The Fed took action to mitigate the risk of a slowdown in the labor market by reducing rates by 50 basis points at the outset of its monetary expansion cycle. Market reaction was relatively subdued. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- The Fed sees no signs of recession but cut rates by half a point.

- FOMC forecasts assume another 50 bp cut in 2024.

- The futures market sees borrowing costs falling by 70 bp.

- The EURUSD pair is trading below a line in the sand of 1.1125.

Weekly US dollar fundamental forecast

Over the past six easing cycles, the Fed has reduced the federal funds rate by 50 basis points at once on three occasions: in 2001, 2007, and 2020. Furthermore, all of these instances were linked to the weak performance of the US economy. Currently, only Donald Trump is publicly stating that the economy is limping. Jerome Powell does not see any reason to believe that a recession is likely. The Fed acted to protect against a cooling labor market, which had a significant impact on the EURUSD pair.

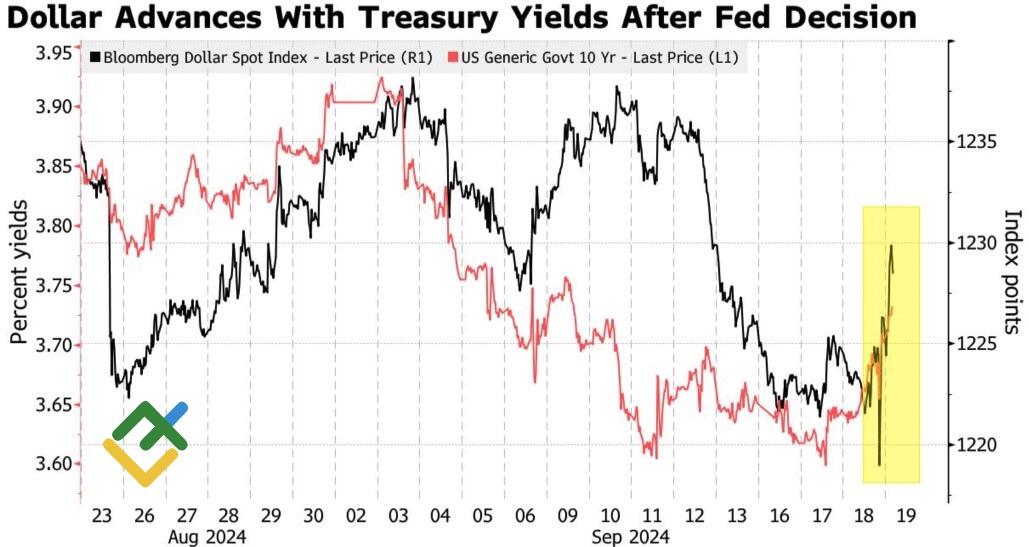

The market discounts everything. However, what can the reaction of bonds and stocks tell us? US Treasury yields initially fell in response to the cut in the federal funds rate by half a point to 5%. However, they managed to recover, boosting the US dollar.

US Treasury yields and US dollar index performance

Source: Bloomberg.

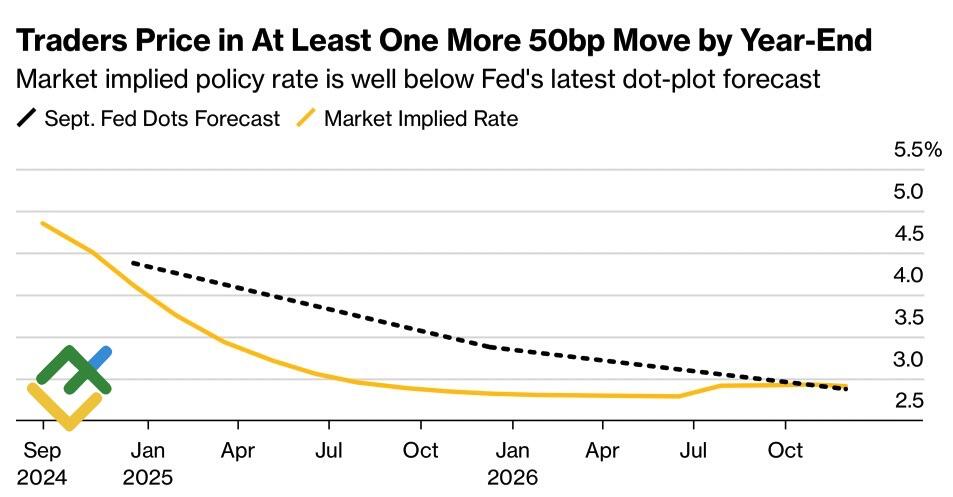

Higher interest rates suggest a robust economy and aggressive monetary easing is not projected. However, the FOMC consensus calls for two additional reductions in borrowing costs in November and December, either by 25 bps each or one by 50 bps. Following an ambitious start to monetary expansion, the derivatives market has increased the estimates to 70 bps by the end of the year.

Fed forecast and market expectations on federal funds rate

Source: Bloomberg.

The markets have reacted with a degree of skepticism to Jerome Powell’s assertion that the US economy is stable, as evidenced by the modest decline in stock indices. The ongoing focus on the possibility of a recession reflects this sentiment.

Nevertheless, it is possible that the response of securities is merely an extension of the buy-on-rumor, sell-on-facts principle. Prior to the September meeting, the futures market expected a reduction in the federal funds rate by 50 bps more than by 25 bps. Following the event, investors began to realize profits, sending the EURUSD pair on a roller coaster ride.

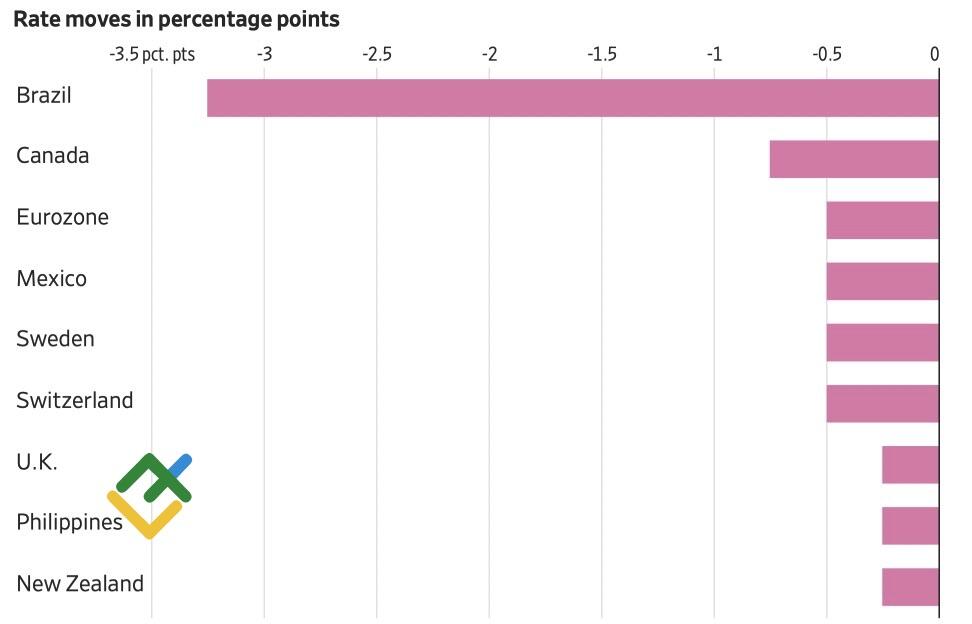

The Fed has started with a bold step, allowing other central banks to follow suit. Some have already begun to loosen monetary policy, while others were waiting for the first step from Washington.

Monetary expansion by global central banks

Source: Wall Street Journal.

The global economy will benefit from monetary expansion, although the impact will be felt over time. In the near term, the Fed’s counterparts will face challenges due to their lack of decisive action. The US dollar can afford to shift focus from the initial stages of monetary policy adjustments to other key events, such as the presidential elections or the issues facing other economies. While Jerome Powell and his colleagues were in the spotlight, other matters have taken a backseat.

Weekly EURUSD trading plan

Due to a spark of volatility in the EURUSD pair’s exchange rate, traders were able to establish short positions at the 1.1155 level. Consider keeping these positions open and closely monitor the 1.1125 level. It will take time for the market to digest the information and stabilize.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.