The ranks of the doves at the European Central Bank are growing on the back of negative signals from the eurozone, which may provoke a large deposit rate by 50 basis points in December and sink EURUSD. Let’s discuss it and make a trading plan.

The article covers the following subjects:

Highlights and key points

- An insider claims that the ECB plans to make a decisive rate cut.

- Investors continue to hedge Trump-related risks.

- The Fed may pause its monetary expansion cycle in December.

- EURUSD’s return to 1.0805 may trigger a pullback.

Weekly fundamental forecast for euro

Almost two years have passed since the energy crisis, but the eurozone economy continues to stagnate. Unsurprisingly, the Governing Council is concerned that the ECB may be too late in easing monetary policy. This could lead to a faster and sharper rate cut. The rumors spread by Reuters insider pushed EURUSD quotes to their lowest levels since early July.

The ECB’s army of doves is growing. According to Governor of the Bank of Italy Fabio Panetta, inflation will anchor near 2% much earlier than the end of 2025 expected by the ECB. Governor of the Bank of Portugal Mário Centeno has warned that the deposit rate may be cut by 50 bp at the December meeting. Even the hawkish Governor of Austria’s central bank, Robert Holzmann, does not rule out a significant move, though he prefers a more modest 25 basis point cut.

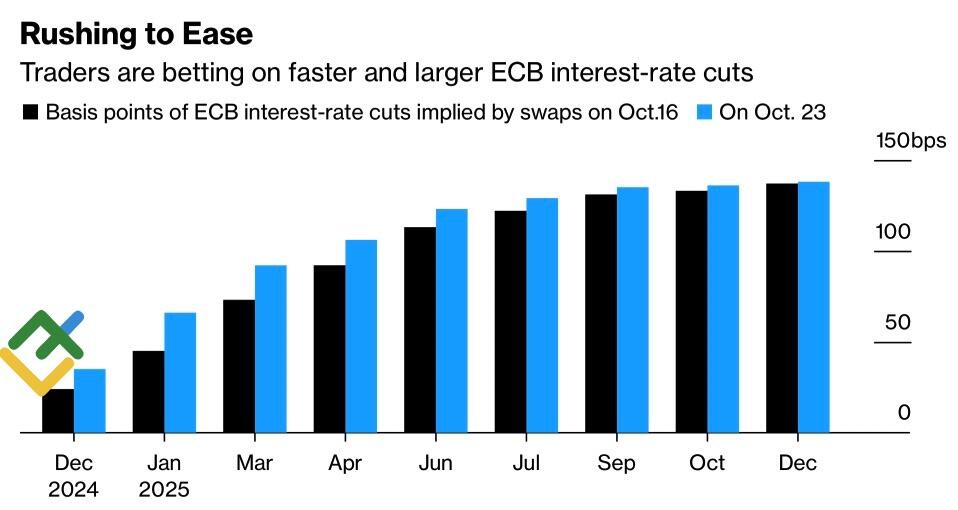

The derivatives market forecasts a quarter-point cut at each Governing Council meeting until June, which is 20 basis points more than what is expected from the Fed during this period. Unsurprisingly, the EURUSD is going downhill.

Market expectations for Fed rates

Source: Bloomberg.

Unlike the stagnating eurozone, the US economy continues to deliver pleasant surprises, causing investors to revise their expectations for the federal funds rate’s trajectory. A month ago, they predicted a fall by 65 bps by the end of 2024; now, that expectation has fallen to 40 bps. No one will be surprised if the Fed pauses its monetary expansion cycle in December.

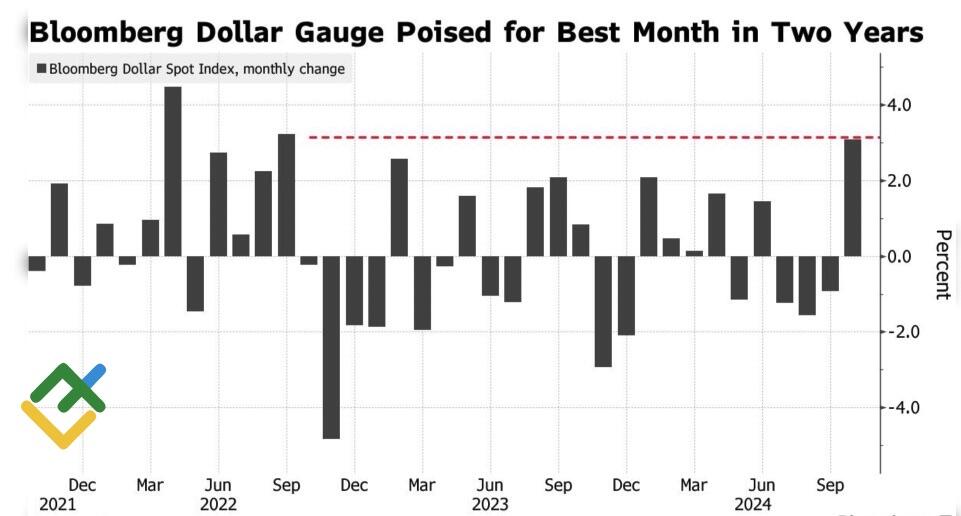

The Trump trade also supports the US dollar, which is set to post its best monthly performance in two years. If you haven’t hedged against the risks of Donald Trump’s new presidency, you should. The rally in the USD index reflects the belief that US assets are relatively safer than others amid concerns of market turmoil if the Republican is re-elected as president.

USD index’s monthly trends

Source: Bloomberg.

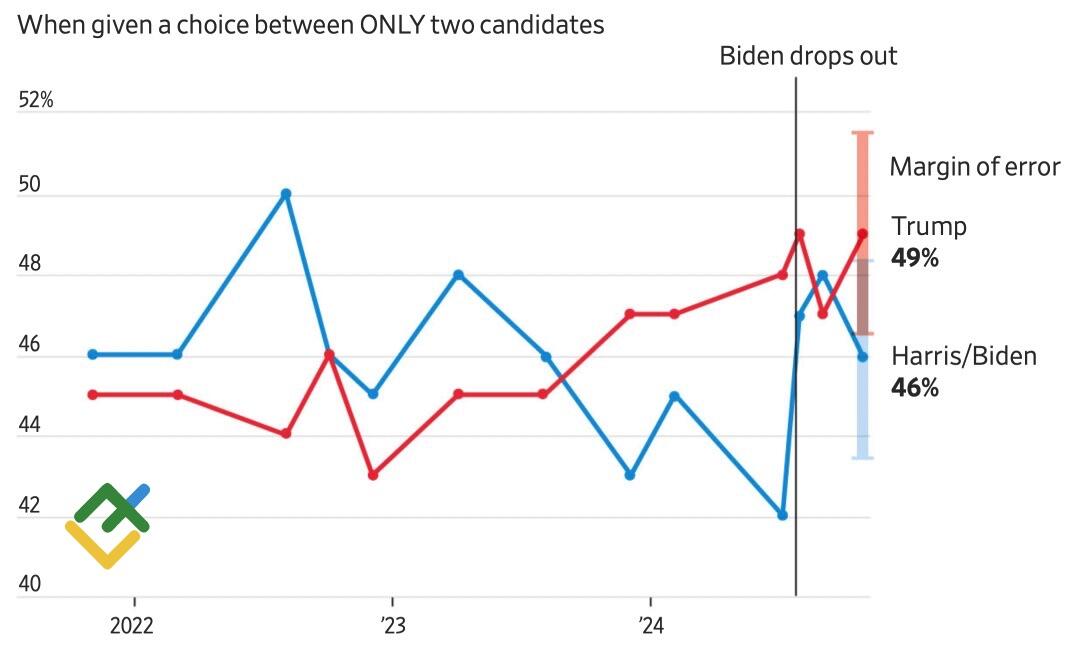

This scenario becomes more and more likely. According to the latest Wall Street Journal poll, Donald Trump is leading Kamala Harris by two percentage points – 47% versus 45%. In August, the Democrat was ahead by the same two points. A Financial Times poll showed that the former president has outrun the vice president for the first time in terms of economic management, with 44% of Americans trusting him, compared to 43% for Kamala Harris.

US candidates rating

Source: Wall Street Journal.

Weekly trading plan for EURUSD

Thus, the different views of the Fed and the ECB on monetary policy, as well as the Trump trade, continue to push EURUSD down. Only stronger-than-expected business activity in the eurozone can lend a helping hand to the euro. A successful test of resistance at 1.0805 could become a signal to close shorts. Will the bears rely on it?

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.