France has avoided the worst, and this circumstance supports the EURUSD bulls. However, something can go wrong at any moment. The market is waiting for Jerome Powell’s speech and inflation in the US. Let’s discuss this and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Emmanuel Macron may win.

- A centrist government will please the markets.

- Investors are waiting for clues on a rate cut from the Fed.

- Uncertainty is high, forcing the EURUSD to consolidate.

Weekly fundamental forecast for euro

Emmanuel Macron, a political gambler, has been allowed to continue playing. After the Renaissance has come the second, the announcement of snap elections no longer looks like political suicide. Moreover, if the centrists play correctly, they can unite with the greens and socialists and form a government loyal to the French president. The markets will like this scenario. In the meantime, the EURUSD is going nowhere fast as the worst has been avoided, and the markets are waiting for Jerome Powell’s speech and US inflation data.

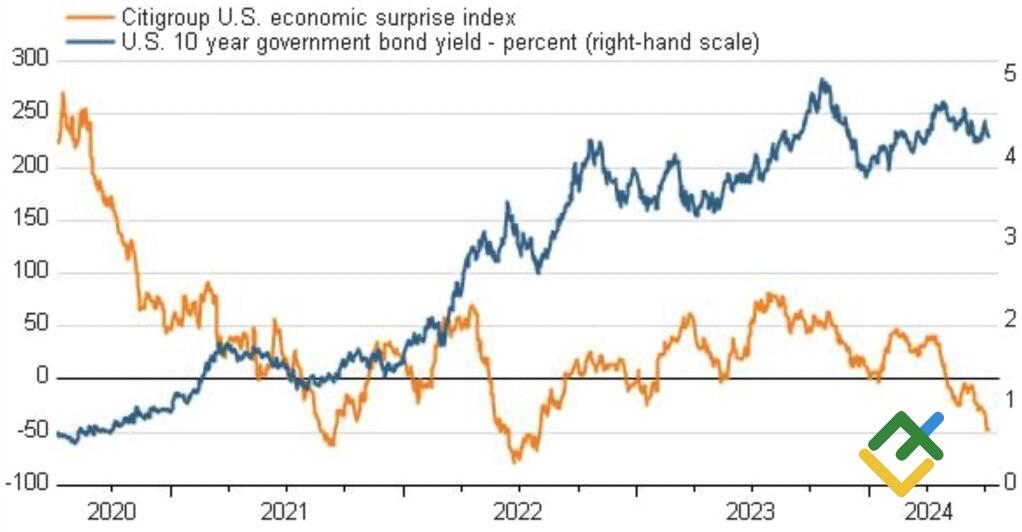

The landscape looks ideal for the euro to continue its rally. Talks about Frexit and parity are in the past, and the slowdown in American GDP is evident. The latest statistics for the United States have been consistently disappointing, which has dropped the Economic Surprise Index. Its divergence with Treasury yields is due to the Fed’s persistent reluctance to notice signs of the US economy’s cooling. However, it will have to be done sooner or later. Why not during Jerome Powell’s speech to Congress?

Economic surprise index and bond yields

Source: Citigroup.

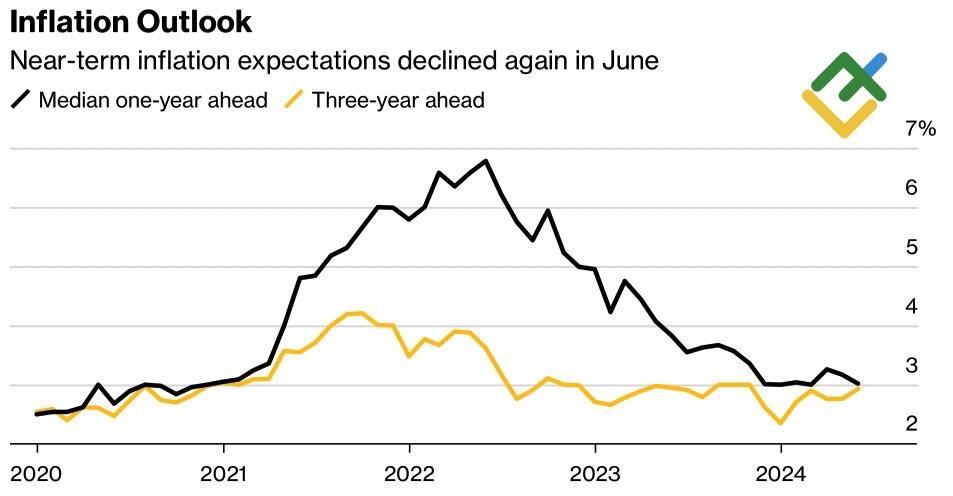

Derivatives give a 78% chance of a federal funds rate cut in September and are fully confident of two acts of monetary expansion before the end of the year. Their projections are confirmed by the revision of annual inflation expectations from the New York Federal Reserve Bank, from 3.2% to 3% in June. The indicator returned to the December-March anchor after jumping to 3.3% in April.

Inflation expectations in the US

Source: Bloomberg.

Consolidating inflation expectations is one of the arguments for the Fed’s policy easing. Even though employment in May exceeded forecasts, the minutes of the last FOMC meeting suggest those data require revisions due to high immigration. Indeed, the data for April-May was adjusted downward by 110 thousand.

Things are developing precisely as the Fed wants: the US economy is slowing down but not falling off a cliff, the labor market is cooling but not freezing, and inflation is confidently moving towards the target. Now is the time to prepare investors for the September federal funds rate cut. If Jerome Powell does it in front of Congress, the EURUSD will continue its march to the North.

Weekly trading plan for EURUSD

The environment does look ideal for the rally to continue, but something could go wrong at any moment. The left-wing may form a government in France and confront the EU, the Fed Chair may continue talking about patience, and Joe Biden may stop fighting for the US presidency. Anything is possible, so the best way is to stay calm and wait for Jerome Powell to speak.

In the meanwhile, hold the EURUSD longs opened at 1.071-1.072.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.