Investors anticipate that a larger reduction in interest rates by the Fed will have a more positive impact on stock performance and a negative impact on the value of the US dollar. However, will the Fed’s decision to cut rates signal an imminent recession? Will this spark panic in the market? Let’s consider these questions and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- Markets are demanding that the Fed cut the rate from 5.5% to 5%.

- An aggressive start could trigger panic.

- A 50 bp cut will be a surprise for EURUSD bulls.

- A 25 bp rate cut will allow traders to sell the euro.

Daily fundamental forecast for euro

The market is calling on the Fed to reduce borrowing costs by 50 basis points, citing the benefits of a more aggressive approach. The Fed has delayed the start of its expansionary cycle long enough. It is imperative that the gap between the federal funds rate and the 2-year Treasury yield be closed as soon as possible. The US economy is approaching, or perhaps already in, a recession. High real rates are accelerating the process. These are the primary arguments put forth by those with a bullish outlook on the EURUSD pair.

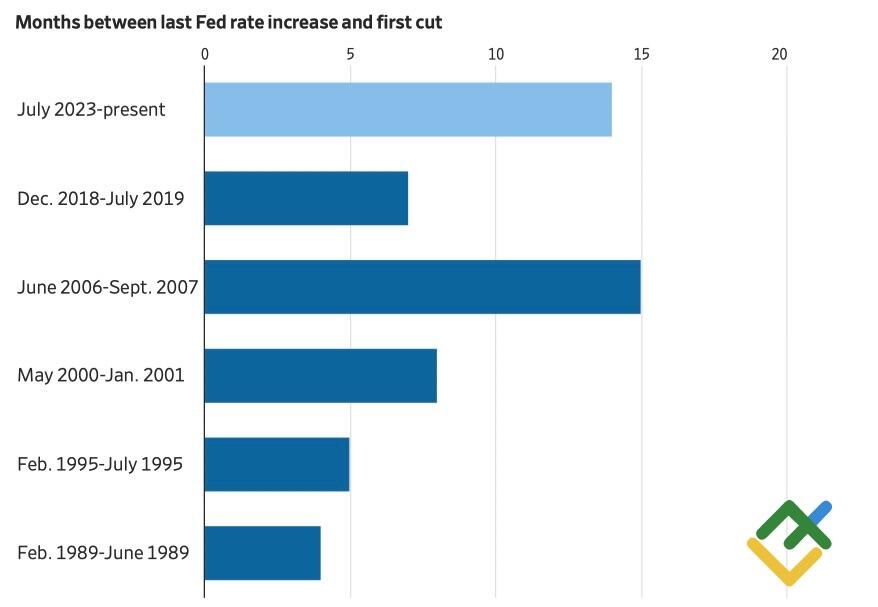

Time between Fed rate increase and cut

Source: Wall Street Journal.

Regardless of the decision made by the US regulator, it will face a barrage of criticism. Those who oppose a smaller step will argue that the Fed has pushed the US economy into a recession, while those who oppose a larger step will say that it risks reigniting inflation.

It would be prudent to consider the potential implications of a 50 bp cut in the federal funds rate. Could this be misinterpreted by financial markets as a sign of panic within the Fed, indicating an imminent recession? Alternatively, could it be viewed as an admission of past missteps, reflecting a recognition of the need to address the current situation with a significant effort?

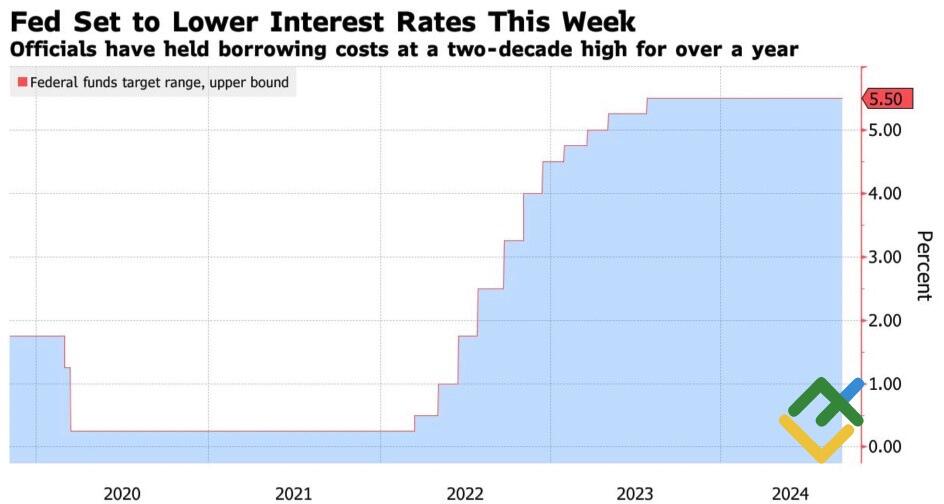

Federal funds rate change

Source: Bloomberg.

The optimal decision is to commence with a 25-basis-point cut. While there has been a deceleration in inflation, it remains significantly above the target level. While there are indications of a slowdown in the US labor market, it is possible that this is merely a return to its pre-pandemic equilibrium. The US economy continues to demonstrate resilience, as evidenced by the positive trends in retail sales and industrial production, as well as the projected 3% GDP growth in the third quarter, according to the leading indicator from the Atlanta Fed.

The Fed can cut interest rates by a quarter of a point while indicating that it has the ability to accelerate if the situation deteriorates more rapidly than projected. At the same time, the market will be focused not only on the size of the initial step but also on the FOMC forecasts. These are highly informative, given that there are only three meetings remaining before the end of the year.

The market is so focused on the initial step’s size that it has overlooked the weakness of the US’s competing economies, namely China and Germany, and the still significant gap in the attractiveness of assets.

Daily trading plan for EURUSD

Based on the fundamental analysis, a 25 bp reduction in the federal funds rate and the FOMC consensus estimate of 75 bp for monetary expansion in 2024 would provide a viable opportunity to sell the EURUSD pair with the potential risk of a subsequent price appreciation on Jerome Powell’s statement that the Fed could accelerate if necessary.

On the contrary, if the Fed opts to start with a 50 bp reduction and projects a total cut of 100 bp in the FOMC forecasts, the EURUSD will likely start a rally followed by a resumption of selling below 1.1155 during the Chairman’s press conference. He will undoubtedly attempt to minimize the significance of such a substantial reduction.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.