The snap election in France has triggered a sell-off in the USDCHF pair. The pair’s decline is fueled by the political drama in the US, where Donald Trump may return to the White House. Let’s discuss these topics and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The franc is one of the main beneficiaries of the Trump trade.

- The SNB may cut the rate against the stronger franc.

- Weakness in the US and Eurozone economies is fuelling the USDCHF decline.

- The pair hit the first of two targets at 0.87 and 0.88, moving toward the second one.

Weekly fundamental forecast for franc

It is better to be dull than to make mistakes. This is the view of Thomas Jordan, who is retiring after a successful 12-year tenure at the helm of the SNB. His leadership has steered Switzerland through the challenges of Brexit, the global pandemic, deflationary pressures, and the surge in inflationary trends amidst Europe’s energy crisis. The country’s CPI has remained within the targeted range of 1-3% for the past 12 months. Meanwhile, the franc has outperformed all other G10 currencies over the past month, with the exception of the Japanese yen.

While the Swiss National Bank’s policy may have appeared somewhat unremarkable at times, it has managed to catch the markets off guard. One of the most recent developments occurred in June when the SNB reduced its key interest rate to 1.5% for the second time in the current cycle. Investors believed there were additional reasons to maintain the current level, but the central bank was considering a different approach. Without the monetary expansion, USDCHF quotes would have fallen significantly. The political crisis in France, the slowdown in the US and German economies, and the impact of the Trump administration have contributed to a favorable environment for the Swiss franc.

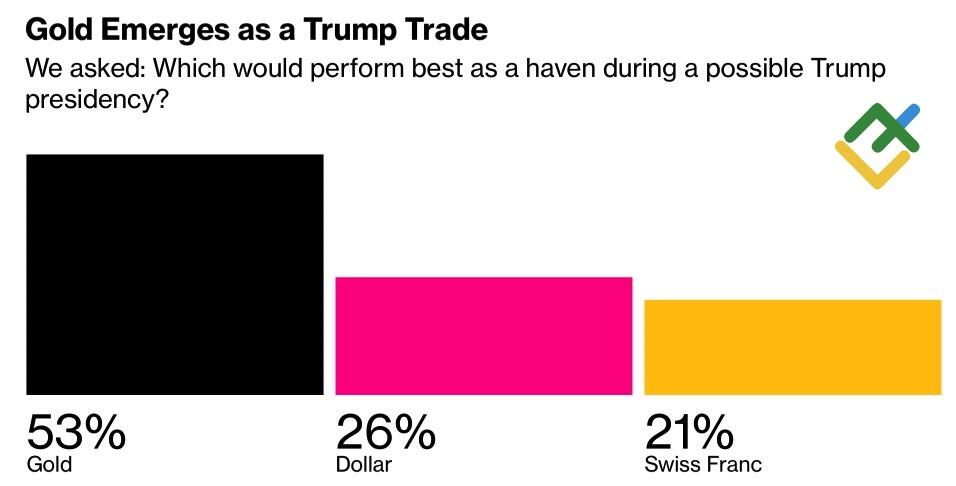

A survey of MLIV Pulse respondents found that 21% believe the franc will benefit the most from Donald Trump’s return to the White House. This figure is comparable to the number of people who voted for the US dollar. The greenback is gaining strength due to a resurgence of American exceptionalism, fiscal stimulus, trade tariffs, and a slowing global economy. However, the weak dollar policy will force investors to seek other safe havens, and USDCHF selling could prove to be very profitable.

Main beneficiaries of Trump trade

Source: Bloomberg.

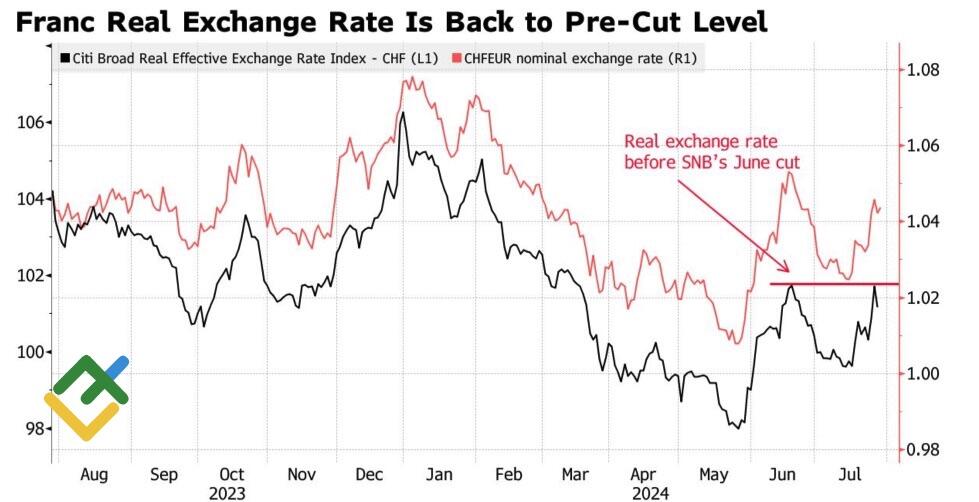

The political developments in France, including the highly anticipated parliamentary elections and the unexpected decline in Germany’s GDP in the second quarter by 0.1%, which was predicted by only one in 35 experts surveyed by Bloomberg, have boosted demand for the Swiss franc. In this connection, the currency’s real exchange rate against the euro reached a critical threshold, prompting the SNB to initiate a cycle of monetary policy easing. This increases the likelihood of currency interventions and a further reduction of the key rate in September.

Real and nominal Swiss franc rate

Source: Bloomberg.

The data on inflation in Switzerland for July, scheduled for release in early August, may provide insight. Bloomberg experts anticipate a 1.3% increase in consumer prices. However, if the indicator nears the 2% target, this could temper the enthusiasm of those advocating a dovish stance by the SNB. However, market attention has been largely focused on the FOMC meeting and employment data in the US.

Weekly trading plan for USDCHF

After reaching the first of two previously set bearish targets at 0.88 and 0.87, the USDCHF pair rebounded. However, the Trump trade and cooling of the US and European economies will likely push the quotes down. In this context, short trades can be opened on the pullback.

Price chart of USDCHF in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.