The July ECB meeting caused a certain level of lethargy in the markets, but the September meeting may inject a renewed sense of activity. Christine Lagarde hinted at this, and the markets responded accordingly. The pace of monetary expansion by the Fed and the ECB has slowed. How will this affect the EURUSD pair? Let’s discuss this topic and then make a trading plan.

The article covers the following subjects:

Highlights and key points

- The ECB is worried about the economy and believes in disinflation.

- The regulator has kept the door open for a September rate cut.

- Christine Lagarde’s dovish rhetoric has harmed the EURUSD.

- The pair is starting to plunge to the lower boundary of the consolidation range.

- The euro risks falling to 1.086, 1.0845, and 1.082.

Weekly fundamental forecast for euro

It is human nature to seek information that aligns with our beliefs and expectations. It would appear that Christine Lagarde did not offer any new insights. She did not indicate a loosening of the ECB’s monetary policy at the next meetings but did suggest that the September meeting could be a “lively” one. She acknowledged the fragility of the European economy, but the “long-term” was no longer included in her speech. She touched upon high services inflation, but stated that it was the result of temporary factors and that the disinflationary process was ongoing. Consequently, the EURUSD pair declined below 1.09.

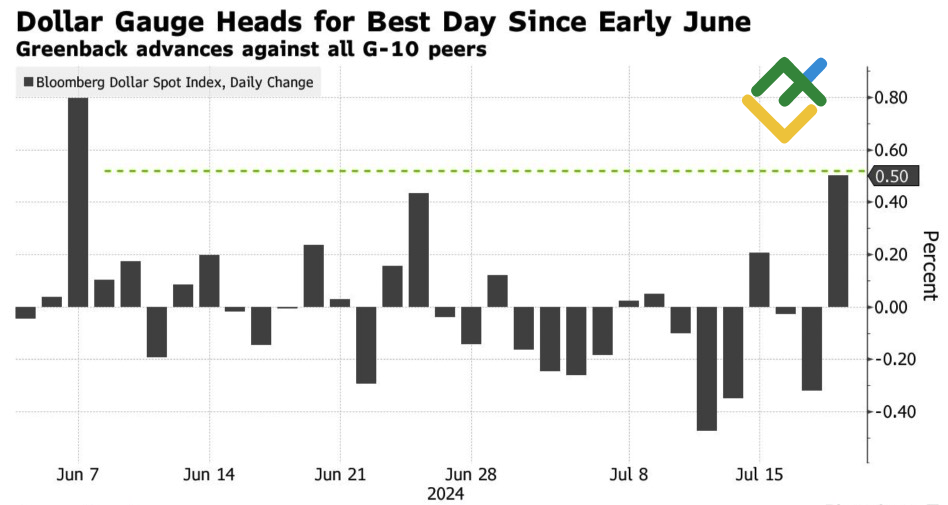

Despite the absence of signals that the monetary expansion cycle will resume in September, the dovish sentiment was evident. Governing Council officials are expressing concern about the fragile state of the currency bloc’s economy and are seeking more inflation data. They are maintaining the possibility of a quarterly deposit rate cut, which has become a significant obstacle to the EURUSD. The pair’s quotes declined significantly, allowing the US dollar to showcase its strongest daily performance since early June.

USDX performance

Source: Bloomberg.

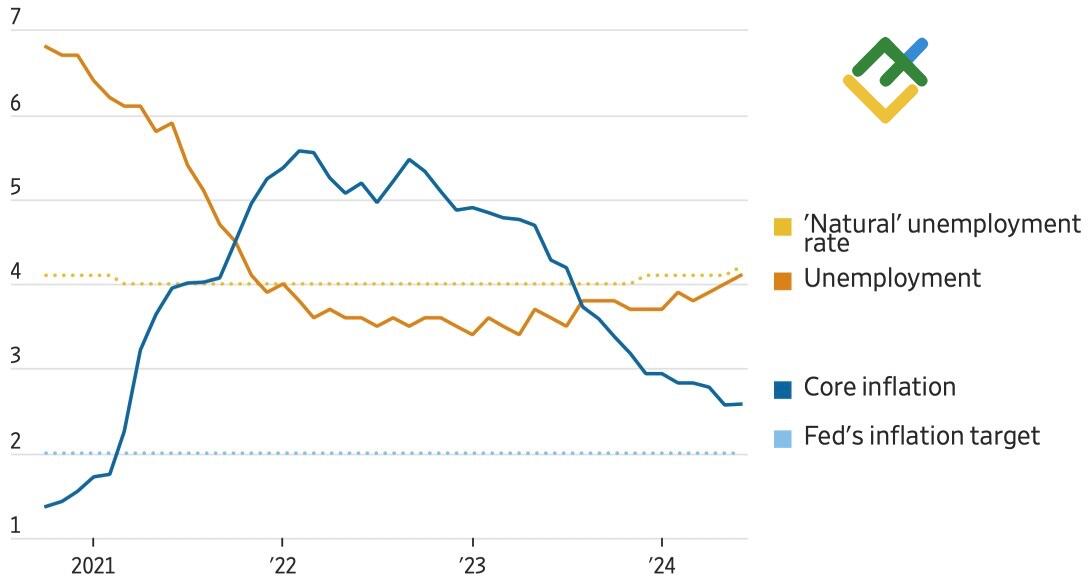

The Governing Council has unanimously decided to maintain the deposit rate at 3.75%, according to Christine Lagarde. The data dependence of ECB policy was also a key topic of discussion. The Fed has also maintained similar stance. However, given the recent decline in US inflation to 2.6% from 4.3%, the sharpest since 1984, and the rise in unemployment to 4.1% from 3.6% that could signal recession, a rate cut could be imminent. Goldman Sachs anticipates a rate reduction as early as July.

US unemployment and inflation

Source: Bloomberg.

In contrast, the majority of FOMC officials maintain that it is premature to take action at this time and that further data should be awaited. One exception is Chicago Fed President Austan Goolsbee. He acknowledges the increasing risks associated with a cooling US labor market and believes that the current monetary policy is too restrictive in light of slowing inflation.

Unfortunately, the markets are inclined to heed the guidance of Jerome Powell, John Williams, and Mary Daly, among other Fed officials, who have reassured investors that borrowing costs would not be adjusted until September. This is a positive development. Futures market data indicates a 96% likelihood of the first month of fall, while the probability of ECB monetary expansion in September is 80%.

Weekly trading plan for EURUSD

Therefore, the pace of the Federal Reserve’s and the European Central Bank’s monetary policies has stabilized, which has eliminated EURUSD‘s primary advantage. The major currency pair is at risk of transitioning from a trending phase to a consolidation phase and will likely seek the lower boundary of the trading range in the near term. It would be prudent to buy the euro once the pair rebounds from the support levels of 1.086, 1.0845, and 1.082.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.