The New Popular Front and Renaissance managed to keep the right-wing out of power, and Macron’s party looked better than in the first round. The EURUSD pair faced a roller coaster ride. Meanwhile, the market turned its focus to the US data. Let’s discuss this topic and make a trading plan.

Highlights and key points

- The French election results left a gap in the EURUSD pair.

- The gap was quickly closed as the market digested the data.

- The labor market signaled a cooling of the US economy.

- Whether the euro reaches 1.09 and 1.0945 will depend on inflation.

Weekly fundamental forecast for euro

As a rule, markets shoot first and ask questions later That is why the victory of the New Popular Front in the French parliamentary elections was seen as a defeat for the euro. The leftists insist on lowering the retirement age from 64 to 60, increasing civil servants’ salaries, and reviving the wealth tax. Their program would require an additional €250 billion by 2027. Against this backdrop, the EURUSD pair opened the week with a gap down. However, it was quickly closed. In fact, the devil is not so black as he is painted.

Although France got a hung parliament, and the New Popular Front and its allies, who won about 178 seats in it, are demanding the realization of their own ideas, there is some good news.

The National Rally failed to achieve a majority of 289 of the 577 seats in the National Assembly due to the unity of its opponents. Moreover, the right-wing slipped to third place. Their result is 143. This is less than the Renaissance with its 156 seats. The centrists have taken stronger positions, allowing Emmanuel Macron to form a broad coalition that the markets will welcome. Unsurprisingly, the spread of French and German bond yields narrowed, and EURUSD quickly closed the morning gap.

France-Germany bond yield spread

Source: Bloomberg.

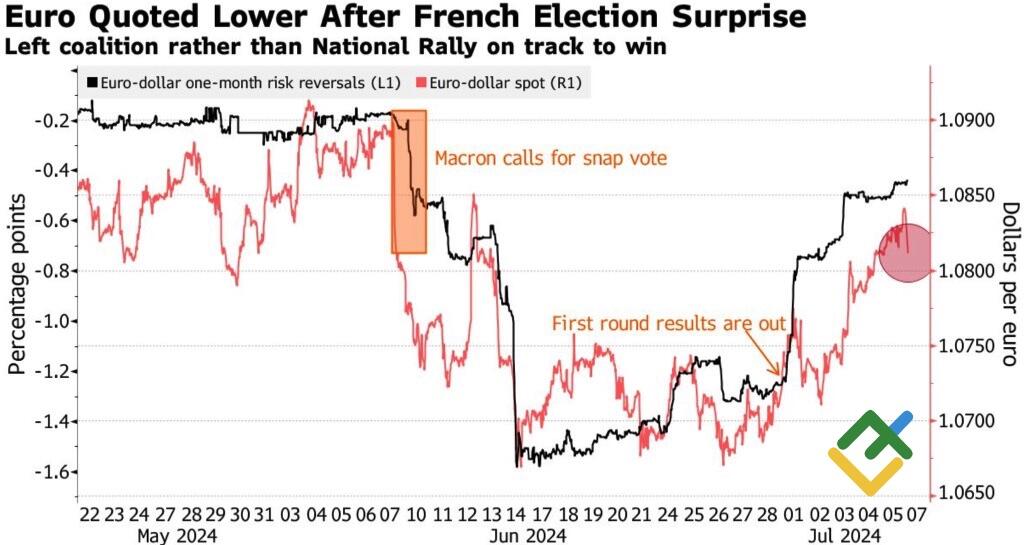

The stabilization of the political situation in Europe is also evidenced by the exit of EUR reversal risks to a plateau. This allows us to say that the drama in France is fading, and the EURUSD pair is no longer under pressure. The major currency pair needs to look for other drivers on the other side of the Atlantic Ocean.

EURUSD performance and risk reversals

Source: Bloomberg.

The US employment data rose by 209K in June, more than expected, but the April and May data was revised by 110K. Average wages rose by 3.9%, the smallest pace in three years, and unemployment has risen by 0.4pp to 4.1% in the last three months. According to the Sahm rule, if an indicator rises by 0.5pp or more from bottom levels during such a period, the US is slipping into recession.

The US economy is clearly cooling, intensifying the FOMC doves’ attacks and leading to a cut in the federal funds rate. The Fed will unlikely loosen monetary policy in July, but it is high time for the central bank to start signaling its start in September. The futures market estimates the chances of the monetary expansion starting in the first month of the fall at 76%.

Weekly trading plan for EURUSD

Thus, the factors of the French parliamentary elections and the cooling of the US labor market have already been priced in EURUSD quotes. A slowdown in June inflation is required to continue the rally towards 1.09 and 1.0945. Otherwise, the pair risks starting to consolidate near the current levels. Against this backdrop, keep your long trades initiated at 1.071-1.072 open.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.