Devastating hurricanes and strike actions risk cooling the US economy and complicating the Fed’s decision-making. This fact, together with rumors about China’s fiscal stimulus, is buoying the EURUSD pair. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- China is ready to implement large-scale fiscal stimulus.

- US GDP and labor market statistics may disappoint.

- The prospect of a 50 bp Fed rate cut is exerting downward pressure on the US dollar.

- The EURUSD pair is consolidating in the range of 1.076-1.0865.

Weekly US dollar fundamental forecast

EURUSD bulls managed to maintain quotes above 1.077 and start a counterattack due to positive economic news from China and expectations of disappointing US economic statistics. The main currency pair is attempting to reach the boundaries of the short-term consolidation range and continues to react sensitively to the US presidential election and Treasury yield performance.

Citing sources with knowledge of the matter, Reuters reported that, following the largest monetary stimulus package since the onset of the pandemic, China would unleash a significant fiscal stimulus initiative to bolster its economy. The package is estimated to be worth 10 trillion yuan, equivalent to $1.4 trillion, and will be officially announced on 4-8 November. However, leaked information has already had an impact on the markets. Following a significant decline, oil prices recovered swiftly after the Israeli attacks on Iran’s military infrastructure.

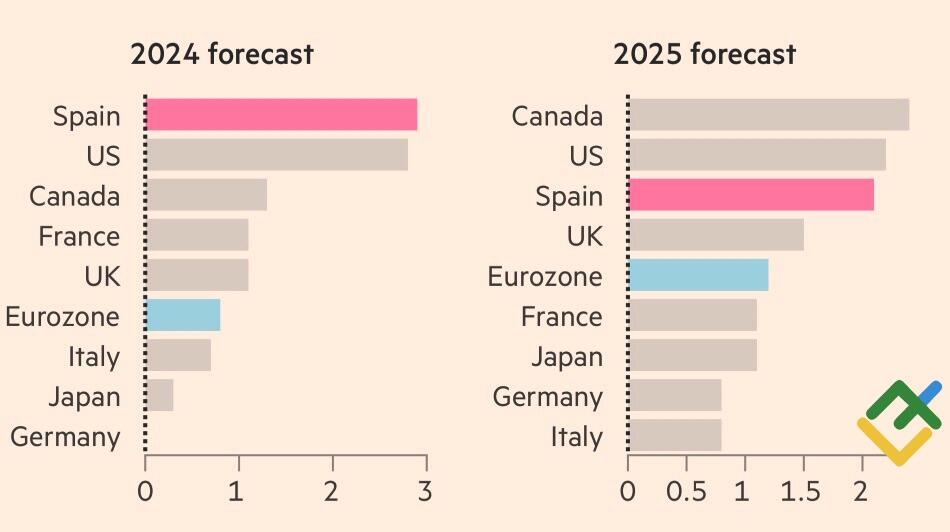

The rumored fiscal stimulus from Beijing was well received in Europe. The currency bloc’s economy is lagging behind the US due to issues in German industry and weak external export demand. Spain is expected to overtake the US in terms of GDP growth in 2025, which would help to improve the situation.

IMF forecasts for the world’s largest economies

Source: Financial Times.

The consensus estimate of Bloomberg experts is that the US economy will expand by 3% in the third quarter. However, following the announcement that the US trade deficit has reached its highest level in 2.5 years, the leading indicator from FRB Atlanta has reduced its forecast to 2.8% from 3.3%. The actual GDP data may be less favorable than experts currently anticipate. In addition, statistics on the US labour market are also a factor.

It is anticipated that employment will decelerate from 254K to 110K in October due to the impact of hurricanes and strikes. This projected figure is one of the weakest since 2020. Meanwhile, estimates from Bloomberg experts range from -10K to +180K. The likelihood of a 50 bp cut in the federal funds rate in November is increased by the disappointing statistics, which also provide a reason to buy the EURUSD pair.

Concerns about the slowdown of the US economy prompted a retreat in the yield of Treasuries. Its growth in October, driven by expectations of large-scale fiscal stimulus from the new president, provided a boost to the greenback. Additionally, long-term securities saw faster growth than short-term ones, indicating investor concerns about increased issuance.

US Treasury bond yield

Source: Wall Street Journal.

Weekly EURUSD trading plan

The CRFB forecasts that the budget deficit will increase by $7.5 trillion over the 10-year period under Donald Trump and by $3.5 trillion under Kamala Harris. The prospect of Trump’s victory is bolstering US Treasury yields and the US dollar. Will the release of weaker-than-expected US economic data stop bears? We will soon have an answer to this question. As for now, the EURUSD pair is trading within the range of 1.076-1.0865.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.