedrich Merz as if the country’s football team has won the World Cup. This is similar to the positive effects that Donald Trump’s policies had on the US economy.

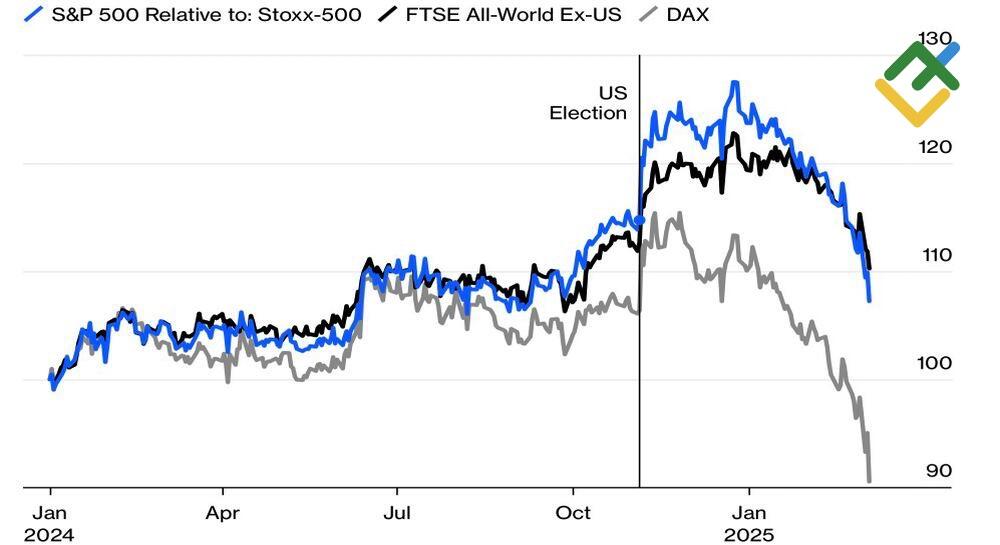

S&P 500 Index vs. Its Counterparts

Source: Bloomberg.

Initially, the Christian Democratic Union party, which won the parliamentary elections, proposed to its potential coalition ally, the Social Democrats, to create a special fund for €200 billion. This figure rose to €500 billion, and now the press is talking about borrowing €800 billion! Germany is in a position to double this amount in order to increase its debt-to-GDP ratio of 62% to the US level of 120%.

The allocation of hundreds of billions of euros to transportation, energy, and housing represents a significant shift in discourse, particularly in regard to the emergence of the term “German exceptionalism.” German banks are revising their GDP forecasts upwards from zero to 1.5–2%, the euro has reversed its downtrend against the US dollar, and even the most recent sell-off in the German debt market since 1990 has not alarmed investors. The bond yields of the leading eurozone economy remain significantly lower than those of the US. Berlin has the financial capacity to allocate additional funds.

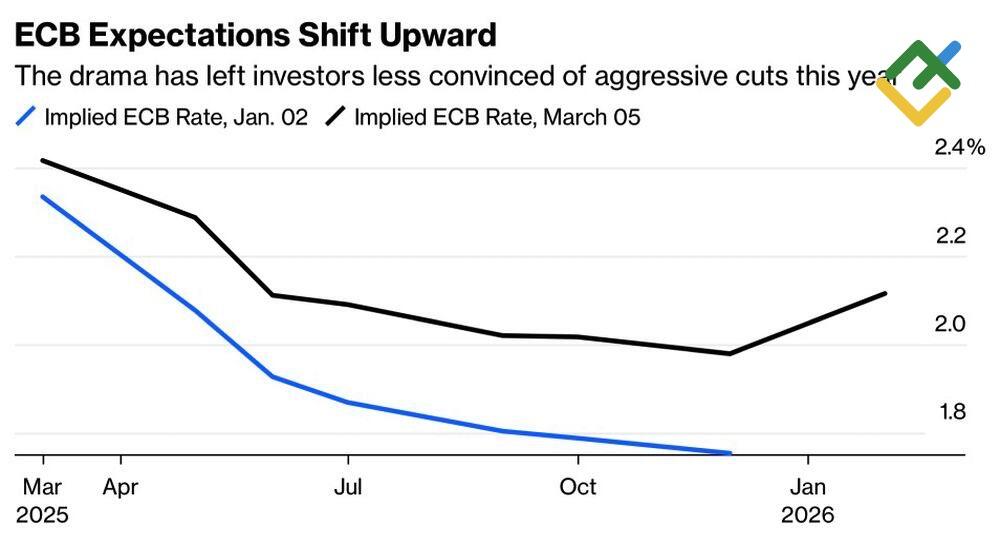

However, large-scale fiscal expansion could potentially prompt the ECB to tighten monetary policy, which could have negative implications for the DAX 40. For instance, the Bundesbank increased its key rate from 5% to 8.75% from 1989 to 1992, hurting the German economy. However, the current cycle of monetary stimulus in Frankfurt continues. The next reduction of the deposit rate from 2.75% to 2.5% is scheduled for March 6.

ECB Interest Rate Expectations

Source: Bloomberg.

The DAX 40 index appears undaunted by the prospect of a trade war with the US, which is expected to spark in April. At the same time, the strengthening of the euro exacerbates the competitive positions of European exporters. On paper, currency devaluation serves to mitigate the adverse impact of tariffs. Germany is relying on domestic consumption and potential strategic partnerships with China. If there is a shift in the US policy, which has found common ground with its geopolitical opponent Russia, why should not the European Union adopt the same approach?

Monthly Trading Plan for DAX 40

German euphoria may persist, but its sustainability is uncertain. The DAX 40 pullback to 22,300–22,400 allowed traders to open long positions with a target of 24,000. However, this target will likely be adjusted upwards to 25,000–26,000. Meanwhile, the German stock index may face a sweeping sell-off if the US imposes tariffs on the EU. Against this backdrop, it would be prudent to move stop-loss orders to the breakeven point at 22,300–22,400, keeping long positions open.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of FDAX in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.