The Swiss franc’s role in carry trades, heightened risks of aggressive monetary easing by the Swiss National Bank (SNB), and potential currency interventions are not supporting the bullish outlook on the USDCHF and the EURCHF. Why is this the case? Let’s discuss it and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The franc may replace the yen in carry trades.

- There is a significant risk of a 50 bps rate cut by the SNB in September.

- Political and economic factors provide a supportive backdrop for the Swiss franc.

- USDCHF risks falling to 0.819, and EURCHF to 0.9135.

Weekly fundamental forecast for franc

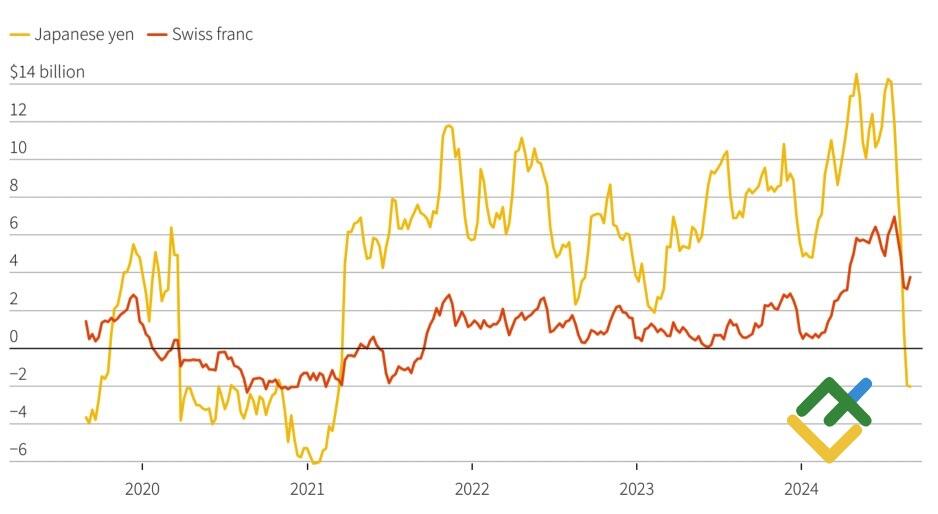

A “holy place is never empty.” Bank of America and Goldman Sachs believe that after the unwinding of carry trades in August, the franc could replace the yen as the preferred funding currency. With the SNB rate at 1.25%, and comparative rates in the Eurozone at 3.75%, the UK at 5%, and the US at 5.5%, the opportunity for carry traders to profit from interest rate differentials is substantial. Furthermore, the SNB likely intervened in the currency markets in August and may further surprise with aggressive monetary easing in September.

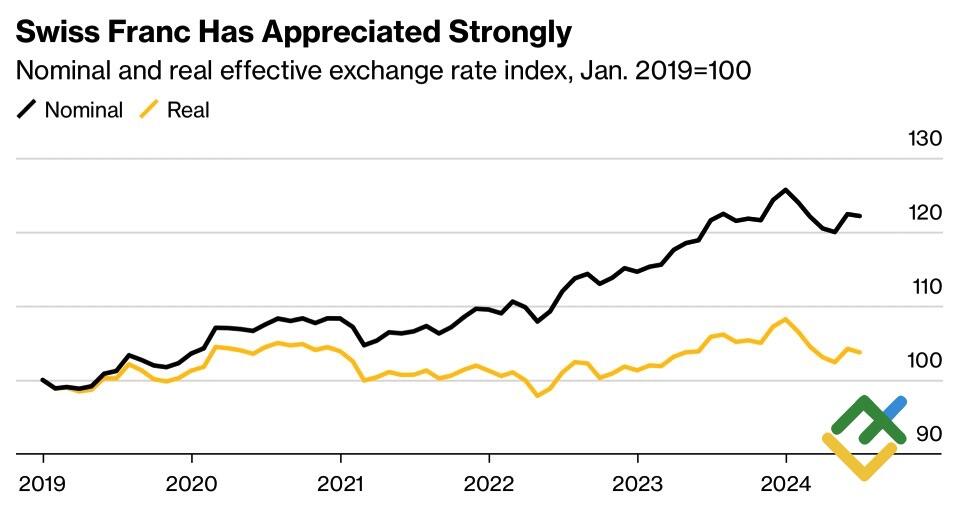

Unlike other central banks, which tread cautiously to avoid drawing the ire of the US regarding foreign exchange interventions, Switzerland has a more consistent approach to currency interventions. In 2023, the franc outperformed the G10 currencies due to the SNB’s active foreign currency sales. According to SNB Chairman Thomas Jordan, these interventions helped keep Swiss inflation below 3.5% at its peak. Meanwhile, inflation in the US surged to 9.1% in 2022, and the Eurozone faced inflation as high as 10.6%.

Dynamics of the Nominal and Real Exchange Rates of the Franc

Source: Bloomberg.

Since June 2023, Swiss CPI has returned to the SNB’s target range of 0-2%. A further decline to 1.1% in August strengthens the case for continued monetary policy easing by the SNB. The derivatives market expects a key rate cut from 1.25% to 1% at the September 26 meeting, with a 30% probability of a more substantial cut of 50 basis points.

However, neither the SNB’s interventions, nor the anticipation of aggressive monetary easing, nor the franc’s increasing role as a funding currency for carry trades have prevented the franc from maintaining its strength. The Swiss franc currently ranks third among G10 currencies, behind the British pound and the euro.

Dynamic of speculative positioning in Franc and Yen

Source: Reuters.

The issue lies in the franc’s status as a safe-haven currency. Engaging in carry trades is inherently risky, and when safe-haven assets like the franc are involved, the strategy can resemble “picking up pennies in front of a steamroller” — you may lose everything at any time. Indeed, financial instability in the US, persistent weakness in China, and political gridlock in Europe create an ideal environment for selling EURCHF and USDCHF.

Not since the banking crisis of March 2023 has there been so much talk of a potential US recession. The recent yield curve desinversion and rising unemployment point to an imminent downturn. In the UK, the post-election enthusiasm for Labour has waned, and while in France, it remains to be seen whether the new prime minister will be able to resolve the country’s ongoing challenges. Meanwhile, the rise of nationalist parties in Germany is raising concerns.

Weekly trading plans for USDCHF and EURCHF

Given the current backdrop, the EURCHF is expected to continue its decline to 0.9235 and 0.9135, offering an opportunity to open short positions. The fate of USDCHF will largely depend on the US employment data for August. Weak figures will likely drive the pair down to 0.819, while stronger-than-expected data may prompt a correction in the bearish trend.

Price chart of USDCHF in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.