If the neutral rate exceeds the Fed’s anticipated range, the central bank should consider slowing the pace of monetary easing. How might this impact the EURUSD pair? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The Fed intends to cut rates in December and pause in January.

- The central bank is not assured that the neutral rate is low.

- Donald Trump’s policies will be pro-inflationary.

- The EURUSD pair may slump to 1.03.

Daily US Dollar Fundamental Forecast

Is the Fed on the verge of reaching a neutral rate? What impact will Donald Trump’s policies have on the central bank and the US dollar? The president-elect may object to the Federal Reserve’s decision to pause its monetary easing cycle, particularly in light of the European Central Bank’s continued reduction in interest rates. This could result in a decline in the EURUSD pair. Trump has previously highlighted concerns regarding the currency policy, citing the strength of the US dollar against the Japanese yen and Chinese yuan. During his first presidential term, his administration designated Beijing as a currency manipulator. What will be the outcome this time?

The Fed is entering the final stage of the first phase of its monetary expansion cycle. The US regulator has consistently emphasized that the cost of borrowing is elevated, with minimal focus on inflation and unemployment. It was crucial to monitor the presence of a downward trend in PCE and indications that the US labor market was cooling. By the end of 2024, everything has changed. An increasing number of FOMC officials are stating that future Fed decisions will be contingent on incoming data. The market anticipates a pause in the cycle of monetary expansion in January, which is favorable for EURUSD bears.

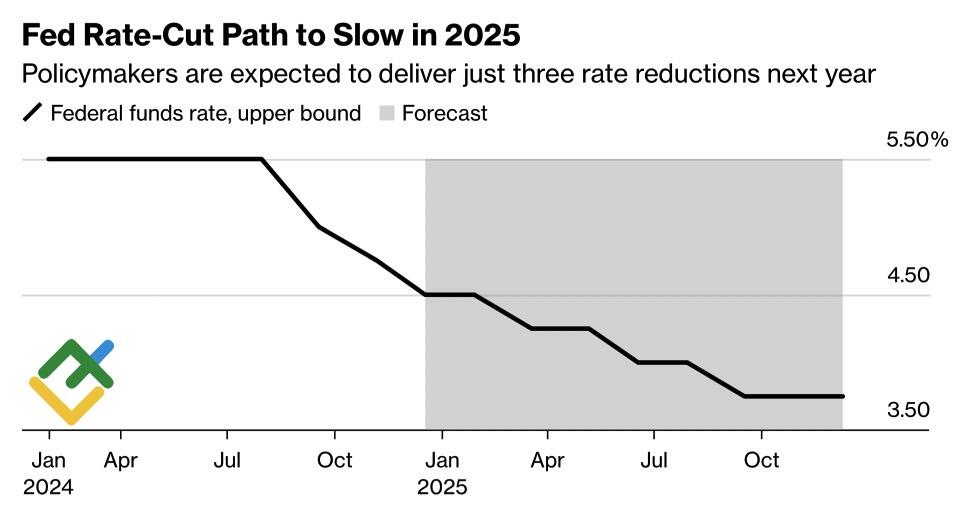

Bloomberg experts concur with this outlook. According to their latest survey, the personal consumption expenditure index, the Fed’s preferred inflation indicator, will be 2.5% in 2025, not 2.3% as previously estimated. In addition, the central bank is expected to cut the federal funds rate three times next year, in March, June, and September.

Fed Funds Rate Expectations

Source: Bloomberg.

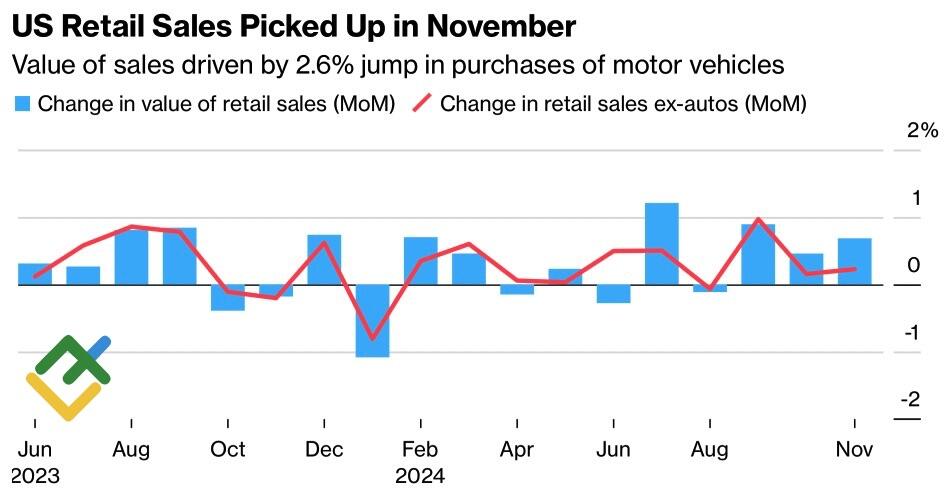

The economy’s resilience to the most aggressive monetary tightening in decades in 2022–2023 has prompted the Fed to question whether the neutral rate is as low as previously thought. Indeed, November retail sales growth of 0.7% m/m exceeded expectations, with October data also revised upwards. This points to a robust expansion in US GDP in the fourth quarter. The leading indicator from the Atlanta Fed projects an acceleration to 3.1% from 2.8%.

US Retail Sales Change

Source: Bloomberg.

If the neutral rate, which neither stimulates nor constrains GDP, is higher, the US Fed will slow the pace of monetary expansion, particularly in light of the pro-inflationary impact of Donald Trump’s policies on tariffs, fiscal stimulus, deregulation, and migration.

Daily EURUSD Trading Plan

The market is confident in the outcome of the December Fed meeting. The rate will be cut by 25 basis points, with the FOMC’s forecasts for rates being adjusted accordingly. The key question is the extent of this adjustment. The most probable scenario suggests a 75-basis-point reduction in borrowing costs in 2025, down from 100 basis points in September. Should the actual figure be less than this, short trades on the EURUSD pair can be opened with the target of 1.03.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.