The deferral of tariffs on trade with Canada and Mexico has allowed the EURUSD to start a relief rally. This is not the sole factor contributing to the recent rebound. The frontloading of exports has boosted GDP and supported the single currency. Let’s discuss these topics and make a trade plan.

The article covers the following subjects:

Major Takeaways

- Inflation and tariffs are the most pressing issues of the year.

- The Fed and the White House view the inflation issue differently.

- Growth of global shipments into the US has bolstered the euro.

- A decline in the EURUSD pair below 1.0365 could offer a strategic selling opportunity.

Weekly Euro Fundamental Forecast

According to the research conducted by JP Morgan, financial markets are most concerned about the potential impact of tariffs and the trajectory of inflation. Increased market volatility has become a common trend, as well as a roller coaster ride in the EURUSD pair. These developments may require a period of adjustment, similar to the adjustment period that followed Donald Trump’s controversial statements.

Risk Factors for Financial Markets

Source: Bloomberg.

The views of the Federal Reserve and the White House on inflation differ. According to Federal Reserve Bank of Chicago President Austan Goolsbee, the central bankers’ tendency to adhere to pure economics while disregarding supply shocks is perilous. The US economy is confronted with the potential of a trade war, and even if this threat is less severe than the pandemic, disregarding supply chain disruptions would be imprudent. ING believes that tariffs can spur inflation. This assertion is not subject to debate, and it is anticipated that tariffs will intensify the repercussions of the recent inflationary shock. It would be imprudent to assume that prices will remain consistently low.

Conversely, Finance Minister Scott Bessent expresses confidence in the potential for non-inflationary GDP growth, attributable to cuts in government spending and the state apparatus, along with declining energy prices. The recent decline in 10-year bond yields serves as a reliable indicator of this outlook. Notably, the White House’s focus is on this particular indicator rather than on the fed funds rates. The decline in the latter could not lower Treasury yields, while Donald Trump could. Meanwhile, Commerce Secretary Howard Lutnick calls the acceleration of prices due to tariffs “nonsense.” He says sellers will be forced to discount, so prices will not rise much.

However, the Federal Reserve is more likely to be trusted on this matter. Tariffs will accelerate CPI and PCE inflation, force the central bank to pause in its monetary expansion cycle for longer, and strengthen the US dollar. Conversely, the removal or postponement of import duties could potentially trigger a recovery in EURUSD quotes. The actions of the White House have been characterized by inconsistency, often resulting in unintended consequences. At the same time, Donald Trump has expressed his intention to reduce the US foreign trade deficit, while the deficit has only reached record levels following his election victory.

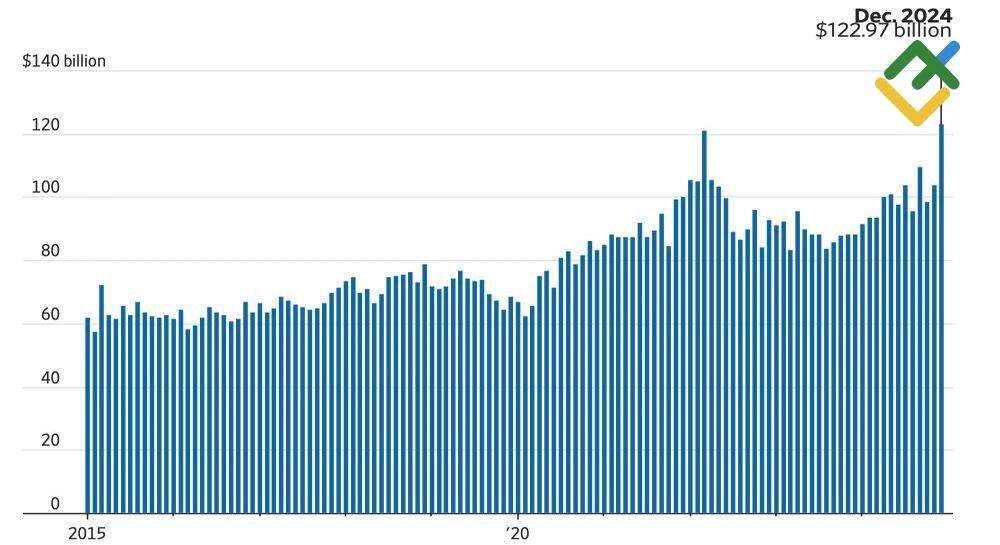

US Foreign Trade Deficit

Source: Wall Street Journal.

Firms are accelerating their shipments to the US due to concerns over tariffs, contributing to a significant expansion in trade deficits. Concurrently, the global economy, which includes the export-oriented eurozone, is expanding. This development is another factor contributing to a rally in the EURUSD pair, along with the deferral of duties.

Weekly EURUSD Trading Plan

In the Forex market, such an upward movement of the euro is referred to as a “relief rally.” Investors are optimistic that once the tariff threats resume, the major currency pair will revert to its downward trend. However, this movement is not solely attributed to protectionism. Traders are awaiting the release of US employment statistics for January, which could lead to a consolidation in the EURUSD pair. Against this background, there is an opportunity to open short trades if the pair violates the support level of 1.0365.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.