The impending recession in the US economy prompted a significant shift in financial markets. Severe shock waves hit global stock markets from Asia to North America. Meanwhile, EURUSD quotes soared to 1.1, a seven-month high. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Black Monday of 1987 returned to Japan’s markets.

- The strengthening yen sent stocks plummeting around the world.

- The Fed reassured the markets saying there was no recession.

- The EURUSD pair reached the upper limit of the consolidation range near 1.1.

Weekly US dollar fundamental forecast

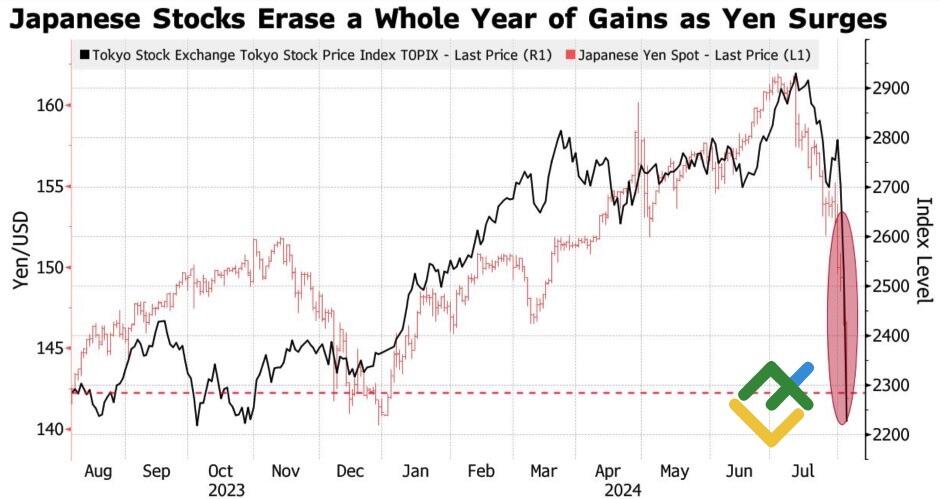

The US jobs report for July has prompted a notable response in the Asian market. The Nikkei 225 experienced a significant decline, with a 12.5% loss in value, marking the most substantial daily sell-off since Black Monday in 1987. This resulted in a 25% reduction in its capitalization from the July peak levels. The Japanese yen appreciated by 13% against the US dollar over the same period, which sent a shock wave through global financial markets. The VIX fear index saw the most rapid rally since 1990, with EURUSD quotes exceeding 1.1. Fortunately, sudden market sell-offs are less dangerous than those that develop gradually over time.

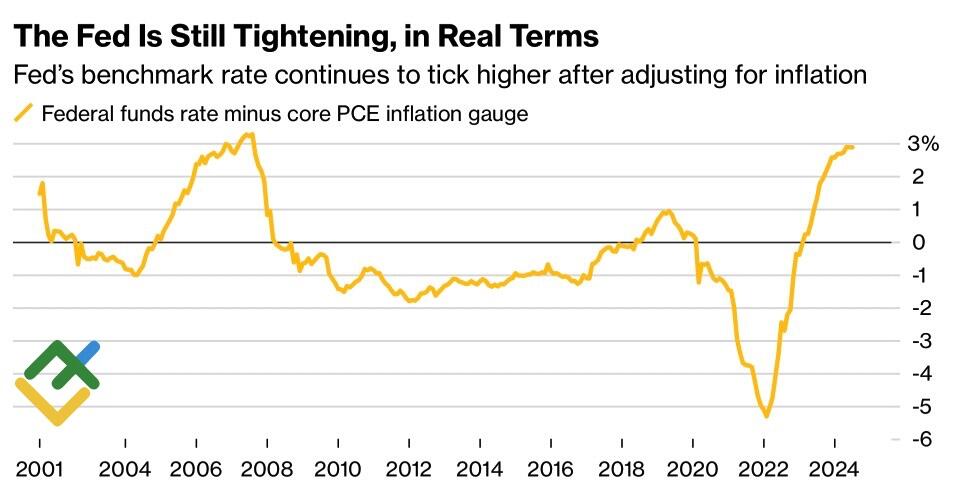

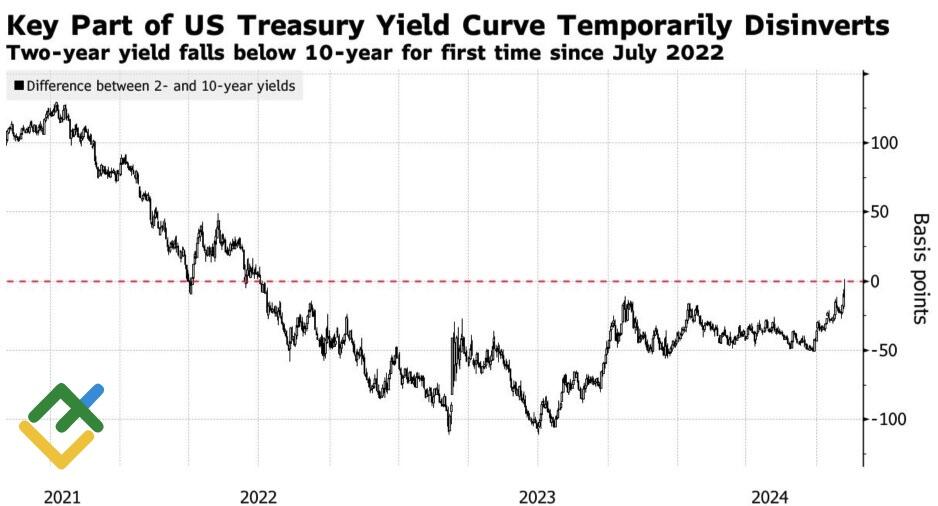

The renewed fears of a recession in the US economy have led to a market panic. The yield curve inversion, the implementation of the Sahm rule, and the elevated real federal funds rate indicate that a hard landing is looming. However, the Fed’s potential monetary policy easing provides a glimmer of hope, reassuring the market and the economy. The probability of a 50 bp cut in borrowing costs in September has reached 90%.

Fed real federal funds rate

Source: Bloomberg.

US Treasury yield curve

Source: Bloomberg.

Fears of an imminent economic downturn and the sharpest weekly decline in US Treasury 2020 yields led to increased market volatility and the closure of some carry trade positions. The yen rapidly strengthened as a funding currency, and the Nikkei 225, composed mostly of exporter stocks, collapsed. Japan’s economic situation significantly impacted the global financial markets, and the Federal Reserve took action to stabilize the situation.

Japanese yen rate and Tokyo Stock Price Index performance

Source: Bloomberg.

Austan Goolsbee, President of the Chicago Federal Reserve Bank and a prominent dove on the Federal Open Market Committee (FOMC), has stated that the US economy is not facing a recession. Should any deterioration occur, the Federal Reserve can readily address it. This is the central bank’s core responsibility. It would be premature to make any drastic assumptions based on a single data set, such as the July employment report. While the economy has been cooling down, this does not indicate that it is facing a recession.

Indeed, US GDP expanded by 2.8% in April-June, with the leading indicator from the Atlanta Fed signaling 2% growth in July-September. Business activity in the services sector rebounded to 51.4 from 48.8 at the end of July. These figures indicate that the economy is not in a recession.

The Federal Reserve will not respond to market fluctuations over a few days. The central bank is aware that significant market fluctuations may result from repositioning or other factors that could reverse. In such a situation, the best solution is to remain calm.

Weekly EURUSD trading plan

Most likely, the EURUSD pair has reached the upper boundary of the consolidation range near 1.1. If bulls fail to keep the price above 1.095, the pair will likely plunge to the key area of 1.09-1.092, where they will attempt to regain ground.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.