The recent German parliamentary elections saw the Christian Democratic Union emerge victorious, a development that was widely anticipated. Friedrich Merz, the party’s leader, played a pivotal role in this outcome, and his firm stance supported the EURUSD pair. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Market rumors of an imminent German coalition supported the euro.

- German PMIs have buoyed the European index.

- The cooling US economy is putting pressure on the US dollar.

- Long trades on the EURUSD pair can be opened once the price breaches the 1.0535 level.

Weekly Euro Fundamental Forecast

Germany’s economy was the last to experience an economic slowdown, as it had been enjoying a period of significant growth and strength. A decade ago, the country was benefiting from a robust Chinese economy and a weaker euro compared to the Deutsche mark, which facilitated a boost in exports. Germany’s balanced finances were notable in a global context characterized by substantial government debt. However, the German economy entered a recession in 2023–2024 due to the slowdown in the Chinese economy, the armed conflict in Ukraine, and US protectionism. In response, Berlin and the EURUSD pair need a strong leader.

The CDU’s election victory and Friedrich Merz’s subsequent announcement of a quick coalition formation led to the euro’s rise above 1.052. Investors have expressed confidence in the new government’s ability to revitalize the economy through amendments to the constitutional borrowing limit, known as the debt brake, which is expected to be more business and investment-oriented. This shift is anticipated to enhance the government’s ability to find common ground with Washington.

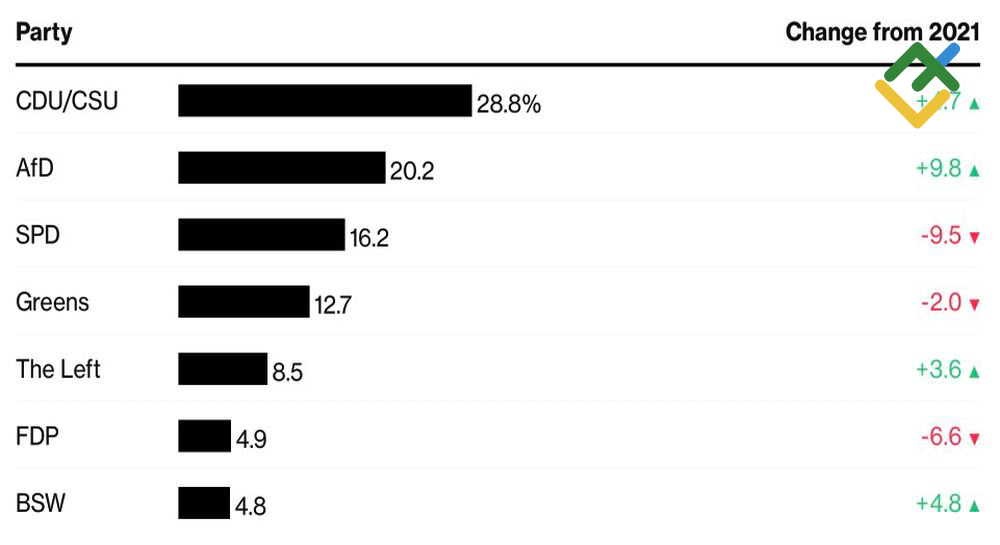

Results of Parliamentary Elections in Germany

Source: Bloomberg.

The most probable coalition partner appears to be Olaf Scholz’s Social Democrats, despite their recent loss. However, the potential for a tripartite alliance should be considered, and the longer it takes to form, the more vulnerable the euro may become. According to Pepperstone, a prolonged period without a government could lead to a decline in EURUSD quotes to 1.03.

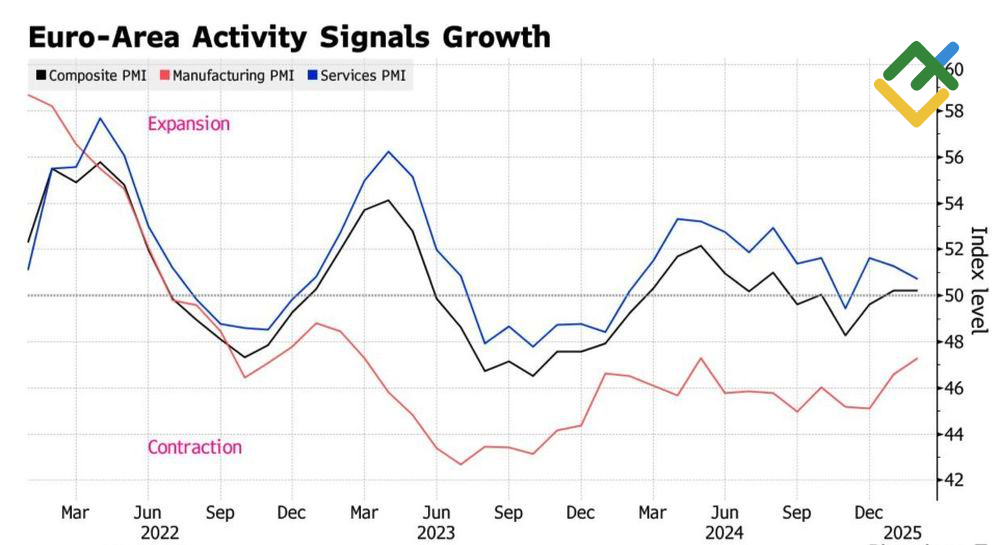

Investors’ confidence in Germany’s potential to drive growth in the eurozone is evident in the positive trends in the country’s PMIs, which have helped maintain the strength of the European PMI amid declining French purchasing managers’ indices.

Euro Area PMIs

Source: Bloomberg.

Amidst the anchored business activity within the currency bloc, recent data from the US counterpart has led to a decline in the US dollar’s value. A notable drop in consumer confidence, as measured by the University of Michigan, has further added to this trend. The potential shift in American exceptionalism may deal a blow to EURUSD bears. The derivatives market has revised the odds of the Fed rate remaining at 4.5% in June from 50% to 41% over the past week, which has contributed to a retreat in the US dollar.

The greenback is facing pressure due to rumors that the White House is urging Mexico to impose import tariffs on China to delay US duties on its neighboring country. Market participants are becoming increasingly confident that these threats are part of Donald Trump’s negotiating strategy, which is contributing to the USD index’s decline.

Weekly EURUSD Trading Plan

The EURUSD correction is generating a significant amount of optimism, but the major currency pair is likely to remain resilient, at least until mid-March. After that time, markets will begin to factor in the introduction of reciprocal tariffs from Washington, effective from the beginning of April. If the pair breaks through the resistance level of 1.0535, traders will have an opportunity to open long trades, adding them to the ones initiated at 1.042. Conversely, a rebound will likely result in a period of consolidation.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.