It is clear that the global economy is interconnected. Therefore, if the leading economy slows down, it will have a knock-on effect on the world economy. This is particularly relevant given the current crises in Germany and China. Let us discuss these issues and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- The slowdown in the US economy will affect global GDP.

- Procyclical currencies see waning optimism.

- Germany and China are causing concern.

- If the EURUSD pair declines below 1.1115, the risks of a pullback will increase.

Weekly fundamental forecast for euro

The US economy is decelerating, with markets anticipating that the Fed will reduce interest rates following the beginning of monetary expansion in September. In addition, rising global risk appetite is exerting pressure on safe-haven assets. These factors have contributed to the USD index reaching its lowest point since the monetary tightening cycle began in 2022. However, it would be premature to assume that EURUSD bears suffer from a lack of optimism.

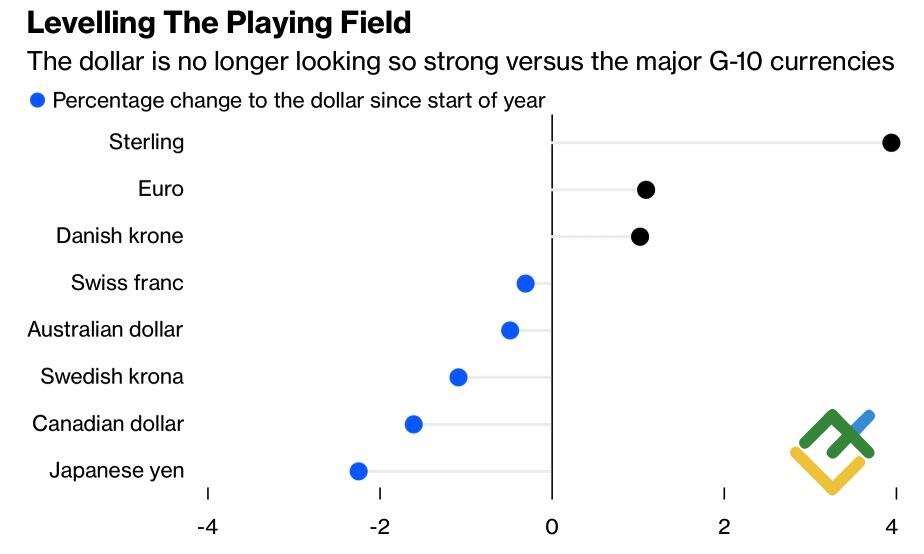

The rally of the major currency pair is based on the greenback losing a key advantage: American exceptionalism. For a long time, the US economy was a frontrunner, but the cooling of the labor market made it possible to discuss the possibility of a recession. As a result, the topic of reducing divergence in economic growth began to be actively discussed in the foreign exchange market, and the main beneficiaries were procyclical currencies such as the pound and the euro.

G10 currencies’ performance

Source: Bloomberg.

It is important to recognize that all aspects of the global economy are interrelated. If the leading economy encounters challenges, the global economy will also be affected. While the US is experiencing some challenges, it is not the only country facing difficulties. Germany’s GDP is contracting for the third time in the last five quarters, with the IFO warning that the country is facing an increasing risk of economic crisis. Meanwhile, China is now being likened to a black hole in the global economy.

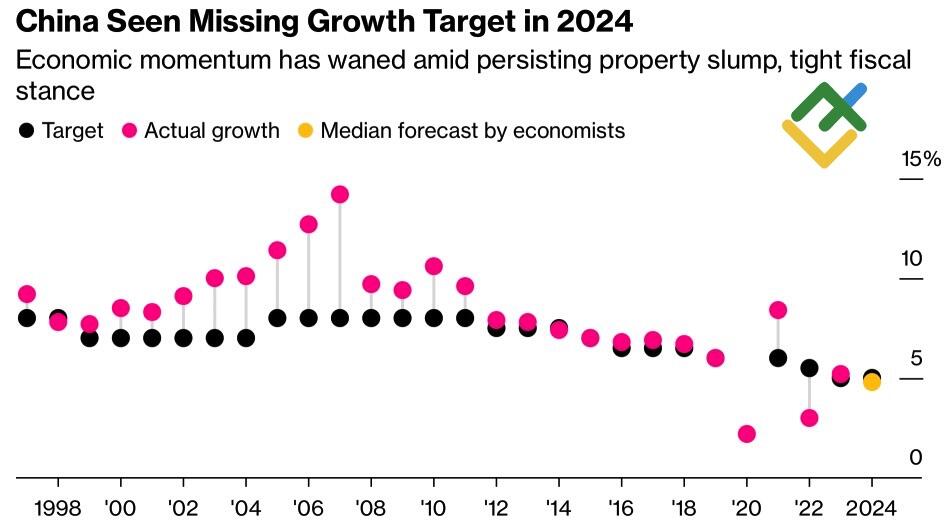

In contrast to other countries, where consumption represents 50-75% of GDP, this figure stands at 40% in China. In the event of weak domestic demand, China must prioritize the promotion of exports. Consequently, the country has achieved a foreign trade surplus of $900 billion, representing approximately 0.8% of the global economy. This results in deficits for the rest of the world. In the US, the figure has increased by $49 billion since 2019, in the European Union by $72 billion, and in Japan by $74 billion.

This situation will not be welcomed by all. Should Donald Trump come to power, the reverse process will begin, which will have the effect of greatly slowing down the economy of the PRC. The problems of China and Europe will have a detrimental impact on procyclical currencies, which are currently at the zenith of glory.

Chinese economy’s performance

Source: Bloomberg.

The US economy does not exist in a vacuum, and therefore, neither is the Fed’s monetary policy. Even if the US regulator reduces interest rates significantly, other central banks will likely follow suit. However, when making a significant change in strategy in the absence of a significant market disruption, it is prudent to proceed with caution. As might be expected, Atlanta Fed President Raphael Bostic prefers to avoid a scenario in which monetary policy will need to be tightened after easing. He believes a gradual approach is optimal.

Markets appear to be overestimating the speed of the Fed’s monetary expansion and underestimating the ECB’s resolve. Should German and European inflation continue to fall, the path to new deposit rate cuts will be open.

Weekly trading plan for EURUSD

It is time for EURUSD bulls to cool down. Should the pair fall below 1.1115, it would be an opportune time to consider opening more short trades, adding them to the previously discussed ones.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.