The EURINR currency pair reflects the value of the euro against the Indian rupee. The rate is influenced by macroeconomic factors, financial regulators’ policies, and global economic trends. The EURINR pair attracts both short-term traders and long-term investors, playing a pivotal role for companies engaged in international trade.

This article provides a comprehensive overview of the history of the EUR/INR pair, the key factors influencing its trajectory, and both fundamental and technical analyses. In addition, the article delves into forecasts offered by various reputable analytical agencies to provide a comprehensive view of the short-term and long-term prospects of this currency pair.

The article covers the following subjects:

Major Takeaways

- The current price of the EURINR pair is ₹93.21 as of 21.03.2025.

- The EURINR pair reached its all-time high of ₹95 on 03.02.2025. The pair’s all-time low of ₹53.30 was recorded on 15.07.2008.

- The EURINR rate is maintaining a long-term uptrend due to the difference in inflation rates and GDP growth between the Eurozone and India.

- The policies of the European Central Bank (ECB) and the Reserve Bank of India (RBI) have a substantial impact on the EURINR currency pair.

- Key fundamental factors influencing the EURINR rate include interest rates, inflation, and trade balance between the two regions.

- The pair tends to face high volatility in periods of economic crises, global financial market turmoil, and major geopolitical events.

- The EURINR exchange rate plays a pivotal role in international trade, particularly in sectors such as pharmaceuticals, information technology, and the automotive industry.

- While the exchange rate has stabilized in recent years, it remains susceptible to fluctuations due to monetary policy shifts or economic turbulence.

EURINR Real-Time Market Status

The EURINR currency pair is trading at ₹93.21 as of 21.03.2025.

It is important to track key indicators that influence EUR/INR quotes. These indicators help traders and investors make informed decisions and promptly adjust their trading strategies.

The following data is relevant as of 17.03.2025.

|

Indicator |

Value |

|

Current rate |

₹93.21 |

|

24-hour range |

₹94.387–₹94.774 |

|

52-week range |

₹87.3245–₹95.466 |

|

1-Year change (%) |

4.97% |

EURINR Price Forecast for 2025 Based on Technical Analysis

The EURINR chart shows a Rising Wedge pattern marked by two black converging lines. This pattern usually signals a bearish reversal. In this case, the price pierced the upward boundary of the Wedge, giving a strong bullish signal. The upward momentum is still intact. The price reached the resistance level of 95.4421 INR, marked by a green line on the chart. At the same time, the pair will likely undergo a correction.

Key technical indicators and factors:

- The breakout of the rising wedge pattern’s upward boundary is a strong trend continuation signal, pointing to intensifying bullish pressure.

- The RSI (Relative Strength Index) is standing at 71.82 in the overbought zone above the 70 threshold, signaling a possible pullback before further growth.

- The ADR (Average Daily Range) is at 0.8175, indicating high volatility in the near future.

- The nearest support level is located at 88.0325 INR. The price may rebound from this level. The level of 86.5625 INR offers a strong support level where long positions can be considered.

The following table presents the lowest and highest values of the EURINR rate until the end of 2025.

|

Month |

EURINR Projected Values |

|

|

Minimum, ₹ |

Maximum, ₹ |

|

|

March |

92.90 |

95.46 |

|

April |

90.15 |

92.90 |

|

May |

88.07 |

90.15 |

|

June |

88.07 |

89.57 |

|

July |

88.00 |

90.50 |

|

August |

90.50 |

91.79 |

|

September |

91.16 |

92.08 |

|

October |

89.57 |

91.16 |

|

November |

87.87 |

89.57 |

|

December |

87.15 |

88.07 |

Long-Term Trading Plan for EURINR

Since the price has broken through the upper boundary of the Rising Wedge pattern and rebounded from the resistance level of 95.4421 INR, short trades can be considered in early 2025.

- Open a short trade at 94–95 INR, placing a take-profit order at 88 INR and a stop-loss order at 96 INR.

- The price is expected to rebound from the 88 INR level.

- Long positions can be opened at 88–89 INR, with take-profit and stop-loss orders placed at 92 INR and 87 INR, respectively.

Key signals:

- Short trades can be initiated if the RSI remains in the overbought zone, and the price pierces the level of 92 INR from above.

- If the price rebounds from the support level of 88 INR, forming a bullish pattern such as a Double Bottom.

This trading plan takes into account a possible medium-term correction before the uptrend continues.

Analysts’ EURINR Price Projections for 2025

EURINR forecasts for 2025 take into account economic policies, inflation, and interest rate changes in India and the eurozone. Most experts predict the currency pair to increase.

CoinCodex

Price range in 2025: ₹93.32–₹111.05 (as of 17.03.2025).

The CoinCodex forecast shows that EURINR quotes will showcase steady growth in 2025, peaking at ₹111.05 in September. The exchange rate will gradually strengthen in the first half of the year, with a minor correction expected in the winter.

|

Month |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

March |

93.32 |

93.82 |

94.55 |

|

April |

93.68 |

97.49 |

99.55 |

|

May |

97.20 |

99.34 |

100.48 |

|

June |

99.59 |

103.11 |

104.52 |

|

July |

102.67 |

103.92 |

105.78 |

|

August |

103.28 |

105.56 |

106.76 |

|

September |

105.82 |

109.75 |

111.05 |

|

October |

107.14 |

108.30 |

109.93 |

|

November |

103.99 |

106.00 |

108.75 |

|

December |

104.32 |

105.27 |

106.12 |

WalletInvestor

Price range in 2025: ₹94.609–₹97.493 (as of 17.03.2025).

WalletInvestor predicts moderate growth in the EURINR rate. In December, the pair will trade near ₹97.493. Minor corrections are expected in the second half of the year.

|

Month |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

April |

94.609 |

94.937 |

95.265 |

|

May |

95.15 |

95.296 |

95.441 |

|

June |

95.435 |

95.778 |

96.121 |

|

July |

96.045 |

96.254 |

96.463 |

|

August |

96.465 |

96.945 |

97.424 |

|

September |

97.169 |

97.341 |

97.512 |

|

October |

96.988 |

97.107 |

97.225 |

|

November |

96.857 |

96.953 |

97.048 |

|

December |

97.09 |

97.292 |

97.493 |

LongForecast

Price range in 2025: ₹90.11–₹105.64 (as of 17.03.2025).

LongForecast anticipates a significant appreciation of the EURINR rate in 2025. By June, the pair will reach ₹105.64. A correction is expected in July–August; the rate may slide to ₹99.26, but later, the pair is projected to recover.

|

Month |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

March |

90.11 |

95.13 |

100.15 |

|

April |

96.25 |

99.70 |

103.15 |

|

May |

101.3 |

102.84 |

104.38 |

|

June |

102.52 |

104.08 |

105.64 |

|

July |

101.51 |

103.06 |

104.61 |

|

August |

99.26 |

101.16 |

103.06 |

|

September |

97.37 |

99.07 |

100.77 |

|

October |

97.99 |

99.48 |

100.97 |

|

November |

99.48 |

101.37 |

103.26 |

|

December |

101.44 |

102.98 |

104.52 |

Analysts’ EURINR Price Projections for 2026

Long-term EURINR forecasts for 2026 rely on the analysis of global economic trends. The currency pair is expected to fluctuate within a wide range.

CoinCodex

Price range in 2026: ₹104.15–₹129.66 (as of 17.03.2025).

Analysts at CoinCodex expect the EURINR pair to continue rising and reach ₹129.66 in August. Meanwhile, analysts expect high volatility.

|

Year |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

2026 |

104.15 |

116.78 |

129.66 |

WalletInvestor

Price range in 2026: ₹96.452–₹99.486 (as of 17.03.2025).

According to WalletInvestor, the EURINR pair may rise to ₹96.452 by September 2026. In general, analysts expect a stable bullish trend without sharp spikes and elevated volatility.

|

Year |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

2026 |

96.452 |

97.969 |

99.486 |

LongForecast

Price range in 2026: ₹98.90–₹106.55 (as of 17.03.2025).

LongForecast‘s forecast reflects a steady rise in EURINR quotes. The maximum price will be ₹106.55 in September. The quotes are not expected to show sharp movements.

|

Year |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

2026 |

98.90 |

102.73 |

106.55 |

Analysts’ EURINR Price Projections for 2027

Long-term EURINR rate forecasts for 2027 reflect the impact of global economic trends, changes in monetary policy, and the trade balance between the eurozone and India. Analysts predict a continuation of the upward trend but do not rule out corrections during the year.

CoinCodex

Price range in 2027: ₹117.52–₹129.99 (as of 17.03.2025).

According to CoinCodex forecast, the EURINR pair will continue to grow in 2027. However, a slight decline in the second half of the year is not ruled out due to changes in macroeconomic policies or the trade balance between the EU and India.

|

Year |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

2027 |

117.52 |

124.38 |

129.99 |

WalletInvestor

Price range in 2027: ₹98.433–₹101.460 (as of 17.03.2025).

According to WalletInvestor, the EURINR pair will remain relatively stable in 2027. The price will fluctuate in a narrow range without a pronounced trend.

|

Year |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

2027 |

98.433 |

99.95 |

101.460 |

LongForecast

Price range in 2027: ₹100.82–₹114.70 (as of 17.03.2025).

LongForecast analysts anticipate a gradual strengthening of the EURINR rate. A bullish trend is predicted, with the price peaking in the second half of the year. By the end of the year, a correction is anticipated.

|

Year |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

2027 |

100.82 |

107.76 |

114.70 |

Analysts’ EURINR Price Projections for 2028

The EUR/INR exchange rate is expected to remain volatile, fluctuating within a broad trading range. However, most analysts forecast stable growth.

CoinCodex

Price range in 2028: ₹113.70–₹130.57 (as of 17.03.2025).

According to the CoinCodex forecast, the euro is poised to strengthen against the Indian rupee gradually. The exchange rate is expected to rise steadily in the first half of the year, with the highest price predicted for the autumn.

|

Year |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

2028 |

113.70 |

122.99 |

130.57 |

WalletInvestor

Price range in 2028: ₹100.405–₹103.432 (as of 17.03.2025).

Analysts at WalletInvestor forecast that the EURINR pair will not change significantly in 2028. The average price is projected to hover near ₹101.918.

|

Year |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

2028 |

100.405 |

101.918 |

103.432 |

LongForecast

Price range in 2028: ₹101.48–₹113.28 (as of 17.03.2025).

LongForecast expects a moderate uptick in the EURINR pair in the first half of 2028, after which a correction is projected. The average price is expected to be ₹107.38.

|

Year |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

2028 |

101.48 |

107.38 |

113.28 |

Analysts’ EURINR Price Projections for 2029

Experts offer mixed forecasts for 2029. Some expect the upward trend to continue, while others expect that the price will change only slightly.

CoinCodex

Price range in 2029: ₹126.58–₹144.96 (as of 17.03.2025).

According to CoinCodex, the EURINR pair will continue to maintain the uptrend in 2029. The growth is expected closer to the autumn due to global macroeconomic changes and monetary policy shifts.

|

Year |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

2029 |

126.58 |

135.04 |

144.96 |

WalletInvestor

Price range in 2029: ₹102.365–₹105.401 (as of 17.03.2025).

WalletInvestor forecasts that the EURINR rate will remain relatively stable in 2029. Analysts expect a slight increase during the year, which may indicate a stable macroeconomic environment in the EU and India.

|

Year |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

2029 |

102.365 |

103.883 |

105.401 |

GOVCapital

Price range in 2029: ₹88.52–₹114.26 (as of 17.03.2025).

GOVCapital analysts anticipate elevated volatility for the EURINR pair in 2029. The maximum price may reach ₹114.26.

|

Year |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

2029 |

88.52 |

101.39 |

114.26 |

Analysts’ EURINR Price Projections for 2030

Projections for 2030 illustrate varying estimates of the euro’s performance against the Indian rupee. Some analysts project moderate growth for the currency pair, while others anticipate relative stability.

CoinCodex

Price range in 2030: ₹127.49–₹137.73 (as of 17.03.2025).

According to CoinCodex, the EURINR pair may exhibit moderate fluctuations during the year, reaching the yearly high in the first half of the year. After that, the rate will likely stabilize by the end of the year.

|

Year |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

2030 |

127.49 |

132.00 |

137.73 |

GOVCapital

Price range in 2030: ₹86.86–₹108.37 (as of 17.03.2025).

GOVCapital projects high volatility for the EURINR pair in 2030, making it a lucrative opportunity for intraday traders.

|

Year |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

2030 |

86.86 |

97.62 |

108.37 |

WalletInvestor

Price range in 2030: ₹104.33–₹104.84 (as of 17.03.2025).

According to WalletInvestor‘s forecast, the EURINR rate will remain relatively stable in 2030. At the same time, high volatility is not expected.

|

Year |

Minimum, ₹ |

Average, ₹ |

Maximum, ₹ |

|

2030 |

104.33 |

104.58 |

104.84 |

Analysts’ EURINR Price Projections Until 2050

Currently, no forecasts are available for the EURINR pair for 2035, 2040, and 2050. Notably, long-term estimates for currency pairs are inherently unreliable. The global economic landscape may undergo significant changes driven by technological breakthroughs, geopolitical shifts, and the evolving nature of the global financial system.

In addition, exchange rates are influenced by monetary policy, inflation, debt levels, and a trade balance, which are difficult to forecast for more than 25 years. In the long term, the eurozone and Indian economies may see substantial changes, which could diminish the relevance of the EURINR as a currency pair or replace it with new financial instruments.

Market Sentiment for EURINR on Social Media

Social media sentiment analysis is crucial when it comes to forecasting the EURINR currency pair’s performance. Users publish their thoughts and analyses on various platforms, and these posts may affect the currency pair’s quotes.

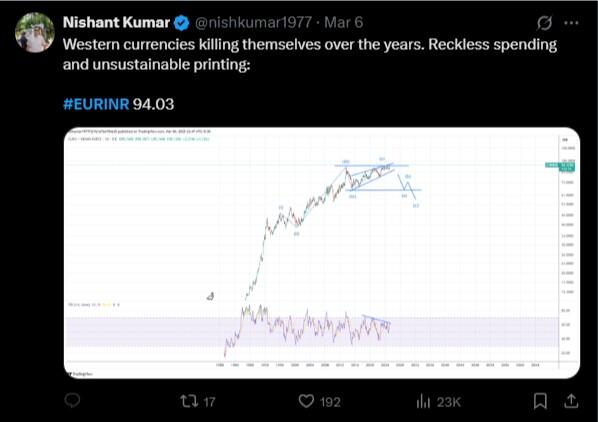

User @nishkumar1977 believes that Western currencies are weakening due to excess spending and issuance. The chart shows that the price may pierce the downward boundary of a Rising Wedge pattern, signaling an emerging bearish trend.

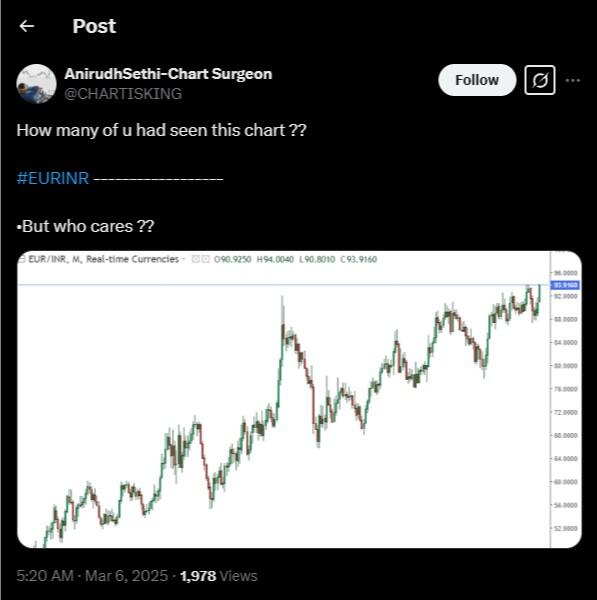

User @CHARTISKING expects the EURINR pair to increase. The chart shows that the euro has been gradually strengthening against the rupee, confirming the sustained bullish trend.

The social media analysis reveals that expectations for the EURINR pair’s future trajectory are mixed. Some expect the euro to fall due to economic uncertainty, while others predict a steady uptrend in EURINR quotes.

In my opinion, this pair is not widely discussed on social media platforms, so media sentiment is not a reliable indicator. When trading the EURINR pair, one should focus on fundamental factors rather than public opinion.

EURINR Price History

The EURINR pair reached its all-time high of ₹95 on 03.02.2025.

The lowest price of the EURINR pair was recorded on 15.07.2008 and reached ₹53.30.

Below is a chart showing the EURINR pair’s performance over the last ten years. In this connection, it is important to evaluate historical data to make predictions as accurate as possible.

-

In July 2008, the exchange rate between the euro and the Indian rupee declined to ₹53.30, notching an all-time low. During that period, the Indian economy was expanding steadily, while the euro weakened amid the global financial crisis.

-

In August 2013, the pair surged to ₹70 due to a significant weakening of the rupee due to a high current account deficit, elevated inflation, and capital outflows from emerging markets.

-

In June 2016, following the Brexit referendum, the euro temporarily declined, but the EURINR rate remained within the range of ₹67–₹69 due to the resilience of the Indian economy.

-

In April 2020, the exchange rate surged to an all-time high of ₹89.66 amid the pandemic. Investors sought defensive assets, which weakened the rupee.

-

In February 2025, the pair approached the level of ₹95, maintaining a robust bullish trend. However, a correction is looming as the currency pair is excessively overbought.

EURINR Price Fundamental Analysis

The euro to Indian rupee rate is shaped by macroeconomic factors, financial regulators’ decisions, and global economic trends. In this regard, fundamental analysis allows traders and investors to assess their impact and make forecasts for the currency pair.

What Factors Affect the EURINR Pair?

- The European Central Bank (ECB) and the Reserve Bank of India (RBI) have a significant impact on the currency pair. Their policies, which include interest rates and stimulus programs, are closely watched by financial markets worldwide.

- Macroeconomic indicators, such as GDP, inflation, unemployment, and industrial production level, are also crucial factors.

- Geopolitical landscape, including trade agreements, sanctions, and conflicts.

- Trade balance between the EU and India.

- Oil prices are also a relevant factor, given India’s status as a significant oil importer.

- Investment flows, including foreign direct investment and capital flows.

- Financial crises and economic instability in the EU and India.

More Facts About EURINR

The EUR/INR currency pair indicates the exchange rate of the euro in relation to the Indian rupee, indicating how much of the Indian rupee you can receive for one euro. The euro is the official currency of 20 countries within the European Union. The Indian rupee represents the national currency of India.

This pair plays a key role in international trade and investment. Moreover, India has strong ties with the EU in the following sectors:

- Information technology sector. Indian companies Infosys, Tata Consultancy Services, and Wipro provide IT services to major European corporations.

- Pharmaceutical sector. Prominent Indian companies such as Dr. Reddy’s Laboratories and Sun Pharmaceutical have a strong foothold in the EU market. They are major suppliers of medicines to the EU, while European companies like Sanofi and Bayer have invested in production facilities in India.

- Automotive sector. German automotive companies BMW, Mercedes-Benz, and Volkswagen have assembly plants in India, while India’s Tata Motors exports cars to Europe.

The EURINR pair fluctuates depending on macroeconomic indicators and decisions made by the European Central Bank (ECB) and the Reserve Bank of India. The currency pair is popular among traders due to its volatility and risk-hedging opportunities.

Advantages and Disadvantages of Investing in EURINR

Investing in the euro against the Indian rupee pair offers traders and investors a number of opportunities. However, trading the EURINR pair comes with financial risks.

Advantages

- High liquidity. The EURINR pair is actively traded in the Forex market.

- Hedging opportunities. The pair is used to hedge currency risk, especially in international trade.

- Divergent economies. The euro and the rupee can respond differently to global events, creating speculative trading opportunities.

- Access to an emerging market. The Indian economy continues to grow, making the rupee appealing to long-term investors.

- Volatility. It allows traders to capitalize on price fluctuations quickly.

- Interest rate differentials. It can be used in carry trade strategies.

Disadvantages

- Monetary policy changes. Decisions made by central banks can lead to unexpected movements in the EURINR exchange rate.

- Geopolitical risks. Sanctions, trade wars, and political instability in the EU or India can affect the exchange rate.

- Economic crises. A sharp slowdown in an economy can increase volatility.

- Limited popularity among retail traders. Unlike the major currency pairs, the EURINR pair is less widely traded.

- High volatility. It can lead to significant losses if risks are not properly managed.

- Dependence on oil prices. India is one of the largest importers of oil, so the value of the rupee is affected by changes in energy prices.

Investing in the EURINR pair is suitable for experienced traders and investors who are prepared to consider macroeconomic factors.

How We Make Forecasts

We employ a blend of fundamental and technical analysis to build our forecast for the EURINR pair. Depending on the time frame, different methods are used.

- Short-term forecasts of up to 3 months rely on technical analysis. This method helps identify trends, support, and resistance levels, as well as assess moving averages, the RSI, and the Bollinger Bands indicator. The analysis also encompasses news and central bank decisions.

- Medium-term forecasts for 3 months to 1 year take into account fundamental analysis, including macroeconomic indicators such as GDP growth, inflation, interest rates, EU-India trade balance, investment flows, and commodity market shifts.

- Long-term forecasts for 1 year and beyond examine global economic trends, decisions by financial regulators, demographic factors, and growth rates of the EU and Indian economies.

These methods allow you to obtain more accurate forecasts, taking into account the underlying market trends.

Conclusion: Is EURINR a Good Investment?

The EURINR currency pair is a highly volatile but predictable asset. Its value is influenced by monetary policy, macroeconomic factors, and global trade. In the short term, it can offer lucrative trading opportunities, especially when combined with the proper fundamental and technical analysis.

However, when considering long-term investments, it is crucial to note that the EURINR pair’s investment potential is somewhat limited. As a rule, currency pairs do not offer the same long-term returns as equities or commodities. Traders and investors should carefully assess the potential risks associated with fluctuating economic conditions and consider using the EURINR pair as a means of portfolio diversification.

EURINR Price Prediction FAQs

The current price of the EURINR pair is ₹93.21 as of 21.03.2025.

The EUR/INR exchange rate forecast is influenced by various factors, including central bank policy, inflation, and trade balance. According to analysts, the exchange rate may show moderate growth in the coming years, but corrections are not ruled out.

Analysts give mixed forecasts for 2025. The EURINR pair will fluctuate within the range of ₹93.32 to ₹111.05, with the possibility of growth by the end of the year. However, this exchange rate will depend on broader macroeconomic factors and the regulatory monetary policy decisions.

The long-term trend indicates a gradual strengthening of the euro. The exchange rate will be shaped by the difference in economic growth rates between the EU and India, interest rates, and global economic conditions.

Key factors are the ECB and RBI’s monetary policies, inflation rates in the eurozone and India, the trade balance, and global macroeconomic developments.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.