The underperformance of European stocks, robust corporate earnings, the ongoing European Central Bank rate reduction cycle, and the recovery of the German economy have enabled the EuroStoxx 50 to outperform its US counterparts. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The EuroStoxx 50 outperforms the S&P 500 by more than 10%.

- US stocks are disappointed with Donald Trump.

- Friedrich Merz will revitalize Europe.

- Long trades can be opened if the EU50 rises above 5,500.

Weekly EuroStoxx 50 Fundamental Forecast

The “America First” policy advocated by Donald Trump is yielding unintended consequences. Consumers are losing confidence, anticipating that inflation will accelerate. The US economy is slowing down, and US stock indices are lagging behind their European counterparts. Since the beginning of the year, the S&P 500 has increased by just 1.3%, while the EuroStoxx 50 has surged by 11.4%.

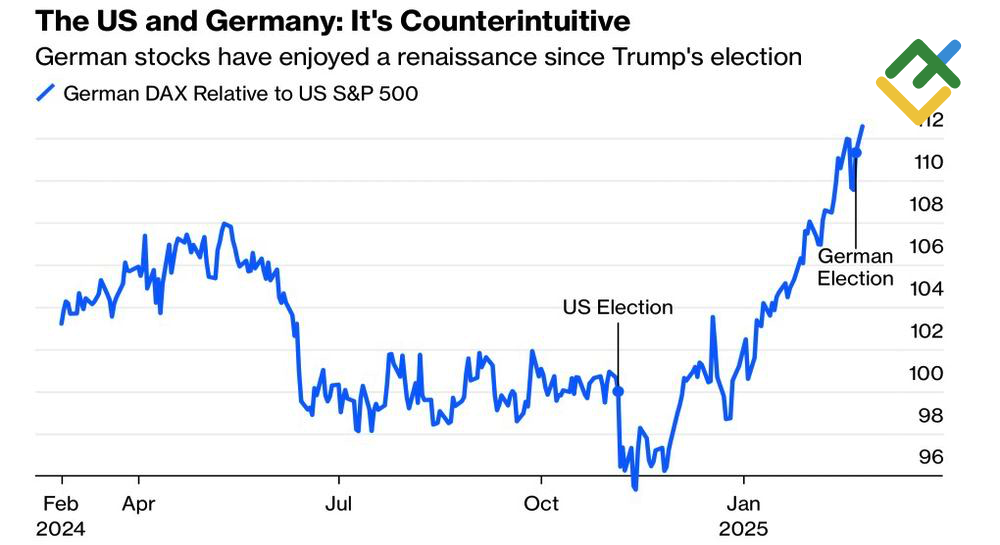

The concept of American exceptionalism has lost its luster. The so-called Magnificent Seven stocks have entered a correction phase, while Europe is experiencing a resurgence. Investors anticipate that Germany will resume its role as a locomotive of the EU economy, with the new leadership of Friedrich Merz expected to revitalize the economy and effectively counteract US protectionism. As a result, the DAX 40 is currently outperforming its US counterparts by a significant margin.

German DAX and US S&P 500 Stock Indices

Source: Bloomberg.

The divergence in growth became especially pronounced after the presidential election in the US due to investors’ disappointment with the White House policy. Any news from the US is perceived as a source of optimism for Europe, be it Donald Trump’s unwillingness to impose tariffs against the EU or deferrals in duties on imports.

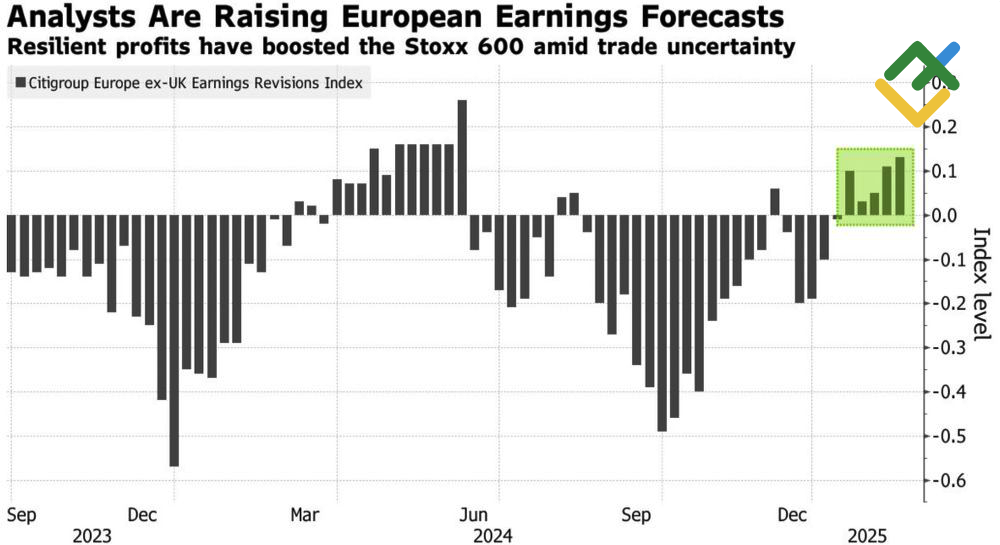

After the 2024 rally in the S&P 500 index, the securities that make up the EuroStoxx 50 index appear undervalued. This, coupled with a steady rise in European corporate earnings forecasts and expectations of the ECB cutting its deposit rate from 2.75% to 2%, is supporting EU stock indices.

Citigroup Earnings Revision Index (ERI)

Source: Bloomberg.

Shares of EU defense industry companies are particularly in demand as the US distances itself from Europe regarding the armed conflict in Ukraine, leading EU countries to increase their military expenditures. Friedrich Merz was the first to negotiate with the Social Democrats to increase defense spending by €200 billion.

At first glance, the EuroStoxx 50‘s superior performance in comparison to the S&P 500 may appear somewhat perplexing. In the US, Donald Trump has assumed power with a focus on stimulating the country’s GDP, while political uncertainty in France and Germany poses a potential obstacle to growth in Europe. However, the prevailing pessimism surrounding EU stock prices has led to a situation where any positive news is often seen as an opportunity to purchase.

Weekly EuroStoxx 50 Trading Plan

It appears that Donald Trump is not abandoning tariffs against the EU, and a trade war remains a possibility. The S&P 500 correction indicates a deterioration in global risk appetite and could trigger sell-offs in other markets. Conversely, a pullback in the EuroStoxx 50 to the support levels of 5,380 and 5,329 or a return above the resistance level of 5,500 could present attractive buying opportunities.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of SX5E in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.