The Swiss National Bank has cut the key rate by 50 basis points, aiming to accelerate inflation and weaken the franc. Will it reach the goals? Let’s discuss it and make a trading plan for EURCHF and USDCHF.

The article covers the following subjects:

Major Takeaways

- The Swiss National Bank has cut the rate from 1% to 0.5%.

- The SNB’s resources in fighting against inflation are almost exhausted.

- Political risks in Europe will continue to strengthen the franc.

- EURCHF risks falling to 0.92, and USDCHF – rising to 0.915.

Monthly Fundamental Forecast for Franc

New lords, new laws. While the previous head of the Swiss National Bank preferred caution, the new chairman, Martin Schlegel, went all in. Under his chairmanship, the SNB cut the key rate by half a point to 0.5%, surprising most Bloomberg experts and financial markets in general. As a result, the franc weakened against major currencies.

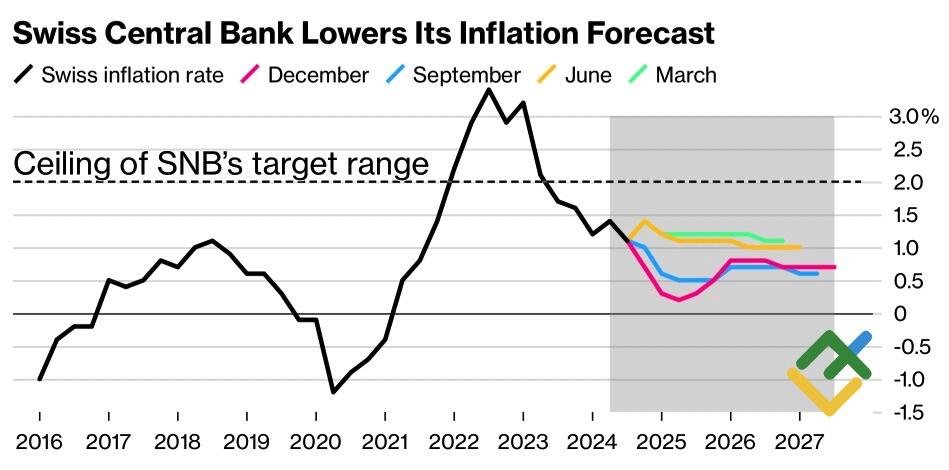

By reducing borrowing costs by 50 bp, the National Bank killed two birds with one stone. First, it stimulated demand to stop the slowdown in inflation, which fell to its lowest since June 2021, although it remains within the target range of 0%-2%. Second, the SNB discouraged fans of the franc, which had recently appeared too strong due to political crises in Germany and France.

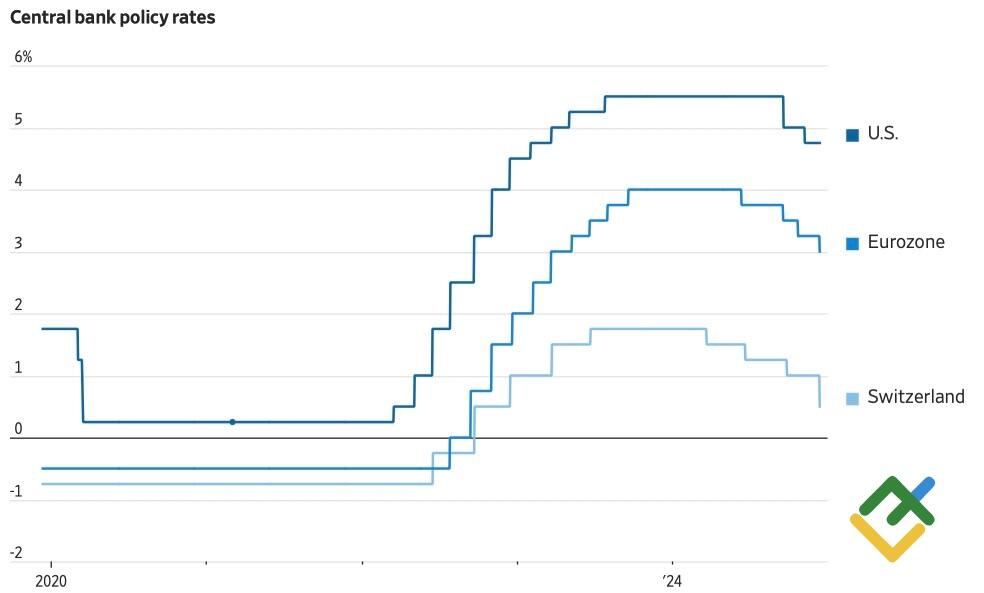

Central-Bank Rate Changes

Source: Wall Street Journal.

However, the National Bank has almost exhausted its resources: only two quarter-point reductions or a single half-point reduction remain for the key rate to reach zero. This circumstance, coupled with the weakness of the eurozone economy, allows Commerzbank to assert that EURCHF‘s rally is temporary.

Martin Schlegel does not favor negative rates but noted at a press conference that the central bank could revert to them if necessary. Still, despite the key rate being below zero from 2014 to 2022, the franc emerged as the best-performing currency in 2015.

Another tool for putting pressure on the Swissie is currency interventions. The SNB confirms its active participation in the Forex market. However, there are risks here, too. In late 2020, the first Donald Trump administration labeled Switzerland a currency manipulator and threatened to impose penalties. The country was removed from the blacklist only in 2023.

Thus, Martin Schlegel went all in and expressed confidence that this broad step in December will prevent the National Bank from reverting to negative rates and slow down the disinflationary process, if not reverse it.

Swiss Inflation Trends and Forecasts

Source: Bloomberg.

However, a downtrend in EURCHF is not broken. The weakness of the European economy will force the ECB to lower the deposit rate to 1.75%. Even if it wants to, the SNB cannot keep up with its peers from Frankfurt. The political crisis in France continues, and the situation will become more tense as the early parliamentary elections in Germany approach in February. Investors will seek refuge in the franc.

Monthly Trading Plans for EURCHF and USDCHF

Thus, the current pullback in EURCHF is a perfect occasion to sell the pair with a target of 0.92. The USDCHF will likely continue to rally to the targets set earlier, at 0.9015 and 0.915, amid expectations of a pause in the Fed’s expansion cycle. Keep your focus on long positions.

Price chart of EURCHF in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.