Donald Trump’s domestic policies involve significant spending, while his foreign policies are based on protectionism. In such an environment, American exceptionalism will enable the US dollar to strengthen. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- A trade war is the last thing the eurozone needs right now.

- If Trump fulfills his promises, the euro may collapse to $0.95.

- Accelerating inflation will force the Fed to pause its rate-cut cycle.

- The bearish target for the EURUSD pair can be shifted from 1.05 to 1.035.

Weekly US Dollar Fundamental Forecast

If you want peace, you must be prepared for conflict. It is challenging for those with limited resources to do so. The eurozone economy, which is already facing significant challenges, could face an even more dire situation if Donald Trump implements at least some of the trade policies he has previously promised during his election campaign. Goldman Sachs estimates that a 10% tariff on imports would result in a 1% reduction in the currency bloc’s GDP. Germany, which is facing snap parliamentary elections in February, will be particularly affected. In light of these circumstances, the EURUSD pair may decline toward parity.

Deutsche Bank believes that if Trump implements the full range of proposals he articulated during his presidential campaign, the euro will decline to $0.95. The Republican Party’s economic policies are designed to target key competitors, including China and the European Union, with the goal of slowing global economic growth outside the United States. This appears to be a redistribution of global economic growth in favor of the US. If this is the case, the US dollar will post significants gains on the advantages of American exceptionalism.

In line with these predictions, several financial institutions, including Barclays, Nomura, and ING, have revised their forecasts for the EURUSD exchange rate. Mizuho anticipates a decline in the major currency pair to 1.01 by March. ING projects a similar trajectory by early 2026, having reduced its previous estimate from 1.1. Barclays highlights that, alongside Donald Trump’s political agenda, economic momentum is shifting towards the US, with traders increasing their bets on a pause in the Fed’s monetary expansion cycle due to a potential acceleration in CPI and PCE.

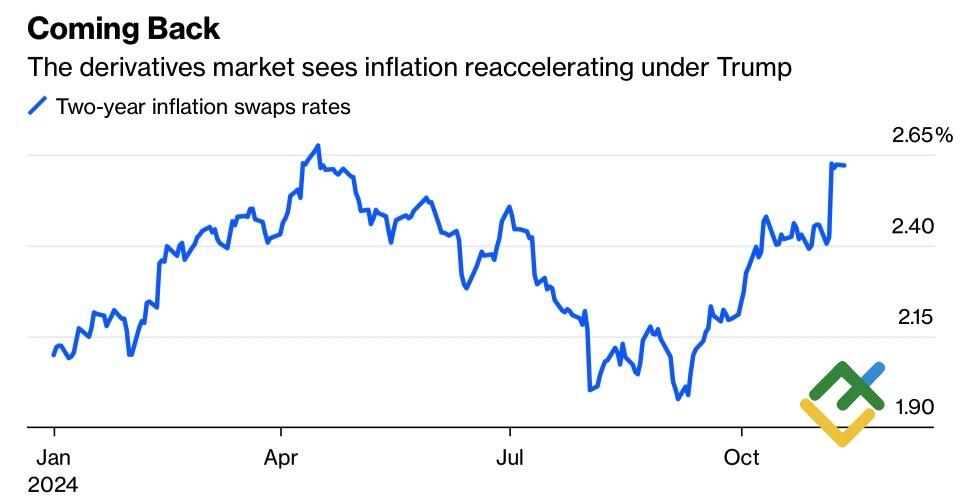

US Inflation Expectations

Source: Bloomberg.

However, Standard Bank notes that during Donald Trump’s previous presidential term, the USD index fell by 10%. Commerzbank also identifies a risk of the White House interfering in the Forex market to weaken the greenback.

Notably, the USD index dropped the most during Trump’s first tenure in 2020, when the pandemic forced the Fed to introduce significant monetary stimulus to support the struggling economy. At the beginning of 2017 and 2018, concerns emerged that China might dispose of its Treasuries in retaliation for the trade conflict. In the absence of these developments, the US dollar would likely have appreciated rather than depreciated. Consequently, bets on the decline of the EURUSD pair appear to be well-founded.

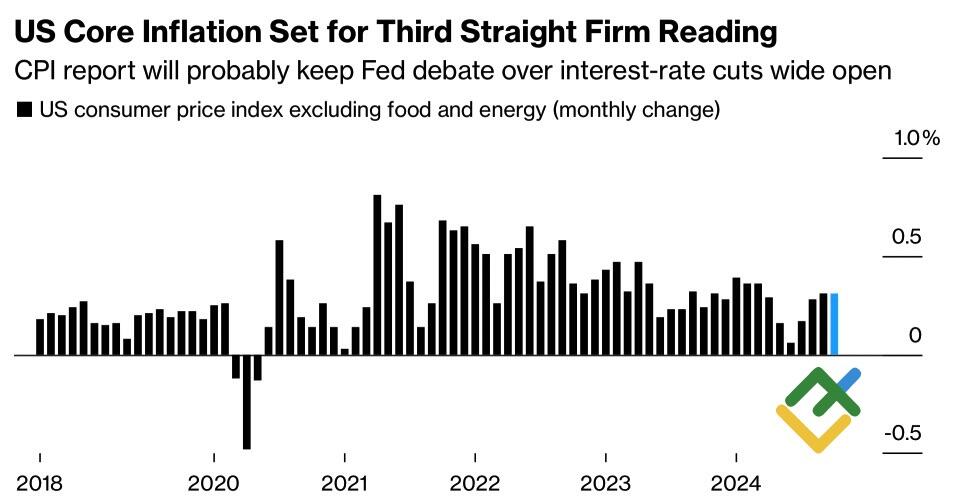

US Inflation Change

Source: Bloomberg.

The collapse may accelerate if inflation rises above forecasts in October. A CPI surprise could result in a pause in the Fed’s easing cycle, according to Minneapolis Fed President Neel Kashkari. The futures market has reduced expectations for a 25 bps cut in the federal funds rate in December to 62% from 80% prior to the US election.

Weekly EURUSD Trading Plan

Traders may take advantage of the current sell-off in the EURUSD pair, which is gaining traction. Therefore, the short-term bearish target should be shifted from 1.05 to 1.035.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.