The EURJPY currency pair has long piqued traders’ interest due to its high volatility and sensitivity to market fluctuations. As two of the most widely traded currencies globally, the Japanese yen and the euro are closely tied to various economic factors that influence their exchange rates.

When analyzing EURJPY quotes, it is crucial to consider several factors such as interest rates, European and Japanese macroeconomic indicators, as well as investor sentiment in global markets. This article reviews expert forecasts and offers fundamental and technical analyses, aiming to clarify the potential trajectory of the EURJPY exchange rate in the coming years.

The article covers the following subjects:

Major Takeaways

- The current price of the pair is ¥163.248 as of 19.03.2025.

- The EURJPY pair reached its all-time high of ¥175.422 on 2024-07-11. Its all-time low of ¥88.87 was recorded on 2000-10-26.

- The EURJPY pair is one of the most volatile currency pairs. Its performance depends on the policies of the European Central Bank and the Bank of Japan.

- The main factors influencing the EURJPY price include interest rates, economic reports from Europe and Japan, and global risk appetite.

- The pair is most actively traded during the European and Asian trading sessions.

- The EURJPY pair is sensitive to changes in stock markets and investor preferences.

- The pair is considered attractive for traders targeting volatility and short-term positions.

- The EURJPY pair is often used in the carry trade strategy due to the interest rate differential between the euro and the yen.

EURJPY Real-Time Market Status

The EURJPY currency pair is trading at ¥163.248 as of 19.03.2025.

When analyzing the EURJPY pair, it is essential to monitor the European Central Bank’s interest rate and the Eurozone’s core consumer price index. Besides, it is vital to take into account all-time lows and all-time highs. Additionally, technical analysis recommendations help identify the best moments to buy or sell the EURJPY pair.

|

Metric |

Value |

|

ECB interest rate |

2.65% |

|

Core consumer price index |

0.6% |

|

All-time low |

¥88.87 |

|

All-time high |

¥175.422 |

|

52-week range |

154.4–175.95 |

|

Price change over the last 12 months |

-0.35% |

|

Technical analysis recommendation |

Strong Buy |

EURJPY Price Forecast for 2025 Based on Technical Analysis

The weekly EURJPY chart shows an ascending channel, meaning the price is expected to advance steadily. Support and resistance levels are located at 156 and 173, respectively.

The EMA and SMA are below the current price at 160.46 and 160.16, respectively, signaling the continuation of the uptrend. The RSI is at 50.6, suggesting the asset is poised for further gains. Additionally, the MACD indicator displays a positive signal: the green histogram points to the strengthening of the upward momentum.

The Bollinger Bands are widening, confirming the spike in volatility. Thus, the price may reach the 165.86 level. If the asset breaks through the channel’s upper boundary of 172–173, which is the key resistance, the pair may climb to 178. The support level is established at 156.52–160.00. Consider long trades during corrections near this zone. The EMA and SMA lines act as additional supports. In this connection, one may consider long trades near these levels.

The table below shows the EURJPY price forecast until the end of 2025.

|

Month |

Minimum, ¥ |

Maximum, ¥ |

|

April |

164 |

175 |

|

May |

167 |

175.3 |

|

June |

165.4 |

171.2 |

|

July |

168 |

176 |

|

August |

165.8 |

173.5 |

|

September |

167.2 |

176.5 |

|

October |

168.5 |

175.4 |

|

November |

166.7 |

173.4 |

|

December |

163.2 |

170.9 |

Long-Term Trading Plan for EURJPY for 2025

Let’s make a long-term trading plan for the EURJPY pair based on the technical analysis performed. The primary strategy is to open long trades during corrections near the lower boundary of the channel.

Potential long entry points are near the support levels of 160.50 and 156.50. Before entering a trade, wait for confirmation signals, such as a price rebound from support and a bullish crossover of the EMA and SMA. Additional confirmation includes the RSI rising above 50 and the growth of the MACD histogram.

Target levels for profit-taking are near the upper boundary of the channel at 170.00 and 175.00. A stop-loss order can be set at 154–155. It is advisable to enter trades only after the price bounces off the support with the confirmation of technical indicators. This approach will help mitigate risks effectively.

Analysts’ EURJPY Price Projections for 2025

Analyzing expert predictions for the EURJPY currency pair in 2025 can help you make more informed trading decisions. Most analysts anticipate that the exchange rate will increase.

LongForecast

Price range: ¥152–¥178 (as of 16.03.2025).

LongForecast expects moderate volatility in the EURJPY pair throughout 2025 with gradual rate appreciation. Analysts forecast that the pair will reach ¥176 in July before declining to around ¥163 by year’s end.

|

Month |

Open, ¥ |

Min–Max, ¥ |

Close, ¥ |

|

March |

156 |

152–173 |

170 |

|

April |

170 |

164–178 |

175 |

|

May |

175 |

167–175 |

170 |

|

June |

170 |

165–171 |

168 |

|

July |

168 |

168–176 |

173 |

|

August |

173 |

165–173 |

168 |

|

September |

168 |

168–176 |

173 |

|

October |

173 |

168–174 |

171 |

|

November |

171 |

167–173 |

170 |

|

December |

170 |

163–170 |

165 |

PandaForecast

Price range: ¥158.2280–¥169.6150 (as of 16.03.2025).

PandaForecast predicts the average price to range between ¥159.10 and ¥166.57. The largest surge is anticipated in the second quarter, with the highest price of ¥169.61 in June. Afterward, the rate may stabilize near ¥162–¥164 with minimal fluctuations in the following months.

|

Month |

Average, ¥ |

Minimum, ¥ |

Maximum, ¥ |

|

April |

162.041 |

160.525 |

165.036 |

|

May |

165.386 |

162.925 |

167.847 |

|

June |

166.577 |

165.577 |

169.615 |

|

July |

162.939 |

159.81 |

164.894 |

|

August |

159.106 |

158.228 |

161.665 |

|

September |

162.123 |

160.722 |

164.302 |

|

October |

162.784 |

161.378 |

165.011 |

|

November |

161.964 |

160.059 |

164.918 |

|

December |

162.508 |

160.363 |

164.731 |

Walletinvestor

Price range: ¥162.752–¥170.515 (as of 16.03.2025).

Walletinvestor forecasts a solid uptrend for the EURJPY pair, expecting the highest price of ¥170.515 in December.

|

Month |

Open, ¥ |

Close, ¥ |

Minimum, ¥ |

Maximum, ¥ |

|

April |

162.752 |

164.738 |

162.752 |

164.738 |

|

May |

164.722 |

165.442 |

164.578 |

165.442 |

|

June |

165.492 |

166.593 |

165.492 |

166.593 |

|

July |

166.616 |

166.784 |

166.616 |

166.997 |

|

August |

166.749 |

166.685 |

166.462 |

166.749 |

|

September |

166.724 |

167.561 |

166.724 |

167.561 |

|

October |

167.601 |

168.314 |

167.586 |

168.314 |

|

November |

168.368 |

168.903 |

168.365 |

168.903 |

|

December |

168.957 |

170.49 |

168.957 |

170.515 |

Analysts’ EURJPY Price Projections for 2026

According to forecasts for 2026, the EURJPY pair will gradually strengthen. However, volatility will remain high.

LongForecast

Price range: ¥164–¥186 (as of 16.03.2025).

LongForecast expects a moderate uptick in the EURJPY pair during 2026. The price is projected to hit a high of ¥186 in November.

|

Month |

Open, ¥ |

Min–Max, ¥ |

Close, ¥ |

|

January |

165 |

164–170 |

167 |

|

June |

179 |

179–186 |

183 |

|

December |

184 |

180–186 |

183 |

PandaForecast

Price range: ¥156.157–¥166.55 (as of 16.03.2025).

According to PandaForecast, the pair’s exchange rate will trade in a narrow range of ¥156.157–¥166.55. The price is expected to reach yearly lows in spring. After that, the pair will recover and hit a high of ¥166.55 in November. At the end of the year, the average price will stand at ¥160.29.

|

Month |

Average, ¥ |

Minimum, ¥ |

Maximum, ¥ |

|

January |

160.012 |

158.706 |

161.587 |

|

June |

157.48 |

156.157 |

159.218 |

|

December |

160.29 |

158.558 |

161.598 |

Walletinvestor

Price range: ¥169.547–¥181.875 (as of 16.03.2025).

Walletinvestor forecasts that the EURJPY rate will climb consistently, hitting a high of ¥181.875 in December. This steady uptrend marks the most optimistic outlook, indicating a strong likelihood for the euro to appreciate.

|

Month |

Open, ¥ |

Close, ¥ |

Minimum, ¥ |

Maximum, ¥ |

|

January |

170.442 |

169.845 |

169.547 |

170.442 |

|

June |

176.84 |

177.951 |

176.84 |

177.951 |

|

December |

180.308 |

181.835 |

180.308 |

181.875 |

Analysts’ EURJPY Price Projections for 2027

Forecasts for the EURJPY pair in 2027 help traders predict the trend direction and optimal points for opening trades. The majority of analysts expect the uptrend to persist.

LongForecast

Price range: ¥183–¥205 (as of 16.03.2025).

LongForecast projects the EURJPY pair to surge to a high of ¥205 in November. A correction is expected in December, with the year closing at ¥196.

|

Month |

Open, ¥ |

Min–Max, ¥ |

Close, ¥ |

|

January |

183 |

183–191 |

188 |

|

June |

196 |

194–200 |

197 |

|

December |

202 |

193–202 |

196 |

PandaForecast

Price range: ¥160.2310–¥169.6760 (as of 16.03.2025).

Analysts at PandaForecast offer a more conservative outlook. The pair is expected to trade in a range of ¥160.23–¥169.67. The forecast indicates moderate volatility, with the price stabilizing at ¥166.12 in December. Experts predict that the asset will ascend gradually with minor corrections.

|

Month |

Average, ¥ |

Minimum, ¥ |

Maximum, ¥ |

|

January |

162.059 |

160.231 |

163.771 |

|

June |

165.575 |

164.542 |

168.635 |

|

December |

165.018 |

163.631 |

166.127 |

Walletinvestor

Price range: ¥180.903–¥193.248 (as of 16.03.2025).

Walletinvestor provides the most optimistic forecast. The pair will progressively climb from ¥181.80 at the beginning of the year to ¥193.19 in December.

|

Month |

Open, ¥ |

Close, ¥ |

Minimum, ¥ |

Maximum, ¥ |

|

January |

181.804 |

181.16 |

180.903 |

181.804 |

|

June |

188.182 |

189.339 |

188.182 |

189.339 |

|

December |

191.689 |

193.195 |

191.689 |

193.248 |

Analysts’ EURJPY Price Projections for 2028

Analysts expect that the EURJPY pair will continue rising. Further strengthening of the euro is predicted.

LongForecast

Price range: ¥196–¥214 (as of 16.03.2025).

LongForecast anticipates a modest uptrend throughout the year, with the highest price of ¥214 in July. In December, the rate is expected to consolidate at ¥205.

|

Month |

Open, ¥ |

Min–Max, ¥ |

Close, ¥ |

|

January |

196 |

196–205 |

202 |

|

June |

210 |

204–210 |

207 |

|

December |

208 |

202–208 |

205 |

Walletinvestor

Price range: ¥192.256–¥204.608 (as of 16.03.2025).

Walletinvestor foresees sustained gains for the EURJPY pair. The rate will start the year at ¥193.195, surging to ¥204.608 by December.

|

Month |

Open, ¥ |

Close, ¥ |

Minimum, ¥ |

Maximum, ¥ |

|

January |

193.195 |

192.516 |

192.256 |

193.195 |

|

June |

199.615 |

200.687 |

199.615 |

200.687 |

|

December |

203.057 |

204.53 |

203.057 |

204.608 |

Analysts’ EURJPY Price Projections for 2029

Expert forecasts for the EURJPY exchange rate in 2029 are mixed. Some analysts expect a bullish trend, while others anticipate a slight price drop.

СoinСodex

Price range: ¥171.39–¥186.7 (as of 16.03.2025).

СoinСodex anticipates moderate fluctuations in the EURJPY pair in 2029 with a gradual plunge. The average price will range from ¥185.22 in January to ¥174.62 in December.

|

Month |

Minimum, ¥ |

Average, ¥ |

Maximum, ¥ |

|

January |

182.31 |

185.22 |

186.7 |

|

June |

173.8 |

175.88 |

178.1 |

|

December |

171.89 |

174.62 |

176.65 |

Walletinvestor

Price range: ¥203.617–¥215.961 (as of 16.03.2025).

Walletinvestor, on the contrary, expects the EURJPY pair to skyrocket in 2029. According to the analysis, the price will open at ¥204.509 in January and close at ¥215.904 in December.

|

Month |

Open, ¥ |

Close, ¥ |

Minimum, ¥ |

Maximum, ¥ |

|

January |

204.509 |

203.95 |

203.617 |

204.509 |

|

June |

210.949 |

212.066 |

210.949 |

212.066 |

|

December |

214.43 |

215.904 |

214.43 |

215.961 |

Analysts’ EURJPY Price Projections for 2030

The forecasts for the EURJPY pair in 2030 are also varied. Some analysts expect the exchange rate to decrease.

СoinСodex

Price range: ¥164.32–¥171.98 (as of 16.03.2025).

СoinСodex expects the EURJPY pair to slide gradually during 2030. By December, the average price is predicted to fall to ¥165.96. According to the forecast, the pair’s depreciation will be caused by the stabilization of the Japanese economy.

|

Month |

Minimum, ¥ |

Average, ¥ |

Maximum, ¥ |

|

January |

166.82 |

170.28 |

171.98 |

|

June |

165.53 |

167.05 |

168.32 |

|

December |

164.32 |

165.96 |

167.63 |

TradersUnion

Price range: ¥197.28–¥206.92 (as of 16.03.2025).

TradersUnion forecasts the EURJPY pair to reach ¥206.92 in mid-2030 but then decline to ¥197.28 by the end of the year due to the improving economic situation in Japan.

|

Year |

Mid-Year, ¥ |

Year-End, ¥ |

|

2030 |

206.92 |

197.28 |

Analysts’ EURJPY Price Projections until 2050

Long-term forecasts for the EURJPY exchange rate until 2050 are uncommon among analysts because of uncertainty. Over such an extended time frame, various geopolitical events, shifts in central banks’ monetary policies, as well as crises and structural changes in the global economy may occur. It is virtually impossible to predict all these events for decades ahead, as economic and political conditions are constantly changing.

Apart from macroeconomic factors, it is crucial to consider structural shifts in financial markets and the potential upgrades to international settlement systems. All these factors make any forecasts for the period up to 2050 highly inaccurate.

Consequently, investors should approach such long-term forecasts with caution, treating them merely as a general guideline. Short- and medium-term forecasts that factor in current market trends and economic indicators are considered more reliable.

Market Sentiment for EURJPY on Social Media

Market sentiment on social media greatly influences forecasts for the EURJPY pair. Analyzing media sentiment helps reveal how the market perceives the asset.

For instance, user Yankee highlights how straightforward it is to trade the EURJPY pair, largely due to its liquidity and the application of ICT concepts.

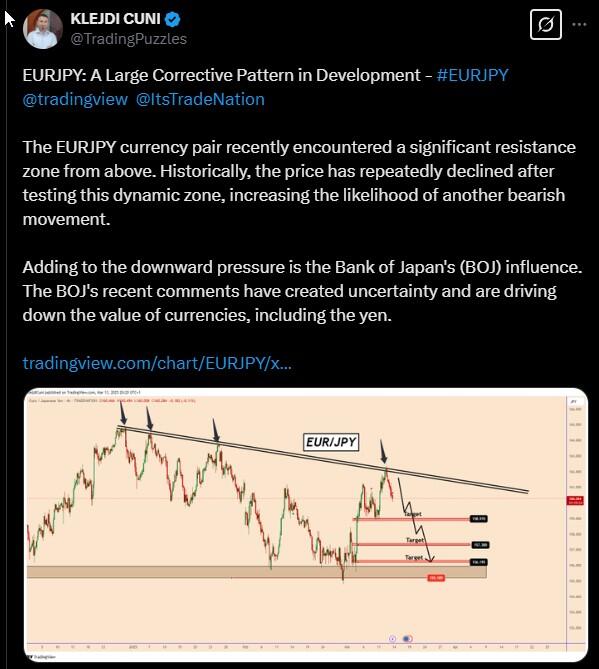

In contrast, trader KLEJDI CUNI mentions that the pair is forming a major corrective pattern and strong resistance. This indicates a possible slump. Moreover, the user emphasizes that the further movement of the pair will depend on the Bank of Japan’s policy.

Thus, the sentiment regarding the EURJPY pair on social media is currently mixed. Investors focus on technical analysis signals while also considering fundamental factors, such as the regulators’ policy. This uncertainty may lead to an increase in the volatility of the pair. Therefore, it is essential to approach trading with caution.

EURJPY Price History

The EURJPY pair reached its all-time high of 175.422 JPY on 2024-07-11.

The lowest price of the EURJPY pair was recorded on 2000-10-26 when the pair declined to 88.87 JPY.

The chart below shows the EURJPY pair’s performance for the last ten years. It is crucial to evaluate historical data to make our forecasts as accurate as possible.

The EURJPY price history reflects the economic ties between the Eurozone and Japan, as well as key events impacting both currencies. Before the euro’s introduction in 1999, the German mark/yen pair was commonly used. In the 1980s, the pair surged above ¥260, driven by robust economic growth in Europe and a weaker yen. However, in the 1990s, the pair plummeted sharply amid Japan’s economic crisis and the European recession.

After the euro’s introduction, the EURJPY pair experienced high volatility, with sharp fluctuations during the 2008 and 2012 financial crises. The COVID-19 pandemic sparked another wave of volatility. However, the pair rebounded in the following years, driven by the ECB’s policy tightening and the Bank of Japan’s persistently loose monetary stance.

EURJPY Price Fundamental Analysis

Fundamental analysis of the EURJPY rate sheds light on the key factors influencing the movement of this currency pair. This approach helps identify the price direction more precisely, uncover potential risks, and create more accurate forecasts for the EURJPY pair.

What Factors Affect the EURJPY Price?

- Central banks’ policies. The decisions made by the ECB and BoJ regarding interest rates and quantitative easing play a crucial role in shaping the investment demand for currencies.

- Economic growth. The exchange rate is closely linked to GDP, employment, and business activity in manufacturing and services, as investors tend to favor the currencies of countries with strong and stable economies.

- Inflation. Rising inflation influences central banks’ decisions regarding interest rates, which in turn affects the exchange rate of currency pairs. Typically, when inflation increases, central banks tighten their policies, leading to a stronger national currency.

- Balance of trade. The trade surplus or deficit in the Eurozone and Japan directly impacts the demand for the euro and the yen.

- Geopolitical events. Various conflicts, political instability, and economic sanctions may lead to a surge of volatility in the currency markets and change investors’ preferences.

More Facts About EURJPY

The EURJPY currency pair represents the value of the euro against the Japanese yen. The euro was launched in January 2002, although it officially appeared in 1999, when it began trading on foreign exchange markets. The Japanese yen is one of the world’s oldest currencies, having been used since 1871. The EURJPY pair is actively traded on Forex and is quite popular among traders owing to its high volatility and liquidity.

This pair is used in various trading strategies, from short-term scalping to long-term investing. The asset is sensitive to changes in the macroeconomic indicators of the EU and Japan. Traders use the pair to hedge risks and utilize it in carry trade strategies. Besides, the pair reflects the demand for risky assets and safe trading instruments.

Advantages and Disadvantages of Investing in EURJPY

Investing in the EURJPY pair can be profitable thanks to its considerable volatility and liquidity. Nevertheless, it is crucial to keep in mind the associated risks that come with trading this pair.

Advantages

- High volatility. The increased volatility of the EURJPY pair allows traders to profit from both short-term and long-term trades.

- Good liquidity. The high trading volume of the EURJPY pair ensures low spreads and prompt execution of trades.

- Sensitivity to news. The asset quickly reacts to the release of important economic reports and Japanese and EU central banks’ decisions.

- Analysis availability. A large number of analysis materials and forecasts help traders to create balanced strategies.

- Popularity among traders. The EURJPY pair is widely favored by investors and is actively traded on all major trading platforms.

Disadvantages

- High volatility risks. Frequent sharp movements of the EURJPY exchange rate can lead to significant losses, especially if a trader is not experienced enough or uses high leverage.

- Dependence on economic factors. The pair responds sharply to events in the Eurozone and Japan, which complicates long-term forecasts and requires constant monitoring of the global economic landscape.

- Sensitivity to market sentiment. The EURJPY pair hinges on investors’ risk appetite. This can lead to unpredictable fluctuations, often with no clear fundamental reasons.

- Influence of central banks’ decisions. Any unexpected statements or changes in the ECB and Bank of Japan’s policies can significantly affect the pair’s rate. This makes forecasting more difficult and increases the risks of sudden losses.

How We Make Forecasts

We make forecasts for the EURJPY pair using a multi-faceted approach, which allows us to obtain accurate and reliable results.

Short-term forecasts cover periods of up to a month and are based on technical analysis. We analyze charts and use the RSI, MACD, moving averages, Bollinger Bands, and key support and resistance levels.

Medium-term forecasts (from a month to a year) rely on fundamental analysis. Decisions of the European Central Bank and the Bank of Japan, inflation, employment and interest rate changes are studied.

Long-term forecasts (a year or more) include analyzing geopolitical events, changes in countries’ trade policies, global economic trends, and general financial market conditions. Investor sentiment and macroeconomic indicators are also monitored.

Conclusion: Is EURJPY a Good Investment?

The EURJPY pair is an attractive investment opportunity due to its high volatility and liquidity. However, investors should take into account macroeconomic and geopolitical factors affecting the currency’s exchange rates. The central bank’s decisions, inflation expectations, the state of the EU and Japanese economies, as well as global risks can dramatically change the market situation and lead to increased volatility of the asset.

Besides, the EURJPY pair is an appealing option for short- and medium-term strategies. However, you should be cautious about long-term investments and use additional technical analysis tools before opening trades.

EURJPY Price Prediction FAQs

The currency pair is trading at ¥163.248 as of 19.03.2025.

Experts predict the EURJPY pair will trade between ¥152 and ¥178 in 2025. Analysts forecast a gradual rise in the exchange rate.

According to analysts, the EURJPY price will continue to climb from ¥156 to ¥186 in 2026. LongForecast offers the most optimistic outlook, suggesting the rate may hit ¥186.

The best time to trade the EURJPY pair is the intersection of European and Asian trading sessions. Trading activity tends to peak between 8:00 and 11:00 GMT when Japanese and European markets are open.

The highest volatility of the EURJPY pair is observed during the opening of European and Asian trading sessions. Significant rate fluctuations occur during the publication of key economic data from the EU and Japan.

The EURJPY exchange rate is influenced by the interest rate differential between the ECB and BoJ, inflation, macroeconomic indicators, unemployment rate, GDP, political stability in the Eurozone and Japan, as well as global demand for risky assets and safe-haven currencies.

The EURJPY pair may be affected by the ECB and BoJ’s meetings, the release of inflation and GDP data, monetary policy changes, and geopolitical developments.

The EURJPY pair shows a positive correlation with European stock indices and the EURUSD pair. In contrast, it tends to move negatively in relation to safe-haven assets like gold and the Japanese yen, which often gain strength during times of financial uncertainty and when investors are more risk-averse.

Forecasts for the EURJPY pair are based on the economic indicators of the Eurozone, whereas predictions for the USDJPY pair rely on key indicators of the US. Besides, the EURJPY pair is more influenced by the European economy, while the USDJPY rate is more affected by the US Fed and the Bank of Japan’s monetary policy decisions.

When forecasting the EURJPY price, several risks can arise, such as unexpected shifts in monetary policy, geopolitical tensions, and economic downturns. To effectively manage these risks, you can employ strategies like diversifying your investments, setting stop-loss orders, closely tracking economic news, and analyzing technical indicators on charts.

The difference in interest rates between the ECB and the Bank of Japan affects the appeal of currencies to investors. The higher the rate in the Eurozone compared to Japan, the stronger the euro against the Japanese yen, and vice versa.

Price chart of EURJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.