The euro managed to maintain stability for an extended period due to investor caution stemming from Donald Trump’s tariff threats. However, the US President has remained steadfast in these threats, triggering a significant decline in the EURUSD rate. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The US imposes additional 10% tariffs on China.

- The duties against Mexico and Canada will take effect in March.

- Protectionism will accelerate inflation and slow down the US economy.

- Short trades on the EURUSD pair formed at 1.045 should be kept open.

Weekly Euro Fundamental Forecast

The market’s cyclicality is evident in the transition from a state of greed to one of fear and then, subsequently, to enthusiasm. During the latter half of February, investor fatigue from Donald Trump’s tariff threats was a prevalent topic in the Forex market, creating an opportunity for the euro to appreciate against the US dollar. The single currency demonstrated resilience in the face of the US President’s suggestions of 25% import duties on EU goods, as hedging costs for the regional currency continued to decline. However, as the year progressed, a shift in sentiment occurred.

Specifically, President Trump announced plans to impose an additional 10% on the existing tariffs against China, while the 25% duties against Mexico and Canada scheduled for March 4 would proceed as planned. A day earlier, the US leader had mentioned April, and his shift in rhetoric caught the EURUSD market off guard.

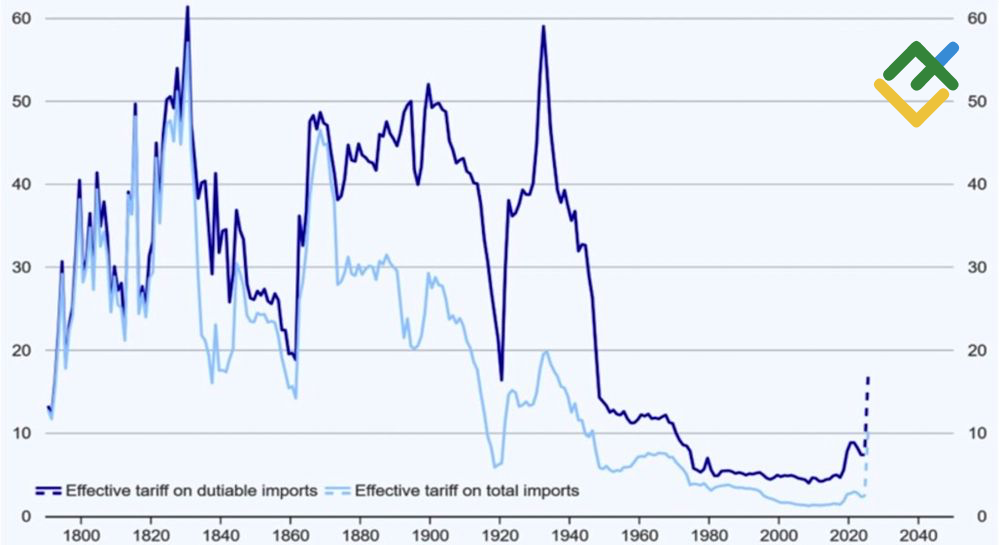

This abrupt transition followed remarks by Stephen Miran, Trump’s nominee to chair his Council of Economic Advisors, who cited historical precedents of robust economic growth coinciding with high tariffs. Miran’s statement underscores the notion that contrary to popular belief, such policies are not inherently detrimental to economic prosperity.

Effective Tariffs on US Imports

Source: Nordea Markets.

Despite the prevalent view that the impact of President Trump’s policies is more significant in terms of their potential than their actual implementation, the threat of tariffs is escalating, with the EURUSD pair facing significant headwinds. Tariff increases are imminent, with duties on Chinese goods set to rise to 20% and additional levies on steel and aluminum imports from Mexico and Canada starting in March. These measures will be followed by tariffs on automobiles, pharmaceuticals, and semiconductors, along with reciprocal duties from April. The potential imposition of tariffs on the EU remains a looming possibility. According to a Harris poll conducted for Bloomberg, 60% of Americans believe that these tariffs would spur US inflation, while 44% think that the US economy will slow.

However, it is crucial to distinguish between rhetoric and action. According to US administration officials who spoke with the Wall Street Journal on the condition of anonymity, identifying other countries’ unfair practices to impose reciprocal tariffs by April 1 is an insurmountable task. Donald Trump’s threats will unlikely result in significant tariffs. Firstly, many countries have low tariffs on the US. Secondly, the United States’ partners will try to negotiate lower duties on imports.

Weekly EURUSD Trading Plan

Therefore, uncertainty regarding Donald Trump’s protectionist policy persists, providing support for the US dollar. The situation will become clearer in early March when the tariffs on Mexico and Canada are implemented. Currently, short positions formed at 1.045 on the EURUSD pair can be kept open. Meanwhile, if the pair breaches the support area of 1.0345–1.0355, one may open more short trades. Otherwise, long trades can be considered.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.