A freely floating franc helps the economy. The franc strengthened against the dollar and weakened against the euro after the SNB let it float. However, tariffs could turn everything upside down. Let’s discuss it and make a trading plan for USD/CHF and EUR/CHF.

The article covers the following subjects:

Major Takeaways

- The SNB has stopped using currency interventions.

- Monetary expansion in Switzerland is over.

- Trade wars could change the franc’s fate.

- A breakout above resistance at 0.8855 will be a reason to buy USD/CHF.

Weekly Fundamental Forecast for Franc

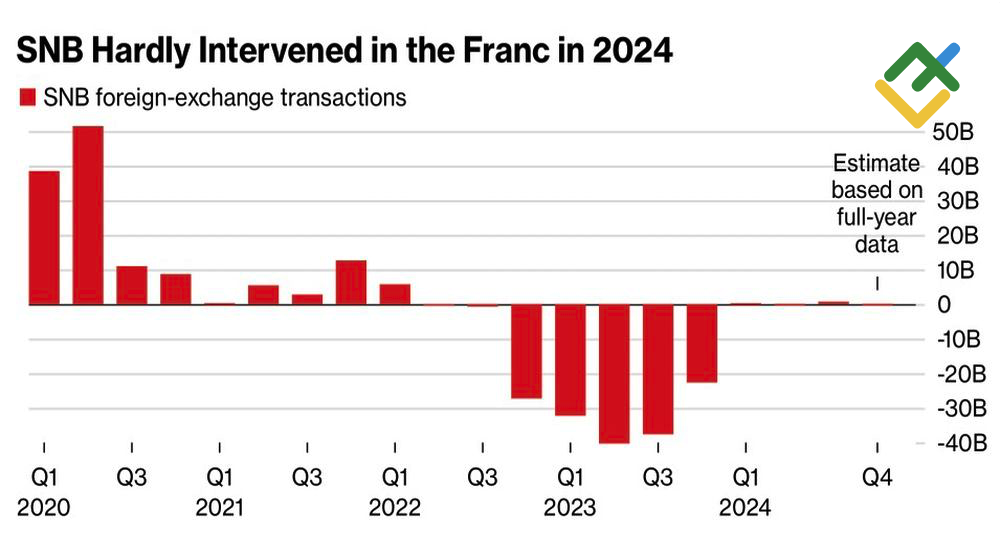

In 2024, the Swiss National Bank cut currency interventions to a minimum, letting the franc float. In the fourth quarter, intervention volumes dropped to just $113 million — a tiny amount compared to before. Did the SNB fear being labeled a currency manipulator by the U.S.? Or did it decide to give the “Swissy” some freedom? Anyway, independence has been good for the franc.

SNB’s Currency Interventions

Source: Bloomberg.

The currency can figure out what’s good or bad for the economy on its own. In 2025, the franc has risen against the U.S. dollar as investors grew disappointed with the Trump Trade. It has weakened against the euro thanks to fiscal stimulus in Germany, which can boost the eurozone economy.

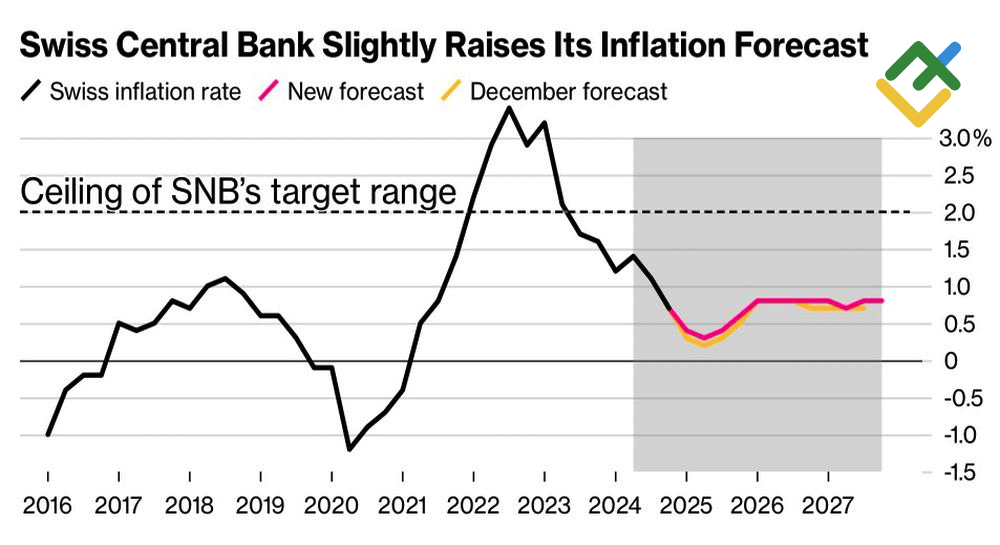

The EUR/CHF rally didn’t stop the SNB from cutting its key interest rate from 0.5% to 0.25%. This decision was driven by stubbornly low inflation: the consumer price index (CPI) in February rose by just 0.3% year-on-year, hovering near the lower boundary of the SNB’s 0%-3% target range. Markets believe the monetary policy easing cycle, which began in March 2024 at 1.75%, is now complete.

Inflation Trends in Switzerland

Source: Bloomberg.

The central bank slightly raised its 2025 CPI forecast from 0.3% to 0.4% and still expects 0.8% growth in 2026. The government is less optimistic, projecting 0.3% inflation growth this year and 0.6% next year. The State Secretariat for Economic Affairs also lowered its 2025 GDP growth estimate for Switzerland to 1.4%.

Economic growth could pick up as Switzerland benefits from Germany’s fiscal stimulus. On the other hand, a large-scale U.S.-EU trade war could slow GDP growth, and the franc’s movements against the euro and dollar might flip entirely.

The unwinding of the Trump Trade after the 47th U.S. president’s inauguration caused USD/CHF to drop 9% from January highs. Meanwhile, the German Bundestag’s approval of incoming Chancellor Friedrich Merz’s plan to adjust the fiscal brake lifted EUR/CHF by 2.2% from its February low.

Weekly Trading Plans for USD/CHF and EUR/CHF

The impact of Germany’s fiscal stimulus package — called a new Marshall Plan for Europe — has largely been priced in. This gives reason to sell the euro against the franc if EUR/CHF fails to climb back above 0.9585. Don’t expect the White House to ease its stance in early April by setting lower-than-expected tariffs. Big mutual import duties will trigger a USD/CHF rally. A breakout above resistance at 0.8855 would be a signal to buy.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDCHF in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.