The latest remarks by Donald Trump and the prospect of rising inflation expectations have reignited discussions surrounding the acceleration of inflationary pressures in the United States. In particular, there is an expectation that CPI will accelerate. As a result, the EURUSD pair’s rally has stalled. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The US labor market is cooling but remains strong.

- FOMC officials speculate about slowing the cycle.

- Donald Trump does not guarantee that tariffs will not spur prices.

- Short trades on the EURUSD could be opened on a rebound from 1.0615.

Weekly US Dollar Fundamental Forecast

Divergence in economic growth and varying rates of monetary expansion prevent the euro from rising. The EURUSD’s downtrend remains intact, as evidenced by the US employment report. The 227K growth figure demonstrated the continued strength of the labor market, albeit with indications of cooling. However, comments from Donald Trump and FOMC officials undermined bullish sentiment in the EURUSD pair.

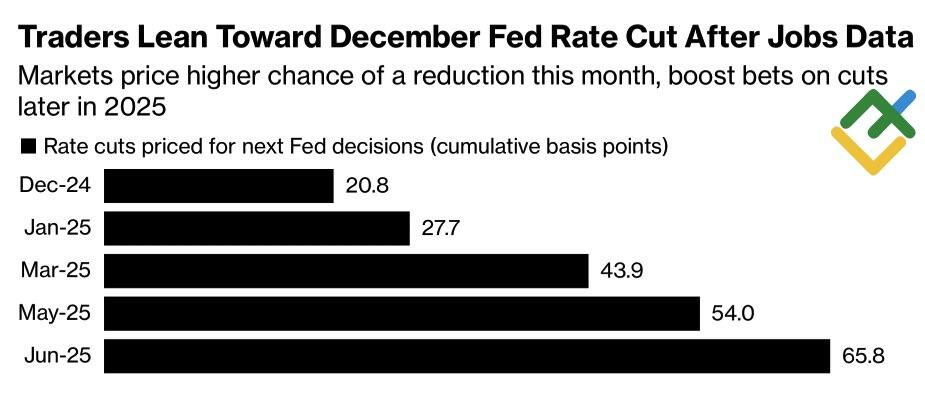

Investors interpreted the data in line with their expectations. The rise in unemployment to 4.2% was the right time to lock in profits on long positions against the Trump trade retreat. In addition, the likelihood of a cut in the federal funds rate increased following the November report.

Estimated Scope of Fed’s Monetary Expansion

Source: Bloomberg.

Nevertheless, decisions are always made by people, and Donald Trump’s statement that he cannot guarantee that tariffs on key US foreign trade partners will not raise prices for American consumers prompted a reassessment of the EURUSD outlook. This is particularly relevant given that inflation expectations in the University of Michigan report have reached their highest level in six months. Furthermore, Bloomberg experts anticipate that consumer prices will accelerate in November to 2.7% from 2.6%.

Comments from FOMC officials indicate that inflation risks are reemerging, which is a cause for concern. Cleveland Fed President Beth Hammack has stressed that the current pace of monetary expansion should be slowed. Michelle Bowman has supported cautious rate cuts, while Mary Daly of San Francisco and Austan Goolsbee of Chicago have highlighted the strength of the labor market. The latter declined to answer a question about whether rates would be cut in December, noting that a year from now, they are likely to be lower than they are now.

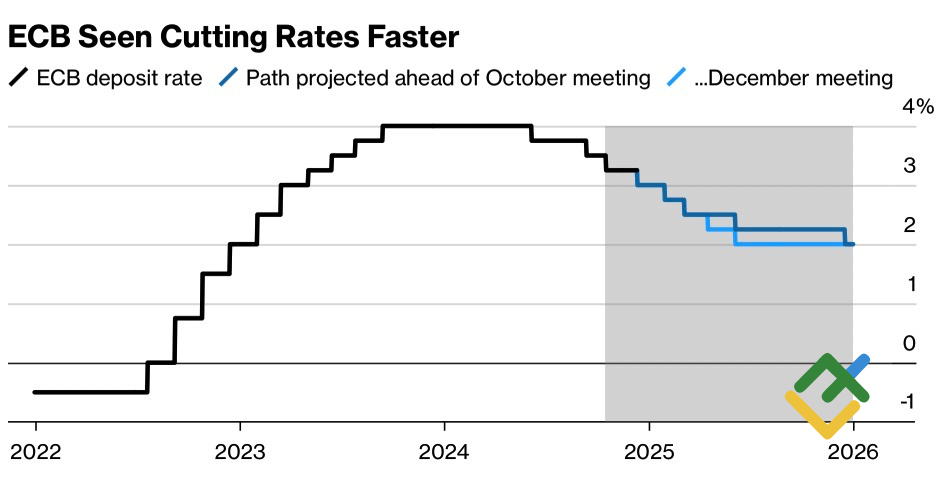

In light of the prospect of accelerating inflation, the Fed is contemplating a potential pause in its rate cut cycle, either in December or January. This is occurring concurrently with the European Central Bank’s intention to ease monetary policy at each meeting, provided that the cost of borrowing decreases to 2%. This dynamic is exerting significant pressure on the EURUSD exchange rate. Bloomberg experts are leaning towards this scenario.

ECB Deposit Rate Changes and Forecasts

Source: Bloomberg.

Analysts project that the deposit rate will decline to 1.75% and potentially lower, according to PIMCO. Given the potential headwinds from Donald Trump’s tariffs and the current political uncertainty, this outcome is a reasonable expectation. The euro is facing pressure from these factors, leading to capital outflows, a decline in business activity, and reduced investment.

Weekly EURUSD Trading Plan

Against this backdrop, the previously chosen strategy of switching from short-term long trades to medium-term short positions on the EURUSD pair is the optimal course of action. Bulls failed to breach the resistance level of 1.0615, allowing bears to initiate short positions. The focus now is on opening more short trades over time.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.