Central banks are painting stagflationary scenarios and are prepared to keep interest rates on hold for a long time. They are preparing for the trade wars that are knocking on the door. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- Central banks prefer to keep rates on hold.

- Trade wars will make inflation transitory.

- The ECB should consider Germany’s fiscal stimulus.

- The EURUSD pair continues to fall toward 1.0715.

Weekly Euro Fundamental Forecast

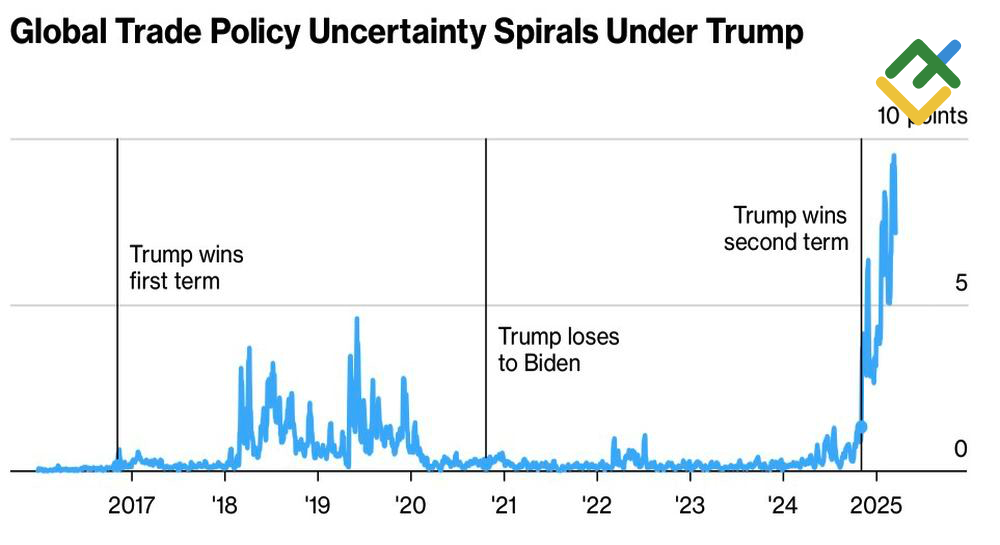

For several months, Donald Trump has been under the spotlight globally. Meanwhile, central banks are no longer the main headliners in the Forex market, and they are adapting to the evolving economic landscape. The US policy uncertainty has placed the Fed and other regulators in a challenging position. Tariffs and trade tensions set the stage for stagflation, making it increasingly risky to adjust interest rates. The Fed’s decision to pause has led to a shift in EURUSD quotes, moving them away from the five-month highs.

Global Trade Policy Uncertainty Index

Source: Bloomberg.

The Fed remains the main trendsetter. As soon as the US regulator acknowledged the impact of import duties on the economy and mentioned the transitory nature of inflation, others started to do the same. For instance, Christine Lagarde’s statement that the 25% tariffs imposed by the US on the EU will reduce the Eurozone’s GDP by 0.3% in the first year, with this figure rising to 0.5% in the event of retaliation, prompted a decline in the EURUSD rate.

Lagarde also noted that a 0.5% acceleration in inflation in the event of a trade war between Washington and Brussels would not force the ECB to raise rates. She asserted that by reducing economic activity, rates would eventually decline. It appears that Christine Lagarde, following Jerome Powell, acknowledges the transitory nature of high inflation. The Federal Reserve maintains its position as a leader in monetary policy trends.

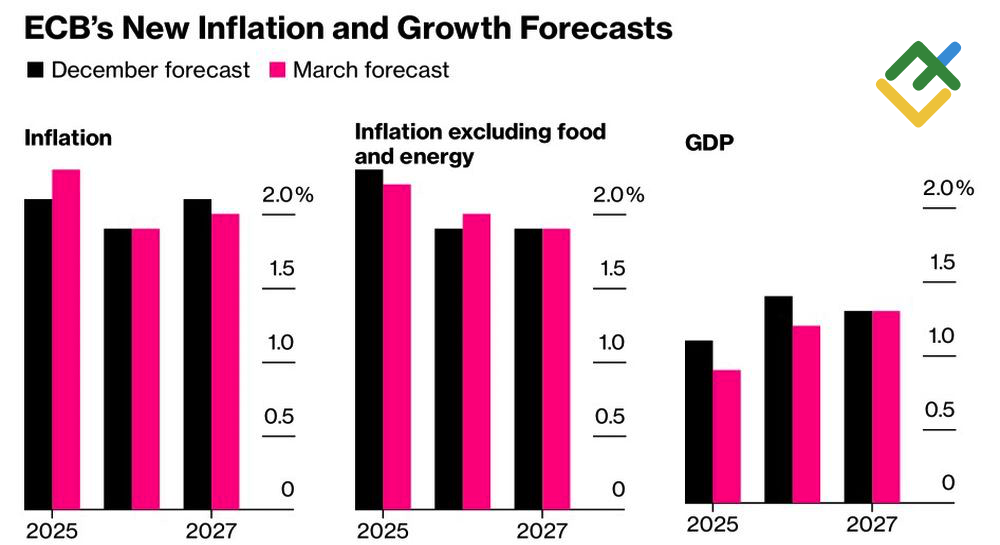

In its latest forecasts, the European Central Bank expected to see GDP growth of 0.9% in 2025 and 1.2% in 2026, CPI at 2.3% and 1.9%, respectively. The ongoing trade tensions are expected to exert downward pressure on GDP figures and upward pressure on the CPI, thereby pointing to a scenario of stagflation.

ECB Forecasts for Inflation and GDP Growth

Source: Bloomberg.

Investors should prepare for the possibility that central banks, under the leadership of the Fed, may opt for a pause in rate hikes, perceiving inflation as a temporary phenomenon. Conversely, the ECB should assess the impact of Germany’s fiscal stimulus on consumer prices. Surging German GDP could provide a compelling rationale for an earlier conclusion to the monetary easing cycle, which would support the EURUSD pair in the medium to long term.

However, Donald Trump has designated April 2 due to US intentions to impose reciprocal tariffs, which could lead to increased market volatility. In such an environment, investors often buy the safe-haven US dollar.

As a result, the uptrend in the EURUSD pair remains intact, though it does necessitate a correction. This is largely due to the ongoing trade tensions between the two nations. The European Union’s decision to postpone the deadline for imposing duties on imports of American whiskey in an attempt to negotiate with the United States is unlikely to impact Donald Trump’s plans. The White House is preparing for something big, and it is time for the euro to start worrying about its future.

Weekly EURUSD Trading Plan

In this market context, short positions formed on the EURUSD pair near 1.09 can be kept open. Traders may consider opening more shart trades with the target at 1.0715.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.