After reaching its highest point since July 2023, the EURUSD pair experienced a significant decline. Foreign exchange markets began to speculate about a renewed surge in US inflation and expressed skepticism about the efficacy of China’s economic stimulus measures. Let’s discuss these topics and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Market optimism over China’s stimulus is fading.

- Investors are starting to speculate about a surge in US inflation.

- The slower monetary expansion of the Fed will strengthen the US dollar.

- If the EURUSD pair falls below 1.111, the sell-off will likely intensify.

Weekly fundamental forecast for euro

The market reaction to the Chinese monetary stimulus and the return of reflationary fears to the US Treasury bond market has resulted in a loss of momentum for EURUSD bulls. The major currency pair reached its highest level since July 2023 but failed to maintain above 1.12. Investors are digesting information about China’s monetary policy and fear that aggressive easing of the Federal Reserve’s monetary policy amid a strong US economy may spur inflation.

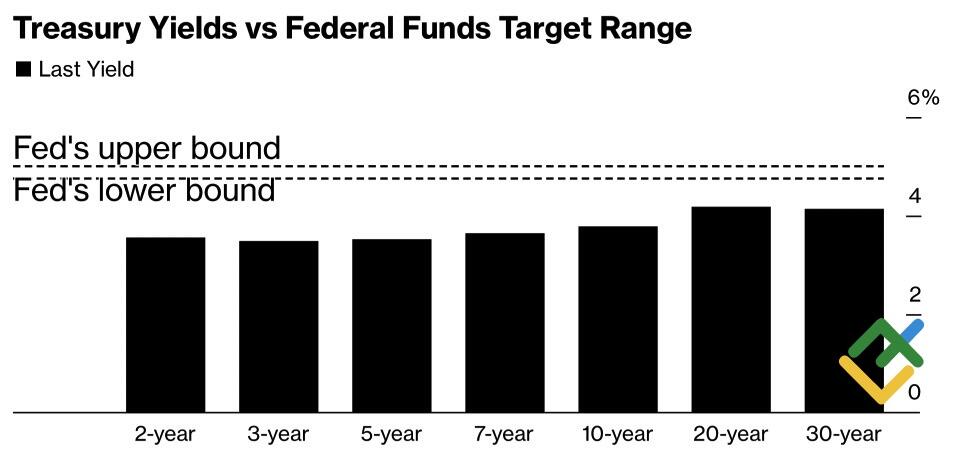

US Treasury yields have risen in five of the last seven trading sessions. This is partly due to new auctions. The initial offering of $70 billion in 5-year securities marked the lowest rates since April 2023. It is expected that similar results will be seen for 7-year securities.

US Treasury yields and federal funds rate

Source: Bloomberg.

Investors are continuing to secure gains on their long positions in the US Treasury bonds. Should the US economy remain robust and the Fed take proactive measures to forestall a cooling of the labor market, the risk of accelerating inflation will increase. This could result in a slower pace of monetary expansion than anticipated and a stronger US dollar. As a result, the EURUSD pair failed to consolidate above 1.12.

Following the measures announced by the People’s Bank of China, market sentiment has become more cautious. ANZ notes that the recently announced 1-2 trillion yuan monetary stimulus package is a significant departure from the measures taken by Beijing in 2009. At that time, the figure under discussion was 14 trillion yuan. The current support measures are unlikely to have a significant impact. It is also important to consider the delayed effect of monetary expansion. It will not have an immediate impact; it will take time for the economy to recover.

The recent market optimism regarding China seems to be excessive. Furthermore, concerns about a possible surge in US inflation are prompting investors to seek the security of the US dollar. The time lag between significant interest rate reductions by central banks and global economic recovery raises questions about the viability of purchasing procyclical currencies. Despite this, the OECD remains optimistic, raising its global GDP growth forecast to 3.2%, an increase from its May estimate of 3.1%, and a significant improvement on the 2.7% forecast at the end of 2023. The organization believes that lower interest rates, lower oil prices, and higher real wages will reinforce the global economy.

Global economic performance

Source: Bloomberg.

Weekly trading plan for EURUSD

Analysts anticipate a deceleration in US GDP growth from 2.6% to 1.6% in 2025, while its European counterpart is expected to accelerate from 0.7% to 1.3%. The Fed will reduce the federal funds rate from 5% to 3.5%, while the European Central Bank will lower its rate from 3.5% to 2.25%. These figures indicate that the EURUSD pair’s uptrend is resilient. However, there is a difference between plans and their realization. Only the statistics on the US labor market for September will help determine the direction for the pair’s quotes. Currently, there is a growing likelihood of short-term consolidation, and a fall of the euro below 1.111 could lead to new sales.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.