The European Central Bank appears to be satisfied with the current market pricing. The ECB did not signal a rate cut in October, which led to a surge in the EURUSD exchange rate. The US data provided further support. Let’s discuss these topics and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The market is uncertain what the Fed will decide in September.

- The ECB ruled out an October rate cut.

- The Fed will not scare investors, which will support the US dollar.

- The EURUSD pair can be sold on a rebound from the range of 1.1115-1.1125.

Weekly fundamental forecast for euro

The market did not allow itself to be misled. Following the release of data indicating a deceleration in inflation and the US labor market, the likelihood of a 50 bp Fed rate cut in September rose from 13% to 45%. This was accompanied by a decline in the US dollar. Bulls started to push the EURUSD quotes higher with the support of the ECB, while ex-New York Fed head William Dudley’s calls for the Fed to take the initiative and expectations of lower US PCE growth also boosted the pair.

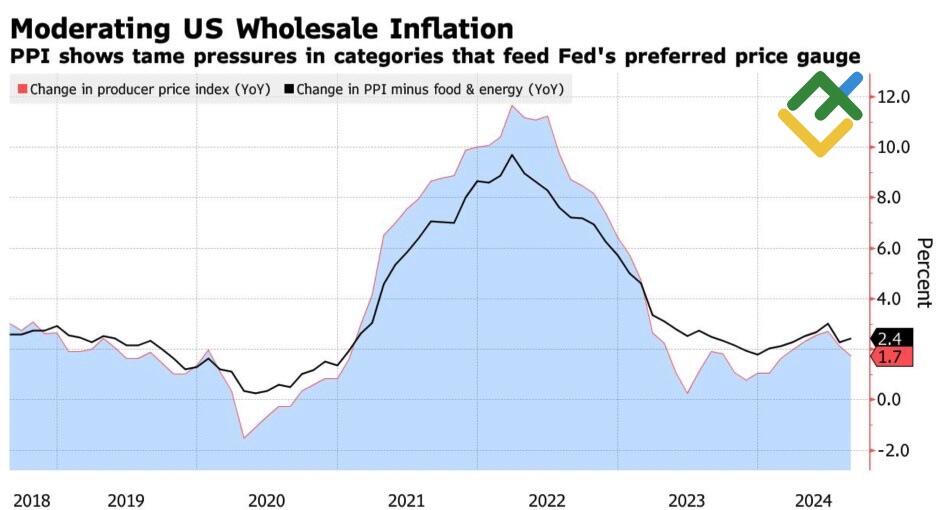

The decline in unemployment, the acceleration of average wages, and the rise in core inflation indicate a return to previous economic trends. This suggests that inflation may reach a new peak while the economy maintains its strength. In such a context, the Fed should exercise caution. The probability of a 25-basis-point cut in the federal funds rate in September increased to 87% but subsequently declined to 55%. The rise in jobless claims and the producer price index have shifted the outlook.

US producer price index change

Source: Bloomberg.

In a recent report, Inflation Insights indicated that the August CPI and PPI figures point to a deceleration in the personal consumption expenditure index, which is the Federal Reserve’s primary inflation metric. The report suggests that this index will likely slow to 0.1% in the coming months. A half-point rate cut in September remains a possibility. In light of William Dudley’s stance on the matter, a decision in this regard seems particularly probable. Prior to the July meeting, the former head of New York Fed recommended that the monetary policy easing cycle should commence. Following the release of disappointing labor market statistics, investors concluded that this was the appropriate course of action.

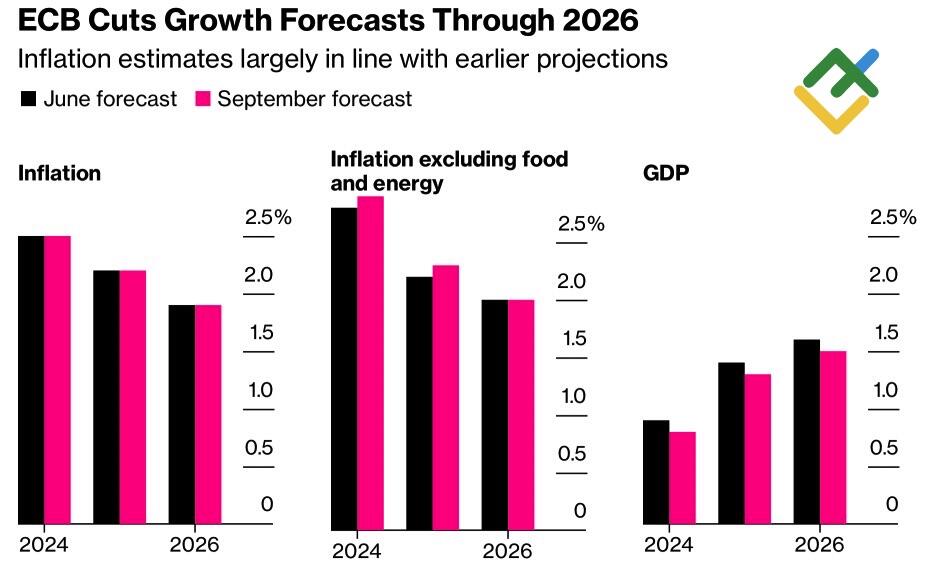

The EURUSD rally is not solely attributable to the anticipated aggressive stance by the Fed. The ECB reduced the deposit rate from 3.75% to 3.5%, but Christine Lagarde indicated in October that there was little probability of continuing the cycle of monetary expansion. She stated that the central bank was “data dependent” but not “data point dependent.” Inflation may slow significantly in September, but it is expected to accelerate towards the end of the year.

Following these remarks, which were supported by the ECB raising its core inflation forecasts, the derivatives market lowered the odds of monetary policy easing in October from 40% to 20%. This allowed EURUSD bulls to start a rally.

ECB economic growth and inflation forecasts

Source: Bloomberg.

Weekly trading plan for EURUSD

The derivatives market anticipates 10 quarter-point cuts from the Fed and 7 from the ECB within 12 months, which could lead to a resurgence of the euro’s uptrend. However, the Fed will unlikely cut rates by 50 bp at the outset, as they are keen to avoid any undue market volatility. At the same time, the fragility of the eurozone economy will compel the European Central Bank to accelerate its pace of action. Furthermore, according to a Bloomberg insider, there is a possibility of monetary expansion in October. These circumstances allow traders to sell the EURUSD pair on growth to 1.1115-1.1125, or in case bulls fail to reach 1.1085.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.