Cryptocurrencies are volatile by nature and, thus, are difficult to predict. Nonetheless, cryptocurrency experts have tried their best to forecast the price of Ethereum in 2024 and beyond. The ETH’s price prediction is a controversial topic, but the price of ETH is expected to perform well on the market this year as one of the leading cryptocurrencies.

While the Ethereum price prediction is not set in stone, its utility as a software network means that it is extremely popular; its wide range of applications means that it has the potential for growth in the long run. Some believe it even has the potential to grow in value by as much as 400%. When will Ethereum go up? Read on to find out more about Ethereum price prediction 2024 and beyond!

The article covers the following subjects:

Ethereum in Short

Ethereum or ETH is not just a cryptocurrency but also a blockchain-based platform, like Bitcoin. In fact, these two crypto projects have quite a lot in common: decentralization, security, and transparency. However, Ethereum has its own unique features.

For example, Ethereum offers smart contract technology. Smart contracts are software that automatically fulfills the terms of digital contracts without intermediaries. This makes Ethereum a fully decentralized platform, more flexible and functional than Bitcoin. There are many services based on smart contracts for users and developers on the Ethereum blockchain.

Another feature of Ethereum is its transaction speed. Ethereum can process more transactions per second than Bitcoin due to its consensus algorithm, according to the Ethereum Foundation. This makes Ethereum more suitable for mass use.

Many users buy the token in hopes of Ethereum’s growth in the future. They believe in the potential of the Ethereum platform to create new applications and services.

Importance of the Network Effect

The network effect gives Ethereum the biggest advantage: the more network participants, the higher the token’s value. It is the first and, therefore, the most popular blockchain for smart contracts. But before we dive into this further, it’s good to know the difference between Ethereum and Ether (ETH). These terms are often used interchangeably.

By Ethereum, we mean the network and the blockchain. You can find all transactions of a cryptocurrency on a blockchain. And on Ethereum, transactions are paid with ETH. That is the cryptocurrency that comes with Ethereum. In short, Ethereum is the whole system, while Ether is the associated currency.

A Little History of Ethereum

To make an accurate forecast, let us look at the Ethereum price history. The concept of Ethereum was introduced by Bitcoin Magazine co-founder Vitalik Buterin in 2013. In July 2016, there was the network hard fork, and the original cryptocurrency divided into two blockchains: Ethereum and Ethereum Classic. In 2017 and early 2018, the price of ETH grew almost exponentially. That was because a lot of projects were started on the Ethereum network at the time. This was done through Initial Coin Offerings (ICOs).

ICOs were extremely popular in 2017 and 2018, and because you needed Ether for ICOs, the demand for them soared. Due to that demand, the price rose to unprecedented heights. However, the era of ICOs is over. Regulators have taken care of that. Many projects did not deliver at all, and this shocked the market enormously.

Undoubtedly, the 2018 bear market was brutal as ETH lost more than 92% of its value – but it has since rebounded to a price above $100.

The Ethereum blockchain remains unquestionably the most robust smart contract platform out there. Of the top 100 tokens subject to market capitalization, 96% are Ethereum-based. Of the 1,000 best tokens, 89% consist of Ethereum.

The Growth of Ethereum

Ethereum officially switched to a Proof of Stake (PoS) consensus mechanism in 2022 as a more secure and energy-efficient way to validate transactions and add new blocks to the blockchain. The energy consumption of the blockchain was reduced by 99.95%. Also, decentralized finance (DeFi) technologies continue to develop and become increasingly popular. In the long term, these factors could lead to unprecedented growth in the ETH rate.

Ethereum 2.0

With the renewal of Bitcoin’s historic high, all attention is riveted on it: volumes and interest are growing, and new institutional investors are coming. However, crypto investors with a long-term planning horizon prefer Ethereum 2.0: the project already reached the TOP-30 in terms of capitalization.

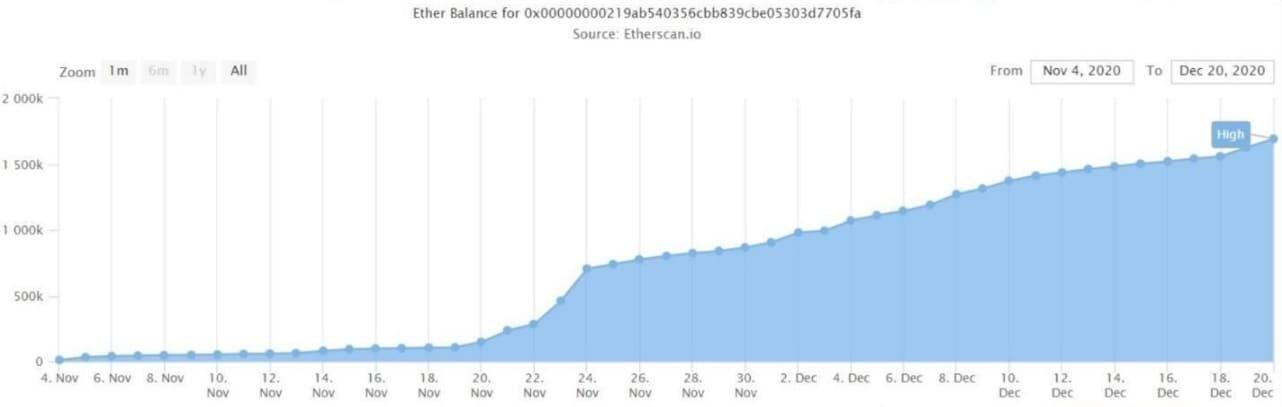

On the 4th of November 2021, Vitalik Buterin opened a deposit contract to create a liquidity pool for the Ethereum 2.0 network. At that moment, crypto investors had reserved 1.7 million ETH.

Image source: etherscan.io

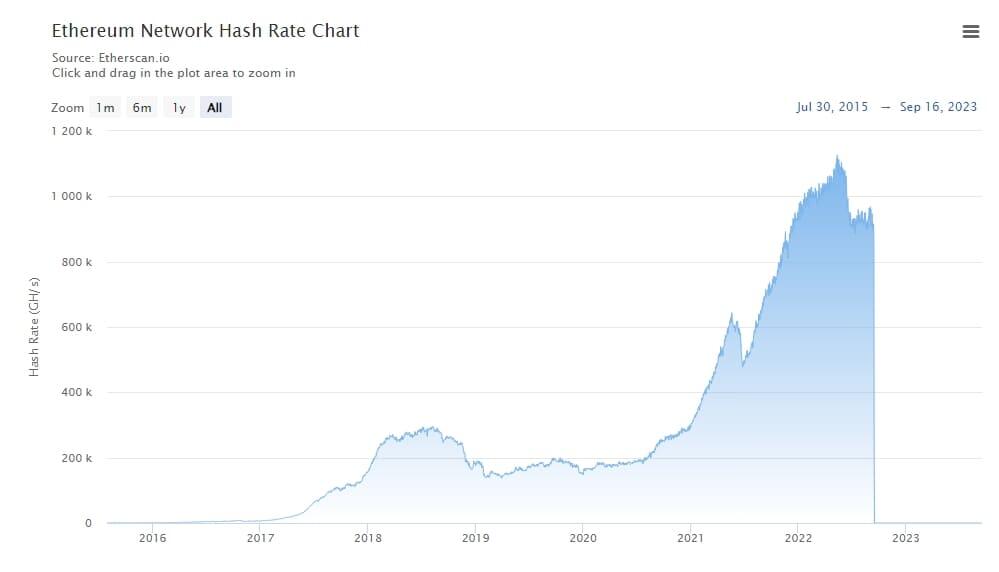

The ETH 2.0 blockchain is a long-term project aimed at improving the operation of the network and is being implemented in stages. One of its stages was the transition to the proof-of-stake algorithm, which replaced the more resource-intensive proof-of-work. Validators reserve funds in blocks of 32 ETH to participate in staking. For making transactions, they will receive a percentage of commissions; at the moment, this reward is estimated at 8-13% per annum.

Image source: etherscan.io

The upgrade aims to make the blockchain platform more scalable, secure, and decentralized. Some experts claim that the greater sustainability of Ethereum 2.0 allows us to expect the price of Ethereum to rise to upwards of $4,000. However, according to pessimistic forecasts, the price of ETH will fall to $1,240 by the end of 2023.

DeFi

DeFi is a decentralized financial service based on the Ethereum blockchain. Decentralized applications (DApps) operating on smart contracts have become the next stage of development. DeFi companies are service providers that offer loans on the Ethereum blockchain. For example, you can lend your ETH on a special platform. Other users can use them for a certain amount of collateral (according to the smart contract terms). There is no need to contact intermediaries or draw up legal paperwork.

DeFi is a relatively new phenomenon. In the future, decentralized finance will become a separate industry. Some DeFi projects use ETH as collateral for their financial applications. Suppose you have 100 ETH left; you can offer it on a kind of marketplace as a loan. Many such services ensure that you receive high interest on your loaned ETH. Popular DeFi services include ETHlend, MakerDAO, Nexo, and NUO Network platforms.

The Introduction of Sharding

“Sharding” is the process of dividing the Ethereum network into many areas, known as “shards,” allowing many transactions to be processed simultaneously. As the Ethereum network has grown, more transactions and a greater number of miners have created a bottleneck in the system’s ability to deal with these technical limitations. Sharding is one way of addressing this problem by distributing data and transaction processing functions among different nodes within the network. All nodes no longer need to store all data and process all transactions. Sharding will greatly reduce hardware requirements — so much so that, eventually, people will be able to run Ethereum from a laptop or even a smartphone.

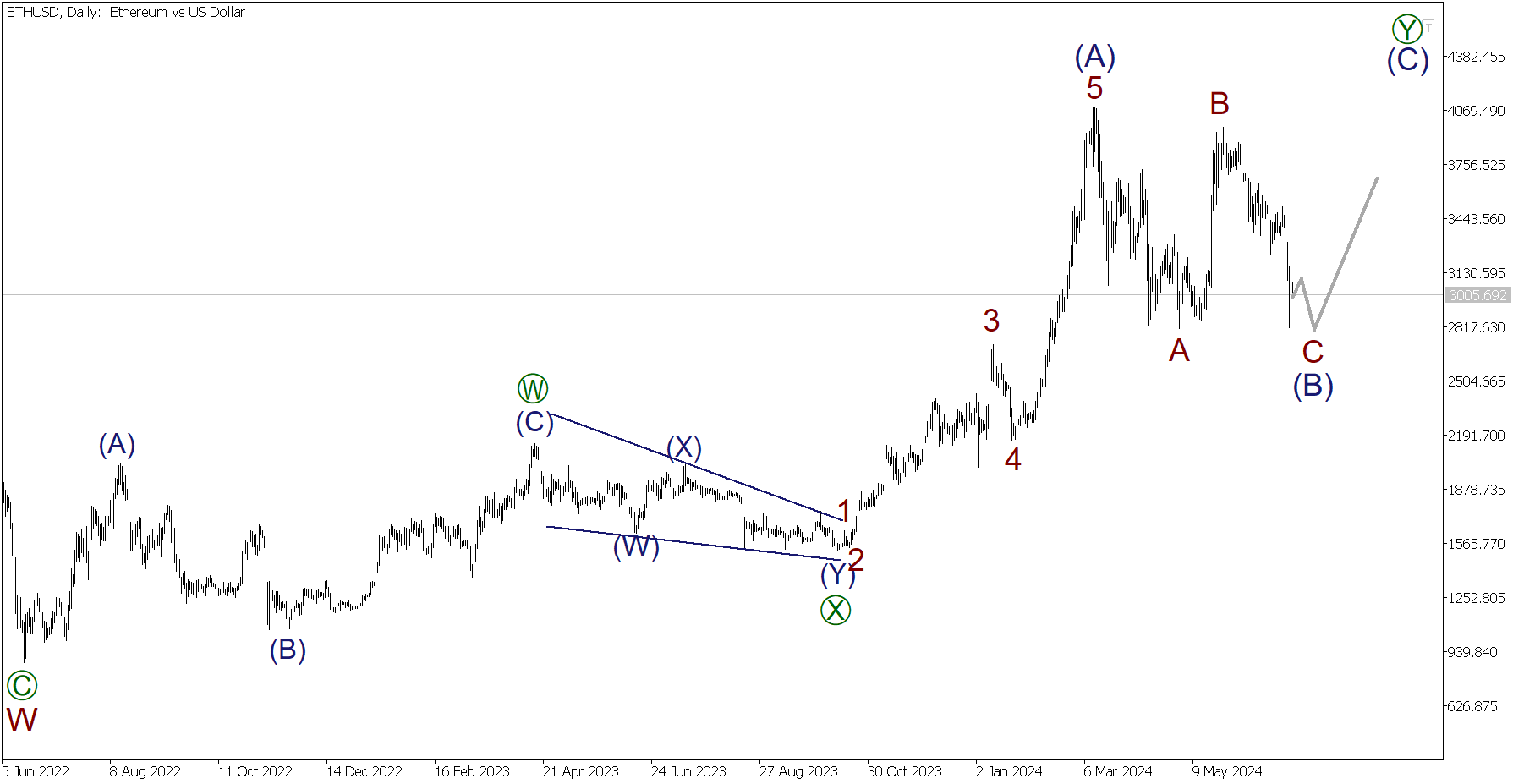

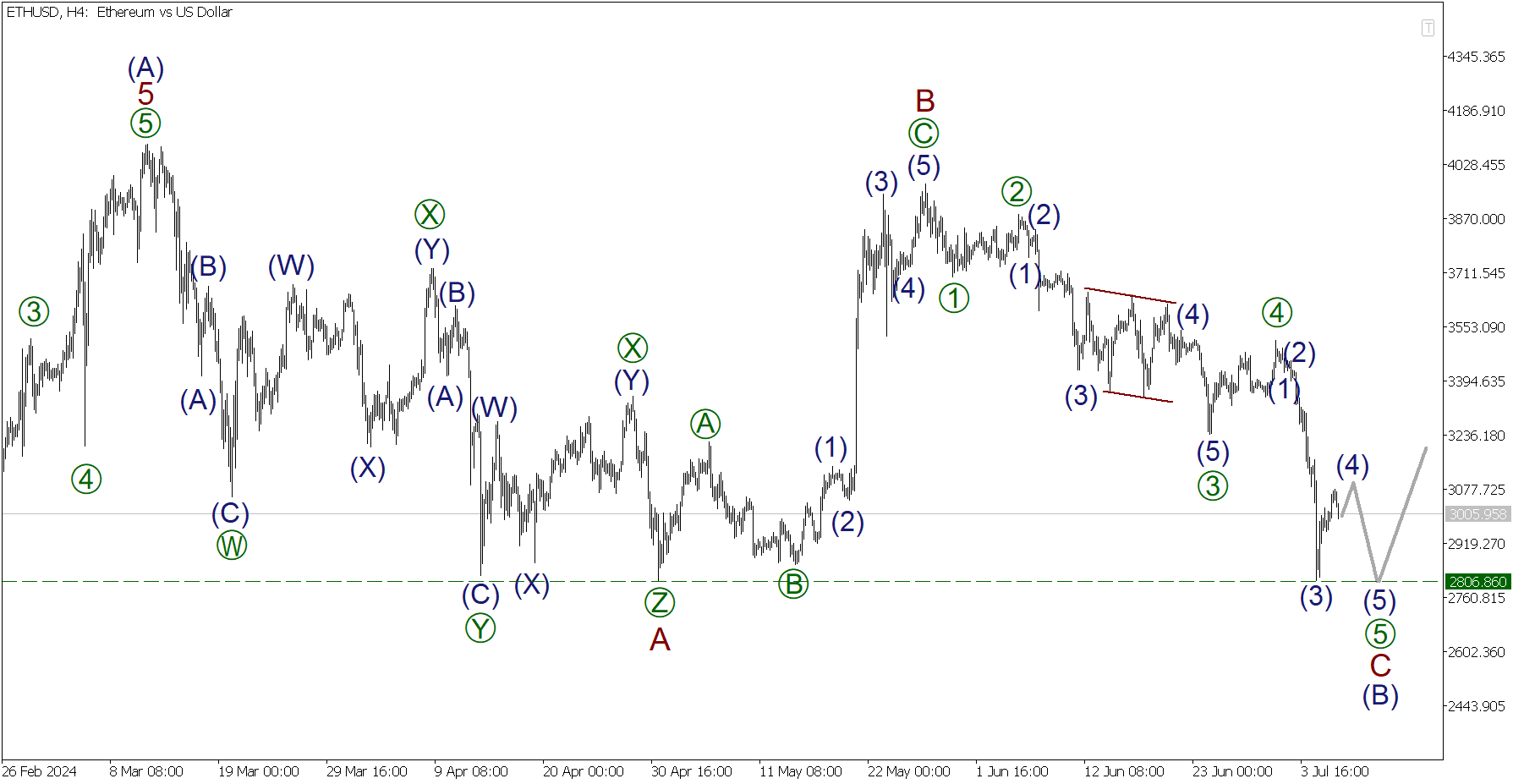

Weekly Elliott wave Ethereum analysis as of 08.07.2024

After completing the large motive wave W, the price soared. Most likely, a double zigzag [W]-[X]-[Y] is forming. Sub-waves [W] and [X], a zigzag, and a double zigzag are completed. The last motive wave [Y] is underway. It is similar to the standard zigzag (A)-(B)-(C). The impulse wave (A) has already been built. The correction (B) is likely forming, and its horizontal structure indicates the flat correction pattern A-B-C.

The first two parts of the ETHUSD’s supposed flat pattern are completed. The wave A is a triple zigzag, while the wave B is a standard zigzag [A]-[B]-[C]. On the last section of the chart, the final wave C is developing as a bearish impulse [1]-[2]-[3]-[4]-[5]. The price will likely fall in the sub-wave [5] of C to the previous low of 2806.86, which is marked by the sub-wave (3).

Weekly ETHUSD trading plan:

Sell 3005.95, TP 2806.86

ETHUSD Elliott wave analysis is presented by an independent analyst, Roman Onegin.

Start trading with a trustworthy broker

Ethereum Price Prediction for 2024 by Crypto Experts

Expert opinions on the future price of ETH vary greatly. Also, before investing in cryptocurrency, one should conduct technical and fundamental analysis and study market sentiment. Let us have a look at some forecasts by crypto experts and see whether Ethereum will go up or down next year.

TradingView

TradingView says the ETH/USD will reach $10,000 by the end of 2024. Experts are considering the potential impact of the 2.0 update on offering Ethereum Merge price prediction.

Trading Beasts

According to Trading Beasts’ forecast, based on analysis of historical data and current trends, ETH will trade in the range of $1,624 to $2,147 and will surpass the average trading price of $1,954.

Wallet Investor

ETH price data provided by Wallet Investor is based on technical analysis and neural network forecasting. The coin is expected to rise in price to $5,500.

CoinPriceForecast.com

The ETH prediction by the Coin Price Forecast is based on the opinions of various experts. The average price of Ethereum will reach $3,000.

DigitalCoinPrice

This agency’s forecast is based on analyzing historical data and current trends. A bullish trend should occur in 2024, and the ETH will rise to $4,500 by the end of 2024.

Long Forecast

Long Forecast analyzes economic factors and market psychology as the basis for its research. The analysts believe that the Ethereum price could range from $1,300 to $2,000. At the same time, the coin value for January 2024 is projected in the range of $1,302-1,498, and for December – $1,370-1,700.

| Month | Open, $ | Low-High, $ | Close, $ |

| April | 1,44 | 1,440-1,753 | 1,638 |

| May | 1,638 | 1,541-1,773 | 1,657 |

| June | 1,657 | 1,657-2,057 | 1,922 |

| July | 1,922 | 1,654-1,922 | 1,779 |

| August | 1,779 | 1,389-1,779 | 1,494 |

| September | 1,494 | 1,494-1,854 | 1,733 |

| October | 1,733 | 1,377-1,733 | 1,481 |

| November | 1,481 | 1,274-1481 | 1,37 |

| December | 1,37 | 1,370-1700 | 1,589 |

Pandaforecast.com

Data on the future value of ETH from the PandaForecast portal is based on the forecast of neural networks and analysis of historical indicators. ETH will move in a range from $1,500 to $2,600. According to the source, already in April, the price of ETH will exceed the average level of 2,095 USD.

| Month | Average price, $ | Pessimistic forecast, $ | Optimistic forecast, $ | Volatility |

| April | 2,095 | 1,959 | 2,32 | 15.58 % |

| May | 2,194 | 2,057 | 2,595 | 20.72 % |

| June | 2,364 | 2,175 | 2,483 | 12.38 % |

| July | 1,815 | 1,588 | 2,091 | 24.08 % |

| August | 1,456 | 1,322 | 1,54 | 14.18 % |

| September | 1,602 | 1,41 | 1,814 | 22.30 % |

| October | 1,938 | 1,774 | 2,234 | 20.61 % |

| November | 2,253 | 2,124 | 2,507 | 15.28 % |

| December | 2,169 | 1,762 | 2,391 | 26.30 % |

Other sources also believe that the ETH rate will rise:

| Source | Average price forecast during the year, $ |

| MarketBeat | 10 |

| Trading-Education | 8 |

| Cryptopolitan | 7 |

| Currency.com | 9 |

ETH Historical Price Changes

We can’t simply make price predictions without looking back. Currently, ETH is traded at $3 039.99. Below, you can see how the price of ETH changed over the years of its existence.

-

January 2018 began with a price near $1,300. In April 2018, Ethereum experienced a price below $400. Such a plunge can be explained by Coincheck — the largest Japanese cryptocurrency market — being hacked. The decline was shown until November across all cryptocurrencies. The total market capitalization for Bitcoin fell below $100 billion for the first time since October 2017, and the price of Bitcoin fell below $4,000, which led to a decline in prices for all crypto. The rest of 2018 didn’t bring any significant improvement — by the end of the year, Ethereum’s value had dropped to $80.

-

During the first half of 2019, ETH grew to above $300 by June. Ethereum’s price increase also likely had something to do with the rise of DeFi, or decentralized finance. Most DeFi protocols are based on Ethereum.

-

ETH didn’t manage to hold its position. ETH continued to drop in value throughout August. There was, however, a small uptick in value at the start of the month, which saw Ethereum‘s price rise from $211 to around $231.

-

The cryptocurrency fell again by December 2019. In early December, US authorities arrested Ethereum developer Virgil Griffith for consulting with North Korea on how to use cryptocurrency to evade sanctions. In the middle of December, UK cryptocurrency exchange Coinfloor said it would delist Ethereum and Bitcoin Cash.

-

2020 showed growth up to $290 in January. On the day when the WHO declared a global pandemic, Ethereum fell to $109, less than half of its high earlier in the year. At the start of December 2020, the Ethereum 2.0 upgrade got under way.

-

From January 2021 to April 2021, the price of Ethereum rocketed. It was only at $1,385.5 in January, but during just five months, the price reached $4,000. It happened due to the upgrade and shifting to the PoS protocol. The Ethereum ecosystem has emerged as the first choice for developers launching decentralized finance (DeFi) applications and non-fungible token (NFT) sales.

-

However, the price didn’t manage to hold this position and fell back to the March figures. The value of ETH in USD has grown from $737.73 on the 31st of December 2020 (BinanceUS) to an all-time high of $4,362.35 on May 12, 2021. Since the 12th of May, a dramatic fall has taken place due to the overall cryptocurrency downtrend. The reason for this trend is believed to be some of Elon Musk’s tweets about Bitcoin-related environmental concerns. Also, on the 19th of May, the price of Bitcoin fell by more than 30%, reaching the local minimum of $30,000. As a result, Ethereum fell to $1,800. It was a stepping stone for Ethereum to transition to a PoS protocol.

-

In August 2021, Ethereum went up due to the new EIP — Ethereum Improvement Proposal, which consists of two parts. It allows Ethereum holders to pay fewer transaction fees. Moreover, about 3 million ETH are to be removed from the market each year. This action will lead to even more demand, as Ethereum will eventually become scarce.

-

A strong bullish trend continued until the beginning of September, when Ethereum reached highs of May 2021 near $3,972. On September 7-8, the price fell by more than $900. The plunge was caused by the BTC sell-off. Until September 21, the price of the cryptocurrency was moving down. It seems ETH/USD has been forming a new downtrend.

-

However, the next wave of Ethereum’s growth started on September 29; since then, its price has risen by more than 70%. The growth can be explained by a combination of encouraging comments from Fed Chair Jerome H. Powell, the upcoming Altair update, and the beginning of October, which has historically been a strong month for cryptocurrencies. This clear trend upwards was strengthened by the fact that the U.S. Securities and Exchange Commission has approved ProShares’ application to launch the Bitcoin Strategy ETF on the 15th of October. On November 2, the CME Group announced it would launch a new Micro Ether futures contract. On November 8, Ethereum rose to a new all-time high of $4,812.09. The value of ETH began to decline throughout December slowly.

-

The downtrend continued throughout January 2022. ETH was not the only crypto affected; many other digital currencies dropped in value at this time. On January 24, ETH dropped to $2,160, its lowest level since July 2021. According to various experts, this decline was due to the rampant increase of the Omicron variant and rising inflation. Moreover, some states continued tightening their crypto policy.

-

In the second half of 2022, the Ethereum value started to recover. The Ether coin price continued to rise due to the development of the Ethereum ecosystem, improvements in network scalability and security, as well as increased demand for DeFi and NFTs. However, the ETH has been very volatile due to macroeconomic factors, regulatory actions, and competition from other cryptocurrencies. The ETH price prediction after Merge is also affected by the impact of the network upgrade.

-

The upward trend continues in 2023. According to Analytics Insight, the price of Ethereum will rise to $4,679 by the end of 2023, which is 184% higher than the price at the end of 2022. However, the cryptocurrency will also be subject to risks due to possible technical problems, hacker attacks, regulatory pressure, and competition from other crypto platforms.

Ethereum (ETH) Technical Analysis

To analyze the future value of ETHUSD, you can use various technical solutions. However, the simplest and, at the same time, effective are:

-

Moving Averages help in determining the overall trend direction and support/resistance levels.

-

Oscillators help identify overbought or oversold market states.

- Pivot Points allow you to predict potential trend reversals and help determine support and resistance levels.

-

You can see the Pivot Points indicator in the H4 chart above. The horizontal black line marks support. The blue circles highlight the moments of testing this level with subsequent breakouts. If you correctly determine the support and resistance levels, you can most accurately set the Stop Loss and Take Profit levels.

-

The RSI indicates the overbought or oversold market state. The tool shows whether bulls or bears dominate the market.

-

Moving averages support our trading decisions to enter or exit the market. Their intersection often indicates a change in the local trend. As we see in the chart, almost all crossovers of MAs gave us a signal about the trend reversal, albeit short-term.

-

Traders should not use only one indicator or follow one approach in their decisions. If several indicators give the same signals, then you can safely open a trading position. Conversely, if the data differs, then it is better to refrain from trading in an uncertain market situation.

Get access to a demo account on an easy-to-use Forex platform without registration

Long-term Ethereum trading plan

Creating a long-term Forex trading plan requires careful analysis and a strategic approach. Here are general recommendations:

1) Determine your financial goals:

First, determine what you want to achieve with Forex trading. This could be buying real estate or a car, saving money for children’s education, etc.

2) Determine your trading style:

Decide what type of earnings you are more interested in – long-term investment, medium-term or short-term trading. Your further plan of action will depend on this.

3) Analyze the market:

Understand the market features, including fundamentals and technical aspects. Analyze historical data and trends.

4) Develop a strategy:

Create a specific trading strategy that suits your goals and style. Here, you should consider the specifics of the asset, the best time frames to trade, and analysis methods.

5) Management of risks:

Determine how much you are willing to risk in each trade.

6) Long-term planning:

Plan for the long term: Determine what events or conditions may affect your trading decisions in the future.

7) Portfolio diversification:

Invest in different types of assets – currency pairs, stocks, cryptocurrencies, etc.

8) Set the rules:

Formulate clear rules for opening and closing trading positions, and learn to manage your capital.

9) Training and update:

Invest in education and stay updated with the latest news and trends in the Forex market.

10) Psychological stability:

Forex trading can be emotionally stressful, and it is important to be able to control your emotions.

11) Testing and adaptation:

Periodically test your strategy on historical data and adapt it according to current market conditions.

12) Execution Plan:

Create a plan for executing your trading plan that includes timelines and milestones for achieving your goals.

13) Discipline:

The most important rule is that you need to stick to your plan, even if you want to break it.

14) Monitoring and analysis:

Keep a log of all your trades, take into account your mistakes, and improve your strategies.

13) Consultation and support:

If possible, share your decisions and plans with experienced traders or financial advisors, and consider independent financial advice.

Long-term Ethereum price prediction for next five years

Ethereum is currently the second most valuable cryptocurrency on the market. According to the latest data, the cryptocurrency volume is $265,468,634,602.31, with a market capitalization of 120226219.38 ETH. With the growing popularity of crypto assets, ETH will have every chance of becoming a truly strong asset. The price of Ethereum in the future depends on many factors. So, what will the price of ETH be in 2025 and 2030?

You can get familiar with the average Ethereum price prediction 2025 by crypto experts:

| Year | Minimum price, $ | Average price, $ | Maximum price, $ |

| 2025 | 857 | 1,133 | 1,409 |

| 2026 | 1,011 | 1,976 | 2,941 |

| 2027 | 2,663 | 3,438.5 | 4,214 |

| 2028 | 3,57 | 3,782 | 3,994 |

| 2029 | 4,15 | 4,438 | 4,727 |

Ethereum prediction 2025

ETHUSD price forecasts for 2025 and 2026 consider many factors, such as technical innovation, market conditions, supply and demand, competition and regulation.

Long Forecast

According to the Long Forecast website, which uses mathematical models in its forecasts, the maximum value of the currency in 2025 could be $1,677 in January, and the minimum could be $797 in July. The forecast is not too optimistic since by 2026, the price of ETH, compared to the beginning of the year, will drop by 26%.

| Month | Open, $ | Low-High, $ | Close, $ | Change/month | Change/Year |

| January | 1,677 | 1,310-1,677 | 1,409 | -16.0% | -14.4% |

| February | 1,409 | 1,101-1,409 | 1,184 | -16.0% | -28.1% |

| March | 1,184 | 925-1,184 | 995 | -16.0% | -39.6% |

| April | 995 | 995-1,187 | 1,109 | 11.5% | -32.6% |

| May | 1,109 | 1,109-1,299 | 1,214 | 9.5% | -26.2% |

| June | 1,214 | 949-1,214 | 1,02 | -16.0% | -38.0% |

| July | 1,02 | 797-1,020 | 857 | -16.0% | -47.9% |

| August | 857 | 857-1,011 | 945 | 10.3% | -42.6% |

| September | 945 | 945-1,173 | 1,096 | 16.0% | -33.4% |

| October | 1,096 | 890-1,096 | 957 | -12.7% | -41.9% |

| November | 957 | 957-1,188 | 1,11 | 16.0% | -32.6% |

| December | 1,11 | 1,110-1,319 | 1,233 | 11.1% | -25.1% |

Trading Beasts

Trading Beasts, based on algorithmic analysis, believes that the low price will be $1,142.315 and the high price will be $1,752.327. This source is more optimistic. When will Ethereum go up? By the end of 2025, ETH is predicted to grow, but the average Ethereum’s price may remain at 1,300 USD.

| Month | Low, $ | High, $ | Average, $ | Change |

| January | 1,142.315 | 1,679.876 | 1,343.900 | -18.05% |

| February | 1,143.84 | 1,682.124 | 1,345.699 | -17.94 % |

| March | 1,145.781 | 1,684.972 | 1,347.978 | -17.80 % |

| April | 1,148.533 | 1,689.020 | 1,351.216 | -17.60 % |

| May | 1,151.806 | 1,693.832 | 1,355.065 | -17.37 % |

| June | 1,155.805 | 1,699.713 | 1,359.770 | -17.08 % |

| July | 1,160.263 | 1,706.269 | 1,365.016 | -16.76 % |

| August | 1,165.467 | 1,713.923 | 1,371.138 | -16.39 % |

| September | 1,171.265 | 1,722.449 | 1,377.959 | -15.97 % |

| October | 1,177.428 | 1,731.511 | 1,385.209 | -15.53 % |

| November | 1,184.360 | 1,741.706 | 1,393.365 | -15.03 % |

| December | 1,191.582 | 1,752.327 | 1,401.862 | -14.51 % |

Coin Price Forecast

At the beginning of 2025, Ethereum will likely cost $1,871, then during the first six months, it will rise to $2,153 and end the year at $2,541.

Ethereum price forecast for 2026-2029

Let’s look at some possible scenarios for the Ethereum coin price changes over the next few years, from 2026 to 2029.

Long Forecast

According to Long Forecast data, stable asset growth is expected starting from mid-2026. By the end of the year, Ethereum could reach $3,055, and by June 2027 – $4,379.

| Month | Open | Low-High | Close | Change/Month | Change/Year |

| 2026 | |||||

| January | 1,282 | 1,003-1,282 | 1,078 | -15.9% | -34.5% |

| February | 1,078 | 977-1,125 | 1,051 | -2.5% | -36.1% |

| March | 1,051 | 1,051-1,304 | 1,219 | 16.0% | -25.9% |

| April | 1,219 | 1,219-1,513 | 1,414 | 16.0% | -14.1% |

| May | 1,414 | 1,414-1,706 | 1,594 | 12.7% | -3.2% |

| June | 1,594 | 1,594-1,978 | 1,849 | 16.0% | 12.3% |

| July | 1,849 | 1,849-2,295 | 2,145 | 16.0% | 30.3% |

| August | 2,145 | 2,145-2,662 | 2,488 | 16.0% | 51.2% |

| September | 2,488 | 2,488-2,892 | 2,703 | 8.6% | 64.2% |

| October | 2,703 | 2,112-2,703 | 2,271 | -16.0% | 38.0% |

| November | 2,271 | 2,271-2,818 | 2,634 | 16.0% | 60.0% |

| December | 2,634 | 2,634-3,269 | 3,055 | 16.0% | 85.6% |

|

Month |

Open |

Low-High |

Close |

Change/Month |

Change/Year |

|

2027 |

|||||

|

January |

3,055 |

2,766-3,182 |

2,974 |

-2.7% |

80.7% |

|

February |

2,974 |

2,974-3,574 |

3,340 |

12.3% |

103% |

|

March |

3,340 |

3,340-4,145 |

3,874 |

16.0% |

135% |

|

April |

3,874 |

3,026-3,874 |

3,254 |

-16.0% |

97.7% |

|

May |

3,254 |

3,254-4,039 |

3,775 |

16.0% |

129% |

|

June |

3,775 |

3,775-4,686 |

4,379 |

16.0% |

166% |

|

July |

4,379 |

3,467-4,379 |

3,728 |

-14.9% |

127% |

|

August |

3,728 |

2,913-3,728 |

3,132 |

-16.0% |

90.3% |

|

September |

3,132 |

2,931-3,373 |

3,152 |

0.6% |

91.5% |

|

October |

3,152 |

3,090-3,556 |

3,323 |

5.4% |

102% |

Trading Beasts

| Month | Low | High | Average | Change |

| 2026 | ||||

| January | 1,131.433 | 1,663.873 | 1,331.098 | -18.62 % |

| February | 1,134.931 | 1,669.016 | 1,335.213 | -18.37 % |

| March | 1,138.385 | 1,674.095 | 1,339.276 | -18.12 % |

| April | 1,142.519 | 1,680.175 | 1,344.140 | -17.82 % |

| May | 1,146.831 | 1,686.516 | 1,349.213 | -17.51 % |

| June | 1,151.592 | 1,693.517 | 1,354.814 | -17.17 % |

| July | 1,156.483 | 1,700.710 | 1,360.568 | -16.82 % |

| August | 1,161.819 | 1,708.558 | 1,366.846 | -16.44 % |

| September | 1,167.432 | 1,716.811 | 1,373.449 | -16.03 % |

| October | 1,173.114 | 1,725.168 | 1,380.135 | -15.62 % |

| November | 1,179.244 | 1,734.182 | 1,387.346 | -15.18 % |

| December | 1,185.398 | 1,743.232 | 1,394.586 | -14.74 % |

Coin Price Forecast

According to experts, Ethereum will continue to grow, and over these five years, the crypto price will reach $3,433, which is an increase of 83%.

| Year | Mid-year, $ | End-year $ | Change |

| 2026 | 2,466 | 2,595 | 0,59 |

| 2027 | 2,303 | 2,533 | 0,55 |

| 2028 | 2,761 | 2,987 | 0,83 |

| 2029 | 3,211 | 3,433 | 1,1 |

Ethereum price prediction 2030

Let us have a look at some Ethereum scenarios for 2030 and beyond.

Coin Price Forecast

The Coin Price Forecast service offers its ETH price prediction 2030, as well as ETH prices in 2031-2034. The cryptocurrency will start the year at $3,433, then decline to $3,212. By the end of 2030, |The Ethereum value could reach $3,405.

| Year | Mid-year, $ | End-year $ | Change |

| 2030 | 3,212 | 3,405 | 1,08 |

| 2031 | 3,597 | 3,787 | 1,32 |

| 2032 | 3,976 | 4,13 | 1,53 |

| 2033 | 4,316 | 4,501 | 1,75 |

| 2034 | 4,685 | 4,868 | 1,98 |

Changelly.com

Changelly.com provides its vision of the Ether price trend during 2030 – 2032.

| Year | Low, $ | Average, $ | High, $ |

| 2030 | 23,055 | 23,724 | 27,994 |

| 2031 | 32,978 | 33,927 | 40,112 |

| 2032 | 45,83 | 47,187 | 57,613 |

According to analysts, the upward trend for ETH will continue until the end of the 2030s.

Traders Union

Traders Union specialists expect that the maximum price of ETH will be $31,656.34 by the end of 2029.

Bill Barhydt

Bill Barhydt, a co-founder of the Abra trading platform and Boom Financial, in an interview with CNBC, predicted that Ethereum could reach $40,000. The reason is the widespread use of the Ethereum blockchain and the Ether cryptocurrency.

Forbes Advisor

According to a forecast from Forbes Advisor for 2030, the price could reach $40,000. This impressive growth is due to its unique blockchain model, broad market strategy, the solution to the scalability problem, and leadership in various DApps.

Ethereum Price Predictions for 2040 by Crypto Experts

Forecasts for the Ethereum price in 2040 by various analysts differ greatly.

For the Ethereum cryptocurrency, the forecast for such a long period can hardly be accurate. If we assume that the trend continues and the price of Ethereum maintains its 5-year annual growth rate of 31.9%, then 1 Ethereum will be worth $274,514 by 2040. This is not a realistic target price; at this rate, ETH would have a capitalization of $33 trillion. Or vice versa, we can turn to the algorithmic forecast of the Ethereum price, for example, by CoinCodex. According to their calculations, growth will continue, and the price of Ethereum will exceed $57,609 by 2040.

As another example, let’s look at what Ethereum would perform in 2040 if it followed the average annual growth of the S&P 500, the main US stock market index. From 1957 to 2021, the S&P 500 grew at an average annual rate of 11.8%. If the price of Ether increased by an average of 11.8% per year, it would be around $13,999 by 2040.

This is a much more realistic scenario. If it is implemented, the Ethereum market cap could reach $1.68 trillion (Bitcoin has already reached $1.2 trillion in market capitalization).

Ethereum Price Prediction for 2050 by Crypto Experts

It is impossible to say for sure what the ETHUSD price will be in 2050 since many factors affect the crypto market.

CoinCodex

The platform’s analysts provide a long-term price forecast for ETH, according to which Ethereum could be worth approximately $42,710 by 2050 (which is more than ten times more than the recent price) if it grows at an average annual rate of 11.8%, like the S&P 500 index. Therefore, the Ethereum market cap would be $5.14 trillion.

Capital.com

According to the Capital.com platform, Ethereum is expected to reach around $50,000 by 2050 if it grows at the same rate as the S&P 500 index. This would mean that Ethereum’s capitalization could be expected to reach 6 trillion dollars, based on the available volume of tokens.

CoinPriceForecast

Analysts at CoinPriceForecast forecast the ETH price could reach around $4,230 by 2050. The calculation uses a unique algorithm that takes into account market cycles, sentiment trends, and other factors. This would mean that Ethereum market capitalization would be $508 billion.

As you can see, these forecasts vary greatly: from $4,230 to $50,000 per coin by 2050. This shows how difficult it is to make predictions this far out, especially for cryptocurrencies. Such analytics should be treated very carefully and should not be considered investment advice. The actual price of ETHUSD in 2050 will depend on various factors, including technological innovation, regulatory changes, market acceptability, competition, and world events.

How do you predict Ethereum price?

It is not easy to predict the future price of Ethereum since the volatility of price fluctuations is very high. However, there are several basic methods and approaches that allow you to make an Ethereum forecast. This includes technical and fundamental analysis, monitoring of news, events, and the market, and the use of various online resources.

At the same time, it is important to understand what fundamental and technical factors can determine the value of an asset in the future. If you take into account everything that affects the Ethereum future price, the forecast will be relatively accurate.

1. Supply and demand.

As with any other cryptocurrency, the Ethereum value depends on the supply and demand in the market. If the demand for Ethereum exceeds the supply, then the price of ETH will grow, and vice versa.

2. The project’s popularity.

The more projects and applications use Ethereum for their own purposes (for example, to create smart contracts and decentralized programs), the higher the potential demand for Ethereum tokens.

3. Regulation.

Decisions of governments and financial regulators in different countries can significantly affect the price of Ether. Hard restrictions can reduce interest in cryptocurrencies.

4. Overall market trend.

The overall market sentiment affects the price of a particular cryptocurrency. For example, if Bitcoin grows in price, then other coins, including ETH, follow the trend.

5. Global events and macroeconomic factors.

Inflation, economic crises, changes in interest rates, and geopolitical conflicts can affect the cryptocurrency price.

6. Information impact.

News and events related to the technical condition of Ethereum can radically change investors’ opinions about the blockchain. As a result, the cost of altcoin can both significantly grow and collapse.

The Ethereum price trend also depends on various technical factors:

1. The speed of transaction confirmation

If the Ethereum network is overloaded, the speed of transaction confirmation may decrease. This may affect the blockchain reputation among users and, as a result, its exchange rate.

2. Protocol update.

Each new Ethereum update can change the functions, performance, and scalability of the network. Successful updates attract more users and impact the Ethereum exchange rate positively.

3. Network security.

Ethereum has proven to be secure. However, vulnerabilities and hacker attacks can affect the price of Ether, especially if attackers manage to gain access to users’ funds.

4. Competition with other blockchains.

Ethereum competes with other blockchains and platforms to create decentralized programs. If users and investors give preference to other projects, the value of ETH will decrease.

5. Infrastructure and development of projects on Ethereum.

The quantity and quality of DApps running on Ethereum, as well as the development of infrastructure for developers, can attract more users and investors.

6. Gas fees

High gas fees could limit the use of Ethereum for many network participants. This could negatively impact demand and price.

As you can see, many factors influence the potential price growth. Before analyzing the further movement of the cryptocurrency, ask yourself a question: under what conditions can the value of the ETH coin remain stable?

Key takeaways: Ethereum price forecast for 2024-2040

Most crypto experts are quite bullish on Ethereum in the future. Smart contract technology, high transaction speed, and sharding make Ethereum stand out from other blockchain projects. Furthermore, the active development of DeFi can lead to an unprecedented increase in the value of ETH.

When trading Ethereum, it is important to create a trading plan and take into account all the technical and fundamental factors that affect its value.

According to our Ethereum forecast, the coin price could reach $31,656.34 or even $40,000 by 2029, according to the forecast by Bill Barhydt.

Ethereum price predictions for 2024-2040

-

Ethereum exchange rate today, 08.07.2024, is 3 039.99 USD.

-

Wallet Investor predicts Ethereum price at $5,500 and DigitalCoinPrice at $4,500 per 1 ETH in 2024.

-

According to the CoinCodex resource, the Ethereum value may exceed $57,609 by 2040.

-

Technical analysis built using the Ichimoku trend indicator suggests a rising buying pressure and a potential price uptrend with a target of $2,000 in the next three months, accompanied by local short-term corrections, down to $1,732 in December.

| Year | Minimum price, $ | Average price, $ | Maximum price, $ |

| 2024 | 3,65 | 4,5 | 5,5 |

| 2025 | 3,055 | 4,3 | 5,98 |

| 2030 | 23,055 | 23,724 | 27,994 |

| 2040 | 31,5 | 35,804 | 57,609 |

Is Ethereum (ETH) a Good Investment?

Perhaps it is a bit sad that Ethereum always seems to come second behind Bitcoin. Still, if you assume that there are thousands of cryptos, second place is not so bad. Ethereum has truly unique features. Sharding technology allows processing, on average, from 30 to 100,000 transactions per second. Rich opportunities for creating DeFi platforms and applications attract many developers; the number of projects created on the basis of Ethereum is growing every year.

The Ethereum network receives regular updates, and more and more crypto users and investors are interested in this blockchain. All this can lead to sustainable long-term growth in the ETH rate. If you are interested in investing in Ethereum, you can register for a free demo account with LiteFinance! Here, you will get all the information you need about investing and can start trading.

Start trading with a trustworthy broker

Ethereum Price Prediction FAQ

The current Ethereum price is 3 039.99 USD.

According to various experts analyzing ETH, the forecast is encouraging: the token rate will exceed $3,000 by the end of 2024.

The average projected asset price by 2025 will be $4,515, adjusted for expected price volatility.

According to our Ethereum price forecast, the cryptocurrency will rise to $23,724.

According to various analysts, the price of Ethereum will rise to $35,804 on average by 2040.

Ethereum 2.0 is a global improvement to the blockchain technology that is being implemented over the long term. The purpose of the upgrade is to make the blockchain platform more scalable, secure, and decentralized. One of the key innovations of Ethereum 2.0 is the introduction of sharding technology, which allows Ethereum to scale up from an average of 30 transactions per second to 100,000 transactions per second. The successful implementation of a global upgrade could attract more DeFi application developers and, accordingly, more investors in ETH. According to the ETH Merge price prediction, the token exchange rate will increase.

Traditional Ethereum mining is no longer available after switching to the proof-of-stake protocol. New blocks are created by staking: users contribute at least 32 ETH to the system and can then participate in storing data, processing transactions, and adding new blocks. Issue volumes decreased after the transition to the POS protocol, and global supply decreased. Therefore, Ethereum is expected to rise in price in the long term, so staking can bring handsome gains in the next few years or the next two decades.

The Ethereum price prediction estimates many factors: supply and demand, technological progress, market sentiment, and regulatory actions. For example, the most optimistic forecast by Forbes suggests that ETH could surpass Bitcoin and rise in price to $50,000 or more. According to the most pessimistic forecast by InvestorPlace, the Ethereum rate will fall to $2,000.

Most analysts expect a long-term ETH bullish trend. Based on the ETH price prediction 2025, the coin will exceed $5,000. By mid-2030, the price will surpass $7,500. At the end of that year, the price of the coin will be over $8,000. This means that Ethereum is one of the most promising cryptocurrencies for those who want to invest in a cryptocurrency with high growth potential.

Price chart of ETHUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.