Spread betting is a distinct trading option similar to a game of chance. You determine the bet amount, which represents the cost of one pip, and then forecast the price direction. If your prediction is correct, you earn the amount of your bet for each pip of price movement. If not, you incur losses.

Spread betting shares some similarities with CFD trading and binary options, yet it stands alone as a distinct method for generating profits in financial markets, attracting dedicated supporters.

This overview introduces you to spread betting, outlining its advantages and disadvantages and highlighting how it differs from Forex trading. This article aims to help you explore new ways to generate income and acquire fresh knowledge.

The article covers the following subjects:

Key Takeaways

|

Main thesis |

Conclusions and key points |

|

Spread betting definition |

Spread betting is a type of trading that involves betting on the future direction of the price. A trader determines the bet amount equal to the one pip price movement. The spread, which is the difference between the asset’s buying and selling price, represents the broker’s commission. |

|

How to earn from spread betting |

For example, the spread is $2. You place a $10 bet, predicting the price growth. With each pip upward movement, you gain $10. Conversely, each downward movement results in a corresponding loss until your deposit is depleted. The spread amount is deducted from the profit and added to the loss. |

|

Spread betting and legislation |

Spread betting does not violate financial laws. Nevertheless, in some countries, spread betting might be prohibited due to being considered a form of gambling. Conversely, in certain countries, spread betting is not just allowed but also exempt from taxation. |

|

Difference between spread betting and CFD trading |

Spread betting yields higher returns but also comes with a significantly higher level of risk. Although less complex, spread betting is also less flexible. |

|

Difference between spread betting and binary options |

Spread betting offers an unlimited level of profit or loss. In binary options, the profit or loss amount is predetermined. |

|

Spread betting advantages |

Spread betting offers the potential for fast and substantial profits. However, it also carries the risk of depleting your funds rapidly. |

|

Spread betting disadvantages |

High risk level. No algorithmic trading. Considerable mental and emotional pressure. |

What Is Forex Spread Betting?

What is a Forex spread bet? Spread betting Forex or spread bets is a type of trading and a form of financial betting where a trader speculates on the direction of the asset’s price, such as currencies, stocks, or commodities, without owning the underlying asset. Instead of buying or selling the actual asset, the trader speculates on the potential price movement. The profit or loss is determined by the extent of the price movement in the chosen direction.

Although traders do not acquire the traded asset, they may receive certain associated rights, such as the right to receive dividends. However, the treatment of these rights varies among brokers. In case of a short trade, a broker may deduct the dividends within the practice known as dividend adjustment.

Trader’s tools available in spread betting:

-

Betting on any assets on one account is available, including currency pairs, stocks, commodity futures (oil, metals), cryptocurrencies, etc.

-

Long and short trades can be opened. You can earn both on the price rise and fall. By opening a long trade, you can hedge it with a short position, placing a bet in the opposite direction. The principle of locking positions is similar to that used in trading CFDs.

-

Leverage. The maximum leverage is set by a broker, but the ratio is mostly small, typically up to 1:10–1:20.

-

Indicators. You can use technical analysis tools available on a trading platform.

Traders place bets based on their deposit amount, creating the potential for long-term investment strategies. If the loss erodes the deposit, the broker automatically closes the bet, similar to a stop-out.

How Does Spread Betting Work?

Review the following example to understand how Forex spread betting works. Assume you have decided to place a bet on the EURUSD currency pair, expecting the rate to grow. At the moment, the broker’s quotes are the following:

-

Bid — 1.1200.

-

Ask — 1.1202.

These are the two main prices displayed in the order.

A spread in trading is the amount you have to pay to open a trade. It is the difference between the best ask and bid prices in the foreign exchange market. The bid price is the highest price a buyer will pay for a security, or the price at which you can sell the base currency, and the ask price is the lowest price a seller will accept for a security or the price at which you can buy the base currency.

The bid-ask spread, which is the difference between the bid and ask price, is two pips. Your profit equals the actual profit minus the spread. The size of the spread can vary based on the market and the asset.

You decide to place a $10 per pip bet on the EURUSD pair, meaning you want to open a long spread betting position. You determine the amount of the bet, which can be either $5 or $50. However, you need to take into account the specific conditions of the Forex brokers. Eventually, you enter the trade at 1.1202, the ask price. For every one-pip increase in the EURUSD rate, you will earn $10, while for every one-pip decrease, you will lose $10.

Possible scenarios:

-

If the EURUSD price increases by 10 pips to 1.1210, which is the bid price, you will close the position with a profit. The profit will amount to (1.1210 – 1.1202) × 10 = 8 pips or $80.

Note: You place your bet at the bid price, but the ask price is factored into the profit calculation. Thus, the price has actually increased by 10 points, but the spread has been deducted from this increase.

-

If the EURUSD price drops by 10 pips to 1.1190, which is the bid price, you will lose money. The loss will amount to (1.1202 – 1.1190) × 10 = 12 pips or $120.

Although the price falls by only 10 pips, the spread is also included in the loss, which is summed up in this case. The smaller the spread, the faster a trader can close a trade profitably.

How does a broker capitalize on Forex spread betting in currency markets:

-

The broker primarily earns money through the market spread, which is the difference between the ask and bid prices. Assume that a spread is two pips. When you open a position, you automatically incur a loss of two pips. This means that if you bought the euro at 1.1202, the price should climb to 1.1204 to reach the breakeven point. If you close the trade at 1.1203, you will make one pip or $10 profit, but the broker will claim two pips, totaling a $20 deduction, resulting in a $10 loss for you.

-

Potential commissions. Apart from a spread, some brokers may charge extra commissions for opening or closing trades, although this is less common in spread betting compared to traditional Forex trading.

A broker earns on the difference between the buy and sell price, which is the market spread. In this example, the broker has earned two pips through the spread. In the case of the US dollar, the profit depends on the size of the bet. Therefore, a broker aims to encourage traders to place larger bets and may offer narrow spreads. Even if you close the position with zero profit, a broker will still get its share of the profit due to the market spread.

Brokers typically provide their own platforms for spread betting. Although platforms like MT4, MT5, or cTrader do not support spread betting, this type of trading can be adjusted individually. Foreign exchange brokers do not offer spread betting as it is not available on the stock exchange.

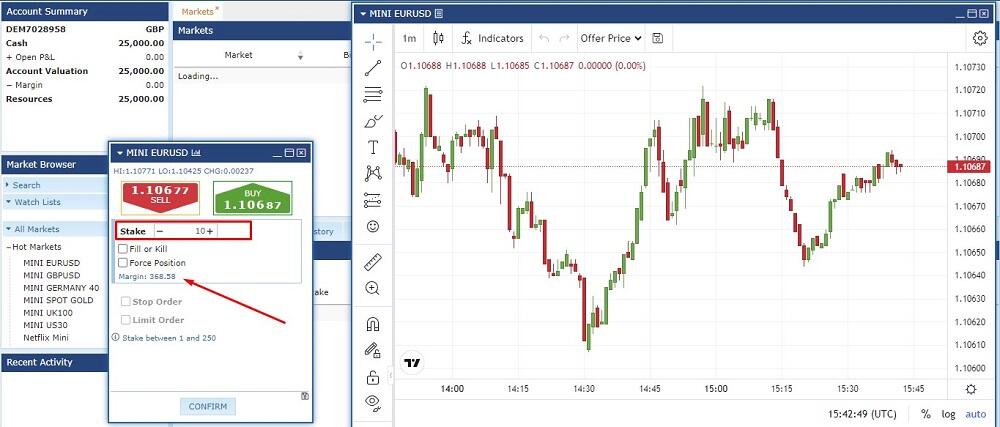

The picture below shows the interface of a platform specifically designed for spread betting.

The platform’s structure mirrors that of CFD trading platforms, featuring a price chart, a standard set of technical indicators, and multiple time frames. The main distinction is that instead of specifying the position volume, users indicate the bet, with the margin or blocked funds being automatically calculated. Users can set stop loss and take profit orders, but pending orders are not available.

Forex Spread Betting Pros And Cons

Forex spread betting advantages:

-

Understanding the operating principle is easier in spread betting compared to CFD trading. The value of a one-point price movement is determined by a bet. Thus, you do not need to calculate the pip value. You can determine it by the bet, along with the volume of the order for buying or selling the asset.

-

With a spread betting account, you never own the underlying asset. Therefore, you do not pay any fees to keep it.

-

A small deposit is enough to start trading. In CFDs, the minimum position volume is 0.01 lot, and a minimum of $1,000 is required for a number of assets without leverage. In Forex spread betting, a $5–$10 bet is possible.

-

Quick returns. You can double your deposit in a few minutes. However, you can also lose it as quickly.

-

No extra fees are charged, regardless of the trading instrument. In most cases, the commission only consists of the broker’s spread. Unlike ECN accounts, there is no fixed commission for each lot, and similar to stock brokers, there is no fee for each share. Swap can be substituted with overnight financing.

-

In certain jurisdictions, Forex spread betting is considered gambling and is not subject to taxation. This means that capital stamp duty and capital gains tax are not applicable. Besides, favorable tax treatment is possible.

Forex spread betting disadvantages:

-

Forex spread betting carries a higher level of risk compared to investing in stocks or making bank deposits. Unlike stock trading, there are no risk limits, and in the event of a loss, you cannot simply wait it out. Positions will be forcibly closed by a broker.

-

Certain jurisdictions prohibit or impose restrictions on Forex spread betting, as it is considered a form of gambling.

-

The psychological impact of high volatility can lead to feelings of excitement, despair, and euphoria, which can result in irrational and impulsive decision-making without careful analysis.

-

There is no algorithmic trading in Forex spread betting. There are no algorithms for trading with Expert Advisors.

The main advantage of spread betting is that actions are based on transparent logic without the need for complex calculations. Price movements are measured in pips, with the value of each pip determined by the bet amount. However, the major downside is the potential to lose your entire deposit within minutes when attempting to generate quick profits. To manage this risk, consider calculating the bet amount in relation to the deposit, utilize technical indicators, assess fundamental factors, and use leverage moderately.

Forex Spread Betting vs CFDs: Key Differences

Spread betting on Forex is often compared to CFD trading. In both cases, no actual commodity is involved in the trading. In spread betting, a trader places a bet based on a specific amount of money for each pip of price movement, while in CFD trading, the bet amount is determined by the volume of the position, based on which the value of a pip is calculated.

At first glance, Forex spread betting may seem simpler, but in practice, CFD trading offers more flexibility and potentially higher returns at a similar level of risk. Notably, CFD trading can be more profitable only when the risk is the same as that of spread betting. This is because, with unlimited risk, spread betting will yield higher returns.

The key differences between spread betting and CFDs:

|

Spread betting |

CFD trading |

|

|

Trading features |

You do not buy or sell the asset itself, but you speculate on its potential rise or fall. |

You make a contract with a counterparty through a broker to speculate on the difference between the initial and final price of an asset. |

|

Trading instrument |

The amount of the bet that you determine yourself. |

Trading volume, calculated in lots. While you can manually decide the trade volume, experts utilize calculators that consider the pip value, the stop order size, and other parameters. |

|

Calculating the pip value |

The pip value is determined by the bet amount. |

The pip value is calculated based on the contract size and trade volume. Depends on the selected asset. |

|

Profitability |

High profitability. You determine the pip value by the bet. For example, with a $50 deposit, estimating the cost of a pip at $10 means that a five-pip increase in price will double your deposit. |

Moderate profitability. The pip value is defined by the volume of a trade. With a deposit of $50, it is sufficient to open a minimal position on EURUSD using a minimum lot of 0.01, but only with leverage of at least 1:100. A 5-pip price movement will bring a 50-cent profit. |

|

Risk |

Involves high risk that grows in proportion to the profitability. A $50 deposit can be depleted by a 5-pip price movement. The daily volatility of currency pairs averages 60–120 pips. |

Involves moderate risk that grows in proportion to the profitability. A 5-pip movement in the opposite direction will reduce your deposit by only 50 cents. |

|

Regulation |

Spread betting may be considered gambling and, therefore, prohibited. |

CFD trading is prohibited in the United States. Most other countries either permit CFD trading or impose only minor restrictions on it. |

|

Taxation |

The application of a higher income tax rate depends on the specific jurisdiction. |

Income generated from investments is subject to taxation. |

Additionally, spread betting is sometimes compared to binary options, which also involves betting on the market direction. The main differences include the following:

|

Spread betting |

Binary options |

|

|

Bet type |

You are betting on how much the asset price will change in a specific direction. Your profit or loss depends on the size of the spread, which is the difference between the initial and final prices. |

You are betting on whether the price of an asset will be above or below a certain level, known as the strike price, by the time the option expires. Regardless of the fluctuations in price, you will receive a predetermined profit or loss. |

|

Risk and reward |

Risk and reward are potentially unlimited, as they depend on the price movement and the moment of closing a transaction. |

The risk is limited to the bet amount, and the potential profit or loss is prespecified. |

|

Regulation |

Strictly regulated by legislation. Brokers offering spread betting are licensed by regulators. |

Virtually unregulated. |

Spread betting is more flexible than binary options and offers more trade management tools, providing greater opportunities to make money. Forex spread betting is regulated at the legislative level, unlike binary options brokers, who rarely have a regulatory license.

If you are a beginner trader, you can start with binary options to gain a solid understanding of the Forex market. Once you grasp the basics, you may switch to spread betting. For those aspiring to become professional traders, CFDs are an excellent option, offering a wide range of financial instruments and numerous opportunities to put your trading strategies into practice.

Conclusion

Spread betting is a high-risk tool that entices individuals with its simplicity and excitement, promising quick winnings. While you can hold a position in the market for a long time, patiently waiting for profit, spread betting can yield visible returns almost instantly. With the same initial investment, spread betting can generate profits 10 times greater than a CFD trade in just a few minutes. However, it can also lead to equally rapid losses.

-

Spread betting is a form of trading that is mostly legal and, in some countries, tax-free. It does not imply direct ownership of the asset, allowing you to make money on changes in the price of various assets such as currency pairs, stocks, and commodity futures.

-

You determine the bet amount or the sum you will gain or lose for each pip change in price. A broker earns on the spread, which is the difference between the ask and bid prices.

-

Spread betting allows you to double your deposit in a few minutes with a minimum $50 deposit. However, it also carries the risk of losing your deposit just as rapidly.

-

Spread betting involves leverage, similar to a swap or overnight fee. However, these platforms do not offer indicators, scripts, or the option for algorithmic Forex trading due to their specific nature.

-

Spread betting involves simpler calculations but also carries higher risks.

If you are a venturous individual with disposable income who values the process as much as the result, spread betting may be the right choice for you. However, if you prefer to analyze the Forex markets thoroughly, act slowly, and prioritize minimizing risks, CFD trading may be more suitable for you.

Which option will you choose? Perhaps it makes sense to try both trading types? Feel free to share your thoughts in the comments!

Forex Spread Betting FAQs

Laws regarding spread betting vary by jurisdiction. For example, in the US and Canada, retail investors are prohibited from spread betting, while it is permitted in the UK and Australia. In the EU, restrictions related to spread betting may be in place depending on the specific country’s gambling legislation.

No, although spread betting and Forex trading share some similarities, there are distinct differences between the two. Forex refers to the international currency market where real currency assets are traded, or it can involve CFD trading. Spread betting, on the other hand, involves speculating on whether the price will be above or below a specific level. CFD trading can also be called betting to some extent, as traders predict the future direction of price movement. However, Forex involves leverage and calculates pip value differently. In spread betting, the bet determines the amount of profit or loss based on the difference between the final and initial price of the asset.

Forex trading involves buying one currency while selling another. Traders make a profit based on the difference in exchange rates, known as CFD, which is a contract for difference in Forex. In spread betting, traders speculate on the change in the currency pair price movements. Profits or losses depend on whether the exchange rate moves in traders’ favor. Forex trading includes risk management tools like stop loss and take profit levels, as well as margin trading. In currency spread betting, risk management is limited to the amount bet per pip, and leverage is replaced by the concept of margin.

Absolutely, you can make money as long as you accurately anticipate the market trend. First, analyze the market to determine the future price trend, and then place your bet. If your prediction is correct, a broker will pay your profit after deducting the commission. The spread betting service is offered by investment banks and CFD brokers.

The spread is also the difference between the actual and the initial price of an asset. Assume you believe that the stock price will drop by 300 pips, which corresponds to $3 for two decimal quotes. You make a 10-cent bet on the decline. This means that if the price falls by $1, you will earn 100 × 10 = 1,000 cents or $10.

Taxation rules vary depending on the jurisdiction. If the legislation categorizes spread betting as an investment activity, the income generated is subject to taxation. In some countries, spread betting is considered gambling and may qualify for tax exemptions. Conversely, spread betting profits may be subject to a higher tax rate. For example, in Great Britain and Ireland, spread betting is exempt from taxation.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.